Market Summary

The global Breast Ultrasound market size was valued at USD 2.80 billion in 2025 and is projected to reach USD 5.80 billion by 2033, growing at a CAGR of 9.30% from 2026 to 2033. With more people facing breast cancer worldwide, demand for ultrasounds has grown fast. Early detection efforts now get stronger support from communities and clinics alike. Imaging tools have evolved - some show depth and motion, others scan without constant manual control. Machines that learn from data help doctors identify what might otherwise be missed. Better precision leads to greater trust in these methods over time.

Market Size & Forecast

- 2025 Market Size: USD 2.80 Billion

- 2033 Projected Market Size: USD 5.80 Billion

- CAGR (2026-2033): 9.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Fueled by clear screening rules, money flowing into health care, and a quick embrace of modern imaging tools, the market pushes forward fast. Growth finds footing where routine checks are standard, cash supports medical needs, while new tech arrives ahead of schedule. With guidance already in place, funding steady, and machines getting smarter all at once, expansion follows naturally.

- Fueled by broad access to breast cancer screenings, this top national market grows fast. New tech like artificial intelligence flows into clinics alongside advanced 3D ultrasound tools. Expansion comes not just from care networks but also from smarter imaging methods, catching on quickly. Size stands out because early detection efforts meet modern tools head-on.

- Health care setups are getting better here, which helps the area grow quickly. More people recognize breast cancer signs now. Diagnostic imaging gets more funding than before.

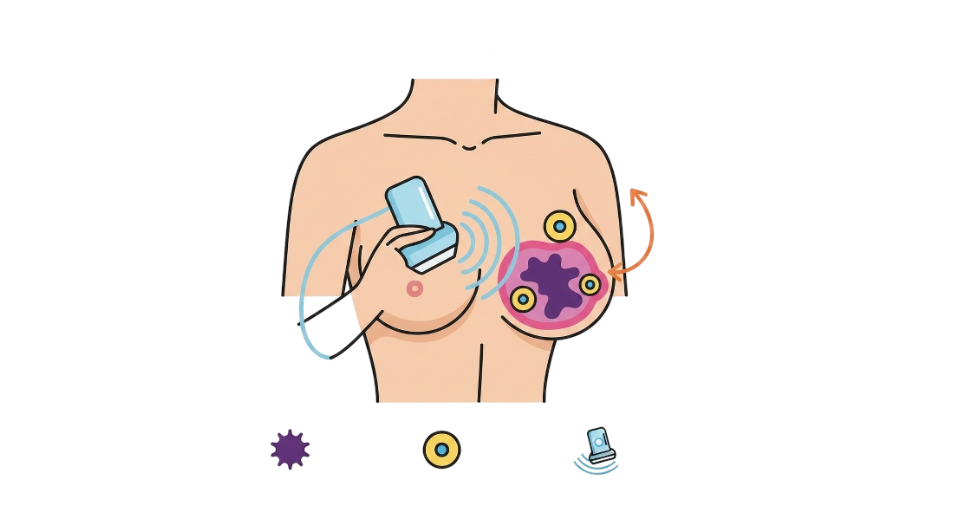

- Automated Breast Ultrasound Systems share approximately 39% in 2026. Starting strong, these ultrasound tools help find issues more easily in dense breast tissue. Because of that, clinics are using them more often lately. Imaging steps stay consistent, which keeps results reliable. Fewer missed findings during exams. Another point is that doctors trust the clearer pictures they produce.

- A clearer picture emerges when doctors use 3D ultrasound, which reveals depth that flat images miss. Volume rendering helps spot irregularities once hidden in standard scans. Some professionals now lean toward this method because shape matters in diagnosis. Detail shifts perception; what looked smooth may actually be jagged underneath. Seeing structure in three dimensions changes how abnormalities are judged.

- Fueled by rising attention, breast cancer checks are climbing - more people reach out when outreach grows. Programs spread, detection follows, quietly changing outcomes across regions.

- Few places see more patients than hospitals, thanks to their wide range of testing tools. Their lead holds because big teams handle complex cases every day.

