Market Summary

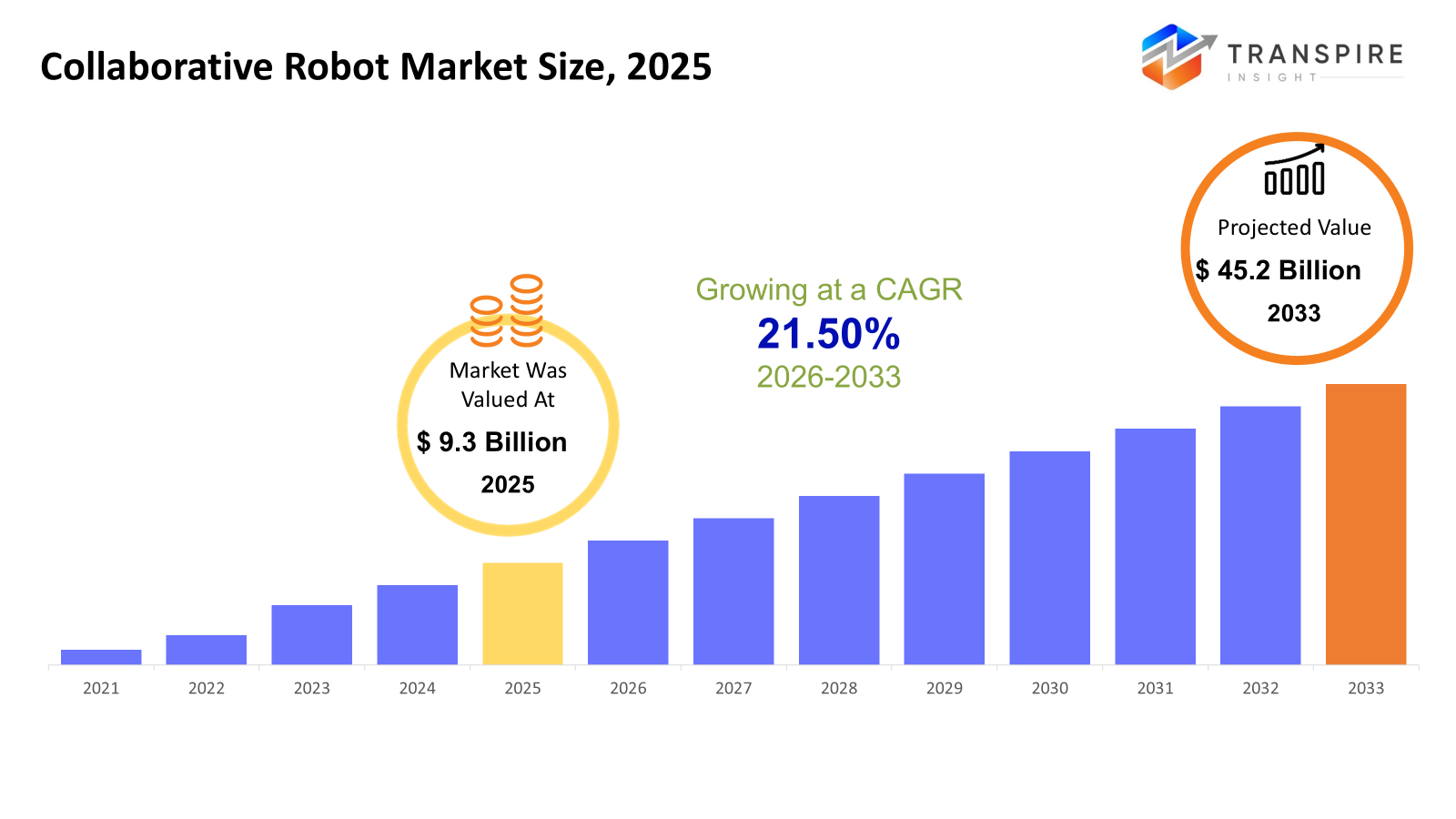

The global Collaborative Robot market size was valued at USD 9.3 billion in 2025 and is projected to reach USD 45.2 billion by 2033, growing at a CAGR of 21.50% from 2026 to 2033. The market for collaborative robots is increasing owing to the increasing adoption of automation in SMEs, because of labor shortages, the need for precision manufacturing, and the need to improve the efficiency of production. Advancements in AI and machine learning technology integrated with cobots are further fueling the growth of the market.

