Market Summary

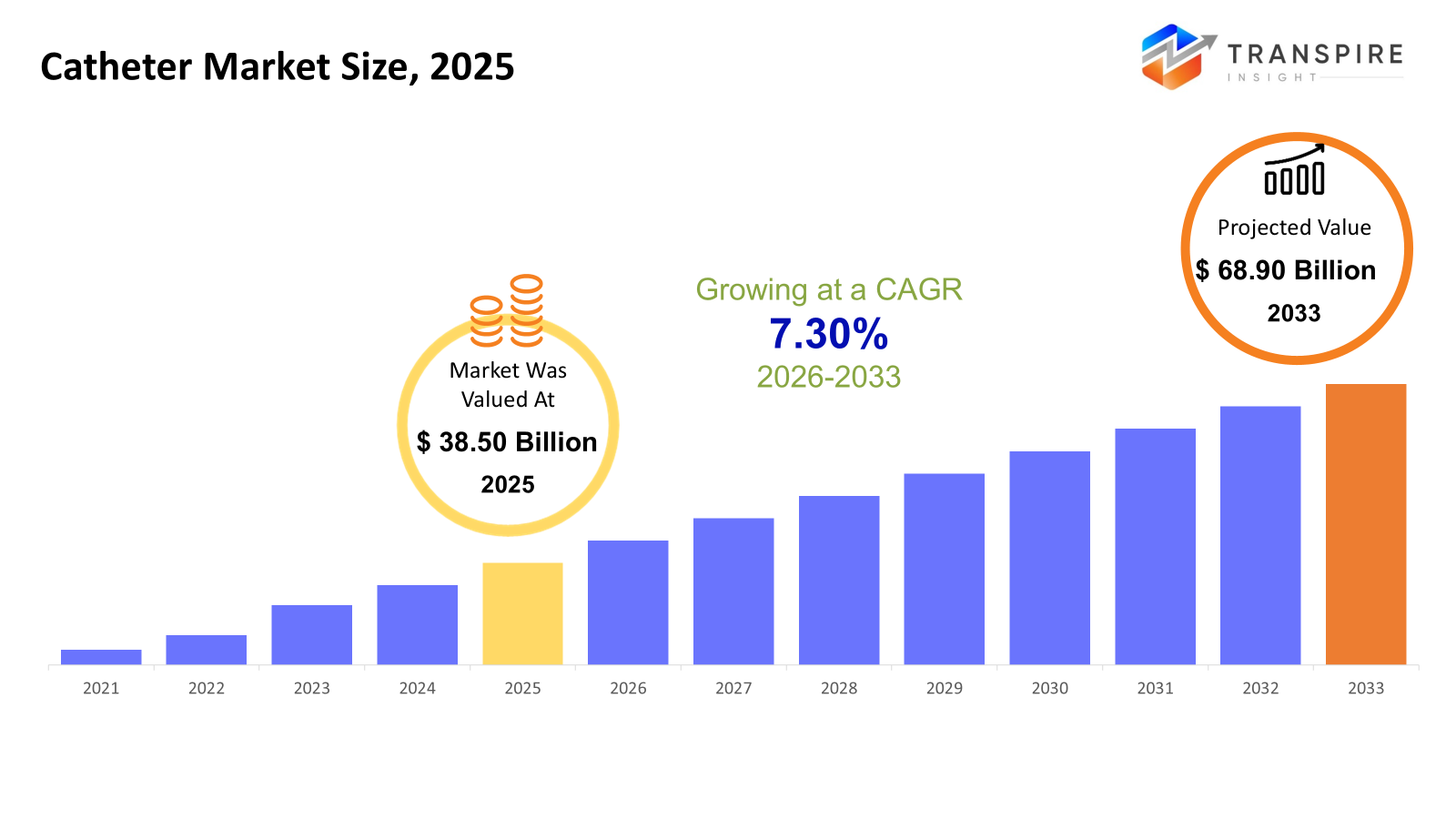

The global Catheter market size was valued at USD 38.50 billion in 2025 and is projected to reach USD 68.90 billion by 2033, growing at a CAGR of 7.30% from 2026 to 2033. Fewer people stay healthy now, so more need catheters as heart and bladder problems spread. Procedures that use tiny cuts are becoming common, helped by better tools that make operations smoother and safer. New designs in tubing tech give doctors sharper control during treatments, reducing harm risks overall. Knowledge spreads, and both clinics and users understand care options much deeper than before. More hospitals are rising across regions, creating space where these devices are used daily.

Market Size & Forecast

- 2025 Market Size: USD 38.50 Billion

- 2033 Projected Market Size: USD 68.90 Billion

- CAGR (2026-2033): 7.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 43% in 2026. Fueled by modern medical tools, North America holds the top spot in worldwide catheter demand. Its strong health systems help in spreading newer techniques fast across hospitals and clinics.

- United States cardiology sees heavy use across America, which helps explain why the United States leads nationally. Procedures in urology add up steadily there, too. Diagnostic work happens often, fueling that position further.

