Market Summary

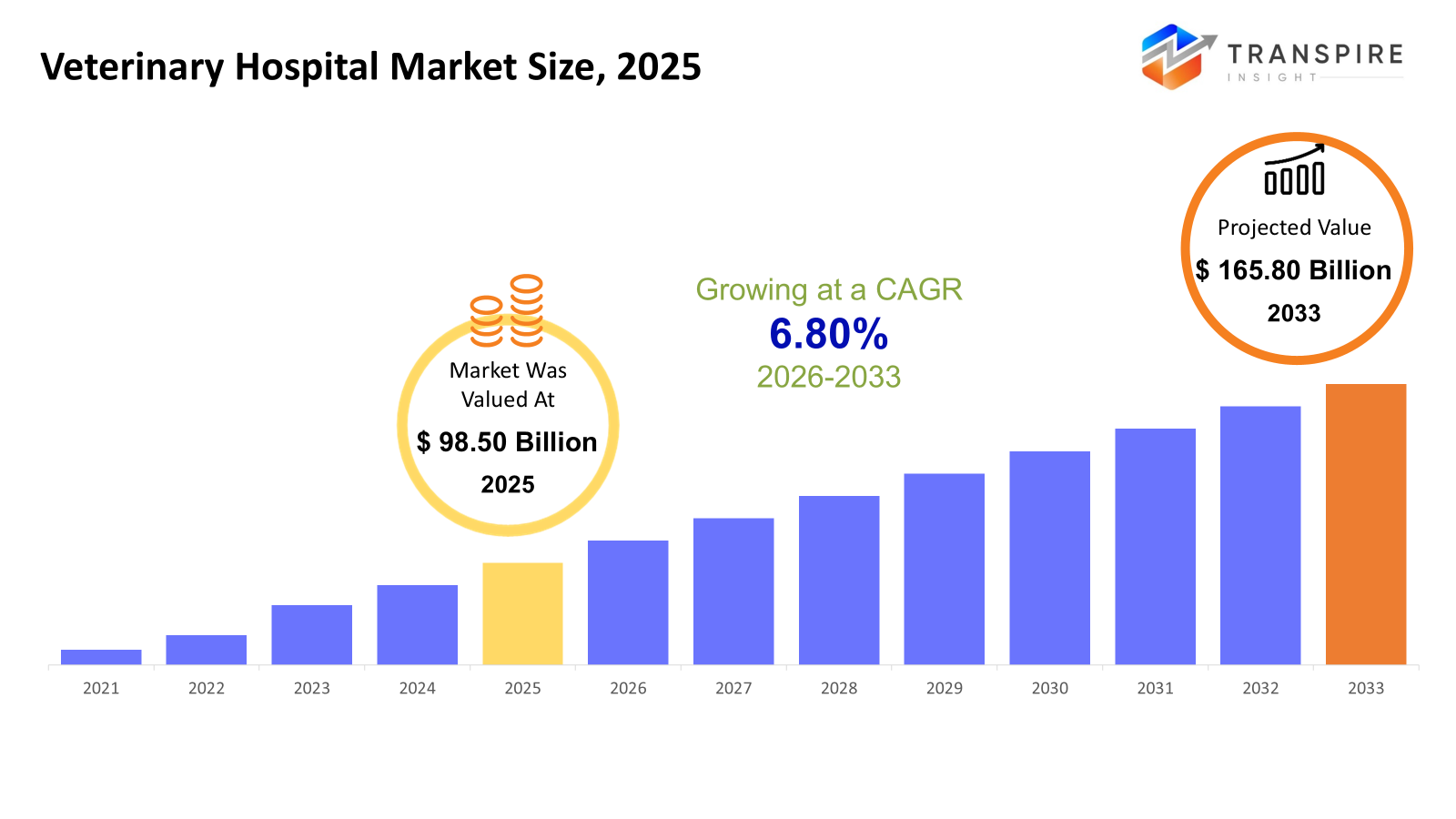

The global Veterinary Hospital market size was valued at USD 98.50 billion in 2025 and is projected to reach USD 165.80 billion by 2033, growing at a CAGR of 6.80% from 2026 to 2033. More pressure to keep drug, biotech, and medical product spaces free from germs. As biologic drugs, shots that prevent disease, and new kinds of treatments get made more often, companies turn to adaptable, tightly managed rooms you can build like puzzle pieces. Rules about safety and consistency have gotten tougher. Pets treated like family members mean owners seek help sooner, often returning for follow-ups. Growth sticks because services adapt, fitting into lives without drawing attention to themselves.

Market Size & Forecast

- 2025 Market Size: USD 98.50 Billion

- 2033 Projected Market Size: USD 165.80 Billion

- CAGR (2026-2033): 6.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 39% in 2026. Pets are common across North America, so demand runs high there. Because clinics and care systems exist widely, treatment access remains broad. Veterinary networks operate well, which keeps services running smoothly throughout the region.

