Market Summary

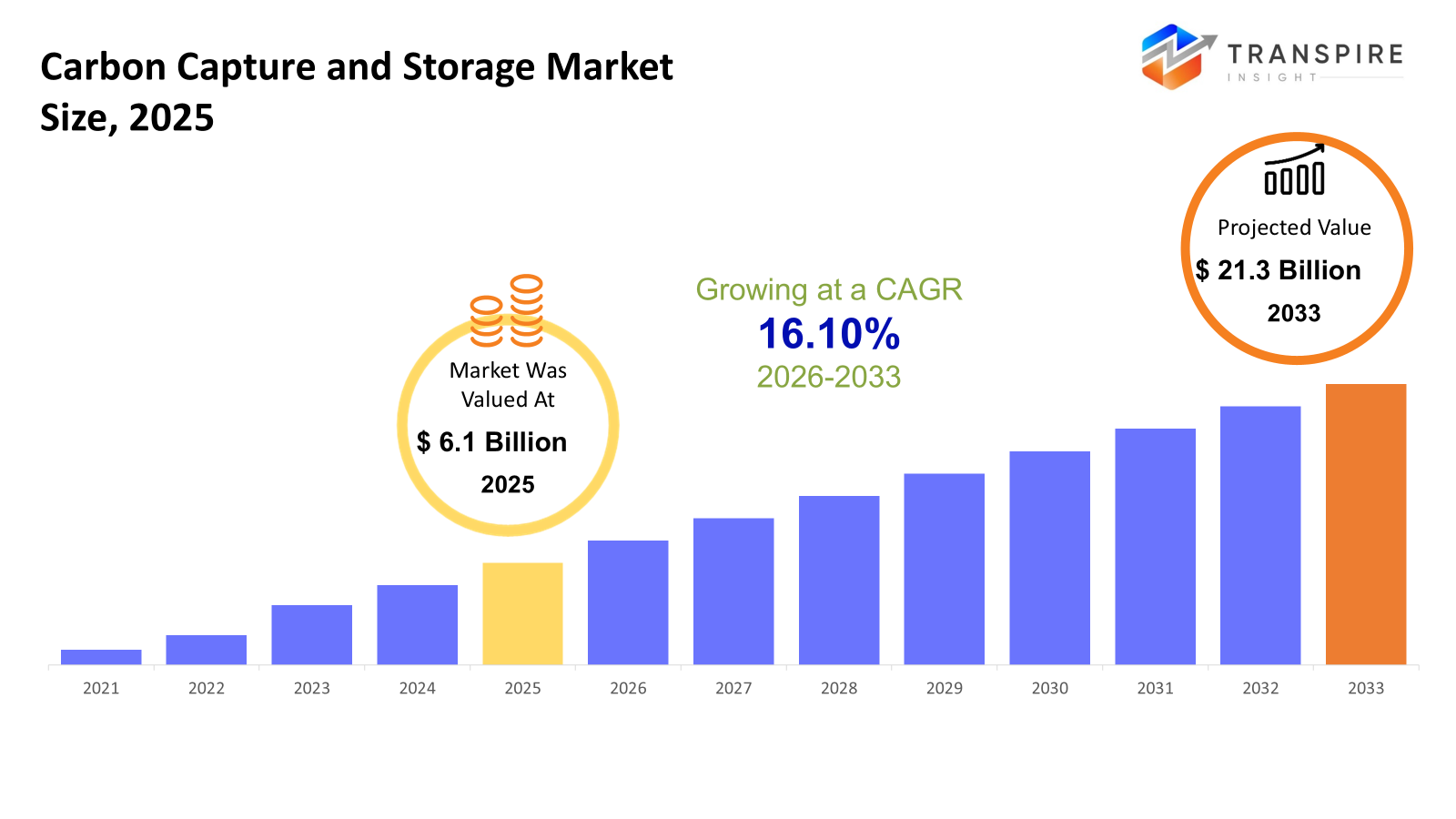

The global Carbon Capture and Storage market size was valued at USD 6.1 billion in 2025 and is projected to reach USD 21.3 billion by 2033, growing at a CAGR of 16.10% from 2026 to 2033. The Carbon Capture and Storage market is expected to experience steady growth with rising demands for reducing carbon emissions driven by regulations. With advancements in cost-effective technology, the use of CCS in the power sector is increasing for the purpose of emissions reduction, thus contributing to the growth of the global CCS market. Investments in pilot projects for EOR activities also support the market.

