Market Summary

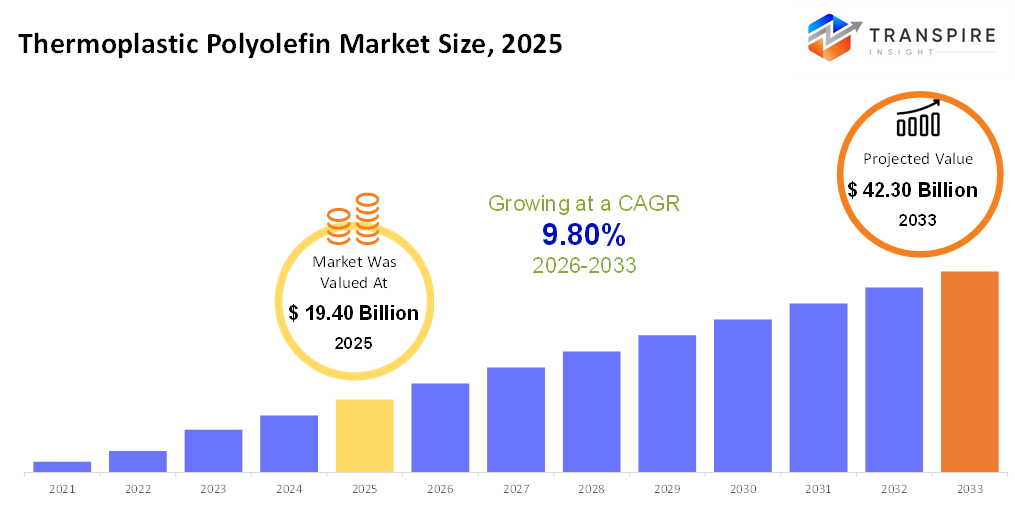

The global Thermoplastic Polyolefin market size was valued at USD 19.40 billion in 2025 and is projected to reach USD 42.30 billion by 2033, growing at a CAGR of 9.80% from 2026 to 2033. The global Thermoplastic Polyolefin (TPO) market is expected to make good money through 2029. This is because the automotive industry wants TPO for lightweight and strong parts. TPO is becoming more common in construction, wire insulation, cables, and the usual everyday stuff people buy. Advances in processing TPO, like better molding and extrusion techniques, are helping its growth. Road and utility upgrades in places such as Asia-Pacific and North America are part of it, too. Also, because everyone wants affordable, recyclable materials, TPO is getting more popular.

Market Size & Forecast

- 2025 Market Size: USD 19.40 billion

- 2033 Projected Market Size: USD 42.30 billion

- CAGR (2026-2033): 9.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Compounded TPO is quickly becoming more popular in North America because car production is up, and people want strong, light materials. It's really catching on in building and factory work because it helps save gas, keeps costs down, and works better overall.

- In North America, more cars are using TPO inside and out. This is because of safety rules, green living rules, and the need for materials that can be recycled don't cost too much, make cars lighter, and last longer.

- In the United States, you see TPO more in building. TPO roofing and insulation are increasingly popular for homes and businesses due to construction growth, energy efficiency rules, and the desire for long-lasting, low-maintenance materials.

- The Asia-Pacific area sees the fastest growth in TPO use because of increased car production, factory construction, and infrastructure work. Manufacturers there want lightweight, strong, and recyclable materials to meet rules and what people want.

- TPO is also being used more in cars in Asia-Pacific, mostly for bumpers, trims, and inside parts. This is because of more car sales, growing cities, and government support for fuel-efficient cars.

- In Asia-Pacific, putting TPO into molds is still the top way to make car parts. It's accurate, good for making lots of stuff, and works with recycled materials. This helps with growing, saving money, and following the rules as the area gets bigger fast.

The market for Thermoplastic Polyolefin (TPO) is expanding fast in the polymer and plastics field because it can be used in cars, buildings, electrical parts, and things people buy. TPO is cheap, light, and can be recycled. It also resists chemicals and heat well, so it's great for car parts (inside and out), roofing, wire insulation, and everyday products. It’s tough, bendable, and easy to work with, making it a good choice instead of things like metal, hard plastics, and regular rubber.

