Market Summary

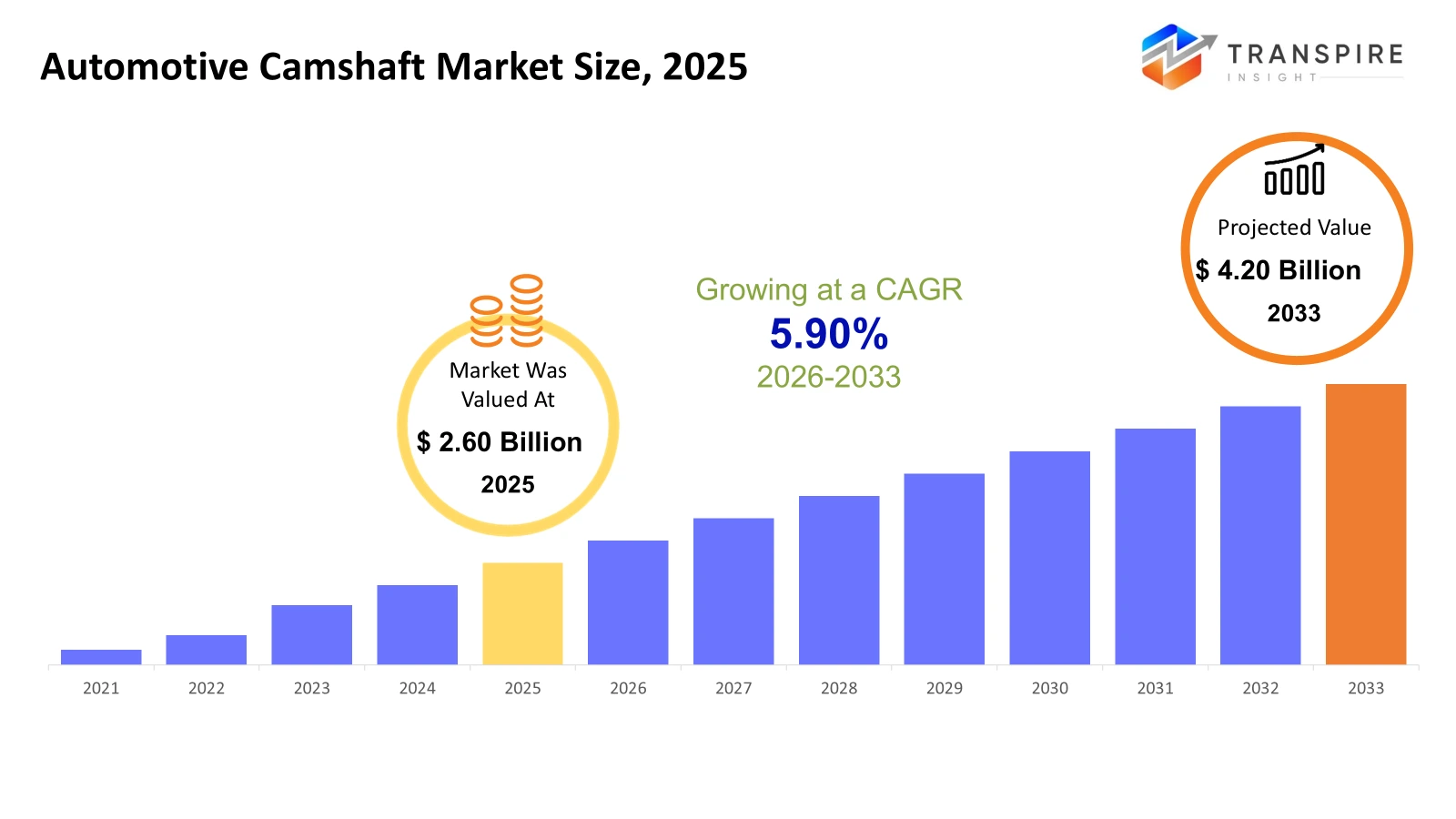

The global Automotive Camshaft market size was valued at USD 2.60 billion in 2025 and is projected to reach USD 4.20 billion by 2033, growing at a CAGR of 5.90% from 2026 to 2033. The market for camshafts will continue on a positive trend (CAGR) as internal combustion engine production remains strong in many emerging markets, even as developed markets slowly transition to electric vehicle use. The demand for fuel-efficient, turbocharged engines is contributing to a rise in the number of precision-engineered, lightweight camshaft types, supporting the steady growth of the overall camshaft market.

