Market Summary

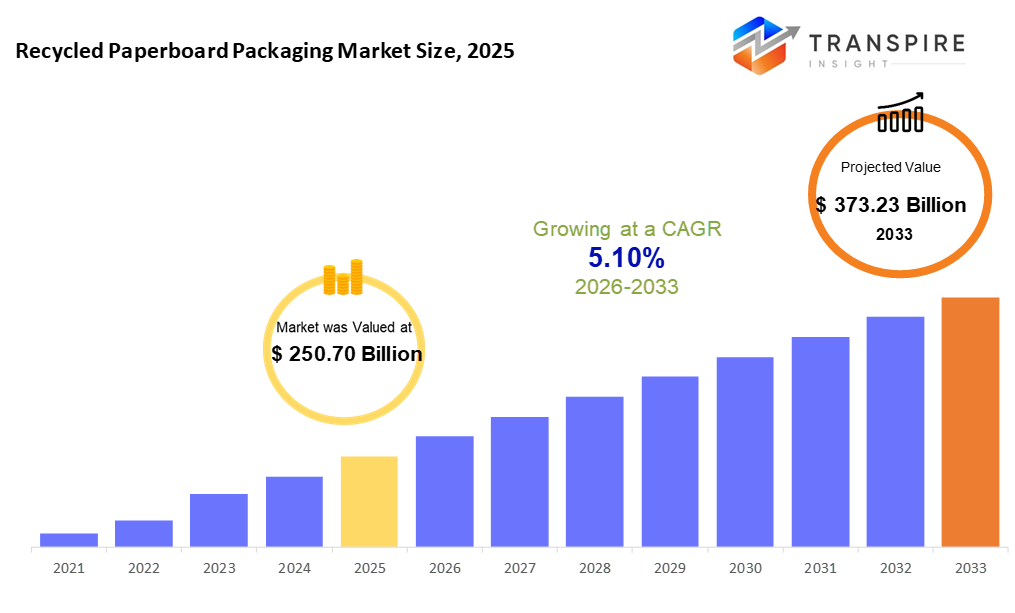

The global Recycled Paperboard Packaging market size was valued at USD 250.70 billion in 2025 and is projected to reach USD 373.23 billion by 2033, growing at a CAGR of 5.10% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 250.70 Billion

- 2033 Projected Market Size: USD 373.23 Billion

- CAGR (2026-2033): 5.10%

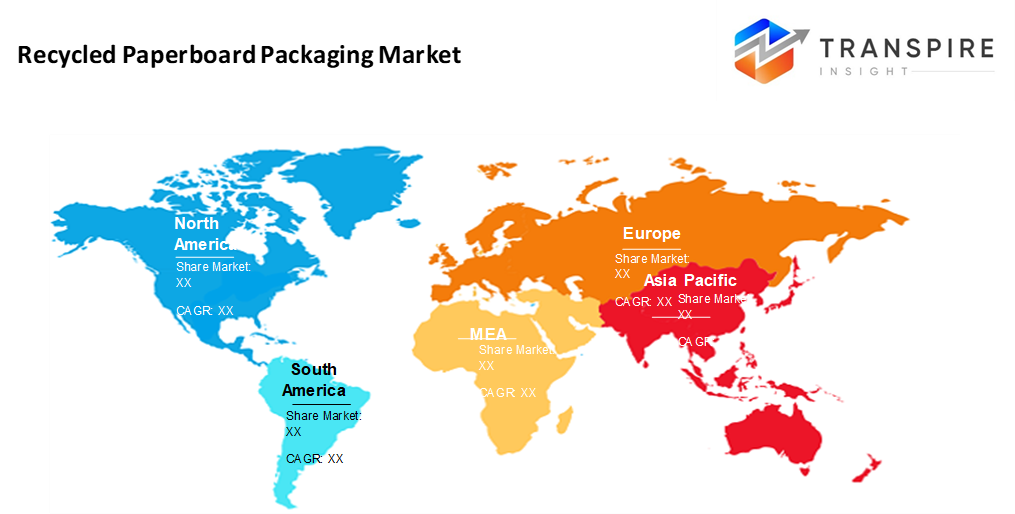

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 32% in 2026. From coast to coast, rules that push for greener practices have taken root. Where waste systems already work well, businesses now lean more on paperboard made mostly from old materials. Online shopping boxes and everyday product wraps lead this shift. Laws are not the only force; habits and habits shaped over time play their part too.

- In the United States, choices made in boardrooms and homes push more recycled paperboard into kitchens, stores, and shelves, driven by rules on the ground, fresh funding, and real shifts in how things get bought and sold.

