Market Summary

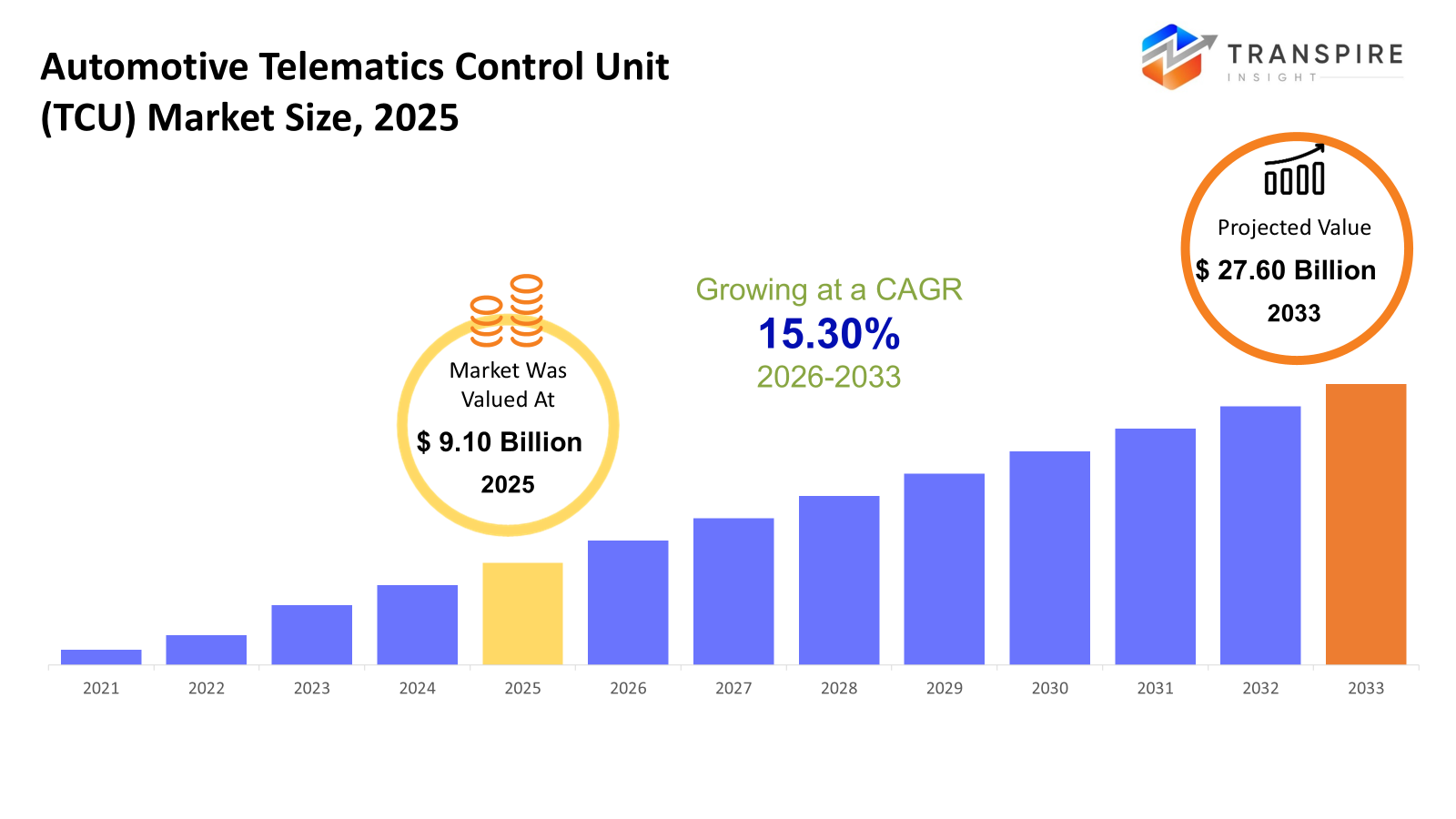

The global Automotive Telematics Control Unit (TCU) market size was valued at USD 9.10 billion in 2025 and is projected to reach USD 27.60 billion by 2033, growing at a CAGR of 15.30% from 2026 to 2033. The market for automotive TCUs is expanding at a strong compound annual growth rate (CAGR) because to the growing demand for connected cars, the growing use of fleet management and usage-based insurance systems, and the strict regional safety and emergency service regulations. Growing urbanization, increase of business fleets, and integration of modern technologies like predictive maintenance, infotainment, and V2X communication further enhance usage. Technological developments in IoT-enabled car data analytics and 5G-enabled telematics are boosting system performance and real-time communication, propelling market expansion.