Market Size & Forecast

- 2025 Market Size: USD 2.60 Billion

- 2033 Projected Market Size: USD 4.20 Billion

- CAGR (2026-2033): 5.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Demand for pickup trucks and SUVs is a significant contributor to North America being a stable market for camshafts, as well as to the high level of production from original equipment manufacturers in the United States and Mexico helping to maintain camshaft production volumes for both gasoline engines and performance vehicles.

- Generous engine displacement and a high level of performance upgrades have driven the United States to lead the regions for the most revenue as a result of large volumes of vehicles needing to be repaired or replaced, along with consistently high levels of ownership cycles.

- China, India, Japan, and South Korea dominate the Asia-Pacific region as a result of significant vehicle manufacturing activity being done in these countries, creating an increasing level of camshaft demand from high volumes of two-wheel and compact passenger vehicles.

- Cast camshafts continue to account for the greatest percentage of camshaft production as a result of their cost efficiency and their suitability for high-volume passenger vehicle production, especially from low-cost countries.

- The majority of vehicle production in the world is done using passenger cars. Broadly speaking, the vast majority of global production predominantly consists of compact and mid-sized vehicles, therefore, the camshaft configurations produced must be optimized in order to yield good fuel consumption and emissions compliant engines.

- The use of inline engines is the highest portion represented in the total global production mainly due to their general acceptance in passenger cars and in light duty commercial vehicles, allowing for a much simplified camshaft architecture and cost effective manufacturing of camshafts for mass production environments.

- It is noted that the OEM sales channel is the primary way that camshafts are sold into the market, and as such, are produced and sold directly from camshaft manufacturers to automotive OEM engine assembly plants using long-term contracts, etc. and through collaboration between manufacturers and OEM’s utilizing both technical and non-technical means.

So, camshafts are a vital component of all OEM-engineered internal combustion engines and their various components. The automotive industry relies heavily on precise timing of the camshaft to perform optimally, fuel effectively, and control emissions. Many manufacturers are implementing precision engineering and optimizing materials used in their camshafts because of stricter regulations globally. The demand for camshafts is directly related to the worldwide production of vehicles (specifically passenger cars and commercial vehicles). The trend toward electrification will influence the future of the automotive sector; however, vehicles with internal combustion engines will still dominate in many emerging markets. The use of hybrid engines will contribute to the continuous need for camshafts because they include an internal combustion engine as part of the vehicle's architecture in addition to an electric propulsion component. As a result, the automotive camshaft market continues to evolve in line with global vehicle production trends, regulatory requirements, and advancements in engine technology, maintaining steady demand despite the gradual shift toward electrified mobility solutions.

Technological progressions, including lightweight assembled camshafts and improvements in the forging process, will support continued value growth of camshafts. There will be a continued level of aftermarket demand for camshafts because of the older age of vehicle fleets in operation, which contribute to revenue stability. The competitive landscape of the camshaft industry is characterized by the establishment of long-term OEM relationships, the utilization of process automation and manufacturing expansion strategy to regionalize manufacturing operations and optimize supply chain channels.

Automotive Camshaft Market Segmentation

By Type

- Cast Camshaft

Economical, high-volume production as a viable option for mass-produced passenger vehicles cast camshafts have the necessary strength and wear resistance to accommodate standard engineered loadings; strong ongoing demand exists in developing markets with price-conscious vehicle segments.

