Market Summary

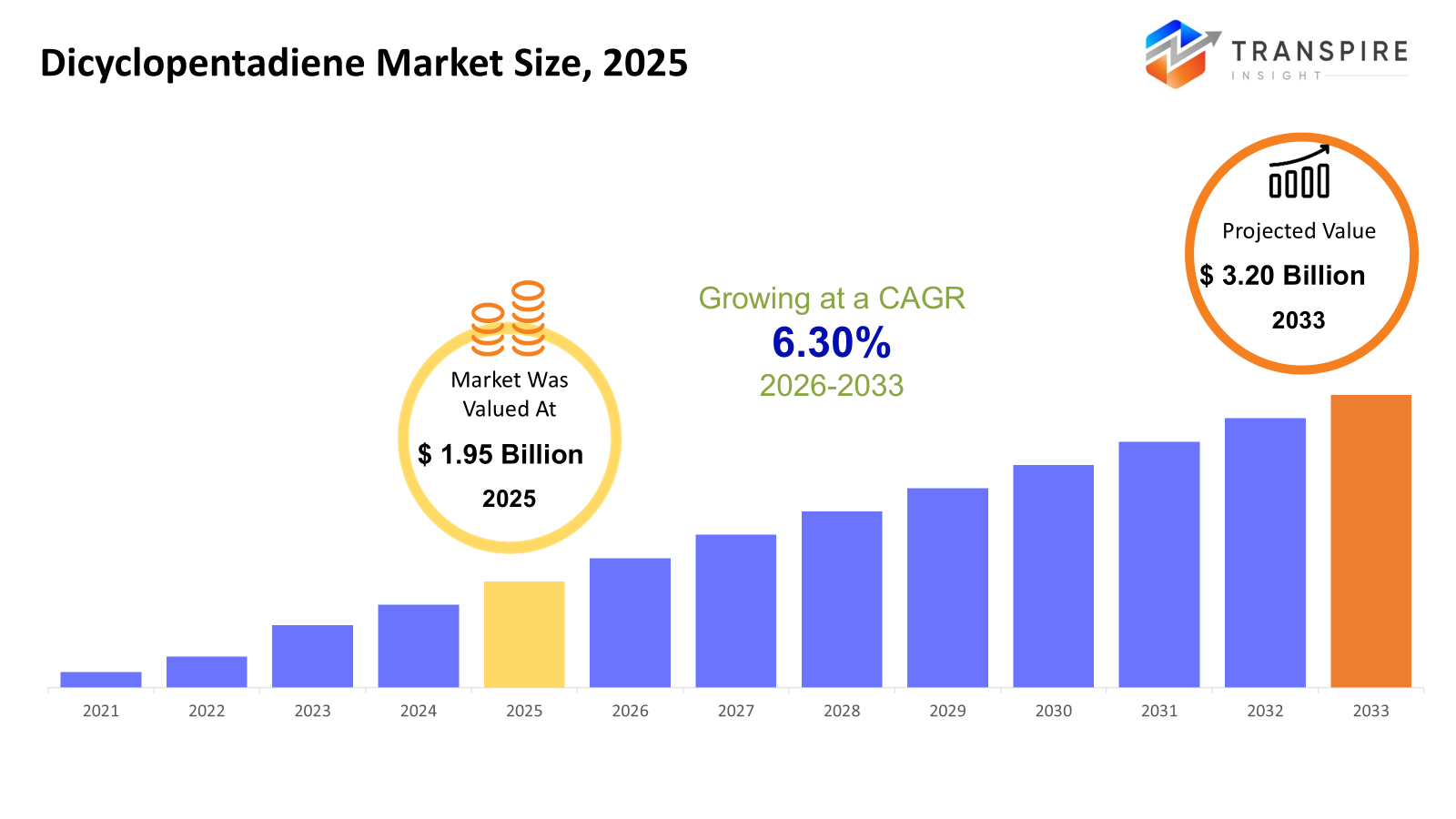

The global Dicyclopentadiene market size was valued at USD 1.95 billion in 2025 and is projected to reach USD 3.20 billion by 2033, growing at a CAGR of 6.30% from 2026 to 2033. Fueled by steady uptake in building projects, cars, and boats, dicyclopentadiene finds its place in resin mixes and composite parts. With cities expanding and autos leaning into lighter builds, demand quietly climbs. Infrastructure pushes forward, vehicle designs shift - material needs evolve right alongside.