Market Size & Forecast

- 2025 Market Size: USD 9.10 Billion

- 2033 Projected Market Size: USD 27.60 Billion

- CAGR (2026-2033): 15.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America exhibits a developed automotive telematics ecosystem, propelled by the widespread use of 5G network infrastructure and connected vehicle initiatives, the high penetration of embedded and integrated TCUs in passenger cars and commercial fleets.

- The United States is a leading market for embedded telematics, which are widely used in passenger cars and commercial fleets to enable real time diagnostics, predictive maintenance and driver behavior monitoring.

- The fastest-growing region is Asia Pacific, where the adoption of tethered telematics is supported by rising smartphone penetration, expanding commercial fleets, increasing passenger vehicle ownership and rapid urbanization.

- Because it integrates with vehicle electronics and supports sophisticated applications like safety and predictive maintenance, embedded telematics continues to have the greatest acceptance rate across all regions. In North America and Europe, fleet management continues to be the most popular application, especially for commercial vehicles. Overall deployment channels are dominated by OEM-installed TCUs, while aftermarket alternatives are becoming more popular in emerging economies.

- With luxury models and metropolitan areas in North America, Europe, and Asia Pacific enjoying the highest penetration and technology integration, passenger vehicles continue to drive TCU adoption as consumers want connected infotainment, navigation, safety and driver monitoring capabilities.

- As commercial operators depend on real-time tracking, route optimization, and operational analytics, fleet management continues to be the most popular application across all vehicle types. This is especially true in North America, Europe, and Asia Pacific where the expansion of logistics and e-commerce drives demand for effective fleet telematics solutions.

- Due to their dependability, integration with factory electronics, regulatory compliance and improved service offerings, OEM-installed TCUs dominate the global sales channel market. Meanwhile, aftermarket solutions are gradually expanding in developing markets and older fleets to offer telematics, security and connectivity upgrades.

So, The automotive telematics control unit (TCU) market includes systems that give passenger and commercial cars connectivity by allowing them to interact with external networks, services and infrastructure. For fleet management, usage-based insurance, safety, navigation, entertainment, predictive maintenance and security applications, TCUs gather, send and evaluate vehicle data. While tethered and integrated units offer more affordable and versatile options, embedded TCUs are factory-installed and provide seamless connection with car electronics. Urbanization, expanding business fleets, growing consumer demand for better vehicle safety and telematics services and growing use of connected vehicles are all driving market growth. Adoption is also accelerated by regulatory requirements for emergency call systems, vehicle monitoring and crash detection in Europe, North America and Asia Pacific. Technological developments that improve operating efficiency, real-time diagnostics and predictive maintenance capabilities such as 5G connection, IoT-enabled analytics and cloud-based telematics further drive market expansion. OEM-installed TCUs dominate the market due to reliability, integration and regulatory compliance, although aftermarket alternatives are gaining popularity in cost-sensitive emerging nations. Growth is boosted by the growing use of telematics in UBI programs, fleet monitoring and driver behavior evaluation which supports customer-focused services and operational effectiveness worldwide.

