Jan 27, 2026

The report “Autotransfusion Devices Market By Product Type (Intraoperative Autotransfusion Systems, Postoperative Autotransfusion Systems, Consumables & Accessories), By Mode of Operation (Automatic Autotransfusion Devices, Semi-Automatic), By Technology (Centrifugation-Based Systems, Filtration-Based Systems), By End-Users (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others)” is expected to reach USD 2.10 billion by 2033, registering a CAGR of 9.70% from 2026 to 2033, according to a new report by Transpire Insight.

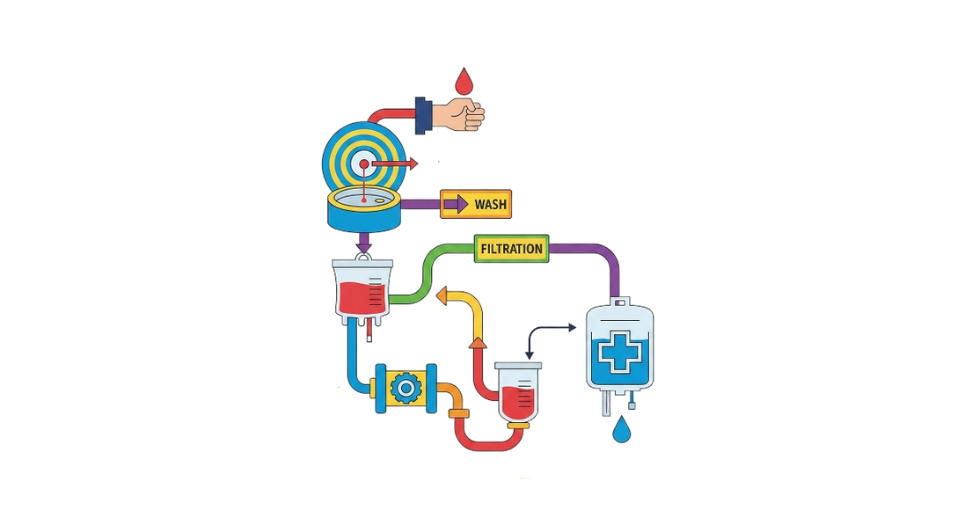

Back at the start, machines that recycle a person's blood mid-surgery are shaping how care teams handle transfusions. Instead of outside donors, these tools gather and return the body’s own supply, cleaned and ready. Safety ticks up when hospitals swap risky donor matches for self-blood loops. Complication odds dip; recovery paths smooth out. With medical systems pushing smarter ways to manage resources, such gear fits right into daily routines. Lately, interest grows not loud, just steady as clinics lean toward methods kinder to patients.

During surgery, machines that recycle a patient's own blood often help when bleeding is heavy, like in heart, bone, or injury operations, whereas similar setups after surgery collect lost blood as people heal. Newer models, especially those using spinning chambers and smart controls, work faster, demand less effort, and deliver more dependable results. Items used once per procedure matter just as much, keeping devices running smoothly and doctors willing to keep using them.

Nowhere else has the push for lower-cost care made such clear gains as in surgery. Because better tools matter, many hospitals use autotransfusion machines as part of routine procedures. These devices help save blood while smoothing out daily operations behind the scenes. Through small changes like these, patient needs now guide more decisions in operating rooms. Technology quietly supports safer surgeries without drawing attention to itself.

The Intraoperative Autotransfusion Systems segment is projected to witness the highest CAGR in the Autotransfusion Devices market during the forecast period.

According to Transpire Insight, growing faster than others, the Intraoperative Autotransfusion Systems part of the market sees rising use in operations where lots of blood is lost, like heart, bone, injury, or organ replacement surgeries. Because they pull out, clean, and give back a person's own blood right away, these tools help surgery move more smoothly; meanwhile, less need exists for donor blood, something tied to infections and shortages.

More hospitals now use patient blood management, plus surgeons increasingly choose automated tools during surgery. What drives this shift is steady progress in tech, like smarter spinning methods, improved filters, and not just simpler setups in operating spaces. These changes make devices work better, feel less complicated. As a result, adoption spreads fast through clinics focused on modern care.

The Automatic Autotransfusion Devices segment is projected to witness the highest CAGR in the Autotransfusion Devices market during the forecast period.

Healthcare workers are leaning toward full-auto machines because they handle blood reuse tasks with less hands-on work, cutting down mistakes made by people. They keep performance steady while speeding up how fast jobs get done. Safety jumps too - a quiet bonus during tough or busy operations where every second counts. Machines like these fit naturally into intense settings without slowing things down.

It's becoming more common to see faster workflows in surgery spaces, so clinics now lean heavily on machines that recycle a patient’s own blood. Because sensors work better these days paired with smarter software and smaller builds, these tools fit smoothly into daily routines at modern medical centers.

The Centrifugation-Based Systems segment is projected to witness the highest CAGR in the Autotransfusion Devices market during the forecast period.

According to Transpire Insight, because it pulls red cells cleanly from blood, centrifuge tech grows fast. Most hospitals pick these machines when operations cause heavy bleeding. They strip out gunk - fat bits, clots, old meds - before sending blood back. Cleaner spin means fewer risks during transfusion.

More doctors now choose centrifuge-driven blood recycling because it works well in real medical settings. As machines get faster, easier to operate, and take up less space, they fit better into busy hospital routines. Progress like this makes them more useful during complex operations. Their role grows especially in fields where steady access to cleaned blood matters most.

The Hospitals segment is projected to witness the highest CAGR in the Autotransfusion Devices market during the forecast period.

Out in the medical world, hospital spaces are set to expand fast. These places stay central when it comes to tough, risky operations needing smart ways to handle blood. With so many procedures happening each day, trained staff on site, plus modern tools inside surgery rooms, they naturally become top spots using self-blood recovery tech. Growth follows where resources and expertise already live.

More attention to keeping patients safe, cutting costs, and using less donor blood helps hospitals adopt these tools. Still, setting up consistent blood care plans across facilities adds weight to hospital use. New spending on high-end surgical gear also plays a part. Hospitals stay ahead in the device market because of this mix. Their lead grows quickly with each added measure.

The North America region is projected to witness the highest CAGR in the Autotransfusion Devices market during the forecast period.

Autotransfusion device use is rising fast, where surgery standards are high and saving a patient's own blood matters more every year. Instead of relying on outside donors, hospitals now lean on tech that recycles blood during operations. This shift helps dodge risks tied to transfusions while easing pressure on limited supplies. Because doctors understand the benefits clearly, plus follow set medical routines, adoption does not stall. What keeps momentum going is not just knowledge but how smoothly these tools fit into real-world practice.

North America sees faster growth in its medical device sector thanks to major companies setting up shop there. Because new tech keeps emerging, progress does not slow down. Due to solid insurance payouts, hospitals switch quickly to machines that automate blood recovery. More heart, bone, and injury operations mean more need for these tools. Since rules around testing and approval are strict, patients and doctors trust the equipment better. That faith helps the area stay ahead in the field of self-blood transfusion technology.

Key Players

Top companies include Haemonetics Corporation, Fresenius Kabi, Medtronic plc, LivaNova PLC, Terumo Corporation, B. Braun Melsungen AG, Getinge AB, Beijing ZKSK Technology Co. Ltd, Redax, Braile Biomedica, Haematonics Corporation, Teleflex Incorporated, LivaNova Inc., and BD Company.

Drop us an email at:

Call us on:

+91 7666513636