- Fueled by high rates of pet ownership, care in the United States leads the region modern clinics popping up often, backed heavily by large vet networks. Still, it's everyday demand that keeps things moving, not flashy promises.

- Spending power climbs across Asia-Pacific, fueling shifts in how people care for pets. More households bring animals into their homes, nudging trends forward. Knowledge about vet services spreads, quietly reshaping priorities. Momentum builds not through sudden leaps but steady steps in daily choices.

- Medical Services share approximately 70% in 2026. Sure thing spreads fast when pets and livestock need checkups, shots, or expert help. A steady push for better health checks across households and fields.

- Lately, more people around the world are bringing pets into their homes. That shift pushes regular vet visits into the spotlight. Care once seen as occasional now includes treatments tailored to specific needs. With cats and dogs leading the trend, clinics adapt fast. Rising numbers mean even small animals get attention they didn’t before. Households treat them like family, so services grow accordingly.

- Most pets get checked at private clinics since they are nearby, offer one-on-one attention, and fit into neighborhood routines.

- Home animal caretakers push the need forward when knowledge about animal well-being grows, leading to more trips to vet clinics. Animal keepers spark interest simply by learning what helps their companions stay strong. More understanding among those who care for pets means fuller waiting rooms at medical spots for animals. As people notice signs of health shifts, clinic traffic rises without loud campaigns or pushes. Knowledge spreads quietly, yet it moves feet toward treatment centers all the same.

More people see animals as family now, so clinics stay busy. Owning a pet is becoming common, which pushes up service needs. Care goes beyond shots; checkups and scans happen often these days. Closer bonds mean better medical attention for pets. Clinics adapt by offering deeper support during each visit. Fewer skip appointments when illness seems far off. Emotional ties shape how owners choose care paths. Regular trips become normal, not just for emergencies. This shift keeps the field moving forward steadily.

Diagnostics, checkups, or shots, these are what people look for most when visiting clinics. Surgery or urgent treatments tag along, filling out the full picture of available help. In farming areas, keeping cows, goats, or horses healthy matters more each year since strong animals mean better harvests. When pets and working animals both need attention, it spreads the workload across vet centers evenly.

Out here, private vet offices hold most of the ground because they are close by, treat each animal like family, yet still keep a neighborhood feel. Big clinic networks, though, are spreading fast since routines stay the same across towns, plus having many spots helps them grow. Some care comes from public or charity-run centers, too; these step in where money's tight, or help is thin, often cutting costs or handling rare cases. All together, that mix keeps the whole system moving forward.

Better tools for spotting illness, new surgery gear, plus remote checkups are making animal clinics work faster and smarter. Money flowing into training vets, upgrading facilities, while also teaching pet owners, boosts regular appointments along with early treatments. These shifts, unfolding hand in hand, keep pushing growth worldwide within vet hospitals.

Veterinary Hospital Market Segmentation

By Service Type

- Surgical Services

Fine blades meet bone and skin under steady hands. Procedures stretch from routine fixes to mending joints or delicate tissue work on different creatures. Each cut is shaped by precision, not guesswork.

- Medical Services

Finding out what's wrong starts here, with tests that spot health issues early. Shots keep diseases away before they start. Doctors handle long-term illnesses along with everyday problems. Experts step in when a specific condition needs extra attention.

- Emergency & Critical Care

When seconds count, help is always nearby. Crises get handled right away, every hour of each day. Injuries from accidents see fast response work. Close monitoring happens for those in serious condition. Care stays steady through the toughest moments.

- Preventive & Wellness Services

Avoiding illness begins with regular visits to your provider. Shots keep harmful viruses at bay when timed right. Dealing with fleas, ticks, or worms works best on a set schedule.

To learn more about this report, Download Free Sample Report

By Animal Type

- Companion Animal

Furry friends like dogs and cats get regular checkups, sometimes special treatments too. Pets living at home are seen by vets who help them stay healthy or recover when needed.

- Livestock

Pigs first, then cattle, both kept healthy to stay productive. Goats follow, just like sheep, cared for so they thrive. Health checks keep them strong, not just active but working well too.

- Equine

Horses get care that covers treatment, operations, when needed, and steps to avoid sickness before it happens.

- Exotic Animals

Strange creatures arrive where only certain clinics can help. Feathers, scales, or fur each need unique care found in few places. From parrots to pythons, these animals depend on experts trained beyond common pets. Tiny paws or clawed feet, they all share one thing: treatment away from ordinary vet offices.

By Ownership Model

- Private Veterinary Clinics

Independently owned clinics providing localized veterinary services.

- Corporate or Chain Hospitals

Folks running several clinics often stick to set routines. These places follow strict rules, so each spot feels familiar. One location works much like the next, built on repeatable steps. Care unfolds in a steady rhythm across towns. Systems stay fixed no matter where you go.

- Government & Non-Profit Clinics

Public or subsidized facilities providing veterinary services.

By End-Users

- Pet Owners

Pets need attention, owners look out for their dogs, yet also keep an eye on cats. Some people watch over birds too, making sure they are doing well.

