Market Summary

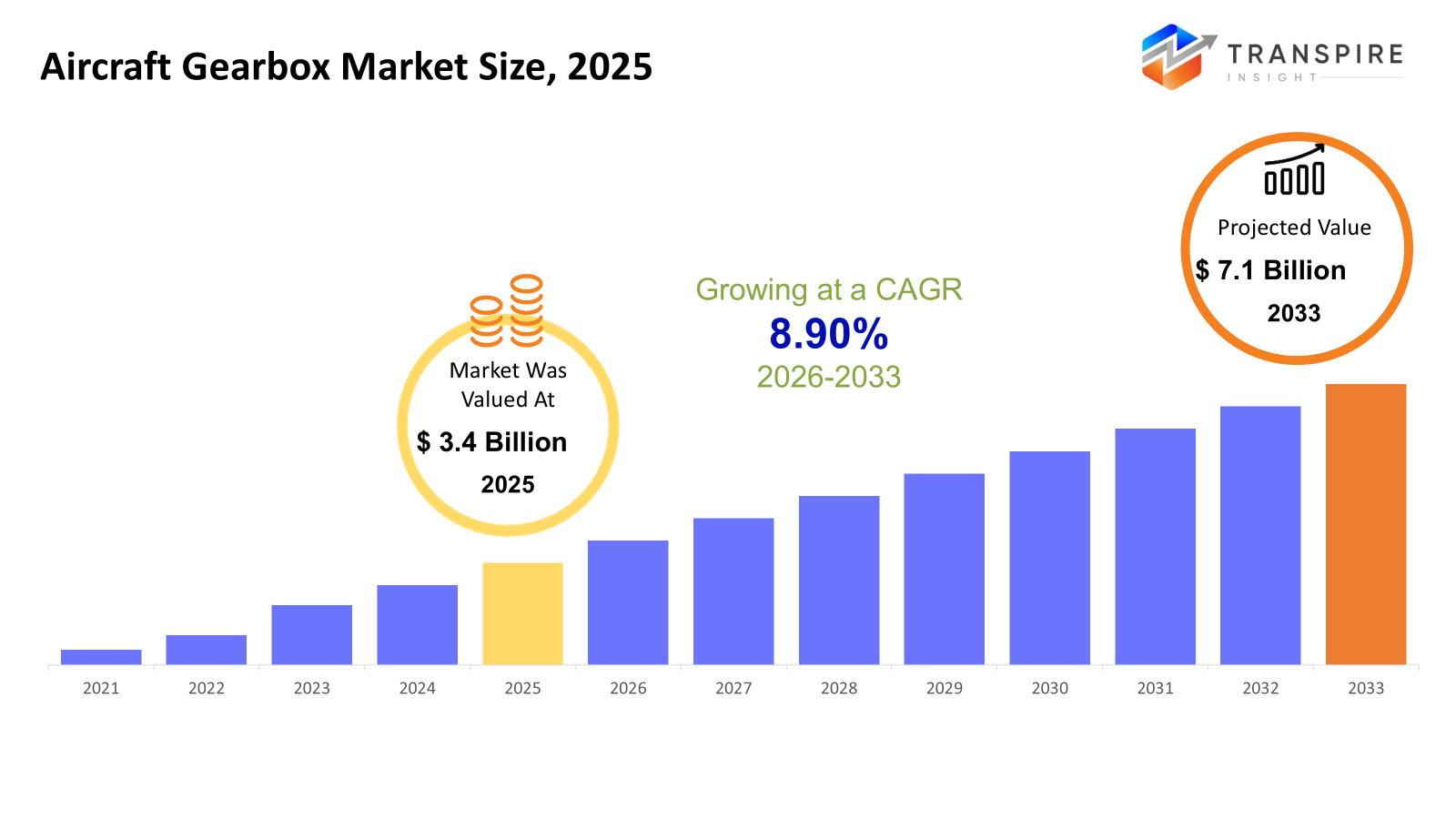

The global Aircraft Gearbox market size was valued at USD 3.4 billion in 2025 and is projected to reach USD 7.1 billion by 2033, growing at a CAGR of 8.90% from 2026 to 2033. Factors such as CAGR of the aircraft gearbox market, driven by commercial aircraft deliveries, growing acceptance of geared turbofans, and continuous expenditure on defense aviation, favor the steady growth of the aircraft gearbox segment.

