Market Summary

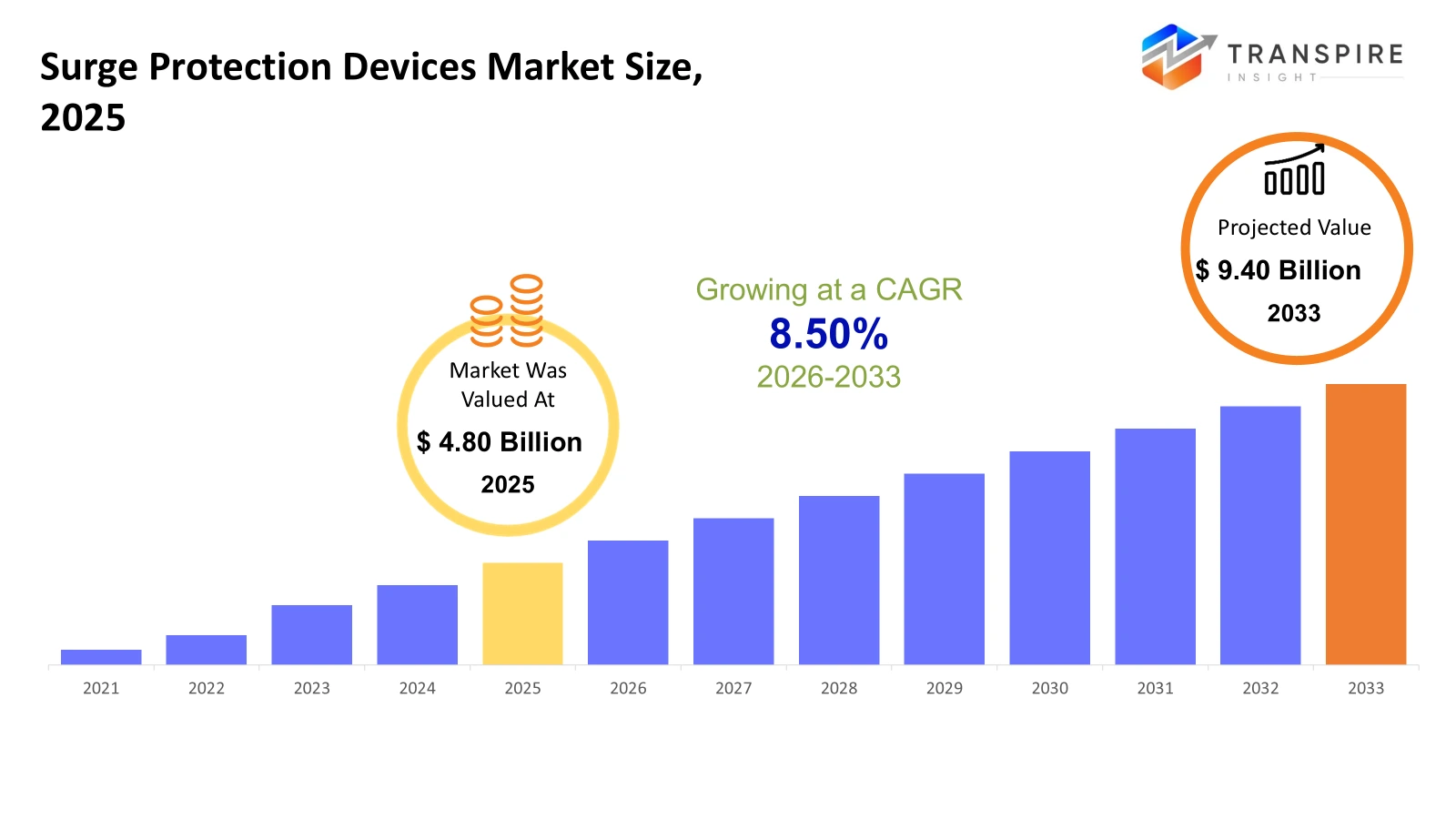

The global Surge Protection Devices market size was valued at USD 4.80 billion in 2025 and is projected to reach USD 9.40 billion by 2033, growing at a CAGR of 8.50% from 2026 to 2033. More people need steady electricity. Because of that, devices guarding against sudden power spikes are seeing higher interest. Machines in factories often require a stable flow. So industries building new sites add more protective gear. Solar farms are spread across regions. Wind parks connect to main lines. Each setup uses parts that block surges. Cities now run on complex digital systems. These rely heavily on uninterrupted current. Data warehouses pop up everywhere. They house powerful computers.

