Dec 23, 2025

The report Data Center Liquid Cooling Market By Component (Solution, Services), By Data Center Type (Hyperscale Data Centers, Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, High-Performance Computing Data Centers), By Service (Design & Consulting, Installation & Deployment, Maintenance & Support), By End Users (IT & Telecom, BFSI, Healthcare, Government & Defense, Manufacturing, Energy, Others) By Industry Analysis, Size, Share, Growth, Trends, Region and Forecasts 2021-2033 is expected to reach USD 28.18 billion by 2033 from USD 2.84 billion in 2025, at a CAGR of 33.22% from 2026 to 2033.

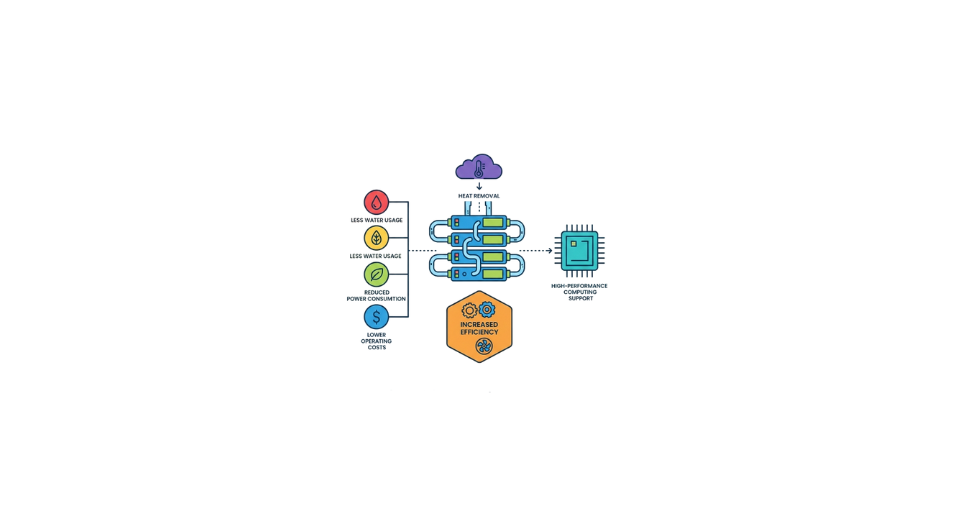

The data center liquid cooling is Liquid cooling uses a liquid coolant to absorb and dissipate heat from data center components. Swapping fans for a fluid-based system moves heat faster. That means using methods like chip-level chillers, metal plates filled with coolant, or dunking hardware in fluid, since liquids haul heat better than airflow. This kind of setup helps facilities pack more computing into each rack without overheating, keeping things steady and running smoothly.

This market is growing more crucial because data centers now handle heavy-duty tasks like AI, ML, cloud setups, or super-fast computing. Air-based cooling can’t keep up with the heat from these uses, so many teams are switching to liquid methods - boosting temperature control while cutting down on power use. That shift often trims running expenses and lifts how well a facility manages its electricity.

From a business angle, liquid cooling is gaining traction in massive data hubs, shared facilities, and speed-focused computing sites around key areas. Progress comes not just from tech upgrades but also better fit with today’s server designs on top of rising demand for greener, smarter power use in these centers. With digital shifts speeding up everywhere, this type of cooling is set to become essential in shaping what data centers look like down the road.

The Solution segment is projected to witness the highest CAGR in the Data Center Liquid Cooling market during the forecast period.

The solution part is expected to grow fastest in the data center liquid cooling space over the forecast years. This spike comes from more high-power computing setups being rolled out. Because of rising needs from AI, machine learning, and heavy-duty computing tasks, tools like chip-level coolers, full-dip systems, cold panels, or coolant hubs are now critical. Unlike old-school air methods, these options pull heat much better. That helps facilities run denser server racks without risking stability or speed.

In fact, more spending on big data hubs is boosting interest in liquid cooling, since companies want systems that save power and can grow easily. Equipment purchases take up most of the budget here, which helps sales rise quickly than service deals. Leading brands continue upgrading their designs, smoother links with current infrastructure, along with shared expanded adoption, further building steady progress down the line.

