Jan 03, 2026

The report “Surgical Robots Market By Type (Semi-Autonomous Surgical Robots, Autonomous Surgical Robots, Non-Autonomous Surgical Robots), By Mode of Operation(Open Robotic Surgery, Minimally Invasive Robotic Surgery, Laparoscopic Robotic Surgery), By Application (General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Urological Surgery, Gynecological Surgery, Others), By End-Users (Hospitals, Ambulatory Surgical Centers, Specialty Clinics)” is expected to reach USD 40.92 billion by 2033, registering a CAGR of 14.67% from 2026 to 2033, according to a new report by Transpire Insight.

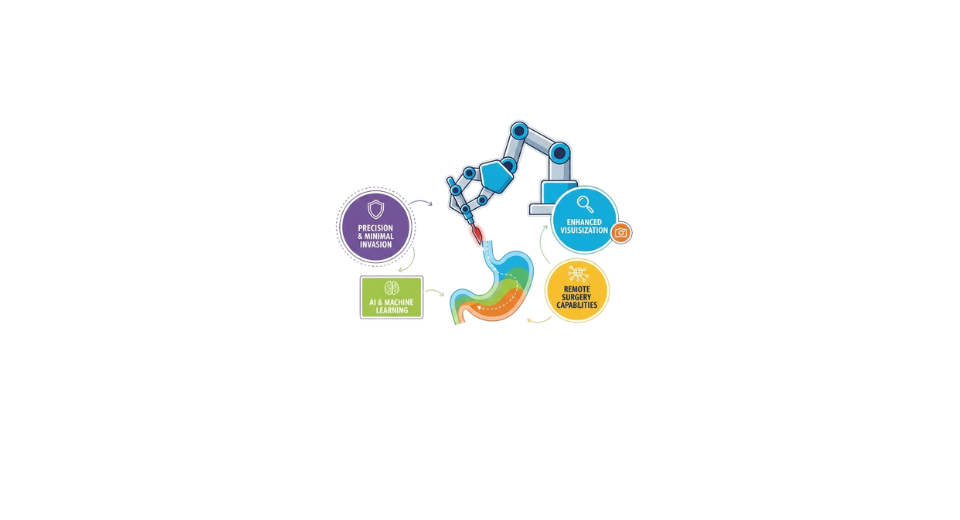

More hospitals are turning to robotic tools during operations because technology in medicine keeps moving forward. These machines help doctors work with greater accuracy, lower chances of mistakes, and fewer complications happen afterward. Instead of just scalpels and steady hands, some teams now rely on mechanical arms guided by screens and software. Not every robot works the same way; some act on their own, others need constant control, and many fall somewhere in between. Procedures like knee replacements, heart repairs, prostate treatments, organ removals, and even delicate womb surgeries now use these systems more often than before.

Fueled partly by patients learning more about robotic surgery, demand keeps climbing, with fewer issues after operations, less time stuck in hospitals, and quicker bounce-backs. These perks matter. Facilities like hospitals, outpatient centers, and even niche clinics now lean into robot systems, chasing better results while answering louder calls for high-end procedures. Tech moves forward too: smarter software, imaging that guides tools inside the body, upgrades that stretch what machines can do during surgery. Progress rolls on, pulling in more fields every year.

With each new version, robots gain sharper tools, smarter arms, better scopes, along with updated control stations that give surgeons a finer touch. Software steps in next, bringing data-driven insights that shape how operations are planned, guided mid-surgery, then reviewed afterward. Growth keeps building, not fast, not slow, fueled by clinics wanting smoother workflows, safer procedures, plus steady funding flowing into automated surgery systems.

The Autonomous Surgical Robots segment is projected to witness the highest CAGR in the Surgical Robots market during the forecast period.

According to Transpire Insight, A burst of progress in artificial intelligence pushes autonomous surgical robots ahead. Machine learning sharpens its accuracy beyond steady hands. Advanced imaging lets them see what once stayed hidden. Precision climbs when human effort steps back quietly. Standardized operations emerge without constant oversight. Surgeons stay fresher through longer days. Outcomes shift toward better recovery rates. Labs pour funding into smarter robotics now. Next-gen models rise from intense research cycles. Growth feeds on its own momentum here.

More hospitals now use smart machines in tough surgeries like heart, bone, kidney, and general operations. Precision matters most here. These tools help doctors work faster and make fewer mistakes during surgery. Some places choose them because they perform consistently under pressure. Approval from health regulators is widening slowly, opening doors for wider use. Machines guided by artificial thinking show steady progress, gaining trust over time. Their role grows stronger as technology proves itself in real settings. Slowly but surely, they take up more space in the world of robot-assisted surgery.