- In the Asia Pacific, factories keep popping up. Online shopping grows fast. People buy more drinks and snacks now. Not really, more folks want clean options. That shift pushes recycled paperboard way up. This part of the world leads because of it. Speed matters. So does demand.

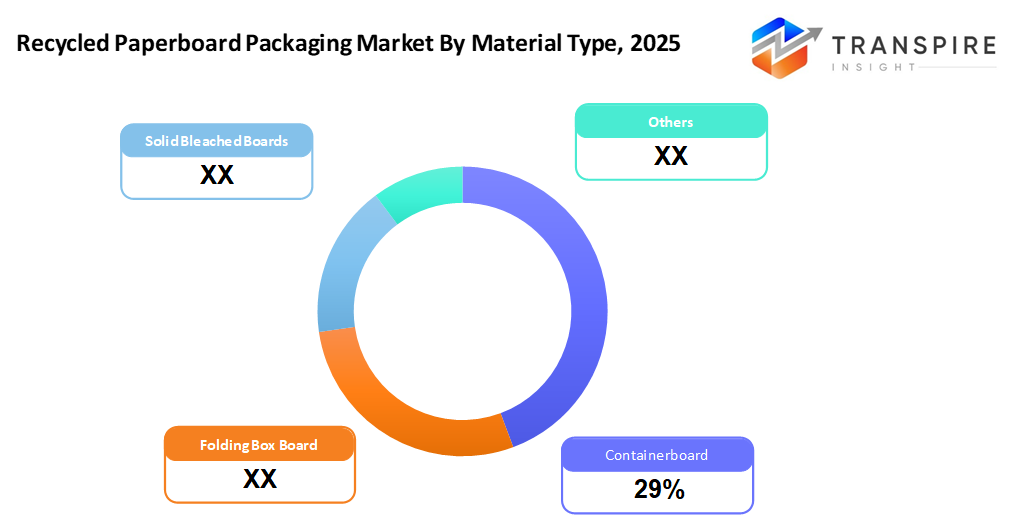

- Containerboard Segment estimated the market share to be 30%. Shipping containers start with sturdy paper rolls. Online shopping pushes the need for tough packaging that can be recycled again. Delivery networks rely on these materials more every year. Boxes must survive rough handling yet break down easily after use

- Beyond just recycling bins, companies now lean on post-consumer waste driven by tighter rules and public promises to cut emissions. What once piled up in landfills is now a key piece in lowering industrial impact. Pressure is not fading; it’s reshaping supply chains one reclaimed material at a time.

- Food companies now choose paperboard instead of plastic, following green rules plus shopper habits. New packaging trends show a clear move away from old materials. Rules matter, sure, yet customer choices pull just as hard. Paper feels right today, lighter footprint, easier recycling path. Not every brand jump in fast, but many test changes. Pressure builds slowly from policy corners and everyday buyers alike.

- Direct sales thrive on solid deals with big-name business clients who buy packaging in huge volumes. Firms stick close to suppliers, locking in steady flows without middlemen slowing things down. Large industries keep coming back, relying on consistent quality plus reliable delivery schedules. This route stays king because trust builds over time, not overnight.

The worldwide growth of the recycled paperboard packaging market is moderately high since industries tend to switch towards sustainable and circular packaging solutions. Recycled paperboard made out of post-consumer and pre-consumer waste is commonly used in containerboard and folding cartons as well as other forms of paper-based packaging because it is recyclable, biodegradable, and less damaging to the environment than virgin materials and plastics. The constantly growing recycling technologies and paperboard quality have served as the stepping stones to its use in protective as well as high-end packaging markets.

On the demand front, the industry is highly motivated by the e-commerce, food and beverage packaging, as well as the consumer goods markets that have experienced a high rate of growth. The continued growth of online shopping has contributed greatly to the growth in the recycled containerboard and corrugated boxes, as more food and beverage brands are now using recycled paperboard cartons and trays to meet their sustainability requirements and changing consumer trends. Moreover, corporate activities of cutting down plastic use and carbon emissions are driving up the need for high-recycled-content paperboard solutions.

North America and Europe are also major markets in terms of regional and competitive forces because of well-developed recycling systems, high recovery rates, and stringent environmental regulations to promote the use of recycled packaging. However, the region of Asia-Pacific is becoming the fastest-growing region; industrial growth, urbanization, and increasing environmental awareness in the countries of China and India drive it. The market leaders are diversifying their capacity, integrating vertically, and making long-term contracts with their suppliers to gain an advantage in the market and guarantee their recycled fiber supply.

