Market Summary

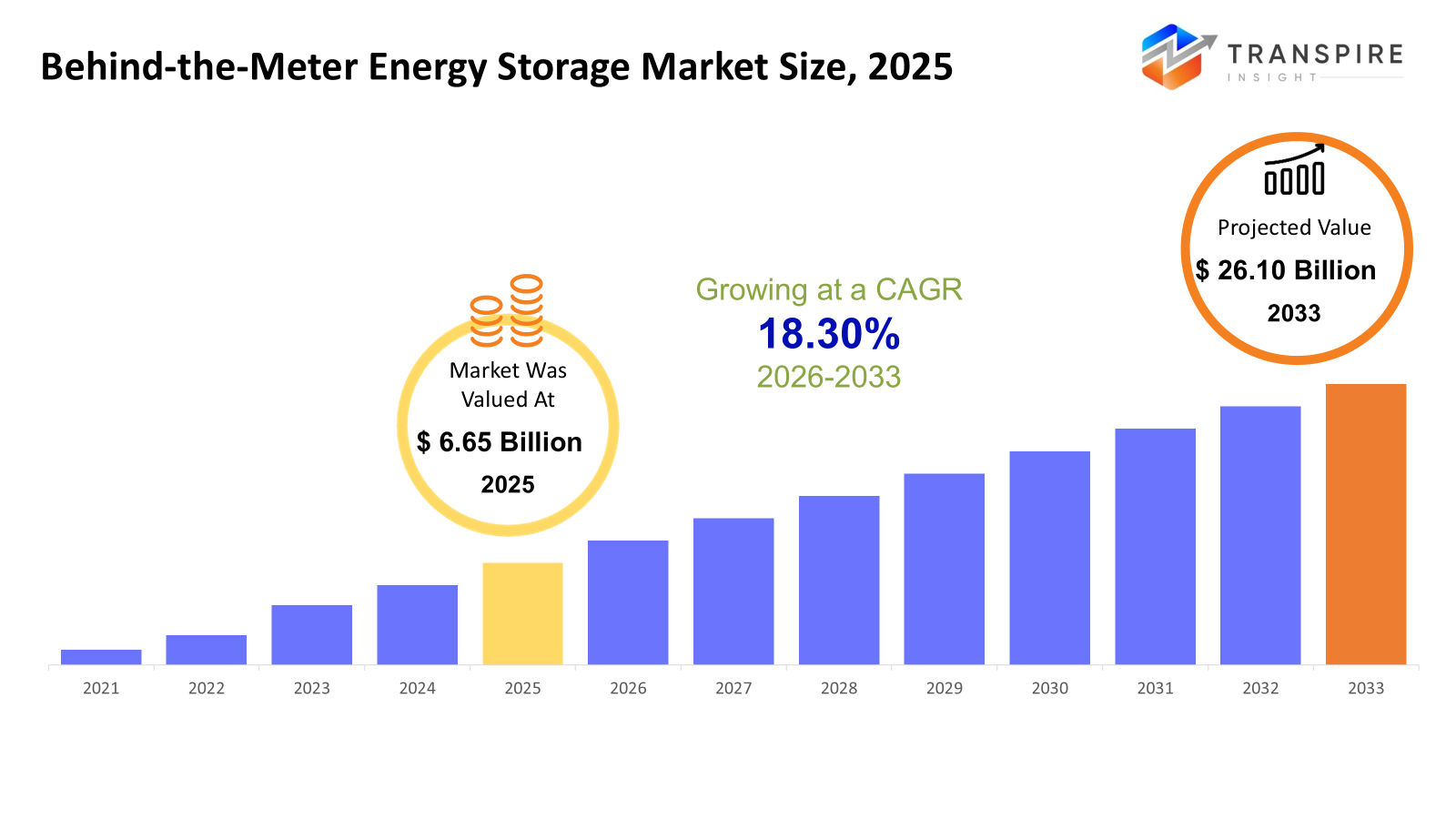

The global Behind-the-meter Energy Storage market size was valued at USD 6.65 billion in 2025 and is projected to reach USD 26.10 billion by 2033, growing at a CAGR of 18.30% from 2026 to 2033. Fueled partly by higher electric bills, people now seek steadier power sources while turning more to small-scale renewables like home solar panels. Because storage units sit between users and the grid, households can cut high usage fees when demand spikes, keep extra power for later, yet stay ready if the lights go off. Rules that favor clean tech, cheaper batteries over time, along with a move away from central plants, shape how fast this sector expands.