Market Size & Forecast

- 2025 Market Size: USD 4.80 Billion

- 2033 Projected Market Size: USD 9.40 Billion

- CAGR (2026-2033): 8.50%

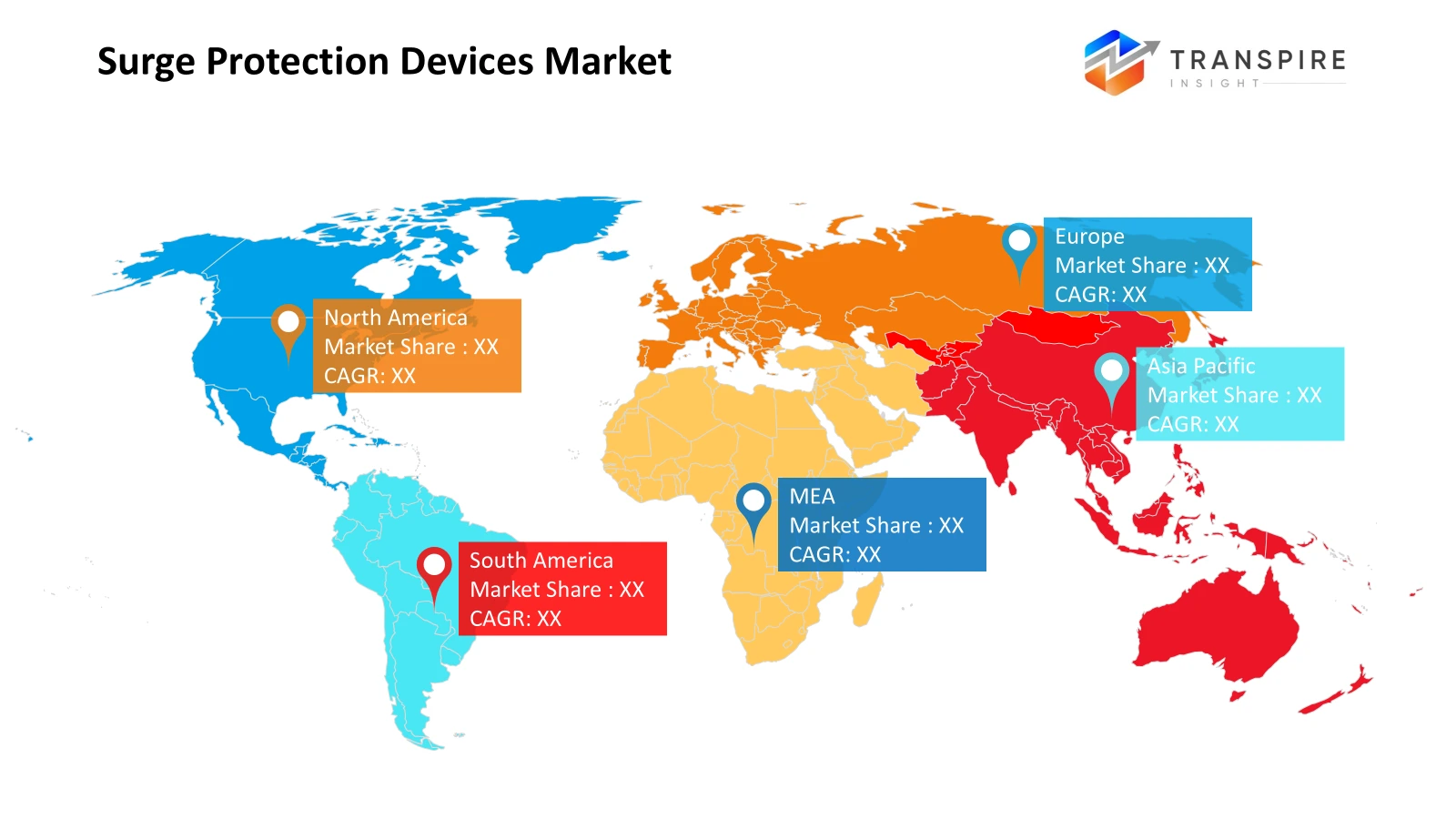

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 40% in 2026. With its modern power systems and tough safety rules, North America takes up a major part of the worldwide surge protection device market. Because businesses, homes, and factories widely use these devices, demand stays strong across sectors. What pushes growth is not just technology but also how carefully buildings are wired. Even so, steady updates to electrical codes keep the region ahead. While other areas catch on slowly, this one sticks out due to real-world needs shaping choices.