Automotive Telematics Control Unit (TCU) Market Segmentation

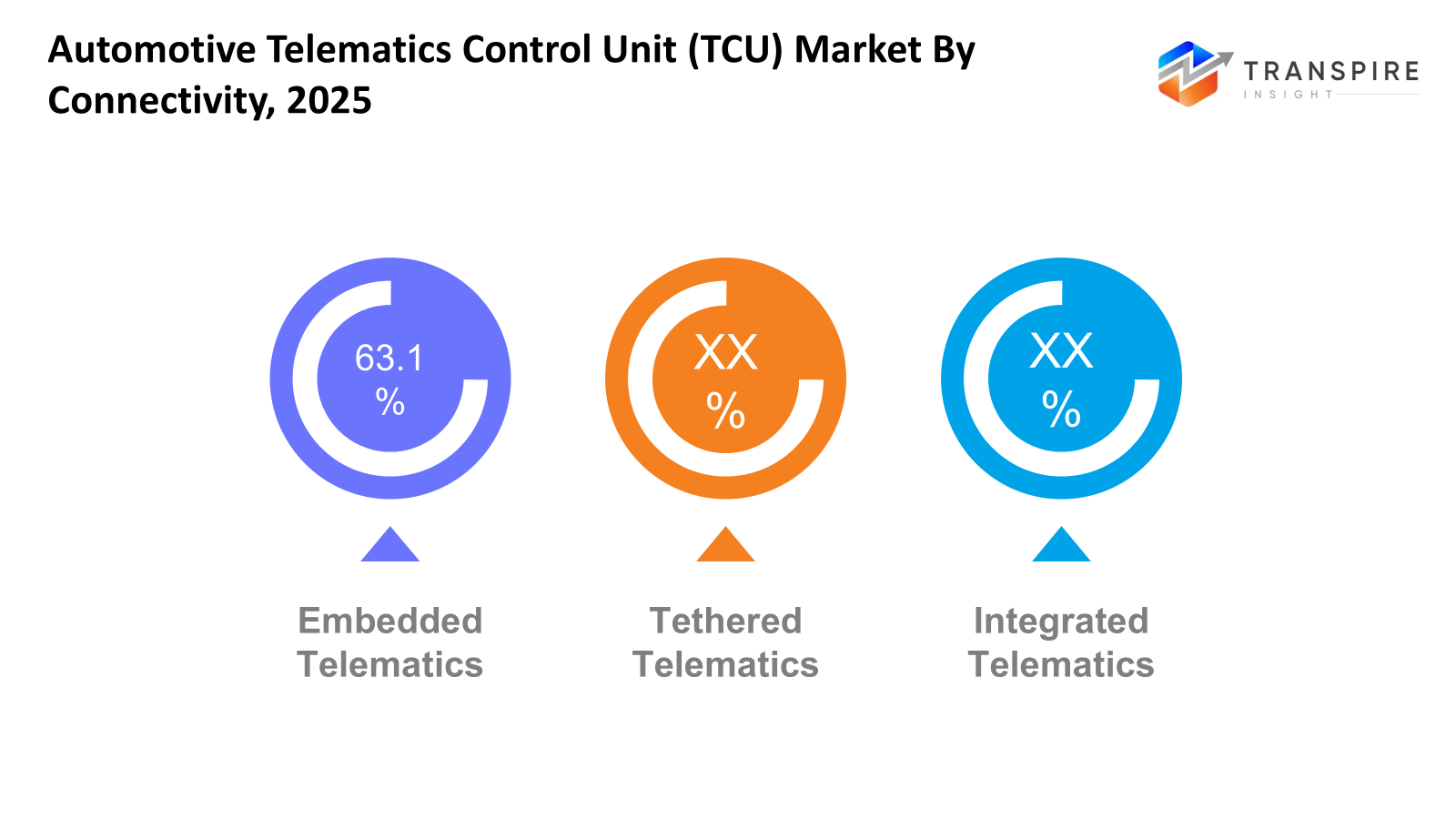

By Connectivity

- Embedded Telematics

Embedded TCUs provide seamless connectivity, excellent dependability, and real-time data exchange. They are factory-installed devices that are built directly into the car's electronics. Because of their strict safety and regulatory standards, they dominate the premium passenger car and commercial fleet markets in North America, Europe, and Asia-Pacific. For sophisticated applications like eCall services and ADAS integration, the embedded section is essential. Remote diagnostics and connected services are becoming more and more popular in North America and Europe.

- Tethered Telematics

Tethered TCUs rely on an external device, such as a smartphone, to provide connectivity. This strategy is mostly used in developing markets and entry-level passenger cars since it is economical. In Asia Pacific nations like China and India, where smartphones are widely used and cost-effective solutions are the norm, its growth is noteworthy. It supports UBI programs and simple fleet tracking, albeit being less advanced than embedded systems.

- Integrated Telematics

Integrated TCUs provide drivers with a multipurpose interface by fusing telematics with infotainment, enhanced safety systems, or navigation. In areas like Europe, Japan, and the US where there is a strong desire for smart and connected cars, this market is expanding. Advanced analytics for fleet management, predictive maintenance, and driver behavior monitoring are made possible by integrated systems. The growth of 5G networks and connected car ecosystems is also associated with their adoption.

To learn more about this report, Download Free Sample Report

By Vehicle Type

- Passenger Vehicles

The majority of TCU adoption is found in passenger cars such as sedans, SUVs and MPVs. Due to the strong customer demand for infotainment, navigation and safety features, North America and Europe have the highest penetration rates. Asia Pacific is expanding quickly due to increased urbanization, middle-class car ownership and emergency call system regulations. For linked services, embedded and integrated TCUs are becoming more and more common in passenger cars.

