Market Summary

The global Electric DC Motor market size was valued at USD 41.80 billion in 2025 and is projected to reach USD 78.90 billion by 2033, growing at a CAGR of 8.00% from 2026 to 2033. The market for Electric DC Motors is growing at a steady level because of increased electrification in the transport sector, industries, and consumer appliances. Inefficiency norms and optimized usage of energy are fueling growth in brushless solutions. Increased usage of electric vehicles and smart manufacturing is adding to sustainable growth rates.

Market Size & Forecast

- 2025 Market Size: USD 41.80 Billion

- 2033 Projected Market Size: USD 78.90 Billion

- CAGR (2026-2033): 8.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America shows robust adoption trends for high-efficiency DC motors due to the penetration of electric vehicles, a focus on factory automation, as well as retrofits within the HVAC sector. Well-developed infrastructure, energy regulations, and technological developments from OEMs within the United States ensure steady replacement volumes.

- The United States has prominent regional growth in massive-scale EV production, space sector electrification initiatives, and the use of robotics technology. The government's support through incentives and the shift in the country's manufacturing back to the United States and the ever-constant demand for energy-efficient appliances boost the use of brushless and mid-to-high power DC motors.

- Due to rapid industrialization, expanding EV production, and high consumer electronics output, the Asia Pacific remains the fastest-growing region. China, India, Japan, and South Korea drive volume demand together, underpinned by cost-competitive manufacturing ecosystems and expanding infrastructure investments.

- Brushless DC motors are the current market leaders in terms of growth as organizations have started preferring efficiency, reduced maintenance, and advanced control in motors. The use of these motors has picked up in EV motors, HVAC blowers, and industrial automation, further replacing the brush motors in motor-intensive applications.

- 0 - 750 Watts voltage ranges exhibit substantial traction in terms of usage in appliant products and power electronics. On the other hand, the mid to high power voltage ranges are driven by the electric mobility ecosystem.

- Industrial machinery and motor vehicles continue to be the most significant end-use categories. The degree of automation, robotization, and electric solutions in transportation infrastructure drive the demand for DC motors in the market.

So, The Electric DC Motor Market involves motors designed to convert direct current electrical energy into mechanical motion. The motors are essential in various applications that include a capacity for variable speed control, high torque at start-up, and a compact design. The motors are central to various industrial ecosystems. The market development is influenced by efficiency optimization and electrification trends. The trend in favor of brushless DC motors over brushed DC motors is growing because of the high efficiency offered by the former apart from reliability factors like long working life. The trend is very much in line with global energy efficiency norms. Demand characteristics are also impacted by the rise in electric vehicle sales, automation in industries, and smart appliance penetration. DC motors are prominent in traction, actuators, pumps, compressors, and precision devices. Asia Pacific is dominant in terms of volume production; however, North America and Europe focus more on advanced products meeting performance requirements. The market is balanced between volume-driven demands based on costs and demands based on new technologies adding value.

Electric DC Motor Market Segmentation

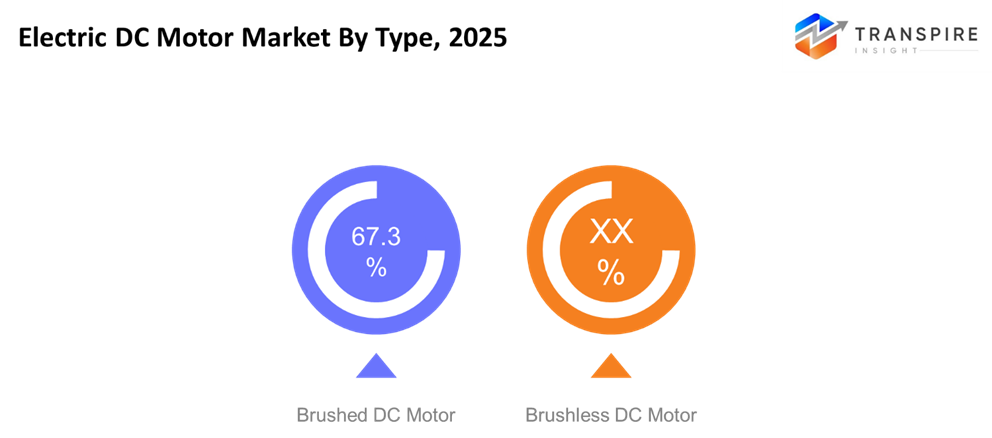

By Type

- Brushed DC Motor

The brush DC motor is the conventional workhorse motor in the DC motor family. The brush DC motor is simple, rugged, and economical. The brush DC motor finds extensive applications in small machines, automobile accessories, and home appliances. The brush DC motor is easily maintainable since it uses brushes. But, it is not suitable for high-speed applications.

- Brushless DC Motor

BLDC motors lead in the market owing to their high efficiency, noiseless operation, and reduced maintenance. They find their applications in EVs, industrial automation, air-conditioning units, and sophisticated devices, thus turning out to be the best choice for energy-frugal and high-end solutions.

To learn more about this report, Download Free Sample Report

By Voltage

- 0-750 Watts

This low-power band leads the market, powering compact equipment such as small appliances, portable tools, consumer electronics, and auxiliary functions in vehicles. Their prevalence comes from versatility and affordable integration.

- 750 Watts – 3kW

Finding a balance between size and output, these motors are applied for medium-duty tasks: larger power tools, mid-range industrial drives, and standard HVAC equipment.

- 3 kW – 75 kW

This kind of range powers larger machines as well as transportation applications, including conveyors, pumps, and electric vehicles that demand higher torque in their drive units.