- Folks here follow strict NEC rules on wiring, so safeguards get used a lot. High power use everywhere keeps that need strong. When storms roll through, sudden spikes become a real worry. That's when surge protectors prove their worth most. Lightning strikes certain regions hard, making these devices essential. Safety steps like these spread widely because of it.

- Fueled by growing knowledge about safeguarding devices from power spikes, the region sees momentum. Industrial activity picks up pace here faster than elsewhere. More people have extra money to spend, which shifts buying patterns. Homes and offices alike install more tech gear into daily operations. This part of the world expands its electrical setups steadily. Growth trends point upward, supported by these overlapping changes.

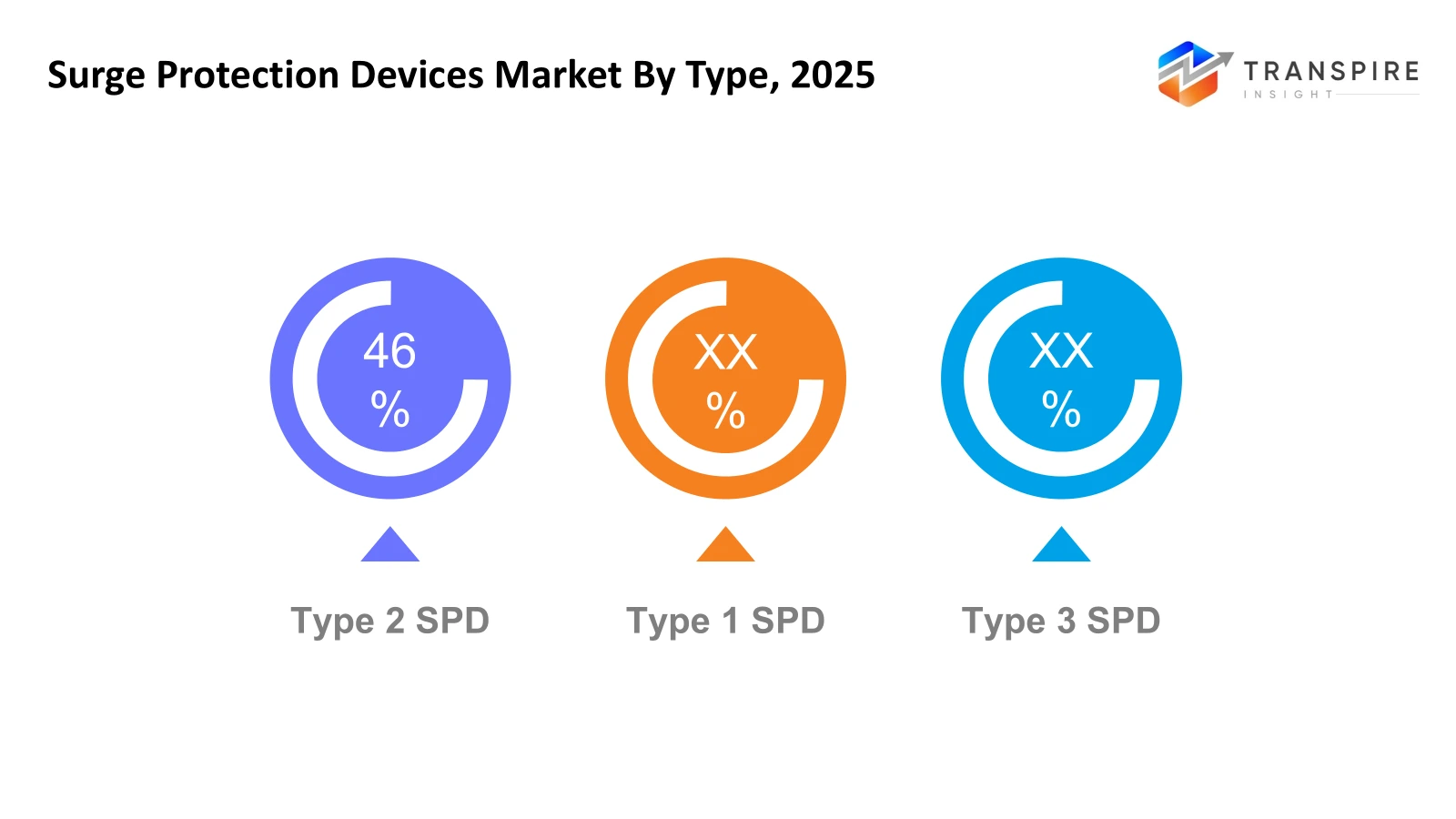

- Type 2 SPD shares approximately 48% in 2026. Even though options exist, Type 2 SPDs maintain their mix of reliable function, straightforward setup, and fit within homes, offices, or factories, which keeps them widely chosen. What holds attention is how often they appear where protection matters most.