With increasing focus on early breast cancer detection, particularly among women with dense breast tissue, demand for Automated Breast Ultrasound Systems continues to grow—contributing significantly to expansion of the breast ultrasound market. These systems capture comprehensive, high-resolution images of the entire breast, offering consistent and repeatable results compared to hand-held ultrasound scans that may vary depending on operator skill. Because imaging outcomes remain uniform across examinations, physicians gain greater diagnostic confidence, while large-scale population screening programs become more efficient and manageable.

New tech is pushing markets forward in quiet but steady ways. Inside modern ABUS setups, 3D scans meet smart software that rebuilds pictures with greater depth. Alongside these, AI steps in to spot irregularities earlier than before. Because of tighter imaging and smoother processes, reading results becomes less guesswork for specialists. Exams now take fewer minutes yet deliver sharper insights. Clinics handling many patients start seeing this method as a grounded choice rather than a leap into the unknown.

Folks are catching on that denser breast tissue can raise cancer odds, which is quietly shifting how screenings unfold. Mammograms still lead, yet they are now often paired with extra tools when breasts show dense patterns. Because standard views sometimes miss what lies deeper, clinics lean into fresh approaches without relying solely on old standards. Automated whole-breast ultrasound, no needles, no rays, just clearer glimpses beneath the surface. Hidden spots that once slipped past notice now stand a better chance of showing up early.

Even so, getting it widely used could stumble over pricier gear, along with demands for focused learning. Still, steady funding into medical systems, constant updates to devices, plus closer ties between tech makers and clinics should help it spread further. With check-up methods shifting toward tailored, tech-based paths, this ultrasound method stands ready to play a central role in today’s breast scans.

Breast Ultrasound Market Segmentation

By Product Type

- Handheld Ultrasound Systems

Small ultrasound tools fit right in your hand. These portable units work well where space is tight. They help doctors check breasts without sending patients elsewhere. Cost stays low compared to larger machines. Many clinics choose them for fast evaluations. Their design focuses on ease during urgent visits. Performance remains solid for basic imaging needs.

- Automated Breast Ultrasound Systems

Starting differently, Automated Breast Ultrasound Systems offer clear images through consistent methods. These tools work well when looking into thick breast tissue. Built for precision, they capture detailed scans without variation. Instead of relying on hand-held techniques, machines handle the process uniformly.

- 3D/4D Ultrasound Systems

Picture-based ultrasound tech brings depth to scans, so doctors see abnormalities more clearly. With layered visuals, spotting issues becomes more reliable. Seeing inside the body in full shape helps reduce guesswork. Volume-focused imaging builds stronger trust in the results found.

To learn more about this report, Download Free Sample Report

By Technology

- 2D Ultrasound

Picture-based scan using flat images, often found in standard checkups for early looks at breast tissue.

- 3D Ultrasound

A different kind of ultrasound uses 3D imaging to show breast tissue more clearly. Because of this, doctors can spot tumors more easily and tell what type they might be.

- Doppler Ultrasound

Finding how blood moves inside breast lumps is possible with Doppler ultrasound. This look helps tell harmless growths apart from harmful ones by watching circulation patterns. Instead of guessing, doctors see real movement clues that point one way or another.

- Elastography

Firmness of tissue gets checked through elastography, helping spot cancer sooner while cutting down on extra biopsy procedures. This method shifts focus toward clearer diagnosis without reaching straight for invasive steps.

By Application

- Breast Cancer Screening

Picking up screening more often now helps catch issues sooner, especially when breast tissue is denser. For those women, it makes a difference to spot things earlier.

- Diagnostic Imaging

When a lump seems unusual after a checkup, imaging helps take a closer look. A scan may follow if something feels off during an exam. Suspicious findings often lead to pictures being taken inside the body. If a doctor notices anything strange, they might rely on visuals to understand it better. Seeing beneath the skin can clarify what touch alone cannot.

- Treatment Monitoring

Watching how a tumor reacts while someone goes through chemo can guide the next steps. Changes seen over time often hint at whether therapy is working.

- Biopsy Guidance

- This helps get it right for reliable samples. With guidance, hitting the target becomes more certain during biopsies.

By End-Users

- Hospitals

Hospitals bring in big money because they have high-end scanning gear sitting inside them. Their doors stay busy, filled with people needing care every single day.

- Diagnostic Imaging Centers

More clinics now offer advanced scans, since demand keeps rising for focused tests outside hospitals. Equipment improves, so patients visit more often without needing long stays.

