Market Summary

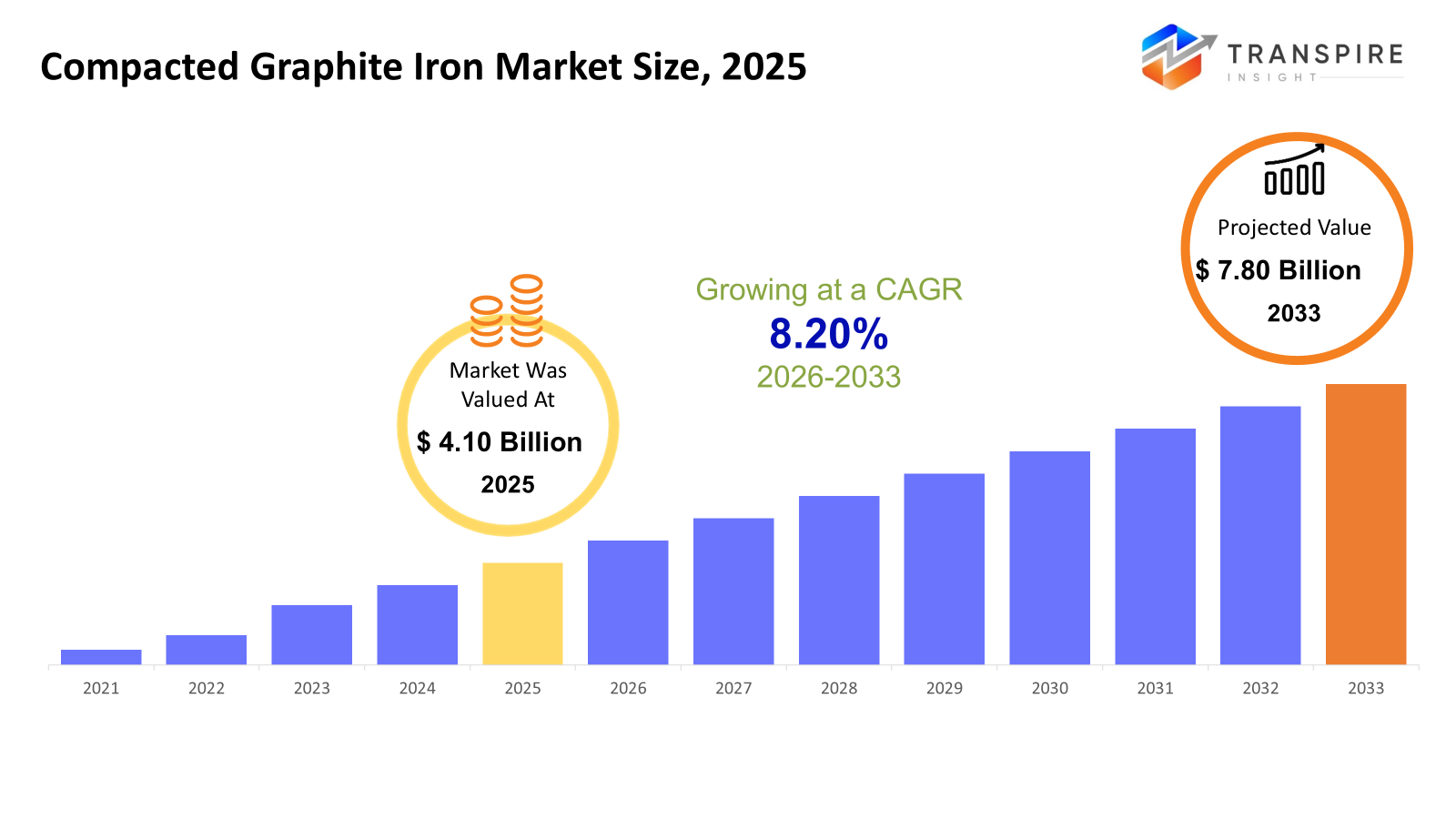

The global Compacted Graphite Iron market size was valued at USD 4.10 billion in 2025 and is projected to reach USD 7.80 billion by 2033, growing at a CAGR of 8.20% from 2026 to 2033. The Compacted Graphite Iron market is seeing steady growth in CAGR, driven by increased demand from the automotive sector for high-strength, lightweight engine parts to attain higher fuel efficiency and lower emissions. This demand is increasing with the growth in industrialization and infrastructure development across the world in applications related to construction and heavy machinery. The increasing investment in the energy sector, especially in turbines and other high-performance components, props up the demand for CGI due to its high thermal stability and resistance to fatigue. Continuous technological improvement in manufacturing processes and support through regulations that favor durability and efficiency have been other factors contributing to stable market growth for CGI.

Market Size & Forecast

- 2025 Market Size: USD 4.10 Billion

- 2033 Projected Market Size: USD 7.80 Billion

- CAGR (2026-2033): 8.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America, being a relatively mature and highly technologically advanced region, boasts a strong automotive, industrial, and energy sector, thus enhancing the demand for high-performance materials, leading to higher penetration of Ferritic CGI in the market.