Market Size & Forecast

- 2025 Market Size: USD 6.65 Billion

- 2033 Projected Market Size: USD 26.10 Billion

- CAGR (2026-2033): 18.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

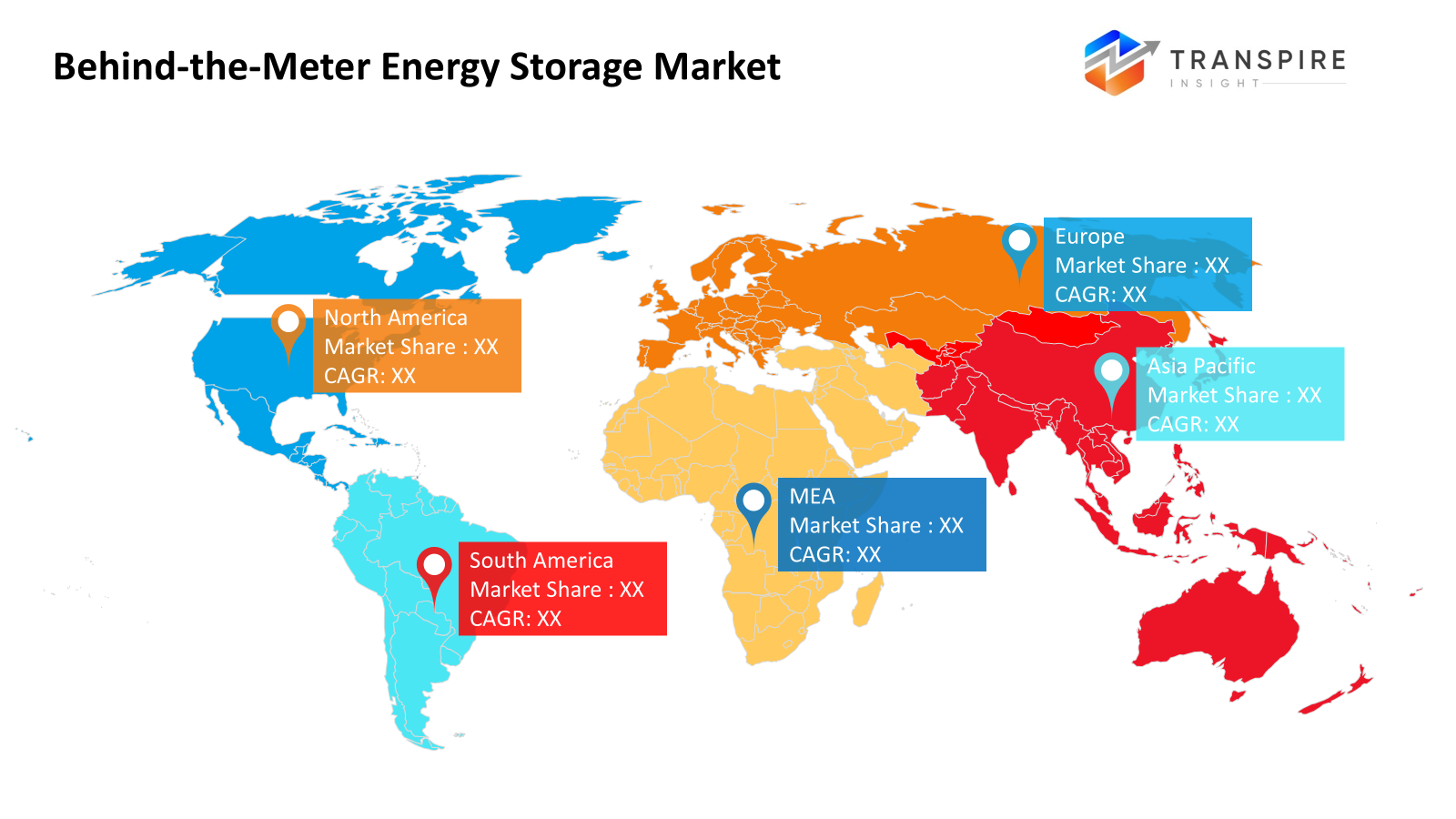

- The North American market share is estimated to be approximately 42% in 2026. North America is fueled by firm policies, power costs that push change, and distributed systems already in wide use. This is where North America stands ahead. Though others watch closely, progress here runs faster on its own rhythm.

- Fueled by quick rollouts of home plus commercial battery systems, the United States pushes ahead in its region. Solar power ties into these efforts, shaping how energy needs are met each day. Instead of waiting, responses shift with usage patterns across neighborhoods and businesses alike.

