Market Summary

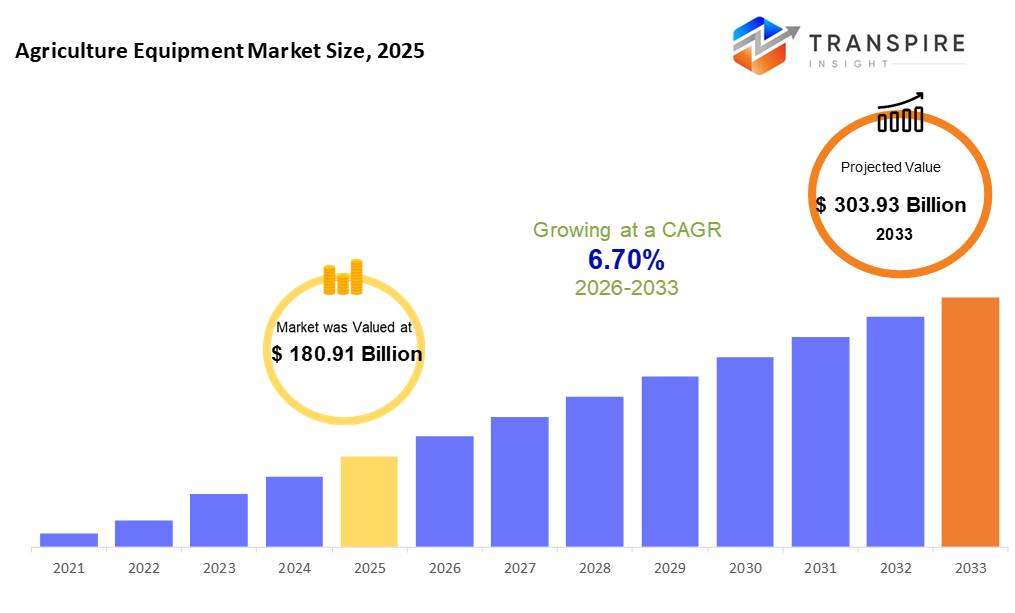

The global Agriculture Equipment market size was valued at USD 180.91 billion in 2025 and is projected to reach USD 303.93 billion by 2033, growing at a CAGR of 6.70% from 2026 to 2033. Farm equipment demand climbs as more people need food around the world. Workers are harder to find on farms, pushing owners toward machines instead. Efficiency becomes key when feeding growing populations. Machines now do tasks once done by hand, changing how fields are managed.