The associated market trends and projections reveal that more investments are likely to be made in lightweighting, barrier coatings, and food-safe recycled fibers to enhance performance and expansion of their use. The use of digital printing, integration of smart packaging, and direct sale channel customization are also picking up. Comprehensively, the market perspective will be favorable in the future, due to regulatory support, sustainable material innovation, and increased end-use applications in the world industries.

Recycled Paperboard Packaging Market Segmentation

By Product Type

- Containerboard

From trees comes a sturdy paper stuff. This material shapes boxes that travel far. It holds things tight during moves across distances.

- Folding Box Board

Foldable, rigid paper stuff is used when making fancy containers meant for stores. Printing works well on it, so brands often choose this for high-end looks. Boxes made from it bend neatly into shape without falling apart. Think gift packages or upscale product cases you see on shelves.

- Solid Bleached Boards

The white top layer makes these boards clean-looking. Their bright finish works well on fancy boxes and printed materials. Smooth coating helps colors stand out clearly. Made from strong paper stock that holds shape. Often chosen when appearance matters most.

- Others

Specialty coated or uncoated recycled boards fall into this group. Some unique paperboard kinds fit very particular uses here, too.

To learn more about this report, Download Free Sample Report

By Source

- Post-Consumer Waste

After people finish using items like cardboard boxes, those get gathered up instead of tossed away. These materials find new life through recycling processes that turn old into fresh resources again.

- Pre-Consumer Waste

Leftover bits from making paperboard get turned into fresh material again. These scraps come straight out of the factory process before anyone uses them. Bits that would otherwise be thrown away find a second life. This kind of waste never reaches customers. Instead, it loops right back into production. Old edges and trim pieces become part of something new.

- Mix Recovered Paper

A mix of old papers comes together with different types once thrown away, now bundled into one stream. These scraps get sorted, cleaned, and then turned into raw material again. Fibers that had separate lives find new purpose here. What was discarded becomes part of a fresh start.

- Specialty Recycled Fibers

From old materials come refined fibers, adjusted for tough jobs or strict rules. These are not your average reused threads; each batch gets a purpose. Built for durability, some handle heat better. Others resist wear in extreme settings. What matters is how they perform when it counts. Not all recycling leads here; only select processes cut. Purpose shapes every strand.

By End-Users

- Food & Beverages

Wrapping things you eat comes in many shapes. Drinks get their own kind of wrap, too. Take-out often arrives in sturdy boxes. Cartons hold plenty of different goods off the shelf.

- E-Commerce & Retail

Boxes made of layered cardboard move products bought online. These packages also deliver goods to stores. Shipping containers protect items during transit. Some designs fit shelves right after delivery.

- Consumer Goods

Everyday items like soaps, cleaners, and similar goods come in packaging made for regular use. These containers hold things people rely on daily, designed simply for practicality. From bathroom shelves to kitchen cabinets, they fit right into routine life.

- Healthcare & Pharmaceutical

Medicine boxes made of paperboard protect pills, tools, or supplies inside. These containers hold healthcare items securely during shipping. Devices used in hospitals often arrive in sturdy paper cases. Some health-related goods come packed in lightweight yet firm board packaging. Protection matters most when moving sensitive materials through supply chains.

- Industrial Goods

Packaging built tough keeps industrial components safe during shipping. Sturdy corrugated materials handle rough conditions without failing. These solutions shield machinery parts from impact and moisture alike.

- Others

Stuff like office supplies shows up too. Packaging made for specific uses fits here as well.

By Distribution Channel

- Direct Sales

Bypassing middlemen, the maker delivers straight to big companies using bulk orders. From the factory floor to the corporate client, no extra steps are involved.

- Distributors

Out there, some outside companies deliver reused cardboard to different buyers.

- Online

Many e-commerce sites offer recycled paperboard plus related packaging options for companies. Orders happen digitally, streamlining how firms’ source eco-friendly materials. Some stores specialize in bulk quantities, catering specifically to business needs. These platforms often provide product details, pricing transparency, and shipping timelines. Access is continuous, letting users browse at any hour without delays.

Regional Insights

North America and Europe are the most developed markets of the recycled paperboard packaging, which is backed by good regulatory provisions, high recycling levels, and high manufacturing facilities. The regional demand is dominated by North America (Tier-1: United States, Canada), as most are using recycled containerboard in e-commerce, food and beverage, and consumer goods packaging, and Tier-2 countries such as Mexico and other Central American countries are starting to see more adoption as retail and logistics operations grow. Tier-1 (Germany, United Kingdom, France, Italy): Hardly any penetration of recycled paperboard is achieved in the markets of Tier-1 due to rigorous European sustainability policies and recycled economy programs, although Tier-2 markets (Spain, Poland, Nordic countries) exhibit consistent growth due to the growing demands of recycled content and modernization of the retail market.