Market Size & Forecast

- 2025 Market Size: USD 9.3 Billion

- 2033 Projected Market Size: USD 45.2 Billion

- CAGR (2026-2033): 21.50%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America will still represent a mature but high-value market due to ongoing aircraft programs, high-tier engine programs, and defense spends. Presence of OEMs and Tier 1 companies will ensure that demand remains constant in commercial, military, and aerospace segments.

- Driving regional momentum across the US and beyond for the Commercial Fleet segment, US military flight hours support the product segment alongside the adoption of the future generation of power plants. Robust MRO support and lengthy service intervals also support the requirement for recurrent gear box replacements.

- Asia Pacific shows the highest growth potential based on the expanding air passenger services, strong fleet expansion, and the Asian governments' initiatives in the production of aircraft materials as well as the aircraft themselves. Rising deliveries of narrow-body aircraft and the local investment in aircraft maintenance services boost gearbox requirement ratios significantly.

- Payload capacity of up to 5 kg fuels the market for light precision applications, providing an economical means of automation for the electronics, pharmaceutical, and food sectors, enabling flexible use in small-scale and repetitive assembly and pick & place applications.

- Collaborative robotic arms lead the way in adoption for their flexibility, ease of integration, and high precision in assembly, inspection, and machine tending applications, while mobile and two-armed cobots are on the cusp of adoption for flexible, multi-tasking scenarios.

- Assembly, pick & place, and machine tending applications continue to lead, as manufacturers seek to maximize efficiency, while quality inspection, packaging, and other niche applications such as welding, dispensing, and painting continue to grow at a steady pace.

- The automotive, electronics & semiconductors, and food & beverage sectors lead the way as a result of high-volume manufacturing needs and the increasing adoption of automation for repetitive precision-driven tasks, lowering costs and improving productivity.

So, The collaborative robot market includes intelligent robots that can be used alongside human workers in manufacturing, logistics and service sectors, providing automation without the need for large safety enclosures or barriers. Cobots are increasingly being used for high-precision and repetitive applications, such as assembly, material handling, machine tending, quality inspection and packaging. These robots use AI, sensors, and flexible programming to improve productivity, safety, and efficiency, suitable for small-scale businesses as well as large-scale industrial operations.

Cobots increase the efficiency of manufacturing by reducing cycle times, eliminating human errors and optimizing the use of labor, especially in the automotive, electronics, pharmaceutical and e-commerce sectors. Improvements in AI, vision systems and mobility have led to an increase in the use of cobots in areas such as mobile logistics, two-arm assembly and laboratory automation. The market is also fueled by rising labor costs, the requirement for mass customization and the increasing global interest in the adoption of Industry 4.0. The market is experiencing a trend of diversification in terms of product types and weight capacities, ranging from light robots for handling small components, medium-weight payloads for general assembly, to heavy payload cobots for material handling and palletizing. The ability to easily deploy, have fewer safety restrictions, and quickly integrate is encouraging manufacturers to adopt cobots in various operations, thereby fueling the growth of the market.

Collaborative Robot Market Segmentation

By Payload Capacity

- Up to 5 kg

Cobots in this weight class are commonly used in high-speed, precision applications such as small component assembly, inspection, and pick & place. The low payload capacity of cobots makes them suitable for the electronics, pharmaceutical, and delicate manufacturing industries.

- 5-10 kg

Mid-range payload cobots strike a balance between speed and lifting power, enabling medium-duty applications such as machine tending, packaging and material transfer. The capability to lift moderately heavy loads enables manufacturers to perform multiple tasks with fewer robots.

- Above 10 kg

Heavy-duty cobots are designed for industrial use cases that involve heavy lifting and force, like palletizing, welding, or moving heavy mechanical parts. They are generally used in the automotive, metalworking, and logistics sectors. Although they are costlier, their heavy lifting capacity leads to increased productivity and less human effort in manual tasks.