- Specialty Clinics

Females seeking care often turn to specialty clinics; these spots shape needs around breast imaging tools. Equipment evolves where attention lands on woman-centered treatment.

- Ambulatory Surgical Centers

Utilize ultrasound for minimally invasive biopsy and interventional procedures.

Regional Insights

Health systems across North America stand out globally because clinics there use modern tools regularly. Patient knowledge runs deep, which helps new scanning methods catch on fast. Big companies making medical gear are often based here, giving local providers quick access to equipment. Insurance rules also back the use of breast ultrasound, weaving it into standard checkups without delay.

Across Europe, the steady need for breast imaging grows thanks to clear national screening plans and solid public health networks. In places such as Germany, the United Kingdom, and France, funding flows into digital upgrades alongside smart software for diagnosis. Mobile units bring services further, reaching people who often miss routine checks.

Out here in the Asia Pacific area, demand jumps fast, better medical care reaches more people, knowledge about breast cancer spreads, and hospitals grow. Countries stepping up include China, India, and even Japan, each adding momentum in its own way. Farther away, parts of Latin America see slow but steady change, much like areas across Africa and the Middle East, where clinics appear more often, and screening programs slowly take root. Growth hums along, fed by fresh funding, local efforts gaining ground.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 23, 2025 – New Breast ultrasound program launched to boost cancer detection.

(Source: https://lovefm.com/new-breast-ultrasound-program-launched-to-boost-cancer-detection/#google_vignette)

- August 25, 2025 – Sonio launched a new set of ultrasound offerings for maternal care.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.80 Billion |

|

Market size value in 2026 |

USD 3.10 Billion |

|

Revenue forecast in 2033 |

USD 5.80 Billion |

|

Growth rate |

CAGR of 9.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

GE Healthcare, Siemens Healthineers, Canon Medical Systems, Hitachi Ltd., Hologic Inc., Koninklijke Philips N.V., Samsung Medison, Mindray Medical, Fujifilm Holdings, Delphinus Medical Technologies, SonoCiné Inc., QT Ultrasound (QT Imaging), SuperSonic Imagine, Esaote SpA, Carestream Health, and Clarius Mobile Health |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Handheld Ultrasound Systems, Automated Breast Ultrasound Systems, 3D/4D Ultrasound Systems), By Technology (2D Ultrasound, 3D Ultrasound, Doppler Ultrasound, Elastography), By Application (Breast Cancer Screening, Diagnostic Imaging, Treatment Monitoring, Biopsy Guidance), By End-Users (Hospitals, Diagnostic Imaging Centers, Specialty Clinics, Ambulatory Surgical Centers) |

Key Breast Ultrasound Company Insights

One name stands out when it comes to high-end medical imaging: GE Healthcare. Worldwide, hospitals rely on their ultrasound tech for clearer diagnostics. Not just another tool, the Invenia ABUS system targets dense breast tissue with precision. Alongside it, smarter versions powered by AI simplify how scans are captured and reviewed. Instead of guesswork, doctors get consistent 3D views shaped by automation. Scanning becomes faster because smart software cuts down manual steps. Image clarity improves, thanks to behind-the-scenes algorithms fine-tuning each frame. Confidence in diagnosis grows when technology removes variability. In busy clinics, efficiency matters; these systems deliver without slowing down. At the core, progress is not flashy; it’s built into every update and refinement.

Key Breast Ultrasound Companies:

- GE Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Hitachi Ltd.

- Hologic Inc.

- Koninklijke Philips N.V.

- Samsung Medison

- Mindray Medical

- Fujifilm Holdings

- Delphinus Medical Technologies

- SonoCiné Inc.

- QT Ultrasound (QT Imaging)

- SuperSonic Imagine

- Esaote SpA

- Carestream Health

- Clarius Mobile Health

Global Breast Ultrasound Market Report Segmentation

By Product Type

- Handheld Ultrasound Systems

- Automated Breast Ultrasound Systems

- 3D/4D Ultrasound Systems

By Technology

- 2D Ultrasound

- 3D Ultrasound

- Doppler Ultrasound

- Elastography

By Application

- Breast Cancer Screening

- Diagnostic Imaging

- Treatment Monitoring

- Biopsy Guidance

By End-Users

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

- Ambulatory Surgical Centers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636