- Not far behind, Asia Pacific pushes ahead, as more people gain care, operations grow common, while long-term illnesses add pressure.

- Cardiovascular Catheter share approximately 30% in 2026. Fueled by steady demand, cardiovascular catheters top the list seen daily in heart checkups and treatments alike. Though many tools exist, these remain central because hospitals rely on them for common procedures. Their role grows quietly, backed by real use rather than bold claims. Not flashy, yet always present where hearts are treated.

- What holds things together here isn’t just one material; it is mostly polyurethane or PVC stepping up. Strength shows up when needed, yet they bend without breaking. These materials fit into different medical uses because they adapt easily. Their role grows where precision matters during procedures.

- Heart-related care leads the field, due to more cases of cardiac illness paired with a shift toward less invasive procedures. Though numbers grow steadily, it's the quieter move away from surgery that shapes demand most.

- Inside medical care, hospitals lead when it comes to procedures using catheters or handling sudden health crises.

Inside today’s medical world, the catheter market holds steady importance, reaching into fields like heart health, urinary treatment, brain care, and blood vessel management. Because they slip gently through the body, these tools let doctors reach deep areas without large cuts cutting harm to patients, shortening healing periods, while lifting results. One after another, hospitals rely on them daily. Found nearly everywhere in clinics, their presence feels quiet yet vital.

Starting with better materials, today's catheters bend more easily without breaking. Coatings that fight germs now pair with smarter shapes at the tip, keeping patients safer. Because they cause fewer problems like infections or harm to tissue, doctors in many fields use them more often. Durability gets a boost, too, due to new kinds of plastics engineered for long-term use. As these upgrades add up, their presence grows in hospitals and clinics alike.

More people now face long-term health issues like heart problems along with urinary tract troubles, pushing up the need for treatments using thin tubes threaded through vessels. Because doctors lean toward methods that avoid large cuts, these slender tools often replace older forms of surgery. What keeps them useful lies in how they help spot illnesses just as well as treat them once found.

Home and clinic use of catheters nudges the market in new directions. Comfort matters more now, especially when managing bladder needs over time or after medical procedures. Fresh designs pop up regularly, fitting real-life demands better. Progress in tools and uses lifts care quality from hospital to home.

Catheter Market Segmentation

By Product Type

- Cardiovascular Catheters

Heart tubes go into blood vessels for tests like checking blockages, opening narrowed arteries, and sometimes studying electrical signals. These tools help doctors see inside without major surgery, sliding through veins to reach the heart area quietly. Movement happens step by step, guided by imaging, avoiding cuts whenever possible.

- Urinary Catheters

A tube slips into the bladder when pee needs help leaving. It handles urine flow after operations, too. Draining becomes possible without normal control. Some people rely on it daily. Surgery recovery often includes this aid.

- Neurovascular Catheters

Delicate tubes slip through blood vessels to reach the brain. These tools help doctors see what is happening inside. Movement must be precise during checks or repairs up there. Tiny shifts matter when working near nerves and circulation. Each step follows the body's natural paths closely.

- Peripheral Vascular Catheters

Inserted into limbs, these tubes help reach blood pathways far from the heart. Used during checks or therapy, they slide into veins outside the core body area. Their role shows up when doctors need access beyond central circulation.

- Others

Something else shows up too - dialysis tools, balloons, devices that reshape tissue, along with special tubes meant for surgery.

To learn more about this report, Download Free Sample Report

By Material Type

- Silicone

Firm yet bendable, silicone shows up often in devices meant for urine drainage over extended periods. Its body-friendly nature makes it a go-to choice for implants that stay put for weeks or months.

- Latex or rubber

It is budget-friendly. These materials often show up when expense matters arise. Not built to last forever, yet they get the job done quickly. A practical pick if you need something temporary. Savings stand out here, especially over pricier types.

- Polyurethane

Starting, polyurethane mixed with PVC stands strong during medical processes that require small cuts. These materials handle stress well when entering the body through narrow paths. Not every substance lasts under pressure as this blend does. From beginning to end, it holds up where others might fail. Its strength shows best in delicate operations needing steady performance.

- Others

Specialized catheters sometimes include advanced polymers. These materials work alongside composites. Composites add strength where needed most. Polymers help shape complex forms. Together, they allow precise performance under pressure. Design demands drive material choice. Not every catheter uses them - only specific cases call for such detail.

By Application

- Cardiology

Catheters are used for heart-related diagnostics, interventions, and therapeutic procedures.

- Urology

Finding ways to handle urine flow often leads to using thin tubes. These small tools help empty the bladder when needed. After surgery, some people rely on them for recovery support. They serve a quiet role in healing routines.

- Neurology

Catheters are used for neurovascular diagnostics, interventions, and cerebral procedures.

- Peripheral Vascular Procedures

Inside arms and legs, tiny tubes help clear blocked pathways. These flexible tools move through vessels far from the heart. Doctors guide them to fix trouble spots in narrower channels. They open narrowed passages where the flow slows down. Treatment happens where circulation meets resistance. Small shifts make room for better movement inside. Paths widen slightly when pressure eases off.