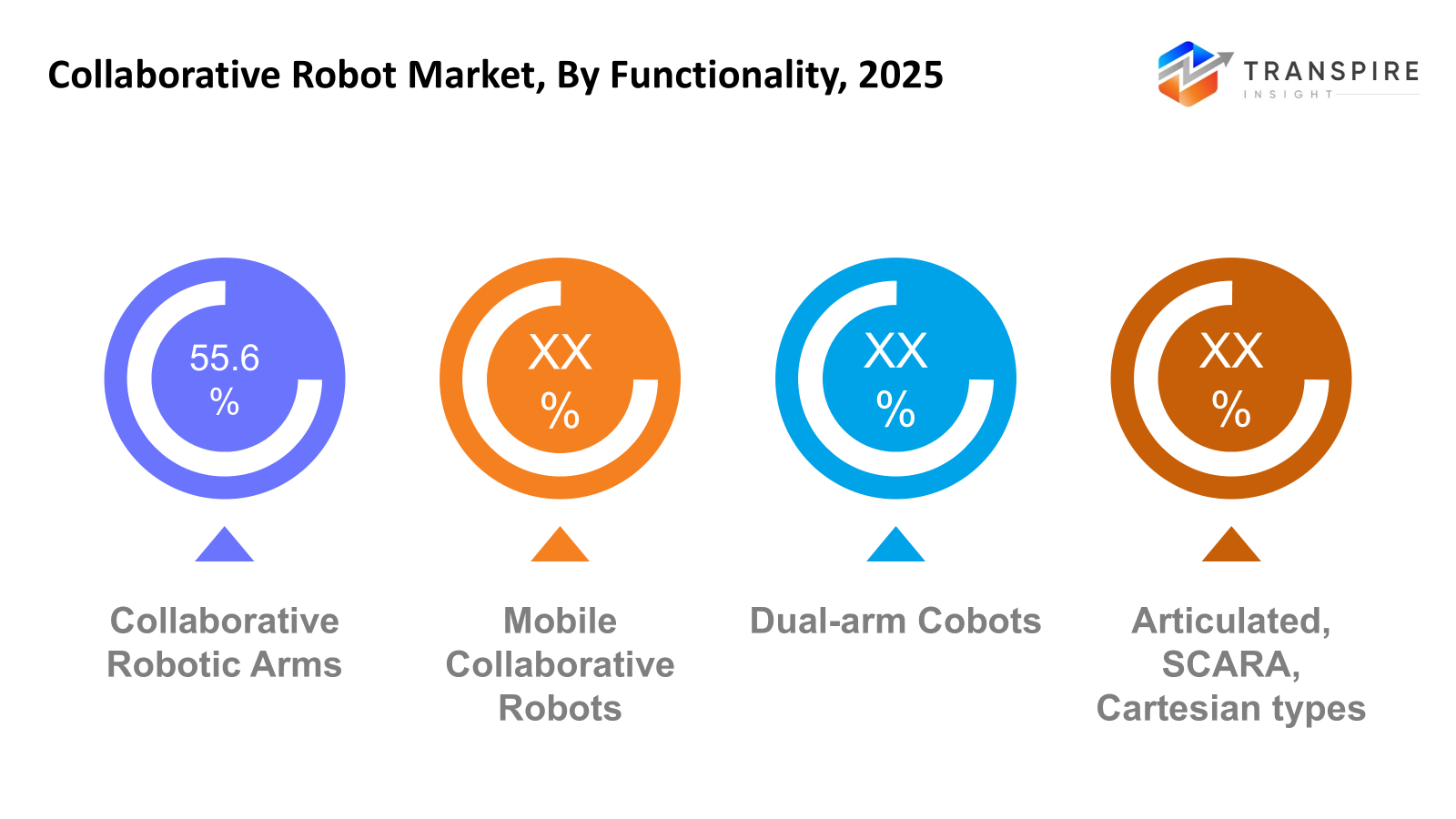

By Functionality

- Collaborative Robotic Arms

The most popular type of cobot is the robotic arm, which is flexible and can be used for a variety of tasks such as assembly and quality inspection. Their modularity makes it easy to integrate them into an existing production line. High repeatability and accuracy are the major drivers for the adoption of robotic arms.

- Mobile Collaborative Robots

Mobile cobots integrate mobility with collaborative technology, which allows flexible automation of various workstations. They are being used in logistics, e-commerce, and large-scale manufacturing facilities. Autonomous mobility makes them less dependent on fixed conveyors.