Market Size & Forecast

- 2025 Market Size: USD 180.91 Billion

- 2033 Projected Market Size: USD 303.93 Billion

- CAGR (2026-2033): 6.70%

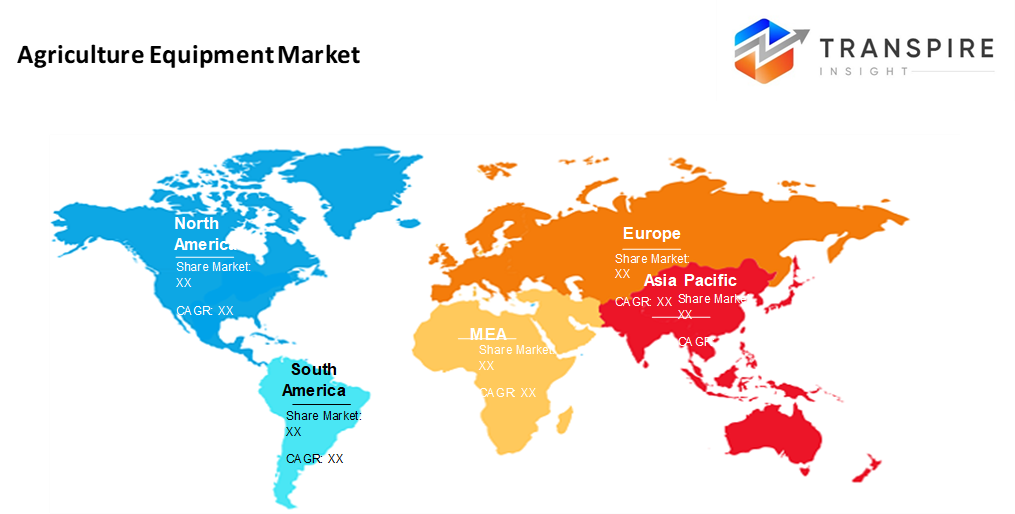

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 36% in 2026. Farming tools in North America stay ahead because new machines spread quickly here. A steady openness to high-tech solutions in fields across the continent. Change takes root fast when old methods meet smart upgrades. This part of the world leans into robotics before most others do. Equipment needs grow simply by doing things differently from the start.

- Farming at massive levels pushes machine accuracy front and center across the United States heartland. Equipment moves on its own, guided by data-rich systems embedded deep within daily operations. Vast fields rely heavily on tech that cuts waste while boosting output steadily over time.

- Farming here shifts quickly as machines take on more work. Support from governments gives farmers a steady push forward. Digital tools quietly reshape how crops are managed across villages. Momentum builds where new methods meet old fields.

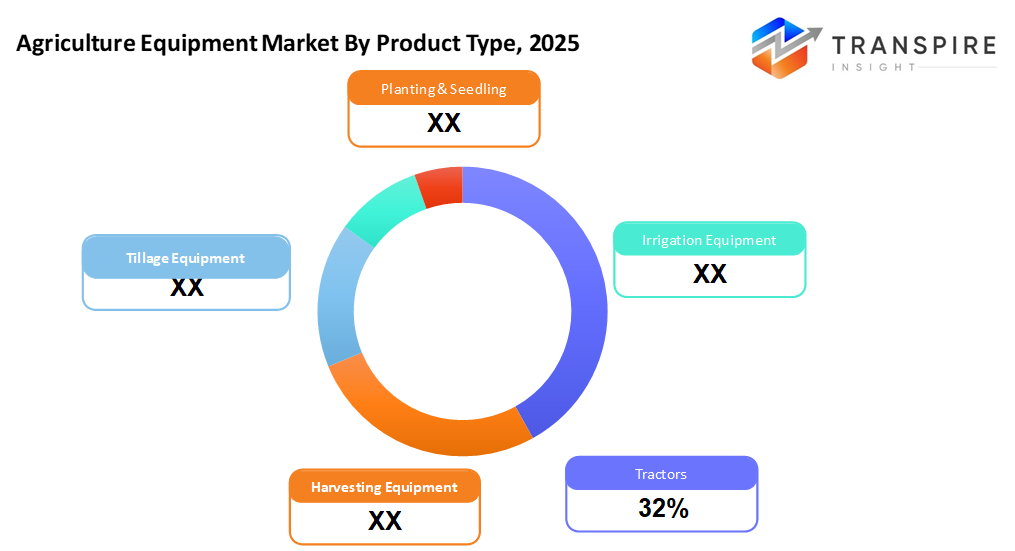

- Tractors share approximately 35% in 2026. Often it is tractors. Their wide use pushes them ahead of other types. When farmers pick equipment, these machines come first. Not every tool sees such a consistent need.

- Farm tools that harvest plus thresh are gaining ground quickly, due to machines doing more of the fieldwork these days, pushing up how much crops produce per acre.

- Robots that work on their own are getting better fast. Because of smarter tech, these machines do tasks without help. Growth happens as systems learn to act independently. Progress in automation pushes equipment to run fully alone.

- Farming crops takes up most of the spotlight when it comes to basic machinery use on farms.

Farming today leans on gear that makes work faster, smarter, and less wasteful. Machines like tractors prepare soil, plant seeds, water fields, protect crops, and then gather harvests, all with precision. Instead of relying only on hands and time, growers use tools suited to their land size and what they grow. From plows to sprayers, each piece plays a role in keeping operations steady and yielding reliable results. Efficiency is not just about speed; it shows up in how fuel, seed, and effort get used, too.

