Market Summary

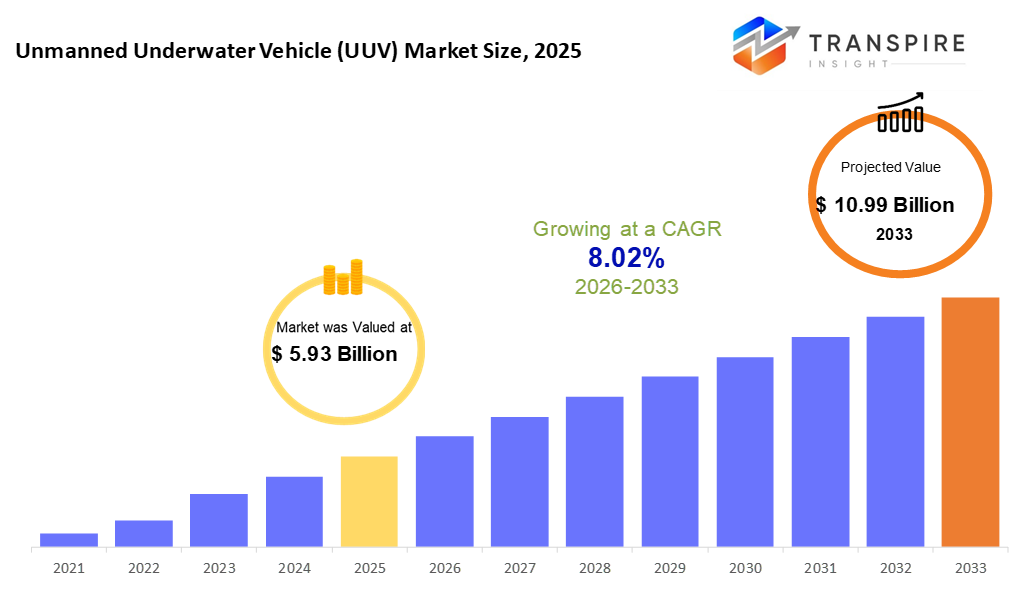

The global Unmanned Underwater Vehicle (UUV) market size was valued at USD 5.93 billion in 2025 and is projected to reach USD 10.99 billion by 2033, growing at a CAGR of 8.02% from 2026 to 2033. The UUV market growth is driven by increasing demand for underwater surveillance, mine countermeasures, and reconnaissance in defense and naval operations. Additionally, rising offshore energy activities, subsea infrastructure inspection, and advancements in autonomous navigation technologies are supporting sustained market expansion.

Market Size & Forecast

- 2025 Market Size: USD 5.93 Billion

- 2033 Projected Market Size: USD 10.99 Billion

- CAGR (2026-2033): 8.02%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 46% in 2026. Across North America, high military budgets fuel demand for unmanned undersea vehicles. Research labs there push new ideas in ocean tech regularly. New systems appear often thanks to deep investment. Progress moves fast because navies test and deploy tools quickly. Innovation thrives where funding meets real-world use.

- Fueled by heavy spending on self-driving tech, the United States leads North America's national market, its edge sharpened through military applications, deep-sea studies, plus checks on underwater structures.

- Offshore energy work pushes growth across the Asia Pacific. Naval forces in the area are adding new tools and vessels slowly over time. Underwater drones now handle tasks like checking ocean conditions or watching ecosystems change. More countries are choosing unmanned systems instead of traditional methods. Expansion happens fastest here compared to other regions.