Market Size & Forecast

- 2025 Market Size: USD 6.1 Billion

- 2033 Projected Market Size: USD 21.3 Billion

- CAGR (2026-2033): 16.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The global capture technology market in North America is expected to continue leading in terms of post-combustion capture and power production due to the retrofitting efforts of power companies to reduce emissions and increase efficiency.

- In the United States of America, there has been an acceleration in the adoption of process capture and oxy-combustion technologies in industries such as cement, steel, and enhanced oil recovery projects, where both the capability to reduce emissions and produce high-purity CO2 are paramount.

- The Asia Pacific market remains the fastest-growing due to innovations by China, Japan, and South Korea in pre-combustion and oil & gas technology, while India and Australia are developing capacities through low-cost industrial process capture projects.

- Post-combustion capture leads the capture technology market trend by a big margin, with plants realizing the advantages of retrofitting existing infrastructure to reduce CO₂ emissions without operational disruption and benefiting from mature commercially proven systems.

- Power generation remains the leading market application on the back of rising energy demand, decarbonization policies, and incentives for renewable integration. Utilities are currently championing the deployment of CCS to help meet climate targets while ensuring a steady supply of electricity.

So, the Carbon Capture and Storage market includes solutions and applications such as carbon dioxide capture and storage from industrial and energy-related sources and storage and commercial use of captured carbon dioxide. The importance and applications of CCS are very essential for global efforts and actions on climate change strategy and measures for reducing carbon dioxide emission from power and energy-related sources such as power plants and energy-related sources such as cement, steel, oil, and gas sectors. The market is also segmented on the basis of capture technology, including post-combustion, pre-combustion, oxy-combustion, and industrial process carbon capture, catering to specific needs depending on the sources and processes. Post-combustion capture accounts for a larger share in retrofits on account of compatibility, while pre-combustion and oxy-combustion in new unit applications with high efficiencies. In terms of application, the leading consumer of CCS technology is power generation, followed by the oil and gas, metal, and cement sectors, and other applications. CCS projects in enhanced oil recovery further provide an economic incentive to CO2 storage. Government policies, tax credits, and worldwide investments in various sustainable technologies continue to support the growth of CCS projects, both in pilot and large commercial sizes.

Carbon Capture and Storage Market Segmentation

By Capture Technology

- Post Combustion

The leading method is post-combustion capture because this process is compatible with existing power and industrial infrastructure. The method uses existing power and industrial infrastructure and is therefore useful when there is a need to reduce emissions with little modification to existing processes. The process is also used extensively for retrofits because of existing power and industrial infrastructure.

- Industrial Process

The use of CO2 capture within industrial process capture can be enhanced by the high-purity streams of CO2 that can be obtained during chemical production, refining, as well as fertilizer production. It can easily integrate into these existing processes.

- Pre-combustion

Pre-combustion capture removes CO₂ before fuel combustion, typically in an integrated manner with gasification and hydrogen production, at a high capture rate and with high capital investment. This segment aligns with strategies related to the hydrogen economy.

- Oxy-Combustion

Oxy-combustion involved the use of pure oxygen, resulting in the production of CO₂-rich exhaust streams that are easier to capture but at an increased dependency on energy-intensive air separation units. It allows for a high concentration of CO₂.

To learn more about this report, Download Free Sample Report

By Application

- Power Generation

CCS in the power industry helps fossil fuel-based power plants meet stringent emission standards while also securing the stability of the power grid. The power industry uses CCS technologies to prolong the life of their existing assets.

- Oil & Gas

In the oil & gas sector, CCS helps in the reduction of emissions throughout the value chains, thereby also aiding in EOR, which in turn reduces costs. EOR-related projects enhance commerciality.

- Metal Production

CCUS plays a crucial role in metal processing, where it mitigates emissions generated by steel and aluminum production, which can't otherwise be reduced by electrification. This is because elevated-temperature processing generates point sources of emissions.

- Cement

The production of concrete involves a natural production of carbon dioxide through calcining limestone; hence, carbon capture and storage is effectively the only readily scalable technology available for this purpose. CCS tackles process emissions.