- Dual-arm Cobots

Dual-arm cobots replicate human ability to perform multiple tasks simultaneously such as assembly, welding or handling material. They are very useful in applications involving multiple tasks that require synchronized actions.

- Articulated, SCARA, Cartesian Robots

Each type of robot is designed to address a particular need in the manufacturing process. SCARA and Cartesian robots are best suited for pick & place and linear applications, respectively. Articulated cobots are useful in complex assembly tasks.

To learn more about this report, Download Free Sample Report

By Application

- Assembly

Cobots optimize repetitive assembly tasks, making them less labor-intensive and more accurate. Cobots are being adopted in the automotive, electronics and consumer products manufacturing sectors. The ability to easily change programming for different product models makes cobots suitable for mass customization applications.

- Pick & Place

Cobots optimize repetitive pick & place operations, increasing speed and accuracy. Cobots have a lower probability of collision and are easy to implement, making them suitable for packaging, sorting, and small parts handling applications. The pharmaceutical, food & beverage, and electronics industries can benefit from cobots' ability to minimize cycle times.

- Machine Tending

Machine tending cobots automate the loading and unloading of CNC machines, presses and injection molding machines. Cobots increase the efficiency of operations, minimize human error and enable operators to perform more complex tasks. Mid-to-heavy-duty cobots are more suitable for machine tending

- Quality Inspection & Testing

Cobots with vision systems and sensors are capable of performing quality inspection tasks. They are used in industries such as electronics, automotive and pharmaceuticals, where quality standards are of utmost importance.

- Material Handling

Cobots are used in lifting, transporting, and positioning materials in a production or warehousing setup. They are used to reduce workplace injuries and improve workflow efficiency. Heavy payload and mobile cobots are used in logistics and automotive industries.

- Packaging & Palletizing:

Cobots are used to increase packaging speed and accuracy while reducing the use of human labor for repetitive tasks. They are used in industries such as food, beverages and e-commerce.

- Welding, Gluing & Dispensing

Cobots have the accuracy required in welding, gluing, and dispensing, ensuring consistency and quality in the output. They are increasingly being used to replace human labor in the automotive, metalworking, and electronics industries. They can be easily reprogrammed for different operations.

- Other Specialty Tasks:

Cobots are used for painting, polishing, or lab automation, which demand accuracy and consistency. The need for specialized manufacturing and industries that focus on hygiene and safety, such as the healthcare and food industries, is driving the adoption of cobots.

By End User

- Automotive

The automotive industry is the biggest user of cobots because of the complexity of assembly lines and the need for high precision. Cobots are used to optimize sub-assembly, welding, and painting processes, thereby minimizing the need for human labor.

- Electronics & Semiconductors

Applications involving high precision, such as PCB assembly, testing, and micro-electronics handling, are best suited for cobots. The capability of cobots to operate safely in a small space with high precision is a major factor in their adoption.

- Food & Beverage

Cobots are used for packaging, sorting, and quality inspection in a hygienic environment. The collaborative nature of cobots ensures safe human interaction, thereby adhering to safety and regulatory requirements.

- Pharmaceuticals & Healthcare:

Automation of repetitive laboratory and manufacturing processes can minimize human error and the chances of contamination. Cobots are applied in drug development, packaging, and laboratory sample transfer.

- Metal & Machinery

Cobots are applied in welding, machine tending, and material transfer, increasing productivity and security. Heavy-duty cobots are more in demand due to higher payload requirements.

- Logistics & E-commerce

Cobots optimize warehouse operations by automating picking, sorting, and material transfer. Mobile cobots and AI technology are major drivers for the adoption of cobots.

- Others

Aerospace, plastics, and chemical industries apply cobots in specific applications like painting, dispensing, and assembly.

Regional Insights

North America continues to be a mature market, with the United States, Canada, and Mexico dominating the region due to their advanced manufacturing facilities, high labor costs and developed automotive and electronics industries. The region is aided by government support and R&D activities that promote the adoption of cobots in assembly, logistics and inspection processes. Europe is represented by Germany, the United Kingdom, France, Spain, Italy and the Rest of Europe, where the region's high manufacturing quality, industrial automation projects and growing use of AI-based robotics in the automotive, electronics and metal processing industries are driving the growth of the cobot market. Asia Pacific comprises Japan, China, Australia & New Zealand, South Korea, India, and the Rest of Asia Pacific, which has the fastest growth rate because of massive car production and electronics manufacturing, as well as the development of logistics and e-commerce infrastructure, and government support for smart factories and Industry 4.0 adoption.