- Livestock Owners

Farmers and agricultural businesses require animal health services.

- Wildlife & Exotic Animal Owners

Folks who care for wild creatures often run zoos. Some set up safe spaces called sanctuaries instead. Others keep unusual animals at home, just on their own land. Each place looks after beasts not seen in regular homes.

- Equine Owners

Horse keepers find help through vets when animals need attention. People who ride or teach riding look for medical support, too. Stables and training centers call experts during health problems. Care providers assist those managing horses every day.

Regional Insights

Fueled by deep pockets and loyal pet owners, North America leads global demand for vet care. Healthcare access here stands out, thanks to widespread facilities equipped for everything from checkups to complex surgeries. Instead of lagging, the United States pushes ahead with its mix of independent offices, big-name clinic groups, and focused treatment centers, setting the pace. Pets get attention fast, backed by systems built over years of steady investment. What shapes this edge is not just money, but habits: people treat animals as family, which keeps services busy. Behind every visit lies a web of labs, trained staff, and tech ready to respond.

Growth in Europe stays on track, thanks to more people welcoming pets into homes, older animals needing extra attention, plus stronger rules protecting their wellbeing. The United Kingdom, Germany, and France already run strong vet systems, whereas parts of Eastern Europe are slowly building up services as knowledge about pet health spreads. Yet progress moves at different speeds across regions.

Far beyond just economic shifts, more folks across the Asia-Pacific find themselves able to care for pets now - especially noticeable in cities throughout China, India, and Southeast Asia. Not far behind, Latin American countries begin shaping better access to animal healthcare through new clinic openings. Meanwhile, parts of the Middle East and Africa are slowly building systems that support proper vet care. What ties these areas together is not speed but steady movement toward stronger medical frameworks for animals. Rising personal earnings in the region boost spending on living needs, including health visits for dogs and cats. Private practices pop up where public options once dominated. Growth here does not roar; it inches forward quietly.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 16, 2025 – Alappuzha municipality launched a floating veterinary hospital.

- February 8, 2024 – Tata Trust launched first state of the art small animal hospital in Mumbai.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 98.50 Billion |

|

Market size value in 2026 |

USD 105.00 Billion |

|

Revenue forecast in 2033 |

USD 165.80 Billion |

|

Growth rate |

CAGR of 6.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Mars Inc, National Veterinary Associates Inc, CVS Group Plc, Apiam Animal Health Limited, Medivet Group Limited, Pets at Home Group Plc, MSPCA-Angell, Greencross Vets Limited, Zabeel Veterinary Hospital, International Center for Veterinary Services, Paw Veterinary Clinic, Chengdu Vet Hospital, Canberra Veterinary Hospital, Shengpu Pet Hospital, Ethos Veterinary Health, PetSmart Veterinary Services, Banfield Pet Hospital |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Service Type (Surgical Services, Medical Services, Emergency & Critical Care, Preventive & Wellness Services), By Animal Type (Companion Animals, Livestock, Equine, Exotic Animals), By Ownership Model (Private Veterinary Clinics, Corporate or Chain Hospitals, Government & Non-Profit Clinics), By End-Users (Pet Owners, Livestock Owners, Wildlife & Exotic Animal Owner, Equine Owners), |

Key Veterinary Hospital Company Insights

Mars, Incorporated runs many vet clinics across the globe under Banfield Pet Hospital and its Veterinary Health Division. While some companies limit their reach, this one spans continents with a dense web of facilities. Preventive visits sit alongside complex surgeries, supported by tools that track pet health over time. Instead of relying only on traditional methods, it weaves in digital records and smart analysis to guide treatment choices. Insurance links are built into the system, making coverage part of routine care. Growth follows where others hesitate; its labs adapt, its staff train differently, and new ideas take root fast. Leadership here does not shout; it shows up quietly in better outcomes.

Key Veterinary Hospital Companies:

- Mars Inc

- National Veterinary Associates Inc

- CVS Group Plc

- Apiam Animal Health Limited

- Medivet Group Limited

- Pets at Home Group Plc

- MSPCA-Angell

- Greencross Vets Limited

- Zabeel Veterinary Hospital

- International Center for Veterinary Services

- Paw Veterinary Clinic

- Chengdu Vet Hospital

- Canberra Veterinary Hospital

- Shengpu Pet Hospital

- Ethos Veterinary Health

- PetSmart Veterinary Services

- Banfield Pet Hospital

Global Veterinary Hospital Market Report Segmentation

By Service Type

- Surgical Services

- Medical Services

- Emergency & Critical Care

- Preventive & Wellness Services

By Animal Type

- Companion Animals

- Livestock, Equine

- Exotic Animals

By Ownership Model

- Private Veterinary Clinics

- Corporate or Chain Hospitals

- Government & Non-Profit Clinics

By End-Users

- Pet Owners

- Livestock Owners

- Wildlife & Exotic Animal Owner

- Equine Owners

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636