- Fueled by growing energy needs, the Asia-Pacific region expands the quickest. Grid limits push change across the area. Rooftop solar spreads faster now. Storage solutions follow close behind.

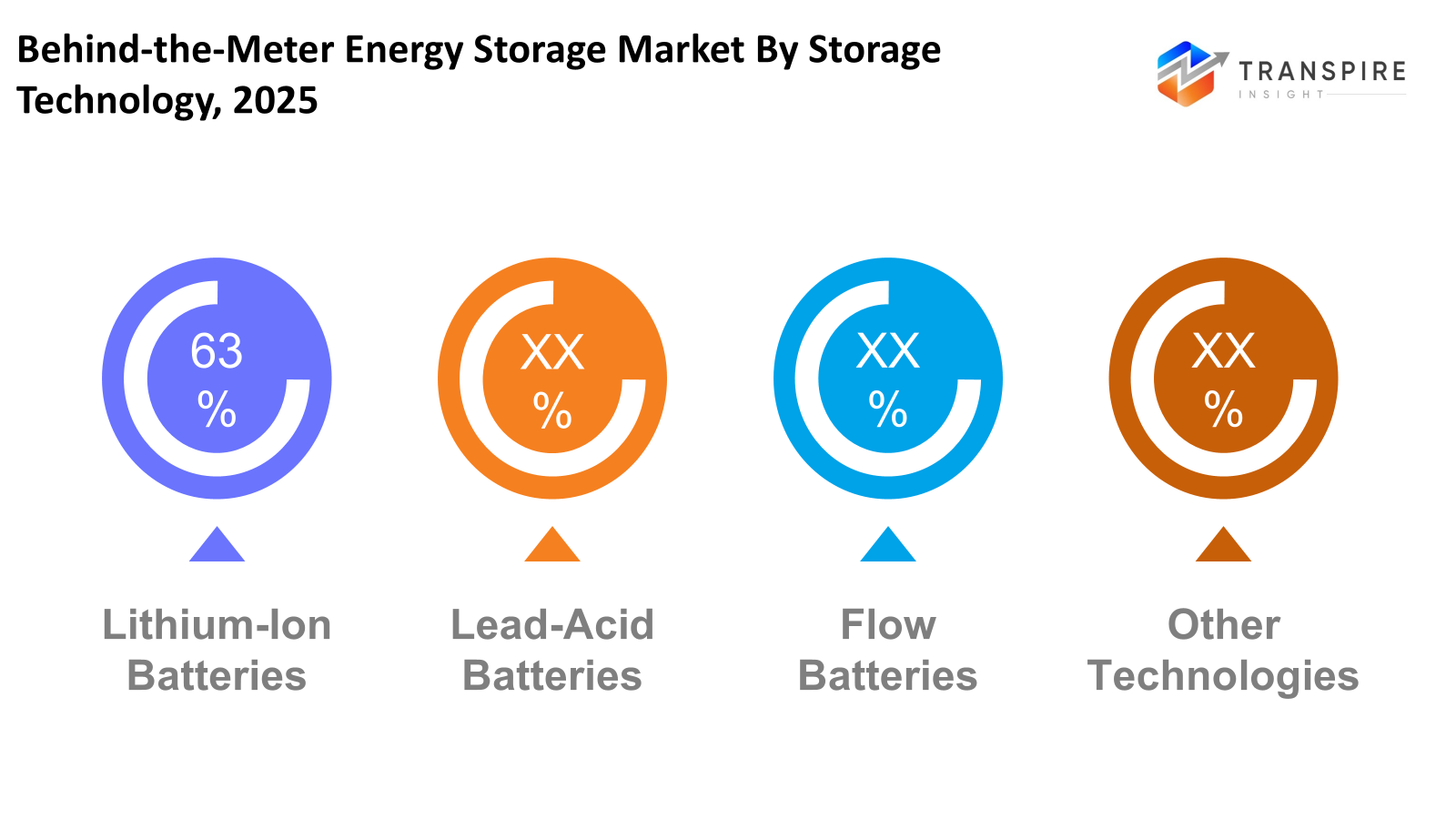

- Lithium-ion Batteries share approximately 65% in 2026. Built on shrinking prices, lithium-ion batteries run today's grid. Their knack for playing well with sunlight setups keeps them ahead. Efficiency pushes their lead further. Most homes tapping power now rely on these cells without a second thought.

- More people now use smart software that helps store power better while cutting down waste. These tools are spreading fast because they make managing energy easier every day.