TPO is now key in the car business because it helps make cars lighter, which saves gas and meets safety rules. The building industry is also helping the market grow. TPO is being used more for roofs, waterproofing, and insulation because cities are growing and there are rules about being sustainable. Wire makers are using TPO for insulation because it can handle heat and chemicals. Companies that make things people buy are using it for strong, light products that meet today's standards for performance and being good for the Earth.

North America, Europe, and Asia-Pacific currently have the most demand. Asia-Pacific is the fastest-growing area, mainly because of increased car production, growing cities, and more factory construction. Better ways of processing TPO, like injection molding and thermoforming, and using more mixed and in-situ TPO are also helping the market grow. The market's path is influenced by trends in sustainability, rules and the need for polymer solutions that don't cost a lot but still work well in many industries.

Thermoplastic Polyolefin Market Segmentation

By Type

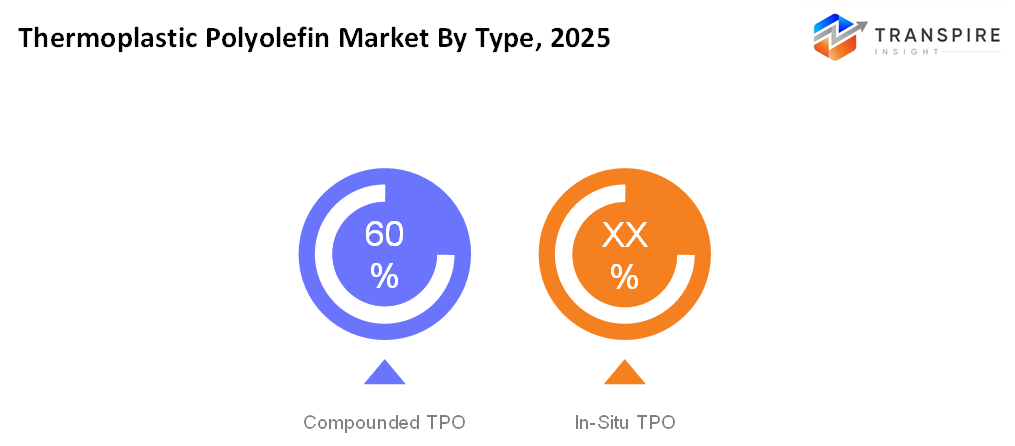

- Compounded TPO

Compounded TPO dominates due to its tailored mechanical and thermal properties, enabling diverse automotive and construction applications

- In-Situ TPO

While In-Situ TPO is gaining traction for specialized use cases requiring enhanced chemical resistance and recyclability, supporting performance and sustainability-driven adoption.

To learn more about this report, Download Free Sample Report

By Application

- Automotive

Automotive applications drive the market with demand for lightweight, durable components improving fuel efficiency and regulatory compliance

- Building & Construction

Building & Construction benefits from TPO in roofing and waterproofing.

- Wire & Cables

Wire & Cables, Consumer Goods, and others segments expand due to versatility and thermal stability.

By End-Use Industry

- Automotive & Transportation

Automotive & Transportation leads to growth due to increasing vehicle production and adoption of fuel-efficient, lightweight materials.

- Construction

Construction sees rising TPO demand for energy-efficient and low-maintenance structures

- Electrical & Electronics

while Electrical & Electronics and Industrial & Consumer Products adopt TPO for enhanced durability and cost-effective performance.

By Processing Method

- Injection Molding

Injection Molding is preferred for precise, high-volume production of complex automotive and consumer components.

- Extrusion

Injection Molding is preferred for precise, high-volume production of complex automotive and consumer components.

- Thermoforming

Thermoforming works well for making big panels, roofing, and light industrial parts, which makes things more efficient and allows for design changes.