Market Size & Forecast

- 2025 Market Size: USD 1.95 Billion

- 2033 Projected Market Size: USD 3.20 Billion

- CAGR (2026-2033): 6.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Fueled by cutting-edge production industries, expansion takes hold where need runs deep for strong yet light materials in vehicles and heavy-duty uses. Heavy reliance on efficiency pushes adoption across factories and transport alike.

- Out front in the region, the United States leans on solid output in chemicals to push DCPD uptake. Resin and polymer sectors here rely heavily on it, fueling steady demand across industrial lines.

- Building work picks up speed here, pushing need for advanced materials. Vehicles roll off lines faster, pulling along chemical supplies. Factories stretch wider, using more composite blends. Growth feeds on itself, quietly. Demand climbs without pause.

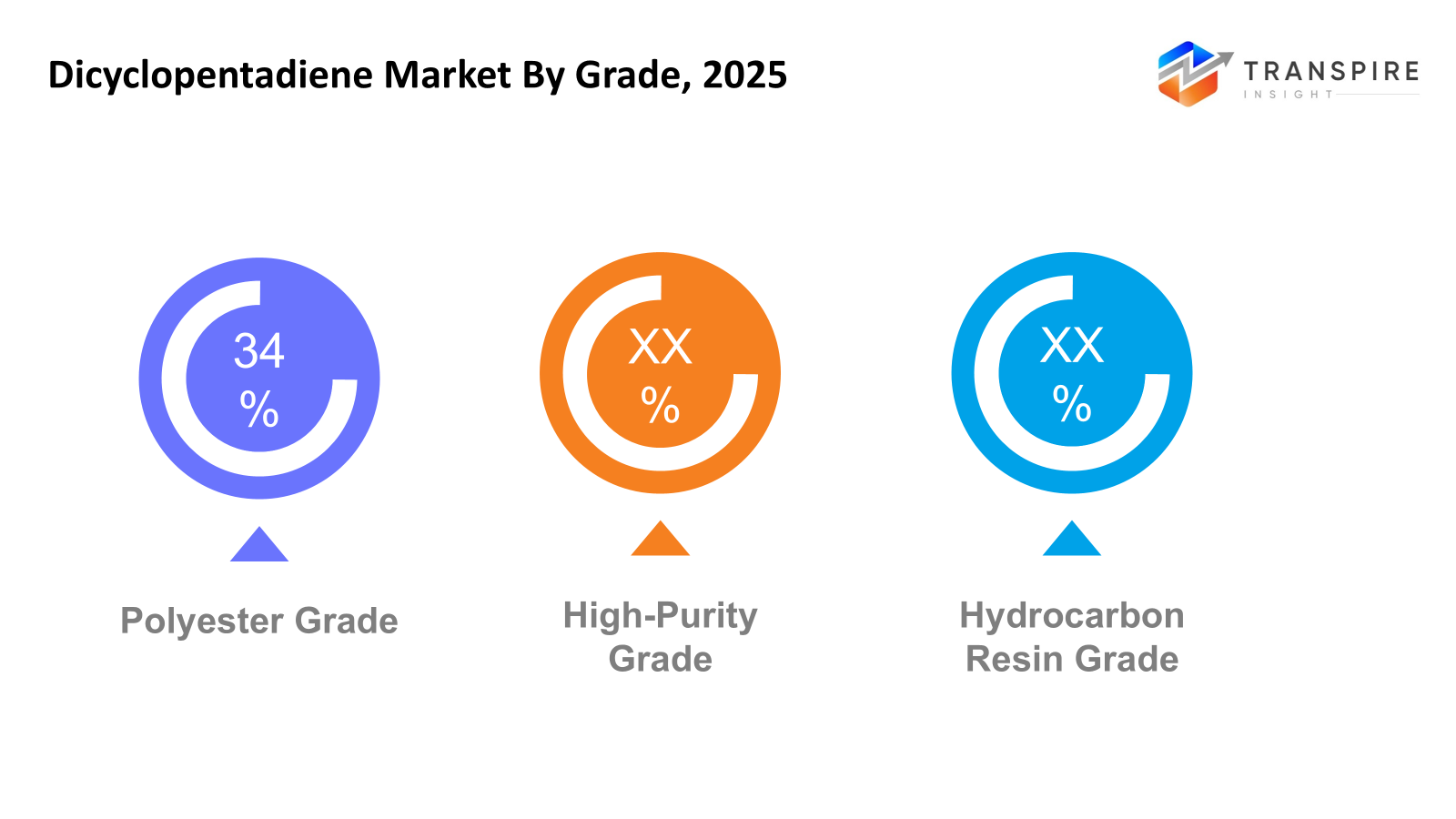

- Polyester Grade shares approximately 35% in 2026. Right now, polyester takes the lead spot because most makers still rely on it heavily for producing unsaturated resin blends. What keeps it ahead is how widely it fits into making strong composites without needing changes. Even with new options around, factories continue choosing this form simply due to track records. Its position grows not from flash but a steady fit across uses.

- Easy to handle, liquids work well across many steps in making resins and chemicals. Their flexibility fits smoothly into various production methods.

- Sure thing, replacing older stuff across fields pushes the need for unsaturated polyester resins. While industries shift their choices, these resins step into roles once held by metal or wood. Since change moves fast, demand grows without much noise. Each upgrade in manufacturing opens space for this material to take hold. Because alternatives lack certain traits, resin finds its place steadily rising.