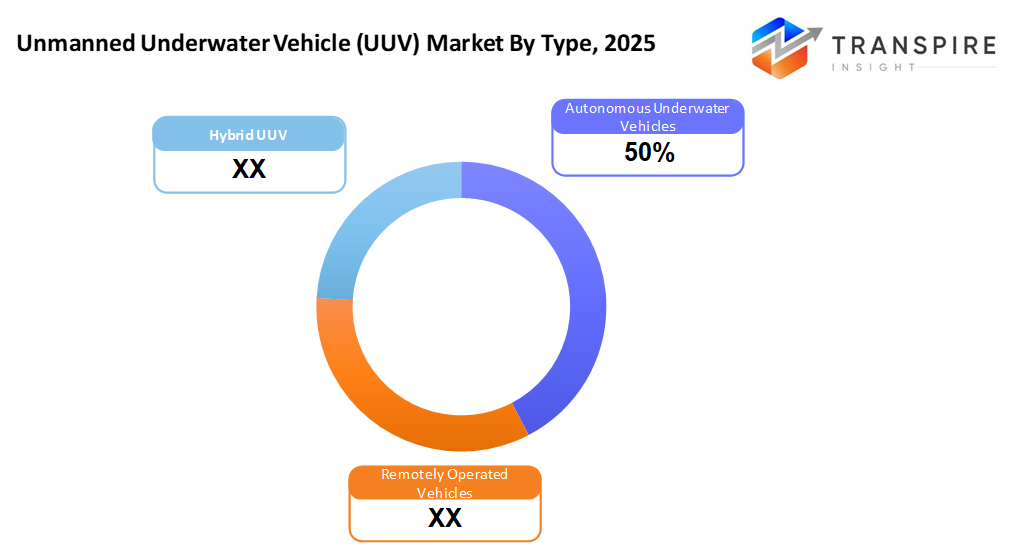

- Autonomous Underwater Vehicles share approximately 53% in 2026. AUVs take the lead, driven by rising needs in military tasks, research dives, plus offshore mapping work. These machines move ahead because missions now favor self-guided tools that operate without constant human input. Demand spikes where deep, long-term data collection matters most.

- Fresh off the design board, hardware takes the lead - smart sensors, advanced steering tech, and powerful drives shape how well machines move below the surface. Equipment like this forms the backbone, simply because diving deeper needs tough, precise tools working together without flaw.

- Electric drives are becoming common because they run quietly while saving power. Their efficiency makes them ideal for extended tasks without constant refills. Mission length matters; these systems handle it well.

- Fleet upgrades push defense work ahead of others. Naval projects plus watch needs keep it on top.

Down beneath the waves, machines move without people inside them, shaping a key part of ocean and military tech. These devices work on their own or follow distant signals, built to handle tasks underwater where humans cannot easily go. Instead of relying on crews, they watch, map, check structures, and gather information, especially where it is dark or dangerous. New progress in self-guided movement, route tracking, plus smarter sensing lets them do more while staying steady and strong.

Worldwide, defense upgrades push market expansion. These vehicles handle mines, watch underwater, gather intel, and also fight subs, key tools for navies. With more funding flowing into self-navigating submersibles, safety at sea improves without relying heavily on crewed missions.

Out in the water, businesses play a big role in pushing growth. Drilling under the sea, checking pipelines below the surface, and watching power cables deep down, these tasks now need more unmanned subs. Work that used to take people into risky spots can now run nonstop without extra costs. Doing things underwater just got easier, quieter, safer, day after day.

New tech keeps getting built into how these vehicles work. Better electric motors show up alongside longer-lasting batteries, which helps them stay underwater much longer. Smarter software lets them navigate on their own, while stronger signals keep them linked to operators. Not just military eyes, now scientists dive in too, watching ecosystems change. Water quality checks, deep-sea mapping, that kind of task adds fresh demand. Because more groups find uses, the number of units needed grows slowly but reliably year after year.

Unmanned Underwater Vehicle (UUV) Market Segmentation

By Type

- Autonomous Underwater Vehicles

AUAVs move on their own, following routes set before launch. These underwater machines handle tasks without real-time human control. Built to dive deep, they rely solely on internal navigation systems. Their path is decided ahead of time, then executed without outside help. Independence defines how they explore hidden ocean spaces.

- Remotely Operated Vehicles

Underwater robots, linked by cable to a ship, take directions instantly from people above. These machines move through water while being guided live from the surface.

- Hybrid Unmanned Underwater Vehicles

Some underwater drones mix self-guided smarts with live human steering. These models move on their own when needed, yet respond to real-time commands too. One moment, they follow preloaded routes, then shift instantly if a person takes over. Built-in logic helps them adapt without constant input. Their design allows solo missions that can switch to guided mode whenever required.

To learn more about this report, Download Free Sample Report

By Component

- Hardware

Hardware means actual machines and tools that can touch things like engines, sensing devices, and maybe parts that help figure out direction. These pieces make up the body of a working system, doing jobs through movement or awareness of surroundings.

- Software

Running missions, handling operations, and turning raw information into insights, each step guided by specialized programs built for specific tasks. These tools shape how systems respond, adapt, process inputs, and then deliver outcomes without relying on constant human direction.

- Services

Training comes with setup help, followed by ongoing upkeep once systems are live. Support sticks around after launch, just like regular check-ins, to keep things running. Getting started includes linking tools together so they work as one. Help is available whenever questions pop up later on.

By Propulsion

- Electric

Powered by electricity, these units run on batteries. Quieter sounds come out while they work. Energy use stays low during movement. Efficiency marks their everyday performance.

- Hybrid

Fueled by more than one source, these systems stretch how far they can go. Running on mixed energy keeps them moving longer without stopping.

- Others

Some newer ways to move vehicles include things like fuel cell systems or upgraded energy storage units. These options are still growing but show different paths forward. Instead of relying only on old methods, they explore how electricity can be made or held in smarter forms. Power sources beyond gasoline might shape what comes next. Ideas once seen as experimental now find their way into real machines.