- The United States, being one of the prominent markets in North America, has shown promising trends of adopting CGI for automobile and industrial applications, backed by its sophisticated foundries, technical strengths, and supportive government policies driving fuel-efficient, thermo-stable engine components.

- Asia Pacific is the fastest-growing segment, attributed to the high motor vehicle production levels in China, Japan, and India, coupled with tremendous growth from accelerated automobile manufacturing and growing infrastructure development, leading to demand for CGI automotive engine parts, construction gear, and oil and gas equipment, which require durability and heat endurance.

- Ferritic CGI, being the strongest and ductilest material, is gaining traction as the top type segment, led by its potential for effective heat dissipation, which is critical in components of engines and equipment, given the increasing emphasis of OEMs on lightweight materials for emissions compliance.

- The application of automotive components is the largest segment, owing to the increasing use of CGI components by OEMs for engine blocks, cylinder heads, and various automotive braking components to enhance vehicle fuel efficiencies and reduce emissions.

- Automotive leads once again as the end-use sector, with CGI technology adoption fueled by regulatory, performance, and light weighting initiatives, hence investing heavily in premium quality production and advanced technology for casting processes for both commercial and passenger vehicles.

So, The Compacted Graphite Iron market is a high-performance grade of cast iron boasting strength, high temperature stability, and fatigue resistance. The Compacted Graphite Iron market is widely used and applied across a slew of industries including automobile, industrial, construction, and energy sectors. Compacted Graphite Iron boasts exceptional ductility and some of the best tensile strength compared to gray iron. Compacted Graphite Iron is extensively used to make engine blocks and other engine components, including heavy machines and their components. Compacted Graphite Iron is used by automobile manufacturers to make lightweight and robust components of engines. The automobiles sector is growing rapidly, and to be environment-friendly, stringent norms have to be followed by countries all over the world. The heavy machines and construction sectors use Compacted Graphite Iron to make robust and long-lasting components. Compacted Graphite Iron is applied across various components of the energy sector, including turbines, pumps, and exhaust systems. With advancements in casting and design technology, there is an improvement in the output quality and efficiency of CGIs, thus propelling market penetration. Moreover, with the demand for environmentally-friendly, durable materials, another advantage of CGIs is added, considering countries with enhanced high-performance manufacturing capabilities.

Compacted Graphite Iron Market Segmentation

By Type

- Ferritic CGI

Ferritic CGI, for instance, has good thermal conductivity and low thermal expansion, thus making it appropriate for the construction of power plant components and machine tools. It is appropriate for lightweight design automobile and energy-related systems due to its strength and ductility properties.

- Pearlitic CGI

Pearlitic CGI material also has better tensile strength and wear resistance, making it suitable for heavy-duty use, such as in engine blocks and construction machinery. However, its ruggedness when subjected to stress creates demand in machinery and power generation industries.

- Martensitic CGI

Martensitic CGI offers the highest hardness and fatigue resistance, making it suitable for use in those components subjected to great mechanical stresses. This material is being used progressively in specialized automotive and industry sectors.

To learn more about this report, Download Free Sample Report

By Application

- Automotive Components

In terms of automobile parts, CGI is used mainly in the motor block, cylinder head, brake parts, etc., as these parts exhibit sufficient durability, heat stability, and weight-reducing advantages. It is increasingly being used as new regulations on pollution and fuel efficiency are becoming tighter.

- Industrial Machinery

In machines, such as those used in industries, gears, casing, and pumps are made of CGI because of its high strength and lightweight material. This makes machine reliability and life longer than usual.

- Construction Equipment

In construction machines, CGI is chosen for components such as hydraulic parts and engine blocks due to their ability to withstand high pressure and harsh conditions. A tough material reduces maintenance frequency, a trait of cost-efficient machines

- Energy Sector Components

It is increasingly being used for power generation and energy equipment, like the housing components of turbines and the exhaust manifolds. This is because it has high thermal endurance, can withstand vibrations, and possesses high strength.

By End-Use Industry

- Automotive

Automotive remains the leading end-use industry for CGI, finding significant momentum in engine downsizing, emission reduction, and lightweighting. It enables component manufacturers to improve performance with guaranteed durability at very high thermal and mechanical stresses.

- Heavy Machinery

Demand for heavy machinery is characterized by high-strength, wear-resistant requirements. CGI's superior performance in harsh operational conditions minimizes downtime, improving operational efficiency in construction and industrial equipment.

- Power Generation

It finds application in the power sector for turbines, heat exchangers, and details of engines because of its thermal stability and resistance to fatigue. Adoption increases with higher global energy demand and the development of efficient and durable machinery.

- Oil & Gas

Oil and gas equipment parts must possess corrosion resistance, high strength, and impressive pressure resistance. Such capabilities make the CGI parts ideal for use in pumps, valves, and engines.