Regional Insights

In North America, the market is stable, with the United States being the main driver because of car making and building projects. Canada and Mexico are also seeing more request for light, strong, and recyclable TPO stuff in cars, factories, and for consumers. Europe is really getting into it, with Germany, the United Kingdom, France, Spain, and Italy as top markets because they make lots of cars, are developing their infrastructure, and have strict rules. The rest of Europe is growing at a reasonable rate, helped by upgrades in factories and more money being spent on building. Asia-Pacific is the quickest growing area, with Japan, China, Australia & New Zealand, South Korea, and India needing stuff for cars, buildings, and factories. The rest of Asia-Pacific is getting a boost from cities growing, factories popping up, and people having more money to spend, which encourages people to use TPO that's cheap and works well. South America is growing at a decent pace, led by Brazil and Argentina, with TPO being used more in car making and building. The rest of South America is slowly starting to use polymer solutions for infrastructure and factories. The Middle East & Africa are seeing consistent growth, with Saudi Arabia, the United Arab Emirates, and South Africa leading the way because of infrastructure projects, request for cars, and efforts to build energy-efficient buildings. The rest of the area is growing slower, with only some factories using it.

To learn more about this report, Download Free Sample Report

Recent Development News

- March 2025, In March 2025, ExxonMobil Signature Polymers announced its participation at Plastico Brasil 2025, highlighting innovative polyolefin solutions that support advanced and mechanical recycling and sustainable product design — trends that directly influence the broader TPO/polyolefin market’s direction. ExxonMobil showcased technologies aimed at improving performance and recyclability across applications such as automotive and industrial parts, which align with demand for sustainable thermoplastic polyolefin materials.

- In July 2025, LyondellBasell has been actively expanding its recycled polymer portfolio that supports sustainable polyolefin solutions (including TPO applications). A key milestone in July 2025 was the FDA No Objection Letter (NOL) for recycled PP and HDPE from its joint-venture GXLYB, which enhances the credibility and safety of mechanically recycled polyolefins used in packaging and related compound markets (including TPO feedstocks). This underscores LyondellBasell’s push toward circular and recycled content in polyolefins — an important trend for TPO materials in automotive, construction, and industrial uses.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 19.40 Billion |

|

Market size value in 2026 |

USD 22.00 Billion |

|

Revenue forecast in 2033 |

USD 42.30 Billion |

|

Growth rate |

CAGR of 9.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

LyondellBasell Industries N.V., ExxonMobil Corporation, Borealis AG, Dow Inc., Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., Braskem S.A., INEOS Group Holdings S.A., Chevron Phillips Chemical Company LLC, PolyOne Corporation, Arkema S.A., BASF SE, LG Chem Ltd., Sinopec Group, Reliance Industries Limited. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Compounded TPO, In-Situ TPO), By Processing Method (Automotive, Building & Construction, Wire & Cables, Consumer Goods, Others), By End-Use Industry (Automotive & Transportation, Construction, Electrical & Electronics, Industrial & Consumer Products), and By Processing Method (Injection Molding, Extrusion, Thermoforming). |

Key Thermoplastic Polyolefin Company Insights

Dow Inc. is a major player in the Thermoplastic Polyolefin market. It depends on new polymer research and eco-friendly items to meet the needs of the auto and construction businesses. Dow’s TPO items focus on light, strong, and recyclable materials, which makes cars more fuel-efficient and buildings more sustainable. Dow works with companies like ExxonMobil and Mitsui Chemicals to improve tech and get into markets. By always investing in production and research, Dow stays ahead in the market, which helps them deal with rules, keep up with what customers want, and follow global sustainability trends.

Key Thermoplastic Polyolefin Companies:

- LyondellBasell Industries N.V.

- ExxonMobil Corporation

- Borealis AG

- Dow Inc.

- Mitsui Chemicals, Inc.

- Sumitomo Chemical Co., Ltd.

- Braskem S.A.

- INEOS Group Holdings S.A.

- Chevron Phillips Chemical Company LLC

- PolyOne Corporation

- Arkema S.A.

- BASF SE

- LG Chem Ltd.

- Sinopec Group

- Reliance Industries Limited

Global Thermoplastic Polyolefin Market Report Segmentation

By Type

- Compounded TPO

- In-Situ TPO

By Processing Method

- Automotive

- Building & Construction

- Wire & Cables

- Consumer Goods

- Others

By End-Use Industry

- Automotive & Transportation

- Construction

- Electrical & Electronics

- Industrial & Consumer Products

By Processing Method

- Injection Molding

- Extrusion

- Thermoforming

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636