By Application

- Defense & Military

Floating beneath waves, these machines scout coastlines before dawn light hits. Their eyes scan seabeds where metal hides under silt and shadow. Quiet runs mark their paths through waters near contested shores. Patrol patterns shift nightly based on tidal drifts and satellite signals. Missions unfold without radio chatter or surface support teams.

- Commercial

Underwater surveys for business use, checking submerged structures. Exploration deep below the surface happens regularly. Mapping ocean floors supports navigation and research. Watching key underwater systems ensures safety and function.

- Scientific & Research

Studies of the sea happen through close looks at ocean life. Work on understanding underwater creatures moves forward in quiet labs and open water. Information gathers drop by drop, each piece adding clarity. Exploration pushes into unknown zones where little is known.

- Environmental Monitoring

Keeping an eye on nature means checking how clean the water is, what the air carries, and watching whether plants and animals thrive. Sometimes it's about noticing changes slowly, other times catching sudden shifts that stand out.

Regional Insights

Due to deep military budgets and sharp naval tech. Leading that charge is the United States, where these machines keep busy scanning waters, clearing mines, studying oceans, plus checking oil rigs far out at sea. A tight network of big defense firms and science hubs helps spread their use even wider. How deeply built-in they’ve become across missions below the waves.

Out at sea, European demand climbs because navies update their fleets and guard coastlines more closely. Naval units in the United Kingdom, France, and Germany now rely on unmanned subs to watch ecosystems, chart ocean floors, and handle military tasks. Moving east, activity surges across the Asia Pacific, where island disputes push countries to strengthen underwater surveillance. China, Japan, South Korea, and India pour resources into undersea drones as oil ventures stretch further offshore alongside wind farms rising from coastal waters. Growth there outpaces other regions thanks to these overlapping demands.

Offshore work pushes demand in Latin America, while nations there start using more unmanned subs for checking pipelines. Elsewhere, parts of Africa and the Middle East see similar movement, tied closely to new spending on sea safety. Inspections happen more often now underwater, thanks to slowly improving access to gear. Hunting for oil, minerals, or studying ocean life draws interest across both zones. Even with slow tech progress and shaky support systems, knowledge spreads. Deals struck with big overseas builders help fill gaps. Quiet momentum builds, fed by joint efforts and a sharper focus on what lies beneath the waves.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 11, 2025 – HII and Babcock joined forces to integrate unmanned underwater vehicles with submarine weapons handling and launched systems.

- September 4, 2025 – China rolls out new unmanned underwater vehicle systems in a parade.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 5.93 Billion |

|

Market size value in 2026 |

USD 6.41 Billion |

|

Revenue forecast in 2033 |

USD 10.99 Billion |

|

Growth rate |

CAGR of 8.02% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Lockheed Martin, Northrop Grumann Corporation, Bae System Plc, Boeing, Textron Systems Corporation, Thales Group, SAAB AB, Kongsberg Maritime, Oceaneering International Inc., Teledyne Marine, ECA Group, Hydroid Inc., General Dynamics, Maritime Robotics AS, and Bluefin Robotics |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Autonomous Undermanned Vehicles, Remotely Operated Vehicles, Hybrid UUV) By Component (Hardware, Software, Services), By Propulsion (Electric, Hybrid, Others), By Application (Defense & Military, Commercial, Scientific & Research, Environmental Monitoring) |

Key Unmanned Underwater Vehicle (UUV) Company Insights

Lockheed Martin Corporation is a leading force in the unmanned underwater vehicle (UUV) sector. The company develops advanced undersea systems for defense and research applications. With deep expertise in autonomous technology, it supports naval operations worldwide. Its innovations continue to shape the future of maritime missions.

A name that stands out in global defense work, Lockheed Martin focuses on smart machines that operate without people inside them. Underwater vehicles made here serve navies by handling tasks like finding hidden dangers beneath the waves. These tools dive deep using high-tech gear to see, move, and share data while staying safe. Innovation drives every design, backed by long-term military deals across continents. Because of relentless testing and worldwide operations, its role in undersea robotics remains unmatched.

Key Unmanned Underwater Vehicle (UUV) Companies:

- Lockheed Martin

- Northrop Grumann Corporation

- Bae System Plc

- Boeing

- Textron Systems Corporation

- Thales Group

- SAAB AB

- Kongsberg Maritime

- Oceaneering International Inc.

- Teledyne Marine

- ECA Group

- Hydroid Inc.

- General Dynamics

- Maritime Robotics AS

- Bluefin Robotics

Global Unmanned Underwater Vehicle (UUV) Market Report Segmentation

By Type

- Autonomous Undermanned Vehicles

- Remotely Operated Vehicles

- Hybrid UUV

By Component

- Hardware

- Software

- Services

By Propulsion

- Electric

- Hybrid

- Others

By Application

- Defense & Military

- Commercial

- Scientific & Research

- Environmental Monitoring

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636