Market Summary

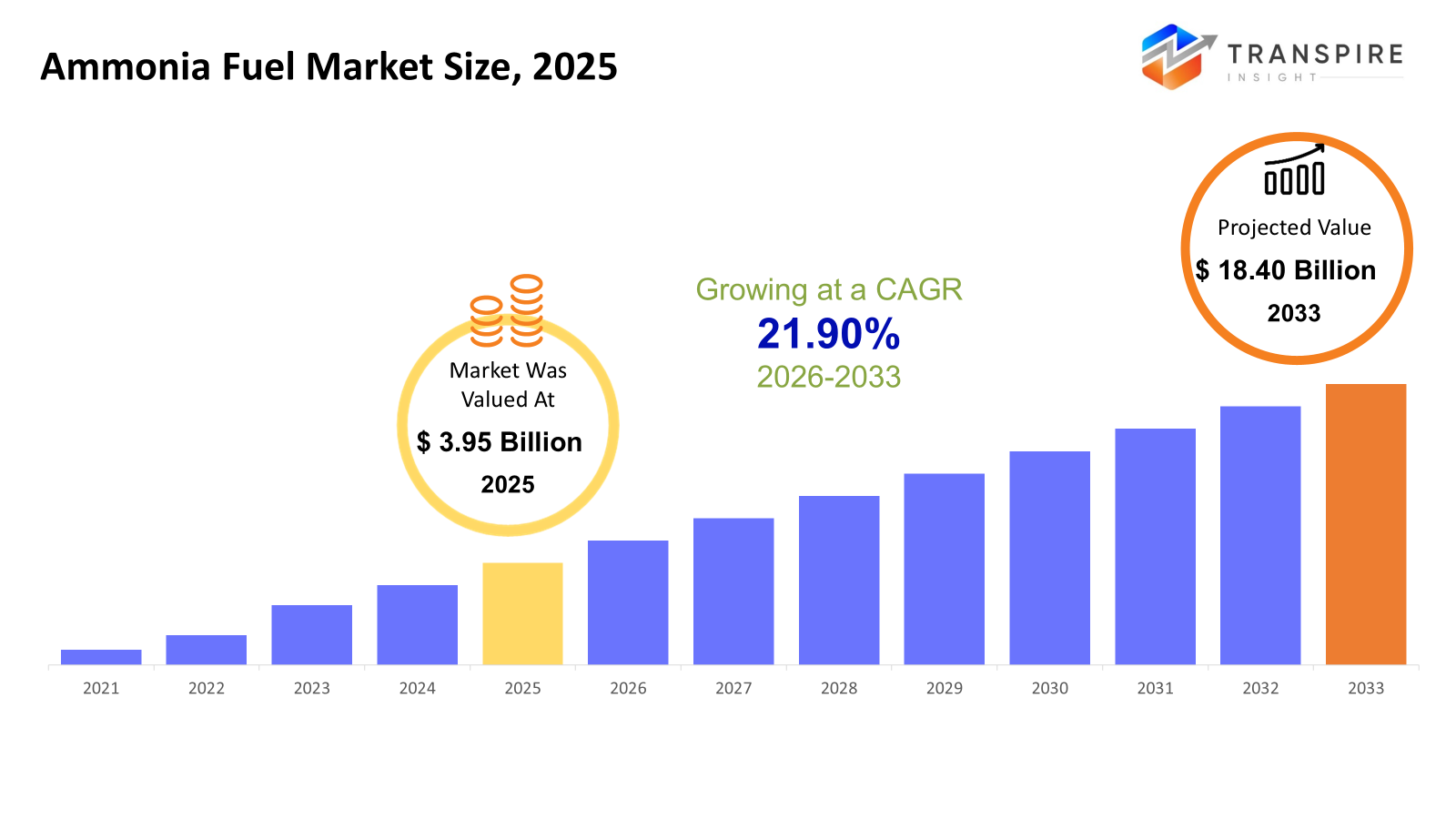

The global Ammonia Fuel market size was valued at USD 3.95 billion in 2025 and is projected to reach USD 18.40 billion by 2033, growing at a CAGR of 21.90% from 2026 to 2033. The average annual growth of the ammonia fuel market is driven by rising global decarbonization targets particularly in sectors difficult to decarbonize such as power generation, shipping and industrial heat production. Increasing investments in green and blue ammonia production, supportive policy incentives and ammonia's role as a scalable hydrogen carrier all contribute to sustainable medium- to long-term growth.