By Data Center Type, the Hyperscale Data Center segment is growing at the highest CAGR in the Data Center Liquid Cooling market during the forecast period.

When it comes to data center kinds, Hyper-scale setups are expected to grow fastest in liquid cooling use over the coming years. This spike ties back to booming cloud infrastructure and more AI or high-performance computing tasks popping up. These massive operations pack servers tighter, pushing power levels so high that regular airflow can't keep things cool enough; because of this, methods like chip-level liquids or full-tank submersion step in to handle heat better and keep systems running smoothly.

On top of that, huge data centers focus on saving power, growing easily, while keeping costs low over time, which pushes them toward using liquid cooling. Since these companies can afford it and know how to handle complex systems, rolling out advanced cooling setups isn't a problem. Big cloud firms keep spending more, aiming for greener operations and lower PUE, which should speed up the use of liquid-based cooling in massive facilities, helping this area grow fast.

By Services, the Installation & Deployment segment is projected to witness the highest CAGR in the Data Center Liquid Cooling market during the forecast period.

Services-wise, setup and rollout are expected to grow fastest in the data center liquid cooling scene through the coming years, with more new centers popping up plus upgrades in older ones using liquid-based setups. Putting in these cooling systems needs skilled help for hooking things together, running pipes, handling fluids, and making sure everything works smoothly with servers, so folks are leaning heavily on expert teams to get it done.

On top of that, more companies are turning to techs like immersion cooling, so they need help setting them up since it's tricky stuff. Big data hubs, shared server farms, or power-heavy systems now prefer hiring outside teams to handle installations for smoother runs and fewer risks. With liquid-based cooling moving out of test phases into full rollout mode, setup jobs will keep climbing steadily in the years ahead.

The End-Users, IT & Telecom segment is projected to witness the highest CAGR in the Data Center Liquid Cooling market during the forecast period.

When it comes to user types, IT and telecom firms are expected to grow fastest in the liquid-cooled data center space over the coming years - this surge comes from booming cloud use, faster rollout of 5G networks, alongside a jump in heavy-data digital tools. As mobile carriers and tech service companies boost their server farms to handle more online activity, smarter software powered by artificial intelligence, plus localized processing at network edges, these upgrades create more heat, demanding better ways to keep systems cool.

Folks in tech and telecom are focusing on saving power and keeping networks stable - cutting expenses while hitting green goals. That’s where liquid cooling comes in, helping run packed server setups without wasting energy, which also brings PUE numbers down. As big cloud players and carriers keep funding massive data hubs or shared hosting spots, this setup pushes more firms to go for liquid-based cooling solutions across the sector in the years ahead.

The North America region is estimated to grow at the highest CAGR in the Data Center Liquid Cooling market during the forecast period.

The North America area should grow over the years, and rise in the Data Center Liquid Cooling market over the coming years. This boost comes from huge data hubs spreading fast, while businesses want cooler systems that use less power. Big tech names like Amazon Web Services, Microsoft Azure, and Google Cloud, which are adopting these technologies, they’re turning more to fluid-based cooling since today’s servers pack intense heat loads needing smarter management. On top of that, tough local rules about electricity use and pollution are nudging firms toward greener, wallet-friendly cooling methods - which gives an extra push to this type of market growth across the region.

On top of that, new upgrades in liquid cooling - like dunking servers or targeting chips directly - are catching on fast in U.S. and Canadian data hubs to boost speed and cut energy waste. Big-name tech firms are pouring cash into R&D for smarter cooling methods, while sectors such as banking, communications, and software push deeper into digital shifts - fueling demand. Together, these trends put North America ahead in the race to adopt liquid-cooled setups, showing solid upside and quick momentum in the years ahead.

Key Players

The main key players that are operating in this market include Alfa Laval, Vertiv Group, Schneider Electric, Rittal GmbH & Co. KG, CoolIIT Systems, Asetek, LiquidStack, Submer, Midas Immersion Cooling, Fujitsu Global, NTT Inc., Asperitas, and Others.

Drop us an email at:

Call us on:

+91 7666513636