The Asia-Pacific is most likely to emerge as the most rapidly increasing market in the recycled paperboard packaging industry due to the rapid growth in terms of industrialization, urbanization, and increased e-commerce. The majority of the demand in the region is performed by the Tier-1 nations like China, India, and Japan, which are backed by the high population of consumers, developing food and beverage markets, and a developing recycling system. Southeast Asia (Indonesia, Vietnam, Thailand) and South Korea are also undergoing an accelerated adoption cycle as governments implement waste-cutting strategies and international brands switch their sourcing of packaging materials in the area towards sustainable paperboard technologies.

Emerging markets have been Latin America and Middle East, and Africa (MEA), which have a potential that is increasing. In Latin America, the Tier-1 countries, Brazil and Mexico, dominate demand because of the growing consumer goods and food packaging industries, whereas Tier-2 countries, Argentina, Chile, and Colombia, are slowly becoming more recycled paperboard users as sustainability comes into the limelight. In MEA, the Tier-1 markets (Saudi Arabia, United Arab Emirates, and South Africa) are experiencing increased adoption due to the growth of retail, sustainability, and long-term prospects in Tier-2 regions in the rest of Africa and the Middle East (where recycling infrastructure and regulation are still in the infancy phase) are increasing.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 24, 2025 – The Saica Group has expanded its packaging recovery network in Spain with its acquisition of the paper and corrugated board recovery business of FCC Ambito, a subsidiary of FCC Enviro.

- June 12, 2025 – Mondi launched recycle paper plus bag advanced.

- February 28, 2025 – Huhtamaki launched recyclable single-coated paper cups for Yoghurt and Dairy.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 250.70 Billion |

|

Market size value in 2026 |

USD 263.49 Billion |

|

Revenue forecast in 2033 |

USD 373.23 Billion |

|

Growth rate |

CAGR of 5.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Westrock Company, International Paper Company, Smurfit Kappa Group, Graphic Packaging International, Mondi Group, Store Enso Oyj, Green Bay Packaging, Georgia Pacific LLC, Cascades, Koehler Paper, Sonoco Product Company, Atlantic Packaging Products, Papier Mettler, Uflex, VPK Group, DS, Smith, and others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Containerboard, Folding Box Board, Solid Bleached Boards, Others) By Source (Post-Consumer Waste, Pre-Consumer Waste, Mixed Recovered Paper, Specialty Recycled Fibers) By End-Users (Food & Beverages, E-Commerce & Retail, Consumer Goods, Healthcare & Pharmaceutical, Industrial Goods, Others) By Distribution Channel (Direct Sales, Distributors, Online) |

Key Recycled Paperboard Packaging Company Insights

WestRock Company is an American multinational packaging company that is the leader in the provision of paper and packaging solutions in the US and globally, such as recycled paperboard, containerboard, and corrugated packaging. The company provides a wide range of end-use markets, including the food and beverage, consumer products, healthcare, and e-commerce sectors, but is well-attuned to the idea of sustainability and high levels of recycled content. WestRock also spends a lot of money on new packaging designs, lightweighting, and recycling technologies to improve performance and reduce impact on the environment. Having a wide manufacturing base in North America, Europe, and Latin America, it has good B2B relationships with its direct sales and personalized package solutions that make it dominant in the global recycled paperboard market.

Key Recycled Paperboard Packaging Companies:

- Westrock Company

- International Paper Company

- Smurfit Kappa Group

- Graphic Packaging International

- Mondi Group

- Store Enso Oyj

- Green Bay Packaging

- Georgia Pacific LLC

- Cascades

- Koehler Paper

- Sonoco Product Company

- Atlantic Packaging Products

- Papier Mettler

- Uflex

- VPK Group

- DS Smith

- others

Global Recycled Paperboard Packaging Market Report Segmentation

By Product Type

- Containerboard

- Folding Box Board

- Solid Bleached Boards

- Others

By Source

- Post-Consumer Waste

- Pre-Consumer Waste

- Mixed Recovered Paper

- Specialty Recycled Fibers

By End-Users

- Food & Beverages

- E-Commerce & Retail

- Consumer Goods

- Healthcare & Pharmaceutical

- Industrial Goods

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Online

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636