- Others

Other industries include chemicals, pulp and paper, and waste to energy, in which the deployment of CCS technology is a reaction to regulatory forces and corporate sustainability strategies. These offer a niche market.

Regional Insights

The North America carbon capture and storage industry is driven by the United States, a Tier1 geography, due to the support provided by the federal incentive structure, as well as the established oil & gas infrastructure and geological storage capacity. Next is Canada, a Tier2 geography due to oil sands decarbonization initiatives. Mexico is in a early adoption stage. Europe's Tier 1 markets include the United Kingdom and Germany, backed by strong climate policies, industrial decarbonization obligations, and international CO2 transport initiatives. France, Italy, and Spain represent the second-tier market with targeted project implementation, and the Rest of Europe follows the CCS region-based development path.

Varying levels of maturity are found in the Asia/Pacific regions. China and Australia are categorized under Tier 1 markets because of their heavy industrial-scale emissions and supportive government programs on CCS. Japan and South Korea function as Tier 2 tech adopter markets, while India and the rest of Asia/Pacific are policy-evolving markets. South America is an emerging country in terms of CCS and is listed as Tier 1 for Brazil because of offshore storage capacity and energy-related projects. Other countries such as Argentina and Rest of South America are Tier 2. In Middle East & Africa, the Tier 1 market comprises Saudi Arabia & UAE, which use CCS to support hydrocarbon exports even with net-zero emissions. South Africa & Rest of ME&A form the Tier 2 market on selective industry & generating sets.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, A CCS project off the coast in northern Australia is set for a second attempt by Japanese firm Inpex’s environmental plan. The scheme, being developed by a joint venture consortium also including TotalEnergies and Woodside Energy, will involve the potential capture and transportation of up to 8 million tpa CO2.

- January 2026, Google has entered into a historic deal in which they will acquire low-carbon energy generated by the Broadwing Energy Center in Illinois, where approximately 90 % of the carbon emissions will be captured and stored by CCS. This partnership signals a new era in the deployment of CCS in gas power plants that will not rely directly on any type of government subsidy.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.1 Billion |

|

Market size value in 2026 |

USD 7.5 Billion |

|

Revenue forecast in 2033 |

USD 21.3 Billion |

|

Growth rate |

CAGR of 16.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Royal Dutch Shell plc, ExxonMobil Corporation, Chevron Corporation, Equinor ASA, TotalEnergies SE, Aker Solutions ASA, Mitsubishi Heavy Industries Ltd., Siemens Energy AG, Fluor Corporation, Linde plc, Halliburton Company, Baker Hughes Company, Schlumberger Limited, Sulzer Ltd., Carbon Engineering Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Capture Technology (Post combustion, Industrial Process, Pre-combustion, Oxy-Combustion), By Application (Power generation, Oil & Gas, Metal production, Cement, Others) |

Key Carbon Capture and Storage Company Insights

Royal Dutch Shell plc is a worldwide diversified energy company, which is a dominant player in the CCS industry through investments, assets, and collaborations. Shell’s CCS business portfolio comprises large projects such as the Quest project in Canada, Polaris CCS, as well as a participating interest in the Northern Lights CO2 transport and storage infrastructure. Shell concentrates on large-scale transport and storage infrastructure combined with advanced capture technology, which is applied in industry and energy sectors. Shell has a worldwide footprint, which makes Royal Dutch Shell plc one of the key players influencing the adoption of CCS technology.

Key Carbon Capture and Storage Companies:

- Royal Dutch Shell plc

- ExxonMobil Corporation

- Chevron Corporation

- Equinor ASA

- TotalEnergies SE

- Aker Solutions ASA

- Mitsubishi Heavy Industries Ltd.

- Siemens Energy AG

- Fluor Corporation

- Linde plc

- Halliburton Company

- Baker Hughes Company

- Schlumberger Limited

- Sulzer Ltd.

- Carbon Engineering Ltd.

Global Carbon Capture and Storage market Report Segmentation

By Capture Technology

- Post combustion

- Industrial Process

- Pre-combustion

- Oxy-Combustion

By Application

- Power generation

- Oil & Gas

- Metal production

- Cement

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636