Market Summary

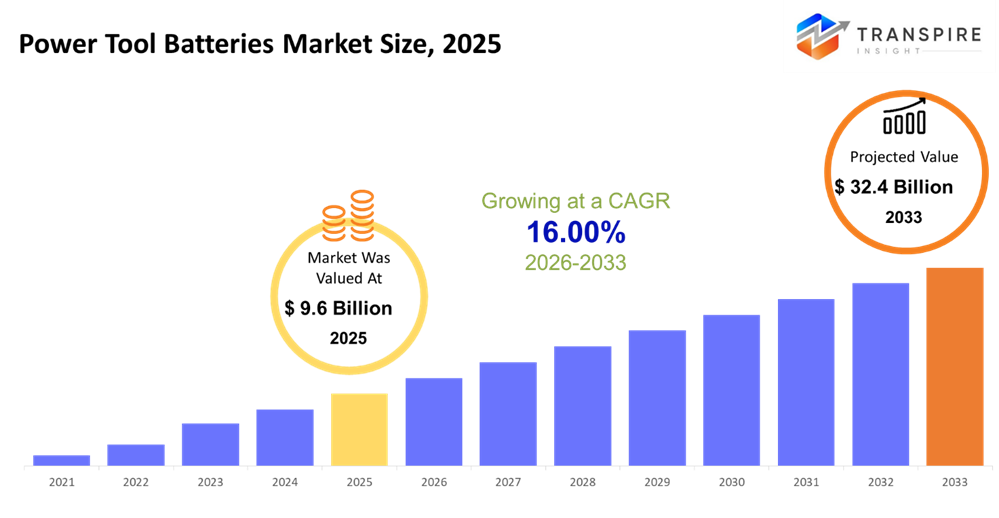

The global Power Tool Batteries market size was valued at USD 9.6 billion in 2025 and is projected to reach USD 32.4 billion by 2033, growing at a CAGR of 16.00% from 2026 to 2033 The market’s CAGR is propelled by the growing adoption rate of renewable resources, the increasing need for the electrification of residential and commercial infrastructure, and the use of reliable back-up power solutions. The decrease in the cost of batteries, advances in the technological field concerning energy density, and government initiatives add to the accelerated growth rate.

Market Size & Forecast

- 2025 Market Size: USD 9.6 Billion

- 2033 Projected Market Size: USD 32.4 Billion

- CAGR (2026-2033): 16.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

Key Market Trends Analysis

- North America maintains its steady expansion with the support of grid modernization, the growing use of residential energy storage, and commercial sector demand from data and retail centers, with the encouragement of policy measures for the use of Lithium Ion batteries.

- The United States shows strong regional demand due to intensive adoption of renewables, EV charging station development, and residential solar and storage projects, besides commercial and industrial adoption of superior battery solutions that address peak demand and electricity unreliability.

- The Asia Pacific emerging as the foremost rapidly growing region, mainly in the wake of massive manufacturing capacity, rapid urbanization, and government-supported energy storage initiatives in China, Japan, South Korea, and the Indian subcontinent to support residential as well as industrial infrastructure security

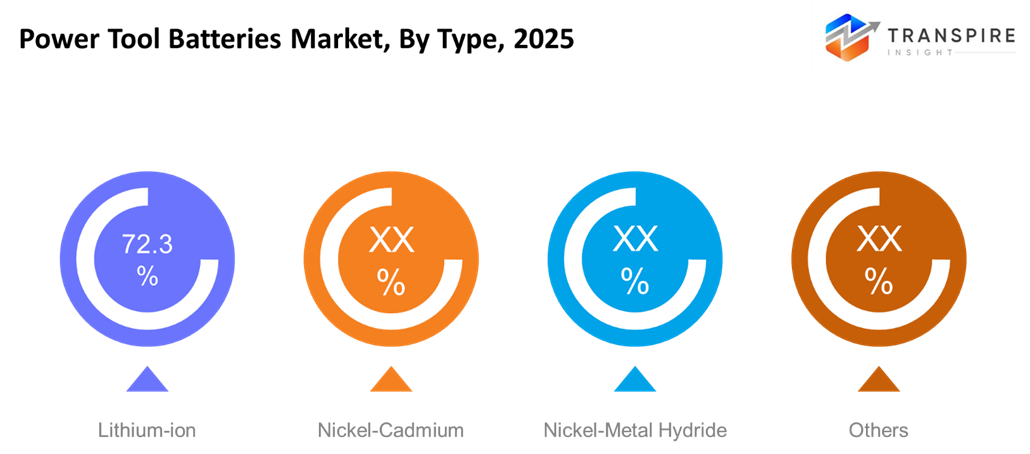

- Lithium-Ion continues to be the leading technology segment, catering to the need for higher energy density, durability, and being cost-effective, thus being the battery of choice for residential, commercial, and industrial applications with the rising need for scalable and high-performing energy storage solutions.

- Residential applications currently drive the market in terms of growth as people install batteries in their homes for the storage of solar energy.

- The use of battery technologies increases in commercial applications as companies implement battery solutions for peak shaving, energy resilience, and sustainable practices, especially in office buildings, retail malls, hospitals, and data centers.

So, the market signifies an imperative aspect of the modern energy infrastructure network, providing an effective means of storing and using electricity. The battery systems are necessary for the stability of the electric grid, the application of renewable energy sources, and the supply of uninterrupted power, necessary for developed, as well as developing, countries.

Demand is intricately related to the transition toward a clean and decentralized energy generation era. Although solar and wind energy sources have gained prominence in the latter years of the decade, the need for a reliable storage mechanism has increased. On the other hand, the electrification of living spaces and industries has steadily augmented the addressable market.