- Fueled by the need to trim demand charges, businesses favor these systems. Energy expenses take a hit when efficiency kicks in. Reliability is not an afterthought; it drives decisions. Heavy usage in factories and offices pushes widespread use. Savings shape choices where power matters most.

- Big businesses use more power, which makes them the top group. Their savings from battery systems tend to be large because of how much they spend on electricity.

Power users now want more say in how they manage electricity. On-site battery setups sit right after the meter, giving households and businesses a way to save power instead of pulling it straight from the network. Once charged, that stored energy kicks in when needed most. Solar panels on rooftops often link up with these batteries, so extra sunshine is not wasted during peak hours. When storms hit or lines go down, having local reserves means lights stay on. More people see value in keeping supply close by, especially as utility prices shift unpredictably.

It comes down to cutting costs and staying powered when things go wrong. Instead of just relying on the grid, businesses install these units to handle high usage times while keeping voltage stable. When blackouts hit, operations keep moving. Homes are using them too, especially where bills climb or service wobbles. Power stays available even if the main supply falters.

Now machines think smarter, thanks to better batteries and sharper control software. Charging patterns shift on their own, blending power from solar, grid, or backup without slowing down. Prices change fast; these tools adjust timing just right. Efficiency climbs when decisions happen faster than humans can react. Value grows quietly behind steady updates and unseen calculations.

Now shaping the market, a worldwide move to local and greener power setups takes hold. With governments, power companies, and suppliers pushing small-scale battery use, grids gain agility while soaking up wind and solar flow. Power networks evolve more spread out, user-focused, and homes and businesses start keeping batteries on their side of the meter. These hidden systems help withstand outages, cut emissions, save money over time, no matter if it's a house, shop, or factory using them.

Behind-the-meter Energy Storage Market Segmentation

By Storage Technology

- Lithium-Ion Batteries

Favored in many behind-the-meter setups, lithium-ion batteries pack a lot of power into a small space. Their ability to last through numerous charge and discharge rounds stands out. Quick to react when demand shifts sets them apart from older types. Performance over time gives users confidence without needing constant replacement.

- Lead-Acid Batteries

Though heavy, these batteries deliver reliable performance when money matters most - efficiency takes a back seat here. Their life runs short compared to newer types, yet they still hold ground where simplicity wins.

- Flow Batteries

These batteries store power for long stretches, staying safe while growing easily to fit big setups beyond the meter. What stands out is how they handle extended use without risk of going up. Size can shift smoothly when demand climbs, making them a steady match for heavy-duty needs off the main grid.

- Other Technologies

Some newer battery types aim to boost safety while cutting environmental harm. These designs often trade older materials for safer ones. Performance gains come through smarter chemistry choices. Long-term reliability gets a lift from these updates. Safer operation is built into their core structure. Sustainability improves without sacrificing power output.

To learn more about this report, Download Free Sample Report

By Component

- Battery Modules

Built to hold power until it is needed, battery modules make up the heart of systems that sit behind the meter. Their job starts when electricity is saved, not used right away.

From batteries, electricity flows out as direct current. That energy gets changed into alternating current by conversion systems. Buildings run on this kind of power. The grid uses it too when connecting back. Different parts make sure the voltage matches what is needed.

- Power Conversion Systems

Running on smart software, these systems handle when to charge or release power. They shape how electricity flows by learning use habits over time. Instead of guessing, they adjust based on real activity.

- Energy Management System

Power is not wasted because timing gets fine-tuned automatically. Decisions happen fast, matching supply with demand quietly behind the scenes.

By Application

- Residential

At home, it helps people use their own solar power instead of sending it all back to the grid. When sunlight runs out, there is still stored energy available. This means less reliance on outside electricity sources. Bills go down as a result of smarter energy habits.

- Commercial & Industrial

For shops and factories, it keeps electricity use steady when demand spikes. This setup cuts expenses on power over time. A stable supply means fewer interruptions during work hours.

- Utility & Grid Services

Folks with home batteries help keep power steady when usage spikes. Power companies tap into these systems during peak times. Instead of building more plants, they rely on stored energy nearby. This setup reduces strain when everyone turns things on at once. Some customers let utilities borrow their excess juice. It happens automatically, no need to lift a finger. Behind the scenes, it smooths out supply hiccups across neighborhoods.

By End-Users

- Residential Customers

People living in houses want power they can count on without spending too much. Some aim to rely less on outside sources for their electricity needs.

- Commercial & Industrial Customers

Big companies and factories rely on battery setups to manage power better, cutting down expenses over time. These users install energy storage to balance supply needs while keeping bills lower month after month. Operations become more efficient when stored electricity supports daily demands.

