Jan 27, 2026

The report “Catheter Market By Product Type (Cardiovascular Catheters, Urinary Catheters, Neurovascular Catheters, Peripheral Vascular Catheters, Others), By Material Type (Silicone, Latex, Polyurethane, Others), By Application (Cardiology, Urology, Neurology, Peripheral Vascular Procedures, Others), By End-Users (Hospitals, Ambulatory Surgical Centers, Clinics & Specialty Centers, Home Care Settings),” is expected to reach USD 68.90 billion by 2033, registering a CAGR of 7.30% from 2026 to 2033, according to a new report by Transpire Insight.

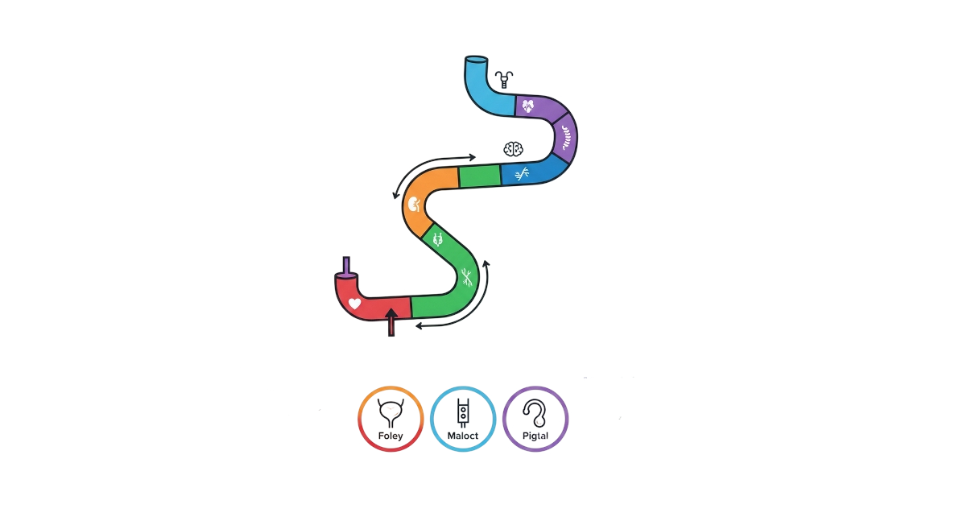

Inside today's healthcare world, tubing devices play a key role, especially when checking or treating conditions tied to the heart, bladder, brain, or blood flow pathways. These slender tools let doctors reach deep areas without large cuts, cutting harm to patients while speeding up healing afterward. Because they work well in so many situations, medical centers, outpatient rooms, and expert treatment zones rely on them daily.

Now, smoother, safer tubes come from better plastics and smarter shapes. Because they resist germs and bend easily, bodies react less during use. With tips built for precision, problems happen far less often these days. Thanks to upgrades like these, doctors now rely on them even in tricky treatments. What once worked only for basics now handles complicated tasks too.

More people needing less invasive treatments means more reliance on catheters. Because they are used often outside hospitals now, especially at home for urine or fluid removal, care focuses more on comfort. Technology keeps changing how these tools work, matching what patients require over time. Growth happens quietly, shaped by real-world medical demands rather than big announcements. What matters most shows up in daily routines, where ease and function blend without notice.

The Cardiovascular Catheters segment is projected to witness the highest CAGR in the Catheter market during the forecast period.

According to Transpire Insight, despite being small tools, cardiovascular catheters are seeing big changes because doctors rely on them for checking and fixing heart issues like blocked arteries or irregular rhythms. Because more patients lean toward less invasive methods, these slender tubes play a central role in modern cardiology practices. Procedures such as opening narrowed vessels or mapping electrical activity depend heavily on their precision. As hospitals update equipment, newer models that offer better control and safety gain attention across clinics. Rising numbers of people facing heart problems push the need for reliable, effective options in daily care routines.

Not just stiffer or softer tips but smarter shapes help catheters move more easily through heart pathways. Because spotting heart issues sooner matters more now, clinics are turning to these tools much more often. New designs fit better with tricky heart treatments, making them harder to ignore. Doctors find they can do delicate work without switching devices constantly. With every small upgrade, hospitals lean heavier on what these tubes offer. Better results for patients keep pushing their use forward steadily.

The Polyurethane segment is projected to witness the highest CAGR in the Catheter market during the forecast period.

Most experts expect polyurethane to grow fast within the catheter field because it blends softness, toughness, and lasting quality better than many alternatives across medical uses. These types of catheters show up often in tough treatments or extended wear situations since they resist bending sharply while keeping their shape under pressure.

They work well for procedures that avoid big incisions or need tubes left in place for a while. Since new methods improve how polymers behave inside bodies, patients feel fewer issues during use. Comfort and lower risk play a role too - this material now leads in newer models meant for future care needs.

The Cardiology segment is projected to witness the highest CAGR in the Catheter market during the forecast period.

According to Transpire Insight, fueled by a shift toward less invasive methods, heart-focused treatments now rely more on catheters than ever before. Procedures like angiography find wider use because they offer precise results without major surgery. Growth spikes here as doctors turn to guided techniques that reduce patient recovery time. New tools designed specifically for these tasks gain favor across clinics and hospitals. Demand climbs steadily alongside advances in how these devices perform during delicate operations.

Fresh tech upgrades keep sharpening accuracy, making procedures safer while speeding things up. This push feeds a faster market rise. With clinics now leaning harder into spotting heart issues earlier and treating them through minimally invasive methods, better results pull more doctors toward using cardiac catheters. That shift quietly fuels wider adoption across the field, shaping strong growth ahead.

The Hospitals segment is projected to witness the highest CAGR in the Catheter market during the forecast period.

Growth in the catheter sector looks set to lean heavily on hospitals these facilities handle most intricate diagnostics and interventions. Because patient volume runs high, plus cutting-edge surgical tools are close at hand, adoption stays robust. Expert medical staff working onsite adds another layer of readiness. Technology tied to catheters finds its busiest home here, simply due to daily demands and built-in capabilities.

More focus on gentle procedures, keeping patients safe, fewer risks, better results, these push catheter use upward inside hospitals. On top of that, steady funding for upgrading medical centers plus newer tools built for heart, bladder, and intensive treatments keeps this area growing through the years ahead.

The North America region is projected to witness the highest CAGR in the Catheter market during the forecast period.

Strong growth expected in North America's catheter market stems from well-developed health systems there. Minimally invasive techniques are common across the region, helping drive demand. Medical facilities rely heavily on catheters for heart-related care, urinary tract issues, and internal diagnostics. Expert staff and long-standing methods back up their widespread use. Growth continues as tools and training remain highly accessible.

New tech advances do their part, while big-name medical gear makers settle firmly into place. Reimbursement setups that support adoption play a role, too. Early detection gains more attention now, tied closely to safer procedures and smarter treatment paths. Patient well-being takes clearer priority, nudging progress across clinics and hospitals. All this helps explain why North America stays ahead in the catheter space - growth sticks around, fed by real shifts on the ground.

Key Players

Top companies include Medtronic plc, Boston Scientific Corporation, B. Braun Melsungen AG, Terumo Corporation, Angiplast Pvt Ltd, Sterimed Group, Ribbel International Ltd, Cook Medical LLC, Cardinal Health, Abbott Laboratories, Teleflex Incorporated, Baxter International Inc., Smiths Medical, Olympus Corporation, Nipro Corporation, Merit Medical Systems, BD (Becton, Dickinson and Company), C.R. Bard (now part of BD), AngioDynamics, and Relisys Medical Devices.

Drop us an email at:

Call us on:

+91 7666513636