Advances in technology, especially in the field of lithium-ion battery technology, have led to improvements in performance, safety, and cost – thus setting the stage for its rapid expansion in the market, which ranges from the domestic backup power market to industrial applications.

Power Tool Batteries Market Segmentation

By Type

- Lithium-ion

Lithium batteries dominate the market because of their higher energy density, fast charging, and falling costs of manufacture. Their flexibility and compatibility with renewable power applications make them the most sought-after option for power storage applications.

- Nickel-Cadmium

Nickel-Cadmium batteries have their applications in specialized industries. The environmental regulations restrictive of cadmium do not allow the extensive use of nickel-cadmium batteries, but the longer lifespan creates a steady market for them in the applications mentioned.

- Nickel-Metal Hydride

Nickel-Metal Hydride batteries provide a balance between performance and environmental safety. They are popular for use in moderate-capacity applications where reliability and thermal stability are important, thereby supporting demand in selected residential and commercial use cases.

- Others

However, other battery types, such as lead acid and newer materials, also play critical roles where cost is an essential factor and where existing infrastructure already exists. This is because these batteries may not be the costliest to purchase and maintain and also do not pose the same disposal concerns as lithium-ion batteries

By Application

- Residential

The driving factors for the residential market include rooftop solar power, increasing electricity prices, and the need for backup power. The battery technology enables residences to optimize energy use and independence, which is expected to contribute to robust growth

- Commercial

Demand from the commercial sector is driven by energy cost optimization, sustainability goals, and business continuity needs. Businesses today use battery solutions to supply peak power and provide business continuity during the loss of grid power.

- Industrial

Industrial uses include large-capacity and long-life batteries for supporting operations. In particular, there is focus on use in the development of infrastructure and factories, as well as in industries that require power.

Regional Insights

North America, with the lead taken by the United States, comprises an established and advanced market equipped with sustainable energy strategies, smart grid infrastructure, and residential as well as commercial penetration. The presence of Canada and Mexico with their clean energy and industrialization initiatives places this market under Tier 1. Europe follows as a Tier 1–2 region because of the strict regulations concerning emissions and the ambitious targets in the renewable resources domain. The demand in the German, U.K., and French markets leads the way in the Tier 1 markets, and the Southern and Eastern European markets are the Tier 2 markets with increasing domestic and commercial demand.

The Asia Pacific is the standout leader in the fastest-growing Tier 1 segment of the lithium-ion market, which is fueled primarily by China’s manufacturing prowess and the growing energy access program in India. Australia and Southeast Asia are the key contributors in the second tier. The overall state of the region is Tier 2–3 with market activity led by Brazil due to renewable investments and industrial demand. Other countries, such as Argentina, show gradual adoption driven by grid reliability needs.

The Middle East & Africa remain an emerging Tier 2–3 market, spearheaded by Saudi Arabia, the UAE, and South Africa. Growth is facilitated by infrastructural development, energy diversification strategies, and rising off-grid power needs.

Recent Development News

- January 2026, The UK Grid-Scale battery storage industry saw a 45% increase in 2025 operational capacity, adding 4GWh to take the total operational capacity to 12.9GWh.

The Clean Power 2030 Action Plan, published towards the end of 2024, identified the need for greater battery storage in the area, which is being met by the swift actions of the developers to capitalize on this new market trend.

- In January , 2026, Egypt has signed contracts related to renewable energies worth a total of $1.8 billion, according to Egyptian state TV. Deals made included contracts with Norwegian renewable energy developer Scatec, opens new tab and China's Sungro.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 9.6 Billion |

|

Market size value in 2026 |

USD 11.5 Billion |

|

Revenue forecast in 2033 |

USD 32.4 Billion |

|

Growth rate |

CAGR of 16.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Contemporary Amperex Technology Co., Limited (CATL), BYD Company Limited, LG Energy Solution, Samsung SDI, Panasonic Holdings Corporation, Tesla, Inc., Fluence Energy, Siemens Energy, Schneider Electric, Eaton Corporation, Hitachi Energy, NEC Energy Solutions, Saft (TotalEnergies), Johnson Controls, EnerSys |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Lithium-ion, Nickel-Cadmium, Nickel-Metal Hydride, Other), By Application (Residential, Commercial, Industrial) |

Key Power Tool Batteries Company Insights

Contemporary Amperex Technology Co., Limited, or CATL, is the world's leading lithium battery maker. Large scale, vertically integrated business models, and increased innovation expenses have encouraged advances in high-density cell technology and large energy storage modules. With manufacturing facilities all across the world and partnership models with car and energy companies, it enables wider use in utility-scale applications, as well as commercial and residential spaces too. With enhanced emphasis on safety, life, and performance characteristics, it has the potential to tap into the increasing demand for RE integration and grid support solutions world-wide.

Key Power Tool Batteries Companies:

- Contemporary Amperex Technology Co., Limited (CATL)

- BYD Company Limited

- LG Energy Solution

- Samsung SDI

- Panasonic Holdings Corporation

- Tesla, Inc.

- Fluence Energy

- Siemens Energy

- Schneider Electric

- Eaton Corporation

- Hitachi Energy

- NEC Energy Solutions

- Saft (TotalEnergies)

- Johnson Controls

- EnerSys

Global Power Tool Batteries market Report Segmentation

By Type

- Lithium-ion

- Nickel-Cadmium

- Nickel-Metal Hydride

- Others

By Application

- Residential

- Commercial

- Industrial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636