- Commercial Vehicles

TCUs are being used by commercial vehicles, such as trucks, buses and vans, mainly for fleet management, operational effectiveness, and regulatory compliance. Due to established logistics networks and standards for digital fleet management, the U.S. and Germany are mature markets. The transportation and e-commerce industries are driving growth in Latin America and Asia-Pacific.

By Application

- Fleet Management

Real-time tracking, route planning, and vehicle performance monitoring are made possible by TCUs used for fleet management. This segment dominates in commercial vehicles, with North America and Europe leading because to developed logistical operations. Growing freight and delivery services are driving Asia-Pacific's emergence as a robust growth sector. Fuel expenses are decreased and operational efficiency is increased through cloud integration and advanced analytics.

- Usage‑Based Insurance (UBI)

To evaluate driving habits and provide dynamic insurance rates, UBI uses TCU data. North America and Europe have the highest adoption rates because to government incentives and consumer demand for individualized insurance. Using smartphone-tethered telematics technologies, emerging regions like Asia-Pacific are starting to include UBI. TCUs supply the speed, braking, and mileage data needed for precise risk assessment.

- Safety & Emergency Services

TCUs improve vehicle safety compliance by enabling features like eCall, SOS warnings and accident detection. Because emergency call systems in passenger cars are required by law, Europe is a prominent market. Adoption is also rising in North America and Asia Pacific particularly in fleet and premium car categories. For emergency communication, embedded TCUs are favored due to their high dependability and short latency.

- Infotainment & Navigation

Through connected services, GPS and media streaming, telematics integration with infotainment and navigation systems improves the in-car experience. Because of their tech-savvy customers, Europe, North America and Japan have high penetration rates. With the rise of urban mobility and smart city initiatives Asia Pacific exhibits robust growth. For these applications smooth communication and real time data are made possible by integrated TCUs.

- Remote Diagnostics & Predictive Maintenance

TCUs lower operating costs and downtime by enabling predictive maintenance and continuous vehicle health monitoring. In North America and Europe, where operational efficiency is crucial, commercial fleets have a high adoption rate. Adoption in the Asia-Pacific region is increasing as total cost of ownership (TCO) management becomes more widely recognized. Transmitting diagnostic data requires integrated and embedded TCUs with cloud connectivity.

- Vehicle Security & Theft Recovery

TCUs facilitate remote immobilization, theft detection, and vehicle security. Because of their high car prices and insurance needs, North America and Europe are the main markets. Adoption in high-density cities and luxury automobiles is rising in Asia-Pacific. For real-time response, this program uses integrated TCUs with GPS and cellular connectivity.

- Driver Behavior Monitoring

In North America and Europe, the application of driver behavior monitoring for fleet efficiency, UBI, and safety evaluation is growing quickly. With business fleets and insurance-based incentives, Asia-Pacific is also expanding. In order to reduce risk and modify insurance rates, TCUs gather information on acceleration, braking, speed, and weariness.

By Sales Channel

- Original Equipment Manufacturers (OEMs)

The market is dominated by OEM-installed TCUs, particularly in North America, Europe and Japan, where cars are increasingly equipped with connectivity modules from the factory. OEM channels provide increased dependability, regulatory compliance and connection with car electronics. This channel is mostly used for the distribution of integrated and embedded TCUs which assist the premium and fleet markets. Advanced applications like V2X communication and predictive maintenance are also supported by OEM-led adoption.

- Aftermarket

Aftermarket TCUs are important in areas with older car fleets, like Latin America, South-East Asia, and portions of Africa. They are added after the sale by dealers or outside suppliers. In this channel, tethered and simple embedded TCUs are prevalent. Fleet managers and individual customers can improve connection, security, and UBI features without having to buy new cars thanks to aftermarket options. Cost-conscious consumers and growing digital use are the main drivers of growth.

Regional Insights

Driven by sophisticated fleet management adoption, strict safety standards, and ubiquitous 5G infrastructure, North America—which includes the United States, Canada and Mexico—represents a mature market with strong penetration of embedded and integrated TCUs in passenger and commercial vehicles. While Canada and Mexico are progressively implementing telematics throughout commercial fleets and logistics operations, Tier 1 subregions such as the United States are at the forefront of usage-based insurance, predictive maintenance and connected infotainment systems. Due to legal requirements for fleet monitoring and eCall systems, Europe which includes Germany, the UK, France, Spain, Italy and the rest of Europe shows a high demand for embedded telematics with Germany and the UK spearheading innovation and acceptance in connected vehicles.