- Forged Camshaft

Depending on use in high-performance and heavy-duty applications, forged camshafts offer superior strength and fatigue resistance. Commercial engines and performance cars that require durability and can withstand high stress utilize forged camshafts; continued growth can be attributed to a growing demand for turbocharged and high-compression engines.

- Assembled Camshaft

An Assembled Camshaft provides a means for weight reduction and design flexibility by using modular methods of assembly; assembled camshafts continue to be widely incorporated into contemporary designed engines for better fuel economy and emissions performance; although original equipment manufacturers prefer assembled camshafts used in downsized engines and advanced variable valve timing systems.

To learn more about this report, Download Free Sample Report

By Vehicle Type

- Passenger Cars

Passenger vehicles generate the most revenue share of camshaft production due to their significant manufacturing volume. A rise in strict emission regulations and the trend toward the use of lower horsepower engines are increasing demand for precision manufactured camshafts. Camshaft design optimization for passenger vehicle applications is also being driven by hybridization strategies.

- Light Commercial Vehicles

Light commercial vehicles require sturdy camshafts that will perform under varying loads. Continued growth of e-commerce and urban logistics provide consistent demand. Manufacturers continue to focus on the durability and improved fuel efficiency of their camshafts as they must also meet regulatory requirements.

- Heavy Commercial Vehicles

Heavy commercial vehicles utilize heavy-duty camshafts that are designed to operate under high torque loads and operate for many hours. Demand for heavy commercial vehicle camshafts is directly correlated to the growth of infrastructure and industrial activity. Additionally, stringent emissions regulations force the use of advanced materials in combination with improved machining accuracy.

- Two-Wheelers

Motorcycle markets are increasingly large in the Asia Pacific region as they are such a popular means of mobility. Camshaft demand in this segment is largely driven by fuel economy standards and costs associated with manufacturing. Additionally, the increasing penetration of premium motorcycles will increase the demand for performance-oriented camshaft variants.

By Engine Type

- Inline Engine

Inline engines dominate the market because they are found in many passenger vehicles and light trucks. The configuration of the camshafts is relatively simple, so production can be done at low cost. The growth of this market is consistent with the ongoing demand for small and fuel-efficient vehicles.

- V-Type Engine

V-type engines typically contain more than one camshaft, which increases the total number of components per vehicle. Because of this type of engine, more cars can be built with these types of engines. The v-type segment also benefits from an increasing demand for high-powered engines around the world.

- Flat Engine

Flat engines are found in a small number of vehicles, but they are often found in performance and specialty vehicles. The camshaft design in a flat engine focuses on balance and compactness. Demand for this type of engine is growing slowly due to the support of certain automotive manufacturers and performance enthusiasts.

By Sales Channel

- OEM

Because they attach camshafts directly at the time of engine build, the OE segment represents the largest share of the world camshaft market. Growth of this segment is primarily due to the increase of global vehicle production volume and technological advances in engine architecture. Additionally, long-term supply contracts and precision requirements are common factors of this segment.

- Aftermarket

The replacement part segment is positively impacted from both the growth of vehicle parc and vehicle maintenance cycles. Demand for replacement parts is impacted by both wear and tear on the engine as well as performance upgrades and vehicle age demographics within the specific region they are. Emerging market economies are experiencing steady growth in the replacement part segment based on increasing vehicle life expectancy.