Market Size & Forecast

- 2025 Market Size: USD 3.95 Billion

- 2033 Projected Market Size: USD 18.40 Billion

- CAGR (2026-2033): 21.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Strong federal incentives, experimental co-firing projects, and growing blue ammonia capacity have all contributed to North America's increasing adoption of ammonia fuel with the US serving as a technical and investment hub for power generation and maritime fuel transitions.

- Through utility-driven co-firing studies, CCUS-enabled blue ammonia projects and large-scale ammonia production assets the United States spearheads regional momentum and positions ammonia as a viable near term decarbonization pathway for current thermal infrastructure.

- Asia Pacific is the fastest-growing region with the assistance of China's industrial demand, South Korea's and Japan's ammonia co-firing regulations, and Australia's export-focused green ammonia projects to secure long-term clean fuel supply chains.

- Because blue ammonia is integrated with current ammonia production capacity and carbon capture infrastructure, it can be immediately deployed in large quantities across power generation, shipping fuel trials, and industrial energy applications without requiring significant asset replacement. As a result, blue ammonia currently dominates market activity..

- Liquid ammonia continues to be the favored form owing to its better storage economics, well-established transportation infrastructure and appropriateness for bulk power, shipping uses, solidifying its dominance in scenarios involving large-scale fuel deployment.

- Ammonia facilitates the decarbonization of coal and gas plants by co-firing, providing utilities with a less risky transition alternative than complete asset replacement, making power generation the most prominent application trend.

- End-user adoption trends are dominated by utilities and power producers who use long-term ammonia supply agreements to strike a compromise between fuel flexibility requirements, grid stability and emissions reduction targets.

So, The use of ammonia as a low-carbon or carbon-free energy carrier in transportation, industrial heating, power production, and maritime shipping is referred to as the ammonia fuel market. Compared to traditional fossil fuels, ammonia can be generated with carbon capture technology or renewable power, allowing for significant emissions reduction in energy-intensive industries. Because of its high energy density, well-established worldwide transportation network, and capacity to serve as both a direct fuel and a hydrogen carrier, ammonia is becoming more and more important. It is especially appealing for industries where direct electrification is economically or technically limited because of these features. Ammonia is therefore being positioned more and more as a bridge fuel in the global energy transition. Government decarbonization goals, hydrogen economy plans, and private sector investments in clean fuel infrastructure all have a direct impact on market growth. The commercial viability of ammonia fuel solutions is progressively improving globally due to continued technological improvements, regulatory clarity, and scale efficiencies, even while cost competitiveness and safety concerns continue to be obstacles.

Ammonia Fuel Market Segmentation

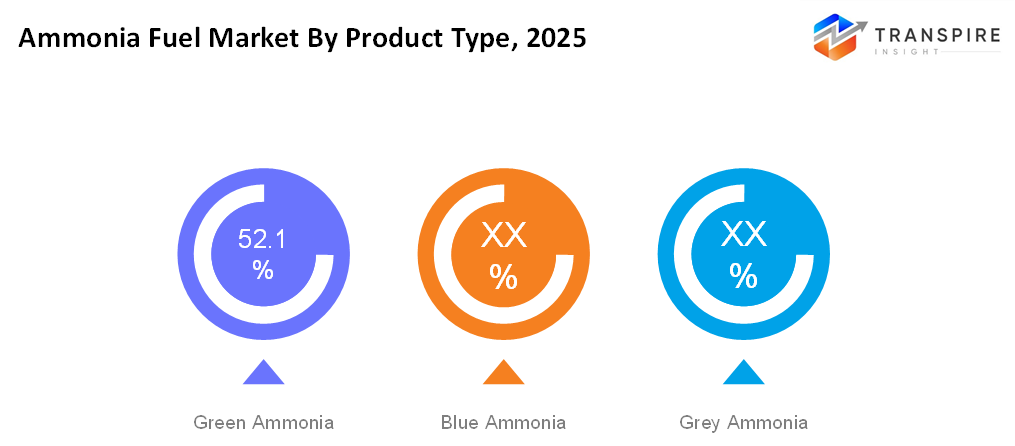

By Product Type

- Green Ammonia

Green ammonia is a fuel with almost no carbon emissions and created by electrolyzing water and using renewable electricity to produce hydrogen. It is becoming more important under decarbonization policies and pilot programs in shipping and power generation indicating significant development potential as the cost of renewable energy drops.