The Minimally Invasive Robotic Surgery segment is projected to witness the highest CAGR in the Surgical Robots market during the forecast period.

Ahead of the curve, robotic surgery with small incisions is gaining ground fast in the surgical robot industry over the coming years. Boosted by a clear shift toward methods that ease patient strain, cut down time in hospitals, faster healing. Sharp accuracy, clearer views during operations, finer hand-like control- these stand out when stacked against standard keyhole approaches. Surgeons lean into it. So do those on the table. Preference builds quietly but firmly.

Doctors across fields like general surgery, urology, gynecology, and even cardiology now rely on it heavily. Because tiny incisions often lead to better results for patients. New tech rolls in steadily, think sharp 3D imaging, artificial intelligence helping guide moves, robots responding with finer precision. These upgrades let surgeons do more with less invasion. Medical centers, from big hospitals to outpatient clinics, pour resources into adopting them. Not just for speedier operations, fewer errors matter too. Patient demands shift, expectations rise, and facilities adapt by bringing these tools on board.

The General Surgery segment is projected to witness the highest CAGR in the Surgical Robots market during the forecast period.

According to Transpire Insight, not far off, operations like removing a gallbladder or fixing a hernia are leaning heavily on robotic help. A surge in these machines shows up most clearly where everyday and tough surgeries happen often. Precision climbs when robots step into general operating rooms. Fewer issues pop up mid-surgery thanks to steadier control. Tasks such as working inside the colon gain sharper accuracy through machine support. Effectiveness in small-incision techniques rises without adding strain on surgical teams. Growth follows closely behind practical results across global hospitals.

Hospital spending on robotics for general surgery helps push the field forward. Patient choices tilt toward less invasive methods, nudging progress even more. Better tools emerge through sharper imaging, smarter software support, and fewer clunky instruments. Results get stronger over time, pulling in more medical centers. Growth sticks because practice widens while tech sharpens. One thing remains clear: this area leads robotic surgery.

The Hospitals segment is projected to witness the highest CAGR in the Surgical Robots market during the forecast period.

According to Transpire Insight, among places using surgical robots, hospitals will likely lead the market. Heavy demand for operations pushes this trend forward. Advanced medical setups inside these centers make adoption smoother, too. Most robotic surgery units settle here because diverse specialties work under one roof. Procedures like heart repairs, joint fixes, organ removals, or women's health surgeries happen regularly within these walls. Skilled doctors ready to operate exist in larger numbers at such sites. Teams across different fields collaborate often, where robotics is present. Money needed for expensive machines tends to be available more easily here than elsewhere. Ownership of costly tools fits better with hospital budgets generally.

More money going into smarter surgical tools makes a difference. Patient numbers go up when less invasive options become available. Better results in treatment, plus smoother hospital workflows, matter too. Machines that work as one system help doctors operate with greater accuracy. Fewer issues after surgery show up when these systems are used. People tend to heal faster under such conditions. Pressure builds on facilities to deliver top-level care day after day. Over time, hospitals keep holding the biggest share in robot-assisted surgery usage.

The North America region is projected to witness the highest CAGR in the Surgical Robots market during the forecast period.

Expect North America to stay ahead in the surgical robots market over the coming years - its edge comes from solid healthcare systems and quick uptake of new tech. Doctors there trust robot-assisted procedures more each year. Hospitals equipped with cutting-edge tools are common here, helping speed things along. Expert surgeons work widely across these centers. New models roll out often, especially used in general, urinary, bone, and heart operations.

Reimbursement policies that make sense help. New green lights from the FDA keep coming. Big names in the industry pour money into innovation. A growing preference for less invasive surgeries plays a role, too. More operations happen now, fueled by older populations needing care. Ties between hospitals and robot makers grow tighter. These links hold weight. Together, they shape why this region stays ahead globally.

Key Players

Top companies include Intuitive Surgical Inc., Medtronic Plc, Stryker Corporation, Zimmer Biomet, CMR Surgical, Renishaw Plc, Smith and Nephew, Think Surgical Inc., Moon Surgical, Meril Life Sciences, MicroPort, SS Innovations, Meril Life Science, Vicarious Surgical, and Momentis Surgical.

Drop us an email at:

Call us on:

+91 7666513636