Market Size & Forecast

- 2025 Market Size: USD 3.4 Billion

- 2033 Projected Market Size: USD 7.1 Billion

- CAGR (2026-2033): 8.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America will still represent a mature but high-value market due to ongoing aircraft programs, high-tier engine programs, and defense spends. Presence of OEMs and Tier 1 companies will ensure that demand remains constant in commercial, military, and aerospace segments.

- Driving regional momentum across the US and beyond for the Commercial Fleet segment, US military flight hours support the product segment alongside the adoption of the future generation of power plants. Robust MRO support and lengthy service intervals also support the requirement for recurrent gear box replacements.

- Asia Pacific shows the highest growth potential based on the expanding air passenger services, strong fleet expansion, and the Asian governments' initiatives in the production of aircraft materials as well as the aircraft themselves. Rising deliveries of narrow-body aircraft and the local investment in aircraft maintenance services boost gearbox requirement ratios significantly.

- Reduction gearboxes are found to be the leading type, driven by the fact that reduction gearboxes play an essential role, enabling geared turbofan engines' efficiency, reduction of noise, and reduction of emissions. For airline sustainability strategies, the drive toward next-gen air propulsion makes reduction gearboxes critical.

- Greater demand for aircraft types, led by turbo-fans, in both Narrow Body and Wide Body configurations worldwide, makes up the dominant segment of the aircraft type space. In addition, the high content of gearboxes in each aircraft and the maintenance rate favor this segment in terms of revenue generation.

- Engine system application drives overall gearbox demand as gearboxes in this area are critical to power transmission accessories and engine propulsion. With increasing complexity in power units, gear box performance is also on the increase, and so are the price and long-term OEM contracts.

- OEMs comprise the largest end user segment driven by steady aircraft production rates, established supplier relationships, and certification requirements. Gearbox manufacturers have predictable volumes, technology relationships, and high barriers to entry thereby controlling competitive pressures.

So, Aircraft gearboxes form a system of mechanical solutions to transmit power, control the rotational speed of machines, and perform crucial functions for the efficient running of the gearboxes themselves. This system of gearboxes plays a critical role in the overall running of the airplanes. It can be associated with the production of the airplanes themselves. The role played by technological innovations is at the core of the market, and with the development of geared turbofan and electric architectures, these are impacting the design specifications of gearboxes for increased torque, reduced weights, less vibration, and increased operational reliability. Aviation regulations and test criteria are significant influencers on supplier choices. The market benefits from a well-developed after-market environment, reflecting the in-service time of the aircraft and the inspection intervals. Replacement demand and overhauls continue to remain strong with increasing and aging fleet sizes globally. Revenues from OEMs and MROs help achieve consistent visibility.

Aircraft Gearbox Market Segmentation

By Gearbox Type

- Accessory Gearbox

Accessory gearboxes play a very important role as drive equipment for the critical systems of the aircraft. This demand is directly proportional to the rate of production of the airplanes along with the improvements made to the engine of the airplane. This segment of the business benefits from the increased electrification of the system. This segment of the business sees most of the demand from OEMs.

- Reduction Gearbox

Reduction gearboxes are picking up significant momentum as next-generation GTF engines rely on such a component. The advantages of using such a gearbox lie in its ability to assure fuel efficiency, minimize the noise produced, and also guarantee extra fuel. There is increasing focus on sustainability and fuel savings among airlines, helping to drive demand forward. Complexity is holding back supplier concentration.

- Actuation Gearbox

Actuation gearbox applications include flight controls, landing gear, and flaps. The growth is driven by increasing aircraft automation and more electric aircraft trends. The reliability aspect is key, with accuracy requirements increasing costs during R&D. There is overlap in fixed-wing and rotorcraft, providing stability for growth.

- Tail Rotor Gearbox

Tail rotor gearboxes are specific to helicopters and play a significant role in the control and stability of the helicopter. User demand is driven by the needs of the military to procure helicopters and the demand from the civil sector for helicopters used for emergency medical responses and offshore platforms. High rates of wear demand require consistent demand from the aftermarkets. Technological advancements aim to make the parts more robust and less prone to vibrations.

- Auxiliary Power Unit (APU) Gearbox

APU gearboxes for power generation for non-propulsion systems drive growth. Growth can also be attributed to the escalating demand for non-journey phases. Main applications for APU gearboxes lie in commercial aircraft, while those used in defense aircraft drive high-end market growth. A focus still persists on reliability, even in extreme conditions.