- Blue Ammonia

Due to its easy integration with current infrastructure and production capacity blue ammonia which is produced from fossil fuels with carbon capture and storage (CCS) dominates the market. Because of its transitory role industries like the power and heavy fuel sectors can immediately reduce their carbon intensity. It is currently the biggest income generator due to its transitional positioning, but long-term growth may slow down in comparison to green ammonia.

- Grey Ammonia

Grey ammonia is traditionally produced from natural gas without carbon capture. Although emissions concerns and regulatory constraints are reducing its commercial importance it continues to support price competitiveness and legacy supplies for industrial processes outside of severe climate policy regimes.

To learn more about this report, Download Free Sample Report

By Form

- Liquid Ammonia

Because of its greater energy density, ease of storage, and compatibility with current transportation and infrastructure, liquid ammonia is the most common physical form for fuel applications. It is the recommended option for industrial deployments at scale since it permits large-scale shipping and power plant co-firing without requiring extensive retrofitting.

- Gaseous Ammonia

Niche markets with rapid on-site consumption, small-scale distributed power, or particular industrial feedstock requirements are served by gaseous ammonia. Although it is limited by storage inefficiency and safety handling issues compared to liquid form, it allows flexibility and on-demand hydrogen carrier responsibilities.

By Application

- Power Generation Fuel

Because ammonia may co-fire with present thermal plants and help grid decarbonization with cheaper retrofit costs, this segment now has a leading revenue share. Ammonia is particularly used by utilities to achieve emissions goals while preserving baseload capacity.

- Maritime Shipping Fuel

Ammonia is a good option to replace heavy fuel oil in transportation because of its high energy density and zero carbon profile (whether green or blue). Adoption is being accelerated by regulatory pressure, especially from the International Maritime Organization, although infrastructure and safety regulations continue to be major obstacles.

- Industrial Process & Heat Fuel

Due to ammonia's adaptability for high-temperature processes and the drive to decarbonize industries like steel and chemicals, industrial heat applications are expanding at the quickest rate. Ammonia's dual function as a fuel and hydrogen carrier supports both energy use and feedstock requirements which is advantageous for this industry.

- Transportation

Ammonia's use in heavy road transportation and possibly rail is expanding beyond ships. Although distribution logistics and engine adaption provide challenges, interest in heavy-duty and long haul applications where electrification is less practical is growing.

- Others

Additional uses include supplemental fuel, off-grid energy systems and backup power. These are still in their infancy but are growing as combustion platforms and ammonia fuel cell technologies advance.

By End User

- Utilities / Power Plants

Utilities are making investments in hybrid and ammonia co-firing systems to lower the carbon footprint of energy production while preserving dependability. Strategic decarbonization commitments are reflected in long term supply agreements with ammonia producers.

- Shipping & Marine Operators

In order to meet pollution regulations shipping corporations are among the most aggressive end users, looking for alternatives to heavy fuel oil. Although complete fleet conversion is still a medium to long term problem, large fleets and investments in specialist bunkering infrastructure indicate growth momentum.

- Automotive & Transportation

The use of ammonia in automobiles and other land-based transportation is still in its early stages and is primarily concentrated on heavy-duty vehicles as alternate fuel carriers or range extenders. The rate of adoption will be influenced by cost, engine conversion, and regulatory frameworks.

- Industrial Energy Users

Ammonia is being integrated by industrial users to substitute fossil fuels for energy and process heat, particularly in situations where electrification is not feasible. Ammonia's adaptability as a fuel and hydrogen source is beneficial to this market.

- Others

Power backup services, remote energy systems, and specialized industries investigating ammonia fuel cells are further end users. These are still minor, but they show how the market is becoming more diverse in terms of technology.

Regional Insights

North America is a fundamentally robust market for ammonia fuel, because to utility-led co-firing projects, CCUS incentives, and the United States' substantial ammonia manufacturing base. Mexico offers long-term possibilities related to industrial energy consumption and cross-border supply chains, while Canada adds through the incorporation of clean hydrogen.