- Above 75 kW

High power DC motors provide heavy-duty applications in industries, heavyweight transportation, and heavy machinery whereby heavy energy and torque are required, especially in automation and electric propulsion.

By End Use

- Industrial Machinery

Industrial machinery has the highest market share because of the need for either industrial automation, industrial robots, and various manufacturing machinery to have sophisticated motor control capabilities. The torque that DC motors provide for these applications is essential for modern industrial production.

- Motor Vehicles

DC motors are becoming even more essential in the rising production of electric and hybrid vehicles since they are indispensable in the propulsion mechanism, auxiliaries, actuators, and cooling circuits.

- HVAC Equipments

DC Motors have seen mounting applications in fans, blowers, and handling units for energy conservation and noise-reduced operations and have received considerable interest for applications in HVAC units. Cases turn out to be a more challenging class than numbers as they include both numbers and sets.

- Aerospace & Transportation

Motors have applications in aerospace and other transport sectors, powering actuators, control surfaces, environment systems, or electric mobility platforms that emphasize reliability, light-weighting, or both.

- Domestic Appliances

Increasing consumption of energy-efficient and smart appliances is driving DC motor consumption in appliances such as washing machines, refrigerators, and vacuum cleaners.

- Others

This includes robotics, renewable systems, medical equipment, and other specialty equipment where small high-precision motor solutions are needed. Such markets expand rapidly due to technological innovations.

Regional Insights

North America, comprising the United States, Canada, and Mexico, is a mature yet innovation-focused region. The United States focuses on EV production, aerospace electrification, and automation, while Canada focuses on energy efficiency and manufacturing support for autos and appliances, and Mexico focuses on auto and appliance manufacturing. Europe, including Germany, UK, France, Spain, Italy, and Rest of Europe, is characterized by tough efficiency regulations and by environmental and sustainable standards and mandates. Germany drives automation and electric vehicle industries, and Southern Europe contributes to appliance and HVAC industries. The Asia Pacific market, including China, Japan, India, South Korea, Australia & New Zealand, and Rest of Asia Pacific, leads in global volumes. While China and India have been at the forefront of mass production for EVs, Japan and South Korea are leaders in high-precision sectors such as industrial automation. Southeast Asia is a support region for low-cost production. .The South America region, in countries such as Brazil and Argentina, records moderate growth in the market, supported by the assembly of autos, the development of the transportation infrastructure, and the penetration of consumer appliances. MEA, including Saudi Arabia, United Arab Emirates, South Africa, and Rest of ME&A, is an emerging market. Growth factors include diversification, HVAC, and infrastructure development, and increasing adoption of automation technology in tier 1 and tier 2 countries.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Vector has increased the CANoe Model Option Electric Motor to its CANoe development tools, allowing for the verification of electric motor control units in the early stages without the need for electric motors. The offering comes with simulation models for brushless DC, permanent magnet synchronous, standard DC, and induction motors. This runs on FPGA technology.

- In January 2025, The company ACEL Power and Vector Náutico joined forces in the launch of the MOLA-e range of electric boats in the Spanish market, where the models feature the use of electric propulsion motors coupled to high energy density batteries.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 41.80 Billion |

|

Market size value in 2026 |

USD 46.00 Billion |

|

Revenue forecast in 2033 |

USD 78.90 Billion |

|

Growth rate |

CAGR of 8.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Nidec Corporation, Johnson Electric Holdings Limited, Maxon Group, ABB Ltd, AMETEK, Inc., Allied Motion Technologies Inc., MinebeaMitsumi Inc., Regal Rexnord Corporation, Siemens AG, Oriental Motor Co., Ltd., Parker-Hannifin Corporation, WEG S.A.,Toshiba Corporation, Faulhaber Group, Portescap S.A. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Brushed DC Motor, Brushless DC Motor), By Voltage (0 - 750 Watts, 750 Watts - 3 kW, 3 kW - 75 kW, Above 75 kW), By End Use (Industrial Machinery, Motor Vehicles, HVAC Equipment, Aerospace & Transportation, Household Appliances, Others |

Key Electric DC Motor Company Insights

Nidec Corporation is a prominent key leader in the electric DC motor market with a broad range of products that include high-efficiency brushless and brushed motors of the DC series. Its diverse range offers products for use with electric vehicles, heating and cooling applications, automation applications, and consumer products. Nidec Corporation focuses its strategic approach by investing in cutting-edge manufacturing solutions and by increasing their capacity for producing motors for electric vehicles’ traction motors. Efficiency and geographic reach allow for quick responses to developments within the market and thereby sustain a strong ability to poach share within the market.

Key Electric DC Motor Companies:

- Nidec Corporation

- Johnson Electric Holdings Limited

- Maxon Group

- ABB Ltd

- AMETEK, Inc.

- Allied Motion Technologies Inc.

- MinebeaMitsumi Inc.

- Regal Rexnord Corporation

- Siemens AG

- Oriental Motor Co., Ltd.

- Parker-Hannifin Corporation

- WEG S.A.

- Toshiba Corporation

- Faulhaber Group

- Portescap S.A.

Global Electric DC Motor Market Report Segmentation

By Type

- Brushed DC Motor

- Brushless DC Motor

By Voltage

- 0 - 750 Watts

- 750 Watts - 3 kW

- 3 kW - 75 kW

- Above 75 kW

By End Use

- Industrial Machinery

- Motor Vehicles

- HVAC Equipment

- Aerospace & Transportation

- Household Appliances

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636