- These days, medium power surge protectors see more use simply because they fit everywhere, offices, shops, and even small factories. Their broad fit keeps buyers coming back. Demand stays solid without spikes or drops

- Factories keep things running smoothly because surge protection devices guard delicate machines. Automation sites rely on these tools more each year to avoid costly stops. Equipment stays safe when sudden power spikes hit during production runs.

- Fueled by rising risks, data centers lean on SPDs more each year. Voltage spikes threaten systems - telecom firms respond by installing protection units across networks. Equipment downtime weighs heavily, so teams add safeguards where signals travel. Power hiccups once caused outages; now defenses stand ready at every node. Growing reliance shapes how tech hubs manage electrical flow.

Voltage spikes from storms, power shifts, or wiring issues often wreck delicate electronics without warning. Because of this risk, more homes, offices, and factories now install safeguards against sudden jolts. Electrical gear everywhere faces growing threats due to unstable supply conditions. Protection units help prevent expensive breakdowns when the current jumps unexpectedly. Their role has grown vital wherever modern technology powers daily tasks. Unexpected surges once ignored are now taken seriously across all building types. As awareness of electrical safety increases and infrastructure modernizes, the surge protection devices market continues to expand, driven by rising demand for reliable systems that shield equipment from unpredictable voltage fluctuations.

Not just limited to servers and cables, today's tech backbone stretches into every corner of modern construction. Power hiccups can knock out essential operations, so safeguards like SPDs now anchor most electrical setups. Instead of working alone, they team up with live tracking tools that spot threats before damage happens. As digital networks grow, their need for steady defense grows too.

Out in factories, machines that handle delicate tasks keep getting more common. Because of this, gadgets like programmable controllers and control boxes need solid shields against power spikes. When systems run nonstop, even small electrical jolts can cause big issues. Places where timing matters most tend to take extra care here. Protection is not just backup - it stays active every second operations move.

Innovation drives makers of protective gear, along with smaller builds and quicker reactions, matching what industries now need. Because renewables rise, especially solar and wind setups, fresh needs pop up for guarding equipment against surges. As wiring networks get smarter and more people recognize safe practices, demand holds steady over the years ahead. Growth stays supported by upgrades in how electricity moves and who uses it.

Surge Protection Devices Market Segmentation

By Type

- Type 1 SPD

A single Type 1 SPD sits where power first enters a building. Lightning hitting nearby sends massive spikes; this device handles those. Its job begins before electricity spreads through walls. Sudden bursts from storms meet resistance here first. Protection starts at this crucial junction, stopping damage before it moves deeper.

- Type 2 SPD

Found inside distribution panels, Type 2 SPD handles voltage spikes from switching operations along with distant lightning impacts. Though not meant for direct strikes, it reacts quickly when surges travel through power lines. Protection happens behind the scenes, working each time irregular currents appear. Its role supports overall system safety by limiting excess energy before damage occurs.

- Type 3 SPD

Close to delicate devices, Type 3 SPD steps in right where power enters the gear. Protection happens just before the machine feels the surge - tight timing, precise spot.

To learn more about this report, Download Free Sample Report

By Power Rating

- Low Power

Fits right into homes or compact business setups. Electrical demands stay covered without heavy draw.

- Medium Power

Mid-level strength fits offices, shops, and small factories. Built tough without going overboard. Handles daily demands of busy spaces. Works well where basic won’t cut it, but heavy-duty is too much. Stands up to constant use yet stays practical.

- High Power

Power demands run high where industry works hardest. Tough spaces need tough shields. Big operations rely on strong safeguards when the stakes are high.

By Application

- Residential

When power jumps too high, it keeps your fridge, lights, and outlets safe at home. What hits hard will not damage hidden wires behind walls either.

- Commercial

Office gear stays secure, while shops keep their tech running smoothly. Buildings meant for public use hold up better under daily stress. The equipment inside them avoids damage when handled correctly. Systems used by many people work without sudden issues. Safety comes

through steady design, not constant fixes.