The use of ammonia in hydrogen plans and maritime decarbonization programs is being advanced by Germany, the United Kingdom, France, Spain, and Italy. Due to limited domestic production capability, the remaining part of Europe is becoming more dependent on imported green and blue ammonia. Asia Pacific is the most dynamic region, driven by the ammonia co-firing mandates of South Korea and Japan, China's industrial scale, India's new clean fuel initiatives, and the renewable energy export projects of Australia and New Zealand. The rest of Asia Pacific exhibits increased pilot activity tied to energy security.

While other nations concentrate on viability and export potential, South America is still developing, with Brazil and Argentina utilizing renewable resources for future green ammonia production. Saudi Arabia and the United Arab Emirates, which use inexpensive gas and renewable energy sources for blue and green ammonia, serve as the anchors of the Middle East and Africa. South Africa and other MEA nations are progressively increasing their industrial demand.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 2025, JERA declared that it has made a final investment decision for the Louisiana, USA-based Blue Point project. With a capacity of over 1.4 million tons annually and CCS to lower CO2 emissions this low-carbon (blue) ammonia complex in collaboration with CF Industries and Mitsui will be one of the biggest ammonia production facilities in the world. Production is scheduled to begin in 2029.

(Source:https://www.jera.co.jp/en/news/information/20250409_2155)

- In September 2024, In order to supply up to 250,000 tons of RFNBO-compliant green ammonia annually from AM Green's Indian production plants (Kakinada and Tuticorin), RWE Supply & Trading and AM Green Ammonia inked a long-term Memorandum of Understanding. Beginning in 2027, the green ammonia will comply with EU Renewable Fuels of Non-Biological Origin regulations and facilitate the growth of clean ammonia supply chains for fuel and energy applications.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.95 Billion |

|

Market size value in 2026 |

USD 4.60 Billion |

|

Revenue forecast in 2033 |

USD 18.40 Billion |

|

Growth rate |

CAGR of 21.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Yara International ASA, CF Industries Holdings, Inc., ExxonMobil Corporation, Royal Dutch Shell plc, Eni S.p.A., OCI N.V., QatarEnergy, SABIC, BASF SE, Air Liquide S.A., Siemens Energy AG, ThyssenKrupp AG, Nel ASA, ITM Power plc, MAN Energy Solutions SE |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Green Ammonia, Blue Ammonia, Grey Ammonia), By Form (Liquid Ammonia, Gaseous Ammonia), By Application (Power Generation Fuel, Maritime Shipping Fuel, Industrial Process & Heat Fuel, Transportation, Others) and By End User (Utilities / Power Plants, Shipping & Marine Operators, Automotive & Transportation, Industrial Energy Users, Others) |

Key Ammonia Fuel Company Insights

With centuries of experience in ammonia manufacturing and a vast global distribution network, Yara International ASA has become a market leader in ammonia fuel spearheading the shift to low-carbon solutions. In order to guarantee a wide supply of clean ammonia, the company has created alliances, strategically expanded into green and blue ammonia which included renewable energy into its manufacturing. Yara's initiatives take advantage of ammonia's dual function as a fuel and a hydrogen carrier, which benefits industrial, power generating, and marine applications.

Key Ammonia Fuel Companies:

- Yara International ASA

- CF Industries Holdings, Inc.

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Eni S.p.A.

- OCI N.V.

- QatarEnergy

- SABIC

- BASF SE

- Air Liquide S.A.

- Siemens Energy AG

- ThyssenKrupp AG

- Nel ASA

- ITM Power plc

- MAN Energy Solutions SE

Global Ammonia Fuel Market Report Segmentation

By Product Type

- Green Ammonia

- Blue Ammonia

- Grey Ammonia

By Form

- Liquid Ammonia

- Gaseous Ammonia

By Application

- Power Generation Fuel

- Maritime Shipping Fuel

- Industrial Process & Heat Fuel

- Transportation

- Others

By End User

- Utilities / Power Plants

- Shipping & Marine Operators

- Automotive & Transportation

- Industrial Energy Users

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr.png)

APAC:+91 7666513636

APAC:+91 7666513636