- Now showing faster growth in building work because resins made from DCPD make materials tougher and more reliable. Infrastructure projects increasingly choose them for longer lives under stress.

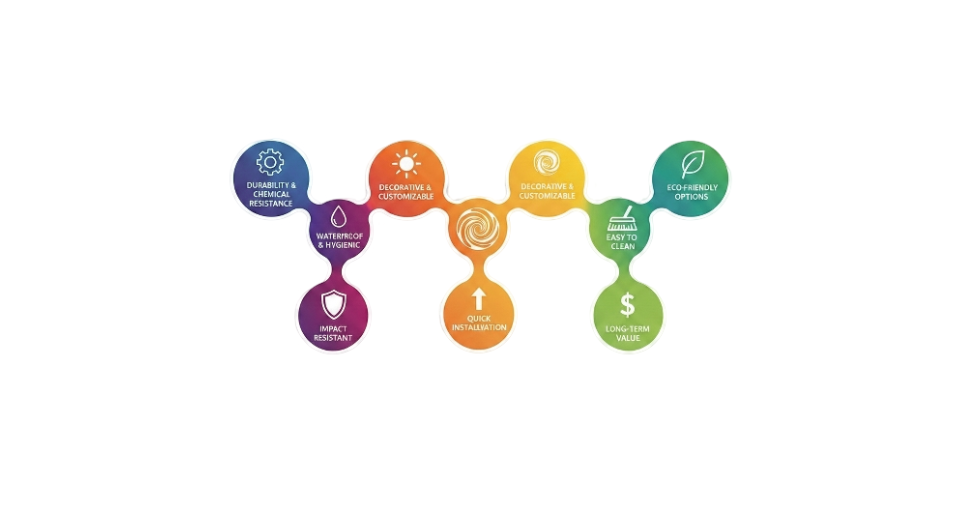

From rooftops to road signs, dicyclopentadiene finds its way into products most people rarely notice. Its high reactivity makes it a valuable building block for manufacturing durable materials. Once blended into resins and polymers, it quietly enhances resistance to heat, impact, and environmental stress. Lightweight yet strong qualities industries constantly pursue are achieved more effectively with its inclusion. This growing reliance across construction, automotive, and industrial applications continues to support steady expansion of the dicyclopentadiene market, where performance and durability remain top priorities.

Because they resist rust and handle stress well, DCPD-made resins often appear in building pipes, storage units, flat sections, and load-bearing parts. Rising needs for long-lasting construction supplies, along with strong composite blends, keep pushing up usage numbers. Elsewhere, transport makers rely on DCPD to form lighter pieces that help vehicles go farther on less fuel while running better.

With uses growing in adhesives, coatings, elastomers, and specialty polymers, the market sees steady gains. Paints, inks, and even rubber mixes now rely more on DCPD-based resins because they bond well while blending smoothly into formulas. New versions keep appearing, purity improves - factories adapt them for niche jobs without missing a beat.