Regional Insights

The demand in North America is stable due to Tier 1 demand in the U.S. coming primarily from large volume production of pickup and SUV products. Tier 2 markets are Canada and Mexico; with Mexico being the largest Tier 2 market as a manufacturing base for engine assemblies for export. Europe is an advanced technological region, with Germany, the U.K., France, Spain, and Italy constituting Tier 1 automotive manufacturing markets; furthermore, the Rest of Europe represents Tier 2 through localized assembly. Asia Pacific represents the most significant automotive market by a large margin, with four Tier 1 regions (China, Japan, India & South Korea) based upon the volume of finished vehicles produced and a diverse range of supply chain capabilities. The markets of Australia & New Zealand and the Rest of Asia Pacific constitute Tier 2 based on their reliance on imports and limited manufacturing activity. In South America, Tier 1 market is Brazil; Tier 2 market is Argentina and the Rest of South America is a smaller Tier 2 market. In the Middle East & Africa, there is slow growth development in Saudi Arabia, the United Arab Emirates and South Africa constitute Tier 1 demand for commercial vehicle usage and imports; while the Rest of the Middle East & Africa is in Tier 2 due to the level of developing automotive infrastructure and the range of economic conditions associated with the various countries that comprise that region.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Schaeffler India Declares Participation in SIAT 2026; Exhibition of Powertrain Solutions for Optimised Combustion Engines and Hybrid Technologies. Further Reiterate Commitment to Supporting the Evolution of Automotive Engine Component Demand.

- In June 2024, The Planetary Gear System (PGS) by Schaeffler India, a company based in the Hosur location, was officially launched on July 29, 2022, and is intended for Dedicated Hybrid Transmission (DHT) vehicles. The move aligns with Schaeffler's objectives of localizing production, increasing the adoption of hybrid powertrains, and collaborating with OEMs to meet the demands of the Indian market.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.60 Billion |

|

Market size value in 2026 |

USD 2.80 Billion |

|

Revenue forecast in 2033 |

USD 4.30 Billion |

|

Growth rate |

CAGR of 10.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

MAHLE GmbH, Thyssenkrupp AG, Schaeffler Group, Linamar Corporation, Precision Camshafts Limited, COMP Cams, Musashi Seimitsu Industry Co., Ltd., Kautex Textron GmbH & Co. KG, Camshaft Machine Company, Melling Tool Company, Piper Cams Ltd., Hirschvogel Holding GmbH, Crane Cams Inc., Elgin Industries, Seojin Cam Co., Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Cast Camshaft, Forged Camshaft, Assembled Camshaft), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers), By Engine Type (Inline Engine, V-Type Engine, Flat Engine) and By Sales Channel (OEM, Aftermarket) |

Key Automotive Camshaft Company Insights

MAHLE GmbH is a global manufacturer that creates products for the automotive industry. It provides high-quality engine system components and camshafts using advanced machining methods and precision engineering, while meeting the very strict requirements placed on Original Equipment Manufacturers. To achieve this outcome, MAHLE has an extensive network of research and development centers as well as manufacturing locations throughout the world. MAHLE’s product portfolio has been specifically developed to comply with current and future legislation regarding emissions and fuel efficiency. In addition, MAHLE is committed to its strategy of using lightweight materials, variable valve timing technologies, and a global supply chain a strategy which provides MAHLE with a significant competitive advantage. The global manufacturing footprint of MAHLE allows MAHLE to quickly respond to regional demand and efficiently manage its supply chain in Europe, North America, and Asia Pacific. As a result of MAHLE’s integrated global footprint, MAHLE has become a leading supplier of camshafts to the automotive industry.

Key Automotive Camshaft Companies:

- MAHLE GmbH

- Thyssenkrupp AG

- Schaeffler Group

- Linamar Corporation

- Precision Camshafts Limited

- COMP Cams

- Musashi Seimitsu Industry Co., Ltd.

- Kautex Textron GmbH & Co. KG

- Camshaft Machine Company

- Melling Tool Company

- Piper Cams Ltd.

- Hirschvogel Holding GmbH

- Crane Cams Inc.

- Elgin Industries

- Seojin Cam Co., Ltd.

Global Automotive Camshaft Market Report Segmentation

By Type

- Cast Camshaft

- Forged Camshaft

- Assembled Camshaft

By Vehicle Type

- Below 50 Tons

- 50–100 Tons

- Above 100 Tons

By Engine Type

- Inline Engine

- V-Type Engine

- Flat Engine

By Sales Channel

- OEM

- Aftermarket

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636