- Other Specialized Gearbox Types

This segment also covers specialized gearboxes geared towards UAVs, VTOLs, and experimental planes. Growth drivers are the technology innovations unfolding in the aerospace arena and defense sector upgrades. Lower production volumes are compensated by the increased demand for precision. Innovation and lightweight technology play major roles as competition attributes.https://www.transpireinsight.com/images_data/12731503.png

By Aircraft Type

- Turbofan Aircraft

Turbofans have the most market share due to the dominance of these aircraft in commercial flying operations. High growth rates are expected in the turbofans, especially the non-narrow ones, which would propel the market growth of these gearboxes. The growing adoption of geared turbofans would contribute more towards the growth of the gearbox market.

- Turboprop Aircraft

Turboprops There are mainly three drivers of turboprop engines in regional services as well as military applications. Gearboxes are essential in turboprop engines in terms of efficiently transmitting power. With constant business in regional services and military applications, turboprop engines ensure a steady revenue stream.

- Helicopter

Helicopters also require several types of gearbox systems, and therefore they are termed as gearbox-intensive units. The military, emergency, and offshore energy markets are the main demand drivers. Operating stresses in this category are very high, and as a result, component replacements are very frequent. This market also has very good after-market support and long product lifespan.

- Unmanned Aerial Vehicles

UAVs constitute a segment with high growth potential, mainly due to defense surveillance, logistics, and commercial needs. Gearbox design solutions focus on the weight and efficiency of the design. Although the value of each product is lower compared with manned aircraft, the volume makes up for it considerably. Technological advancements constitute the second market differentiator.

To learn more about this report, Download Free Sample Report

By Application

- Engine Systems

Majority of gear box demand occurs in engine systems owing to their critical function in power transmission and accessory drives. With rising demands for increased engine efficiency, gear box complexity and precision increase. Performance and lightweight aspects of gear box are preferred by original equipment makers. There is a long timeline in gear box certification, and therefore entry is difficult for new suppliers.

- Piston & Turboprop Engines

The gearboxes of piston and turboprop engines emphasize speed reduction and torque control. The market size remains stable and well-supported due to regional aircraft fleets and military trainers. Cost pressure is relatively higher when compared with turbofans. Reliability and maintenance are major influencers when purchasing these engines.

- Turbojet Engines

Turbojet is a niche application with strong performance characteristics mainly in military platforms. Gearbox demand is limited by the decline in commercial use. Defense modernization programs sustain selective demand in this application. The high stresses in this application require advanced materials.

- Turboshaft Engines

Turboshaft engines mainly used in helicopters, demand highly dependable gearboxes. Revenues will also come from increased helicopter fleets and military upgrades. Gearboxes are critical in the efficiency and security of these airplanes. Services will make an essential contribution towards revenues.

- Turbofan Engines

Turbofan engines drive engine demand for gearbox systems due to the high number of commercially used aircraft. Advanced reduction gearboxes and accessory gearboxes improve fuel efficiency and noise reduction. Expanded aircraft deliveries in Asia Pacific and North America benefit the market. OEM relationships are vital for securing contracts.

- Airframe Systems

Applications of airframe gearbox include landing gears, flaps, and control surfaces. With increasing automation and electric drive solutions, the scope of airframe gearbox is increasing. The demand for airframe gearbox is directly proportional to the production of aircraft.

By End User

- Original Equipment Manufacturers (OEMs)

OEMs hold the largest share of revenues with the largest volume of aircraft and engine manufacturing. Long-term agreements and stringent certification processes govern the OEMs’ business model. Technology sharing between gearbox players and engine OEMs is essential. The entry barriers are high, restricting players and favoring established players.

- Aftermarket / MRO (Maintenance, Repair & Overhaul)

The aftermarket business benefits from the long life service cycles of aircraft and regular maintenance requirements. Gearboxes are a critical part of aircraft, and inspection cycles are regular. With an aging fleet in mature markets, replacement requirements are high for these gearboxes.

Regional Insights

The region of North America, which includes countries like the United States, Canada and Mexico is at the forefront of the aircraft gearbox market. The United States is classified as a Tier 1 region, whereas countries like Canada help the region in regional supply chain activities, while Mexico enhances manufacturing growth. The European market is indicative of a technologically affluent marketplace, marked by strong participation from countries like Germany, the United Kingdom, France, Italy and Spain. Cooperative projects in the space arena and environmentally inspired improvements to propulsion units help fuel gearbox demand in Tier-1 and Tier-2 countries.