Still, shifts in feedstock costs tied to crude oil affect how the market moves, while rules around chemical output and pollution play a role too. Even so, progress in how composites are made keeps pushing things forward, along with growing interest in materials that are both strong and light, which helps keep DCPD relevant over time.

Dicyclopentadiene Market Segmentation

By Grade

- High Purity Grade

Top-grade purity stands out in niche chemical builds, also shines where advanced polymers demand precision.

- Polyester Grade

Polyester Grade shows up often in making unsaturated polyester resins meant for composite materials. While it plays a central role, its main job ties back to structural support during production processes. Resin systems lean on this grade because of how well it blends under heat and pressure. Because performance matters, manufacturers choose it instead of alternatives that react differently when cured. Its chemical layout fits neatly into chains that strengthen final products.

- Hydrocarbon Resin Grade

From sticky helpers to paint bases, this resin type plays a quiet role. Its grade shapes how well glue holds or coating sticks. Not flashy, just functional in everyday materials. Performance comes down to molecular fit, nothing more.

To learn more about this report, Download Free Sample Report

By Form

- Liquid

Sipping through production lines, liquid flows smoothly into resins and chemical mixes. Its fluid nature makes shaping reactions simpler than rigid forms. Moving fast in labs, it binds well with compounds that build plastics. Often chosen for steady behavior during manufacturing steps. Fits neatly into tanks without clumping or blocking paths.

- Solid

When a mix needs steady behavior, solid forms fit best. Stability matters most when making things work right. Controlled delivery often depends on using solid versions instead.

By Application

- Unsaturated Polyester Resin

Firm strength and resistance to rust make unsaturated polyester resins useful in many uses. Their toughness stands up well under stress while holding off decay from moisture or chemicals.

- Hydrocarbon Resin

Sticky stuff shows up in paints and glues, helping them stick better while playing nice with other ingredients.

- Ethylene Propylene Diene Monomer Elasomer

Starting strong, EPDM elastomers include a diene part that boosts rubber performance. With this addition, flexibility and durability get a noticeable uptick. Instead of standard materials, these rubbers handle stress better over time. Because of their structure, they resist heat and weathering quite well. On top of that, aging characteristics turn out to be more stable. Through careful design, resilience in tough conditions stands out clearly.

- Poly DCPD

Firm plastic stuff made by twisting small parts into shape. Tough things come out when it sets hard after forming. Made using a method where circles open up and link together.

- Cyclic Olefin Copolymers

Clinging tightly to clear views, cyclic olefin copolymers stand firm under heat. These materials shape tough plastic pieces without fogging up. Instead of melting fast, they hold their ground when things get warm. Sharp looks meet steady performance here. Not every polymer keeps such cool composure while staying see-through.

- Others

Besides that one main role, it shows up in less common spots like certain chemical mixes, materials that block leaks, or bits added to change how stuff works.

By End-Users

- Automotive

From cars to trucks, materials built with light help save gas while lasting longer. Tough rubber parts stand up to wear without adding weight. Efficiency gets a boost when components resist damage yet stay slim. Lasting power meets lighter loads across modern vehicles.

- Construction

Pipes, tanks, and panels often get built using this material because it holds up well and fights rust. Strength matters here, so does standing up to decay over time. It shows up where durability is non-negotiable. Corrosion resistance makes it a go-to choice in tough spots. Longevity plays a role just as much as toughness.

- Marine

Out on the water, materials face salt, sun, wind - tough conditions without pause. Built to resist wear, these composites hold strong when tested by time. Coatings made this way guard surfaces where damage often strikes. Strength matters most where storms hit hard and corrosion creeps in slowly.

- Electrical & Electronics

A spark runs through tough plastics made for wires and tiny parts inside gadgets. These materials hold up when things get hot or power surges hit. Inside phones and circuits, they keep signals moving without leaks. Heat resistance matters just as much as blocking electric flow. Some synthetics last longer than older styles once did.

- Packaging

Films made for tough jobs often use this material when they need to resist chemicals. Parts shaped by molds rely on it just as much, especially where solvents or corrosive substances are present.