Asia Pacific which includes Japan, China, Australia & New Zealand, South Korea, India and Rest of Asia Pacific is the fastest growing area with increased vehicle ownership, large commercial fleets and high smartphone penetration supporting tethered and integrated telematics systems. Tier 1 markets include South Korea, China and Japan. Tier 2 growth hubs include Australia and India. Fleet management and vehicle security are the main factors driving South America's reliance on affordable aftermarket telematics which includes Brazil, Argentina and the rest of the continent. The Middle East and Africa, which includes South Africa, the United Arab Emirates, Saudi Arabia and the rest of the area exhibits growing demand driven by urban mobility initiatives, premium passenger cars and logistics.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2025, 5G Automotive Association (5GAA) meeting in Paris, LG Electronics unveiled its satellite based next-generation Telematics Control Unit (TCU) solution. LG's demonstration of smooth IoT-NTN (Non-Terrestrial Network) telematics connectivity across terrestrial and satellite networks is highlighted in the news release. This allows for continuous voice communication and improved safety in remote places.

- In April 2024, The ProConnect platform, a fully integrated cockpit with onboard entertainment and 5G telematics capabilities, was announced in a press release by Marelli, a global supplier of automotive technology. ProConnect, which is mainly aimed at the Chinese market, uses a MediaTek SoC to integrate cluster, IVI (In-Vehicle Infotainment), and TCU operations, resulting in lower costs and better performance for OEMs and customers.

(Source:/Press%20Release_Marelli%20ProConnect_Beijing%20Auto%20Show_11Apr2024_ENG.pdf)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 9.10 Billion |

|

Market size value in 2026 |

USD 10.20 Billion |

|

Revenue forecast in 2033 |

USD 27.60 Billion |

|

Growth rate |

CAGR of 15.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Continental AG, Robert Bosch GmbH, LG Electronics, Harman International (Samsung), Denso Corporation, Valeo SA,Visteon Corporation, Marelli Holdings Co., Ltd.,Aptiv PLC, Panasonic Automotive Systems, Huawei Technologies,Peiker Acustic GmbH & Co. KG, Ficosa International S.A., Infineon Technologies AG, Queclink Wireless Solutions Co., Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Connectivity (Embedded Telematics, Tethered Telematics, Integrated Telematics), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application (Fleet Management, Usage‑Based Insurance (UBI), Safety & Emergency Services, Infotainment & Navigation, Remote Diagnostics & Predictive Maintenance, Vehicle Security & Theft Recovery, Driver Behavior Monitoring) and By Sales Channel (Original Equipment Manufacturers (OEMs), Aftermarket) |

Key Automotive Telematics Control Unit (TCU) Company Insights

With a wide range of telematics control units that fulfill global OEM connectivity requirements, including 4G/5G, V2X, and OTA update capabilities, Continental AG is a major leader in the automotive TCU industry. The company's solutions, which cover fleet management, safety, and remote diagnostics requirements, are integrated across passenger and commercial vehicles. Continental’s strong OEM connections and global supply footprint drive high deployment volumes, particularly in Europe and North America. Its competitive position is further strengthened by ongoing investments in edge computing, cybersecurity, and AI-enabled telematics platforms, which offer scalable, future-ready connected car solutions that correspond with changing autonomous and data services trends.

Key Automotive Telematics Control Unit (TCU) Companies:

- Continental AG

- Robert Bosch GmbH

- LG Electronics

- Harman International (Samsung)

- Denso Corporation

- Valeo SA

- Visteon Corporation

- Marelli Holdings Co., Ltd.

- Aptiv PLC

- Panasonic Automotive Systems

- Huawei Technologies

- Peiker Acustic GmbH & Co. KG

- Ficosa International S.A.

- Infineon Technologies AG

- Queclink Wireless Solutions Co., Ltd.

Global Automotive Telematics Control Unit (TCU) Market Report Segmentation

By Connectivity

- Green Ammonia

- Blue Ammonia

- Grey Ammonia

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Fleet Management

- Usage‑Based Insurance (UBI)

- Safety & Emergency Services

- Infotainment & Navigation

- Remote Diagnostics & Predictive Maintenance

- Vehicle Security & Theft Recovery

- Driver Behavior Monitoring

By Sales Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636