The growing region is Asia Pacific, led by China, India, Japan, and South Korea; this is further boosted by increasing aircraft delivery and local aerospace programs. There is a contribution from defense aviation and regional programs from Australia and New Zealand. South America shows moderate growth with Brazil being the main driver of the tier-1 market with regional aircraft availability and MRO facilities, followed by tier-2 countries such as Argentina and its surrounding nation.

Its driving factors include the wide-body fleet growth trend in Saudi Arabia and the UAE, backed by expanding MRO flies, along with the South Africa-based maintenance and defense flying.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, Pratt & Whitney celebrated its GTF MRO Network awards, recognizing MTU Maintenance Hannover and Eagle Services Asia for excellence in maintenance service quality and for achieving significant operational improvements for the PW1100G-JM engine family.

- In April 2025, Pratt & Whitney announced an agreement with MTU Aero Engines to expand GTF engine overhaul capacity, increasing MTU's annual capability to 600 shop visits across all GTF models and enhancing aftermarket propulsion support globally.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.4 Billion |

|

Market size value in 2026 |

USD 3.9 Billion |

|

Revenue forecast in 2033 |

USD 1.5 Billion |

|

Growth rate |

CAGR of 7.1% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Safran Transmission Systems, General Electric (GE Aviation), Honeywell International Inc., Rolls-Royce plc, Pratt & Whitney (RTX), MTU, Aero Engines AG, Leonardo S.p.A., ABB Turbo Systems, Shanghai Aerospace Gear Co., Ltd., Kobe Steel, Ltd., Liebherr Group, Aero Gear Inc., Northstar Aerospace Inc., Triumph Group, Inc., SKF Group |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Gearbox Type (Accessory Gearbox, Reduction Gearbox, Actuation Gearbox, Tail Rotor Gearbox, Auxiliary Power Unit (APU) Gearbox, Other Specialized Gearbox Types), By Aircraft Type (Turbofan Aircraft, Turboprop Aircraft, Helicopters, Unmanned Aerial Vehicles (UAVs)), By Application (Engine Systems, Piston & Turboprop Engines, Turbojet Engines, Turboshaft Engines, Turbofan Engines, Airframe Systems) and By End User (Original Equipment Manufacturers (OEMs), Aftermarket / MRO (Maintenance, Repair & Overhaul)) |

Key Aircraft Gearbox Company Insights

Safran Transmission Systems is also an essential global supplier of aircraft types of gearboxes, starting with the better mechanical type of power transmission systems included in commercial as well as military aircraft types. The types of aircraft gearbox offered by Safran Translation Systems cover aircraft accessories, driving reductions, as well as aircraft component types included in various types of turbofans. The partnership of Safran Translation Systems with different types of aircraft OEMs, starting with R&D investments, mainly fuels Safran Translation Systems’s competitive advantage, ensuring the adaptation of aircraft types of gearboxes to different types of aircraft.

Key Aircraft Gearbox Companies:

- Safran Transmission Systems

- General Electric (GE Aviation)

- Honeywell International Inc.

- Rolls-Royce plc

- Pratt & Whitney (RTX)

- MTU Aero Engines AG

- Leonardo S.p.A.

- ABB Turbo Systems

- Shanghai Aerospace Gear Co., Ltd.

- Kobe Steel, Ltd.

- Liebherr Group

- Aero Gear Inc.

- Northstar Aerospace Inc.

- Triumph Group, Inc.

- SKF Group

Global Aircraft Gearbox Market Report Segmentation

By Gearbox Type

- Accessory Gearbox

- Reduction Gearbox

- Actuation Gearbox

- Tail Rotor Gearbox

- Auxiliary Power Unit (APU) Gearbox

- Other Specialized Gearbox Types

By Aircraft Type

- Turbofan Aircraft

- Turboprop Aircraft

- Helicopters

- Unmanned Aerial Vehicles (UAVs)

By Application

- Engine Systems

- Piston & Turboprop Engines

- Turbojet Engines

- Turboshaft Engines

- Turbofan Engines

- Airframe Systems

By End User

- Original Equipment Manufacturers (OEMs)

- Aftermarket / MRO (Maintenance, Repair & Overhaul)

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636