In South America region includes Brazil, Argentina, and the Rest of South America, which has moderate adoption with emphasis on the automotive and food processing sectors, slowly integrating cobots to enhance productivity and minimize labor-intensive tasks. Middle East & Africa, includes Saudi Arabia, United Arab Emirates, South Africa, and the Rest of the region, has emerging growth as the manufacturing and logistics industries begin to adopt collaborative robots to enhance efficiency, especially in the aerospace, oil & gas, and pharmaceutical sectors.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, Doosan Robotics made an announcement regarding the acquisition of an 89.59% stake in ONExia Inc., an engineering and automation firm based in the U.S., aiming to accelerate its shift to intelligent robotic platforms by incorporating cutting-edge collaborative robot systems with full automation capabilities.

- In July 2025, ABB Robotics released a press release about its joint exhibition with B&R at Teknologia 25 in Helsinki, focusing on the demonstration of GoFa collaborative robots integrated with intelligent transport systems, showcasing ABB's contributions to human-robot collaboration and automation technology advancements.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 9.3 Billion |

|

Market size value in 2026 |

USD 11.5 Billion |

|

Revenue forecast in 2033 |

USD 45.2 Billion |

|

Growth rate |

CAGR of 21.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Universal Robots A/S, FANUC CORPORATION, ABB Group, TECHMAN ROBOT INC., AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD, KUKA AG, Doosan Robotics Inc., DENSO CORPORATION, YASKAWA ELECTRIC CORPORATION, Rethink Robotics, Inc., OMRON Corporation, Kawasaki Heavy Industries, Ltd., Stäubli International AG, Comau, OnRobot US Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Payload Capacity (Up to 5 kg, 5–10 kg, Above 10 kg), By Functionality (Collaborative Robotic Arms, Mobile Collaborative Robots, Dual‑arm Cobots, Articulated, SCARA, Cartesian types), By Application (Assembly, Pick & Place, Machine Tending, Quality Inspection & Testing, Material Handling, Packaging & Palletizing, Welding, Gluing & Dispensing, Other Specialty Tasks) and By End User (Automotive, Electronics & Semiconductors, Food & Beverage, Pharmaceuticals & Healthcare, Metal & Machinery,Logistics & E‑commerce, Others) |

Key Collaborative Robot Company Insights

Universal Robots A/S is generally acknowledged as the market leader in the area of collaborative robots, and this leadership position has been established through early entry and a deep focus on the technology of cobots. The company’s UR line of robots is recognized for ease of programming, flexibility of use, and widespread distribution around the globe, and this has been achieved through a strong developer community and support for third-party peripherals. The company’s strategic moves into new markets, along with ongoing innovation in products, have helped to establish and maintain its leadership position, and this has allowed the company to address a wide range of industries from automotive to electronics while still offering strong differentiation compared to traditional robot manufacturers.

Key Collaborative Robot Companies:

- Universal Robots A/S

- FANUC CORPORATION

- ABB Group

- TECHMAN ROBOT INC.

- AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD

- KUKA AG

- Doosan Robotics Inc.

- DENSO CORPORATION

- YASKAWA ELECTRIC CORPORATION

- Rethink Robotics, Inc.

- OMRON Corporation

- Kawasaki Heavy Industries, Ltd.

- Stäubli International AG

- Comau

- OnRobot US Inc.

Global Collaborative Robot Market Report Segmentation

By Payload Capacity

- Up to 5 kg

- 5–10 kg

- Above 10 kg

By Functionality

- Collaborative Robotic Arms

- Mobile Collaborative Robots

- Dual‑arm Cobots

- Articulated, SCARA, Cartesian types

By Application

- Assembly

- Pick & Place

- Machine Tending

- Quality Inspection & Testing

- Material Handling

- Packaging & Palletizing

- Welding, Gluing & Dispensing

- Other Specialty Tasks

By End User

- Automotive

- Electronics & Semiconductors

- Food & Beverage

- Pharmaceuticals & Healthcare

- Metal & Machinery

- Logistics & E‑commerce

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636