- Utility Companies

Power firms can use customer-side batteries to help balance supply. These systems support the network during peak times instead of relying only on central plants. Storage units at homes and businesses respond quickly when demand spikes. They also smooth out fluctuations from solar and wind sources nearby. Managing local generation becomes easier with built-in battery capacity. Grid operators gain flexibility without major infrastructure upgrades.

Regional Insights

The North American Behind-the-meter Energy Storage market leads worldwide. This comes down to the United States (tier-1), where key biologic patents are ending, rules from the FDA make approvals smoother, and medical systems can handle new treatments well. Meanwhile, Canada (tier-2) helps push expansion forward because hospitals are using more Behind-the-meter Energy Storage, and insurance plans cover them better now. A lot of people here deal with long-term or immune-related conditions, so demand stays high; doctors and insurers trust these drugs, making it easier for similar versions of cancer antibodies to spread quickly.

Europe’s a big market too; Germany, France, and the United Kingdom take the lead because rules and budget pressures push cheaper copycat drugs. Meanwhile, nations like Spain, Italy, or the Netherlands see rising use since hospitals swap costly treatments for affordable options. Backed by early approval paths, doctors trust these alternatives more; bidding setups in clinics boost their spread, especially for cancer, immune issues, and blood conditions.

The Asia Pacific area is changing fast. Japan, China, and South Korea (top-tier) lead because more people face long-term health issues, hospitals are spreading, and patients find care easier to reach. In second-level spots like India, Australia, plus Southeast Asian regions, growth comes from making products locally, getting state support, while knowledge about cheaper options instead of biologic drugs goes up. On the flip side, Latin America, along with the Middle East & Africa stay minor player yet hints at room to grow, especially in leading nations such as Brazil, Mexico, the UAE, and South Africa, thanks to better medical systems, looser rules for approvals, spending on health services, and pushing interest in similar biological treatments.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 9, 2025 – Behind-the-meter deployments set to lead Brazilian energy storage by 2034.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.65 Billion |

|

Market size value in 2026 |

USD 8.00 Billion |

|

Revenue forecast in 2033 |

USD 26.10 Billion |

|

Growth rate |

CAGR of 18.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ABB Ltd, Siemens AG, BYD Company Ltd, Schneider Electric, Honeywell International Inc., Enphase Energy Inc, LG Energy Solution Ltd, Panasonic Holdings Corporation, Samsung SDI Co. Ltd, Sonnen GmbH, Tesla Inc, Blue Planet Energy, and Delta Electronics |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Storage Technology (Lithium-ion Batteries, Lead-Acid Batteries, Flow Batteries, Other Technologies) By Component (Battery Modules, Power Conversion Systems, Energy Management Systems) By Application (Residential, Commercial & Industrial, Utility & Grid Services) By End-Users (Residential Customers, Commercial & Industrial Customers, Utility Companies), |

Key Behind-the-meter Energy Storage Company Insights

Starting strong, Tesla builds batteries people actually use at home, in businesses, even on big power grids. Not just cars, they shifted focus toward saving electricity for later when needed. Homes run on Powerwall units that store sunshine from rooftop panels. For larger needs, Powerpacks and Megapacks are standing tall in warehouses or substations. These rely on modern lithium cells paired with smart control programs inside. That mix helps owners use more of their own solar instead of buying from distant plants. High usage times become easier because stored juice kicks in automatically. Outages matter less since the backup charge sits ready without warning. Growth hasn’t slowed; installations keep rising across continents year after year. In housing zones, especially, few brands appear in conversations as Tesla does. Their network can link thousands into shared digital power pools, too. Grid operators tap these clusters during stress moments to smooth sudden gaps. So rather than building new towers or lines, old ones stretch further using spread-out packs.

Key Behind-the-meter Energy Storage Companies:

- ABB Ltd

- Siemens AG

- BYD Company Ltd

- Schneider Electric

- Honeywell International Inc.

- Enphase Energy Inc

- LG Energy Solution Ltd

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd

- Sonnen GmbH

- Tesla Inc

- Blue Planet Energy

- Delta Electronics

- Sunverge Energy

- SimpliPhi Power

Global Behind-the-meter Energy Storage Market Report Segmentation

By Storage Technology

- Lithium-ion Batteries

- Lead-Acid Batteries

- Flow Batteries

- Other Technologies

By Component

- Battery Modules

- Power Conversion Systems

- Energy Management Systems

By Application

- Residential

- Commercial & Industrial

- Utility & Grid Services

By End-Users

- Residential Customers

- Commercial & Industrial Customers

- Utility Companies

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636