- Marine

Marine vehicles employ CGI to create engine blocks, propeller shafts, and other such fittings. The high corrosion resistance of CGI allows these components to perform and withstand the stringent conditions prevailing underwater.

Regional Insights

North America, led by the United States, is home to a mature CGI market where there is considerable penetration in the automotive, aerospace, and industrial machinery industries. Canada and Mexico are also improving their industrial and automotive sectors, thereby raising demand in the region. Europe, comprising Germany, the UK, France, Spain, and Italy as tier-1 markets, shows high growth potential in CGI consumption, mainly in automotive and energy sectors. Rest of Europe also contributes to the demand from industrial machinery and construction sectors. Asia Pacific is the largest consumer of CGI, led by China, Japan, and India as tier-1 markets, being major automobile production hubs. Australia, New Zealand, and South Korea are also bringing in growth for CGI consumption, mainly in the energy and infrastructure sectors. Rest of Asia Pacific accounts for demand from industrial and construction machinery. South America, comprising Brazil and Argentina, shows moderate growth, mainly due to automobile and mining equipment usage. The Middle East & Africa, which comprises Saudi Arabia, UAE, and South Africa, is majorly fueled by investment in oil & gas infrastructure markets as well as power infrastructure markets. The rest of the region maintains investment in industrial applications, exploiting the benefits of using CGI, such as durability and resistance to corrosives. Industrialization, automotive, and infrastructure strategies influence the regions.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 2025, SinterCast AB said its partner, Tupy S.A., had secured a significant order to deliver Compacted Graphite Iron (CGI) cylinder blocks for a new 13-litre class commercial vehicle engine program in North America. This shows demand for SinterCast’s CGI technology with industrial partners, particularly in North America, with production to start in late 2026 at Tupy’s foundry in Ramos Arizpe, Mexico, which is a signal of growth for demand for CGI technology. OEM deliveries to be made in 2027.

(Source:https://sintercast.com/investor/financial-reports/press-releases/)

- In February 2025, On 10 February 2025, as part of an official announcement from SinterCast AB, Saroj Group earned the status of being the first licensee in India to offer CGI products. This development highlights the increasing rate of penetration of the SinterCast CGI process technology in Asia and also indicates the geographical expansion of the scope of technology licensors and foundry partners.

(Source:https://sintercast.com/investor/financial-reports/press-releases)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.10 Billion |

|

Market size value in 2026 |

USD 4.50 Billion |

|

Revenue forecast in 2033 |

USD 7.80 Billion |

|

Growth rate |

CAGR of 8.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

SinterCast AB, Tupy S.A., Georg Fischer Ltd., Waupaca Foundry, Inc., Ductile Iron Pipe Company, Eisenwerk Brühl GmbH, Henan Longcheng Casting Co., Ltd., ASIMCO International Casting Co., Ltd., YTO Group Corporation, Sakthi Auto Component Limited, Caterpillar Inc., Kubota Corporation, FAW Foundry Co., Ltd., Ford Motor Company, and Hyundai Motor Company |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Ferritic CGI, Pearlitic CGI, Martensitic CGI), By Application (Automotive Components, Industrial Machinery, Construction Equipment, Energy Sector Components) and By End-Use Industry (Automotive, Heavy Machinery, Power Generation, Oil & Gas, Marine) |

Key Compacted Graphite Iron Company Insights

SinterCast AB is a leading innovator in the CG Iron market and includes proprietary CGI production technology with process control systems that ensure high‑material quality consistency. Its advanced thermal analysis solutions are widely adopted among foundries globally, which creates a competitive moat and propels the adoption of CGI worldwide, especially for automotive and industrial applications. SinterCast's strategic partnerships with major OEMs and emphasis on material performance optimization elevate fuel efficiency and structural durability in engine components. Its continuous investment in R&D underpins technological leadership, with expansions into emerging markets where lightweight, high‑strength materials are increasingly prioritized.

Key Compacted Graphite Iron Companies:

- SinterCast AB

- Tupy S.A.

- Georg Fischer Ltd.

- Waupaca Foundry, Inc.

- Ductile Iron Pipe Company

- Eisenwerk Brühl GmbH

- Henan Longcheng Casting Co., Ltd.

- ASIMCO International Casting Co., Ltd.

- YTO Group Corporation

- Sakthi Auto Component Limited

- Caterpillar Inc.

- Kubota Corporation

- FAW Foundry Co., Ltd.

- Ford Motor Company

- Hyundai Motor Company

Global Compacted Graphite Iron Market Report Segmentation

By Type

- Ferritic CGI

- Pearlitic CGI

- Martensitic CGI

By Application

- Automotive Components

- Industrial Machinery

- Construction Equipment

- Energy Sector Components

By End-Use Industry

- Automotive

- Heavy Machinery

- Power Generation

- Oil & Gas

- Marine

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636