Food needs keep growing while farmland gets smaller, so machines on farms are becoming more common. Because fewer people work in fields now, growers look to technology that helps plants produce more without spending too much. When storms or droughts surprise them, automated tools offer a way through tough seasons. Starting with GPS-guided tractors down to sensors in soil, digital gear fits into daily farm tasks quietly. Machines that adjust planting depth based on real-time data are slowly becoming standard across regions.

Out in fields where old methods once ruled, self-driving tractors now move without a person at the wheel. Equipment guided by satellite signals rolls through rows with precision unseen decades ago. Sensors wired into soil and machines send updates every few minutes, feeding live info to screens on site. Instead of guessing when repairs are due, alerts pop up before parts fail. Decisions come straight from patterns found in numbers gathered daily. With clearer insights, workers adjust how they plant, water, or harvest. Less fuel gets burned, fewer seeds go unused. Machines that run on batteries are beginning to replace loud diesel models. Each change shifts energy use lower. Farms operate more smoothly simply because information flows faster.

Support from governments through funding and rewards for farming that uses machines and protects nature is giving the market a boost. Take North America and Europe: they’ve got solid systems already in place, plus they started using new methods earlier than others. Over in Asia Pacific and Latin America, change is picking up speed as farms shift toward machinery and updated techniques. Technology shapes much of today’s farming, making it run smoother, smarter, and with fewer resources wasted, and that shift keeps pushing the market forward.

Agriculture Equipment Market Segmentation

By Product Type

- Tractors

Farm work gets done with tractors; these motor-driven tools move equipment across fields. Rolling over dirt, they run gear that plants or harvests crops. Not just haulers, they supply energy to attached machinery. Moving slowly but strongly, their role shapes much of today's farming.

- Harvesting Equipment

Machines are designed to efficiently harvest crops.

- Tillage Equipment

Furrows begin with tools that loosen the ground before seeds arrive. These machines shape the earth, making it ready for crops to take root.

- Planting & Seedling

Seeds go into soil using tools built for precision. These machines handle planting tasks without guesswork. Position matters, so equipment ensures each seed lands right. Accuracy comes first when setting up crops.

- Irrigation Equipment

Farming needs steady water flow; machines handle that task. These tools move liquid where plants grow, keeping the soil moist on schedule.

To learn more about this report, Download Free Sample Report

By Function

- Land Development & Seedbed Preparation

Bumpy ground gets smoothed first. Tools shape the dirt surface before planting begins. A flat base forms where seeds will lie. Machines press and ready the earth gently. Soil settles into place with careful passes. Each step readies the land just enough.

- Sowing & Planting

Tools for placing seeds and seedlings.

- Harvesting & Threshing

- Out in the fields, machines pull crops from the ground. Then they shake the stalks loose, so seeds fall free. These tools work fast, breaking apart stems and heads. One step removes grain; another catches it clean. Movement keeps everything flowing without stopping.

- Irrigation & Crop Care

Water flows where plants need it most. Healthy crops depend on steady moisture. Pipes move liquid across fields. Roots drink when the supply arrives on time. Growth follows consistent care.

- Post-Harvest Processing

Drying gear comes first, then machines that tidy up the harvest. After that, tools for moving it into storage take over. Each step links to the next without delay.

By Automation Level

- Manual Equipment

Tools are moved by hand, needing a person to work them.

- Semi-Automatic Equipment

Some machines run on their own but still need people to help. These tools do part of the work without constant control.

- Fully Automatic

A machine that runs on its own out in the field. Moves without a person sitting inside. Works through rows of crops by following signals. Runs day or night if needed. Do tasks once done only by hand.

By Application

- Agriculture

Farming crops often means using machines built for older methods. These tools help grow food the way people have done it for years.

- Horticulture

Growing crops needs specific gear. Tools differ depending on whether you work with fruit, veggies, or decorative greenery. Each plant type asks for its own kind of help. Equipment shapes change based on what’s being tended.

- Livestock Farming

Farm animals need tools to help with daily care. Machines make feeding easier. Water systems keep creatures hydrated. Shelters protect them from the weather. Health checks rely on special devices. Movement around fields uses fencing gear.

- Forestry

There is a gear built just for that. Moving logs across rough ground and tough terrain needs strong equipment. Carefully managing woodland areas means using tools made for precision work among trunks and roots.