- Paints & Coatings

- Pulling better grip on surfaces, lasting longer, giving a smoother look - these traits slip into paints and coatings naturally. Toughness grows quietly behind the scenes. A clean result shows up every time without asking. Performance tags along through wear and weather.

Regional Insights

Fueled by heavy reliance on durable plastics, the North American DCPD market thrives where factories need tough resins, especially for cars, buildings, and electronics. Pushing ahead, the United States efforts pour into sleeker composite parts and niche chemical blends that hold up under stress. Elsewhere, Canadian production lines stretch further into synthetic binders at a steady clip. Over borders, Mexican plants crank out more molded goods using upgraded formulas each quarter.

Heavy industry in Europe keeps demand steady for advanced resins used across vehicles, planes, and machinery. Germany, France, and the United Kingdom lead efforts to shape new composites while cutting emissions through tighter eco rules. Progress moves quietly here, driven less by flash, more by precision and long-term thinking.

China, India, Japan, and South Korea pull ahead in the DCPD market across Asia Pacific, fueled by surging factory growth, expanding cities, and stronger needs in vehicles and building projects. Elsewhere, places like Latin America and parts of the Middle East, along with Africa, see slow but steady upticks in usage, thanks to new factories and public works spending, yet they trail behind the Asian surge.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 10, 2022 – ORLEN Unipetrol opens new production unit as its rise in European dicyclopentadiene industry rankings.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.95 Billion |

|

Market size value in 2026 |

USD 2.10 Billion |

|

Revenue forecast in 2033 |

USD 3.20 Billion |

|

Growth rate |

CAGR of 6.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ExxonMobil Chemical, Chevron Phillips Chemical Company, Shell Chemicals, LyondellBasell Industries, Braskem S.A., Dow Inc., Eastman Chemical Company, Zeon Corporation, Kolon Industries, ENEOS Corporation, JXTG Nippon Oil & Energy, Formosa Plastics Corporation, Maruzen Petrochemical, China Petrochemical Corporation (Sinopec), PetroChina Company Limited, Shandong Qilong Chemical Co., Ltd., and Zibo Luhua Hongjin New Material Group Co., Ltd |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Grade (High Purity Grade, Polyester Grade, Hydrocarbon Resin Grade), By Form (Liquid, Solid), By Application (Unsaturated Polyester Resins, Hydrocarbon Resin, Ethylene Propylene Diene Monomer Elastomers Poly-DCPD, Cyclic Olefin Copolymers, Other), By End-Users (Automotive, Construction, Marine, Electrical & Electronics, Packaging, Paints & Coatings), |

Key Dicyclopentadiene Company Insights

One name stands out in the world of petrochemicals: ExxonMobil Chemical shapes how dicyclopentadiene flows across industries. Its production lines deliver pure-grade DCPD, vital for making tough resins and specialized plastics. Backed by linked networks of refineries and chemical plants, it keeps deliveries steady no matter demand shifts. Materials born here push limits in composites where strength matters most. New methods emerge constantly within its labs, nudging what these chemicals can do. This blend of scale and invention holds firm ground when others struggle to keep pace globally.

Key Dicyclopentadiene Companies:

- ExxonMobil Chemical

- Chevron Phillips Chemical Company

- Shell Chemicals

- LyondellBasell Industries

- Braskem S.A.

- Dow Inc.

- Eastman Chemical Company

- Zeon Corporation, Kolon Industries

- ENEOS Corporation

- JXTG Nippon Oil & Energy

- Formosa Plastics Corporation

- Maruzen Petrochemical

- China Petrochemical Corporation (Sinopec)

- PetroChina Company Limited

- Shandong Qilong Chemical Co., Ltd.,

- Zibo Luhua Hongjin New Material Group Co., Ltd

Global Dicyclopentadiene Market Report Segmentation

By Grade

- High Purity Grade

- Polyester Grade

- Hydrocarbon Resin Grade

By Form

- Liquid

- Solid

By Application

- Unsaturated Polyester Resins

- Hydrocarbon Resin

- Ethylene Propylene Diene Monomer Elastomer

- Poly-DCPD

- Cyclic Olefin Copolymers

- Other

By End-Users

- Automotive

- Construction

- Marine

- Electrical & Electronics

- Packaging

- Paints & Coatings

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636