- Industrial

Electrical surges can wreck heavy machines - protection here keeps assembly chains running without burnout. Equipment stays intact when voltage spikes hit, thanks to built-in shields that block harmful currents. Automation gear, often sensitive, avoids disruption because safeguards cut through interference quietly.

By End-Users

- Energy & Power

Machines run where electricity flows through stations that feed cities, connect spots making clean power like wind farms plus solar fields; big plants burning fuel also tie into these networks to send out voltage across wires reaching homes far away.

- IT & Telecom

Out in the digital world, safeguards keep critical systems running smoothly. Servers stay shielded through constant monitoring and smart design. Data hubs rely on layered defenses to maintain flow. Communication networks hold strong because protections adapt quickly. Each part connects yet operates safely due to built-in resilience.

- Manufacturing

Factories lock down robots along with the machines that run them.

- Healthcare & Others

When it comes to hospitals and essential services, steady safeguards are always active. What keeps operations running smoothly is constant defense against disruptions. For clinics plus power systems, backup strength never steps back.

Regional Insights

Strong growth in North America's surge protection market comes from heavy spending on modernizing power systems, while updated electrical safety rules spread widely across areas. Because the industry is well established, new tech moves fast into homes and businesses, creating a steady need for solid protection against surges.

Steady growth appears in Europe, thanks to tough regulations that push for better electrical safety, sparking wider use of surge protectors at factories, offices, and homes. Industrial powerhouses grow alongside the rising adoption of green energy setups. This mix nudges demand for advanced protective gear.

Fast growth in Asia-Pacific looks likely, driven by surging factories and city growth, especially in places such as China, India, and nations across Southeast Asia. Rising use of electronics pushes the need, while upgrades to electricity networks add momentum. Expanding internet hubs plus stronger telecom spending also play a part, pulling more demand for systems that guard against voltage spikes. Growth here ties closely to how quickly technology spreads, and buildings go up across the landscape.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 21, 2026 – Consistent Infosystems launched advanced surge protectors for reliable power safety

- October 1, 2025 – Schneider Electric launched an industry-first plug-and-play surge protection device in the UK.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.80 Billion |

|

Market size value in 2026 |

USD 5.30 Billion |

|

Revenue forecast in 2033 |

USD 9.40 Billion |

|

Growth rate |

CAGR of 8.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Schneider Electric, ABB Ltd., Siemens AG, Eaton Corporation plc, Legrand, General Electric, Littelfuse Inc., Mersen, Raycap Corporation, Phoenix Contact, Belkin International, Hager Group, Chint Group, Havells India Ltd., Panasonic Corporation, Rockwell Automation, and Emerson Electric Co |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Type 1 SPD, Type 2 SPD, Type 3 SPD), By Power Rating (Low Power, Medium Power, High Power), By Application (Residential, Commercial, Industrial), By End-Users (Energy & Power, IT & Telecom, Manufacturing, Healthcare & Others), |

Key Surge Protection Devices Company Insights

Schneider Electric French-based tech firm, leads worldwide in managing power flow and automated control setups. Instead, it builds tough tools that block sudden electric surges inside homes, offices, shops, and factories, too. These units fight off quick bursts of high voltage using smart internal designs made recently. Even brief jumps in electricity get stopped fast by these built-in shields. Across continents, people trust their wiring when using such gear during storms or grid shifts. Innovation drives every update they release each season without fail. Green goals shape how products are planned years ahead. Digital networks link everything together behind the scenes quietly. Safety climbs higher wherever these parts connect to main circuits. Market strength grows through steady engineering progress like this one.

Key Surge Protection Devices Companies:

- Schneider Electric

- ABB Ltd.

- Siemens AG

- Eaton Corporation plc

- Legrand

- General Electric

- Littelfuse Inc.

- Mersen

- Raycap Corporation

- Phoenix Contact

- Belkin International

- Hager Group

- Chint Group

- Havells India Ltd.

- Panasonic Corporation

- Rockwell Automation

- Emerson Electric Co

Global Surge Protection Devices Market Report Segmentation

By Type

- Type 1 SPD

- Type 2 SPD

- Type 3 SPD

By Power Rating

- Low Power

- Medium Power

- High Power

By Application

- Residential

- Commercial

- Industrial

By End-Users

- Energy & Power

- IT & Telecom

- Manufacturing

- Healthcare & Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636