Regional Insights

Farming gear fills fields across North America, where machines do much of the work thanks to long-standing tech upgrades and large-scale crop ventures. Machines like tractors and harvesters dominate daily tasks in the United States and Canada, their routines fine-tuned over decades. Meanwhile, down south, Mexico pushes forward slowly, nudged by funding programs and efforts to bring older farms into the modern age.

Fueled by strict eco-rules, Europe keeps moving forward, helped by smarter ways to farm and a push to leave less damage behind. While top-tier nations rely on high-tech tools, automated systems, and digital oversight out in the fields, others just below are quickly bringing in machines that boost harvests while meeting Brussels’ growing list of farming demands.

Fueled by hunger for more food and state-supported automation pushes, the region stretching from China through Japan to Australia races ahead as demand surges. In nations like India, pockets across Southeast Asia, plus South Korea, farmers lean into compact, budget-friendly machines instead of heavy gear. Down south, Brazil and Argentina start shifting gears, and new money flows into watering systems, pest control, and tools that till soil. Over Africa and parts of the Arab world, including South Africa and the United States, the same rhythm builds: investment climbs slowly but surely in hardware meant for fields.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 29, 2025 – Mahindra farm machinery launched a new groundnut thresher in Gujarat, Rajasthan, MP, and UP.

- September 29, 2025 – Revolutionising Zoomlion launched the DX7004 hybrid tractor.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 180.91 Billion |

|

Market size value in 2026 |

USD 193.03 Billion |

|

Revenue forecast in 2033 |

USD 303.93 Billion |

|

Growth rate |

CAGR of 6.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

AGCO Corporation, Deere & Company, CNH Industrial N.V, Kubota Corporation, Mahindra & Mahindra Ltd, Yanmar Co. Ltd, Claas KgaA MbH, Escorts Limited, Agro Tractors SpA, JCB Agriculture, Buhler Industries, Valtra Oy, Great Plains Manufacturing Inc., and Agro Tactors |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Tractors, Harvesting Equipment, Tillage Equipment, Planting & Seedling Equipment, Irrigation Equipment, Others), By Function (Land Development & Seedbed Preparation, Sowing & Planting, Harvesting & Threshing, Irrigation & Crop Care, Post-Harvest Processing), By Automation Level (Manual, Semi-Automatic Equipment and Fully Automatic), By Application (Agriculture, Horticulture, Livestock Farming Forestry) |

Key Agriculture Equipment Company Insights

Farming tools built by Deere shape fields across continents. Machines like tractors and harvesters roll out year after year with new thinking inside. Planting gear now works smarter thanks to digital help woven right into the design. GPS guides these systems, while sensors talk through networks to adjust tasks on the go. Intelligence embedded in each unit learns from soil and weather patterns alike. Innovation flows steadily from labs where engineers test bold ideas daily. Reach stretches wide via service points that dot rural regions far and near. Attention sticks to cleaner methods, cutting waste without slowing work. Small plots benefit just as much as vast estates when wheels turn at dawn. Progress shows not in slogans but in rows aligned, yields steady, ground preserved.

Key Agriculture Equipment Companies:

- AGCO Corporation

- Deere & Company

- CNH Industrial N.V

- Kubota Corporation

- Mahindra & Mahindra Ltd

- Yanmar Co. Ltd

- Claas KgaA MbH

- Escorts Limited

- Agro Tractors SpA

- JCB Agriculture

- Buhler Industries

- Valtra Oy

- Great Plains Manufacturing Inc.

- Agro Tactors

Global Agriculture Equipment Market Report Segmentation

By Product Type

- Tractors, Harvesting Equipment

- Tillage Equipment

- Planting & Seedling Equipment

- Irrigation Equipment

- Others

By Function

- Land Development & Seedbed Preparation

- Sowing & Planting

- Harvesting & Threshing

- Irrigation & Crop Care

- Post-Harvest Processing

By Automation Level

- Manual

- Semi-Automatic Equipment

- Fully Automatic

By Automation Level

- Agriculture

- Horticulture

- Livestock

- Farming Forestry

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636