- Others

Few tools handle tasks like kidney filtration support, tissue zapping, or niche operations. These fit into a category all their own.

By End-Users

- Hospitals

Hospitals see widespread use because of heavy demand during operations. Surgical volume pushes integration forward through routine needs.

- Ambulatory Surgical Centers

Outpatient care sees more activity these days inside Ambulatory Surgical Centers. These spots handle smaller surgeries without overnight stays quite often now. Minimally invasive work fits well within their setup, so they are used more frequently. A shift away from big hospital rooms toward quicker recovery spaces drives this trend slowly forward.

- Clinics & Specialty Centers

Hospitals often run separate wings just for heart care, where doctors guide thin tubes through blood vessels. One floor down, specialists treating bladder issues rely on similar tools during exams. Brain-focused units also use these slender instruments when checking nerve pathways deep inside the body.

- Home Care Settings

Increasing adoption of long-term urinary and drainage catheter needs.

Regional Insights

Hospitals in wealthier areas rely heavily on catheters due to modern medical setups and a preference for less invasive treatments. Skilled staff work within solid hospital networks, helping new catheter tools spread quickly, especially in heart, bladder, and testing-related care. Safety matters more every year, nudging clinics toward reliable, precise methods. Steady need grows quietly, pushed by better outcomes rather than bold claims.

More people in developing areas now reach care due to better clinics, while knowledge about less invasive options spreads. Hospital setups stretch further, funds pour into health infrastructure; meanwhile, long-term illnesses become more common, pushing up the use of catheter methods. With outdated systems upgrading, pressure builds to find affordable, dependable tools for these treatments. Modern medicine moves forward, pulling the need for solid catheter tech along with it.

Fresh demand is building in developing areas as clinics upgrade and more private money flows into health services. Though usage still lags behind wealthier nations, better doctor training plus wider availability of at-home treatments open fresh paths forward. Each region moves at its own pace, shaped by how far hospitals have come and what tools they can reach.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 14, 2025 – Abbott Introduced TactiFlex™ Sensor-Enabled™ Ablation Catheter in India for the treatment of Abnormal Heart Rhythms

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 38.50 Billion |

|

Market size value in 2026 |

USD 42.00 Billion |

|

Revenue forecast in 2033 |

USD 68.90 Billion |

|

Growth rate |

CAGR of 7.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Medtronic plc, Boston Scientific Corporation, B. Braun Melsungen AG, Terumo Corporation, Angiplast Pvt Ltd, Sterimed Group, Ribbel International Ltd, Cook Medical LLC, Cardinal Health, Abbott Laboratories, Teleflex Incorporated, Baxter International Inc., Smiths Medical, Olympus Corporation, Nipro Corporation, Merit Medical Systems, BD (Becton, Dickinson and Company), C.R. Bard (now part of BD), AngioDynamics, and Relisys Medical Devices. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Cardiovascular Catheters, Urinary Catheters, Neurovascular Catheters, Peripheral Vascular Catheters, Others), By Material Type (Silicone, Latex, Polyurethane, Others), By Application (Cardiology, Urology, Neurology, Peripheral Vascular Procedures, Others), By End-Users (Hospitals, Ambulatory Surgical Centers, Clinics & Specialty Centers, Home Care Settings), |

Key Catheter Company Insights

Starting off with medical tools, Medtronic plc stands out across the world in making catheters for heart, brain, and blood vessel treatments. Instead of old methods, it pushes smarter, less invasive tech to help doctors work more accurately while helping patients heal better. Behind the scenes, heavy backing in science and testing keeps new ideas flowing, especially around how catheters are built and what they are made of. Because it operates widely and works closely with clinics and health networks everywhere, its spot at the front of the field stays steady.

Key Catheter Companies:

- Medtronic plc

- Boston Scientific Corporation

- Braun Melsungen AG,

- erumo Corporation

- Angiplast Pvt Ltd

- Sterimed Group

- Ribbel International Ltd

- Cook Medical LLC

- Cardinal Health

- Abbott Laboratories

- Teleflex Incorporated

- Baxter International Inc.

- Smiths Medical

- Olympus Corporation

- Nipro Corporation

- Merit Medical Systems

- BD (Becton, Dickinson and Company)

- R. Bard (now part of BD)

- AngioDynamics

- Relisys Medical Devices.

Global Catheter Market Report Segmentation

By Product Type

- Cardiovascular Catheters

- Urinary Catheters

- Neurovascular Catheters

- Peripheral Vascular Catheters

- Others

By Material Type

- Silicone

- Latex

- Polyurethane

- Others

By Application

- Cardiology

- Urology

- Neurology

- Peripheral Vascular Procedures

- Others

By End-Users

- Hospitals

- Ambulatory Surgical Centers

- Clinics & Specialty Centers

- Home Care Settings

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636