Market Summary

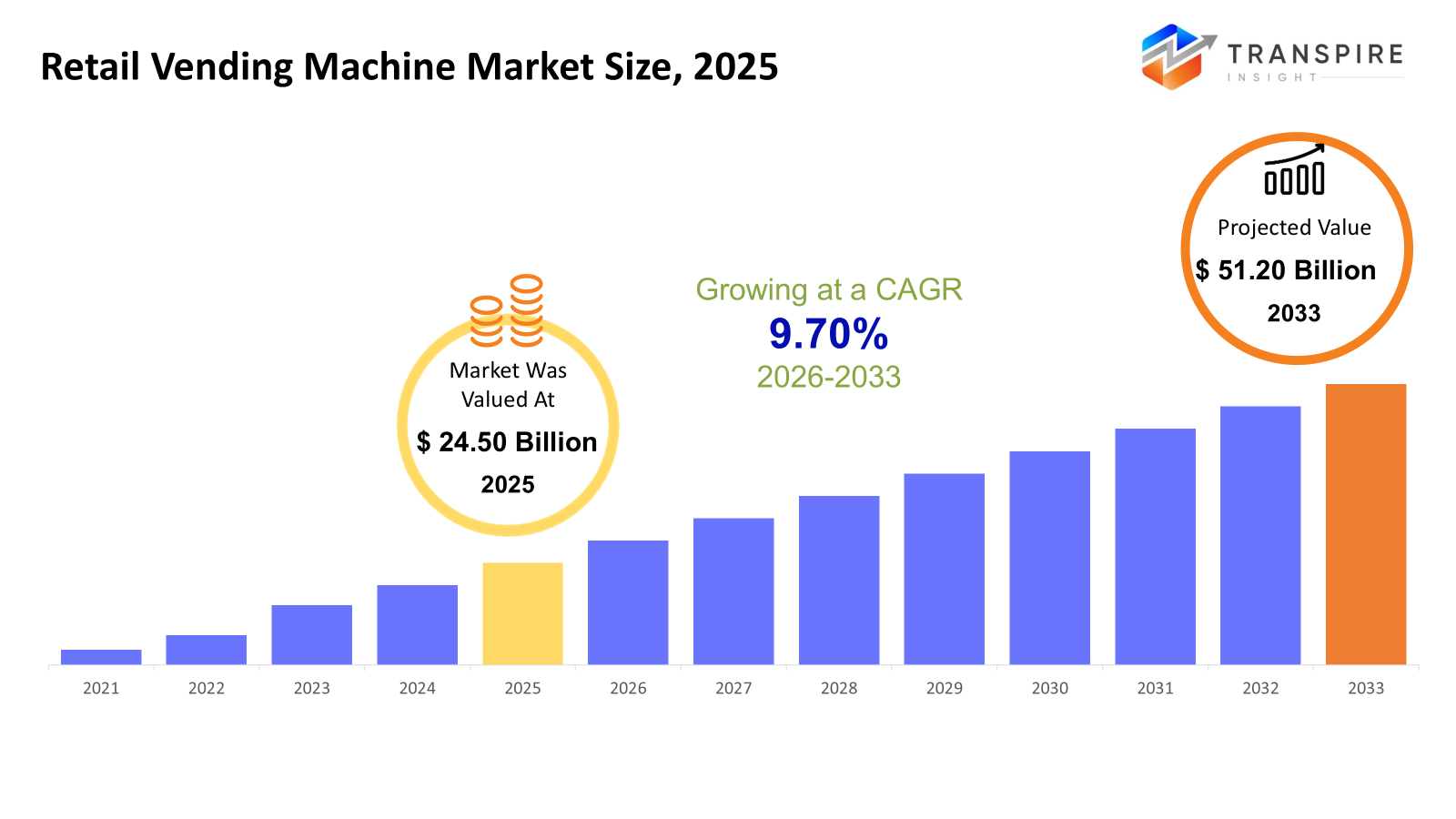

The global Retail Vending Machine market size was valued at USD 24.50 billion in 2025 and is projected to reach USD 51.20 billion by 2033, growing at a CAGR of 9.70% from 2026 to 2033. The market for retail vending machines is expected to expand at a strong compound annual growth rate (CAGR) because to factors such growing urbanization, the quick uptake of mobile and cashless payment methods, and the growing need for easy-to-transport food and drinks. Technological advancements in smart and AI-enabled vending machines, which offer real-time inventory tracking, tailored product recommendations and improved customer experiences, further boost growth. Along with growing consumer preference for contactless and hygienic retail solutions, expanding applications throughout public areas, healthcare institutions and workplaces further support the market's steady expansion.

Market Size & Forecast

- 2025 Market Size: USD 24.50 Billion

- 2033 Projected Market Size: USD 51.20 Billion

- CAGR (2026-2033): 9.70%

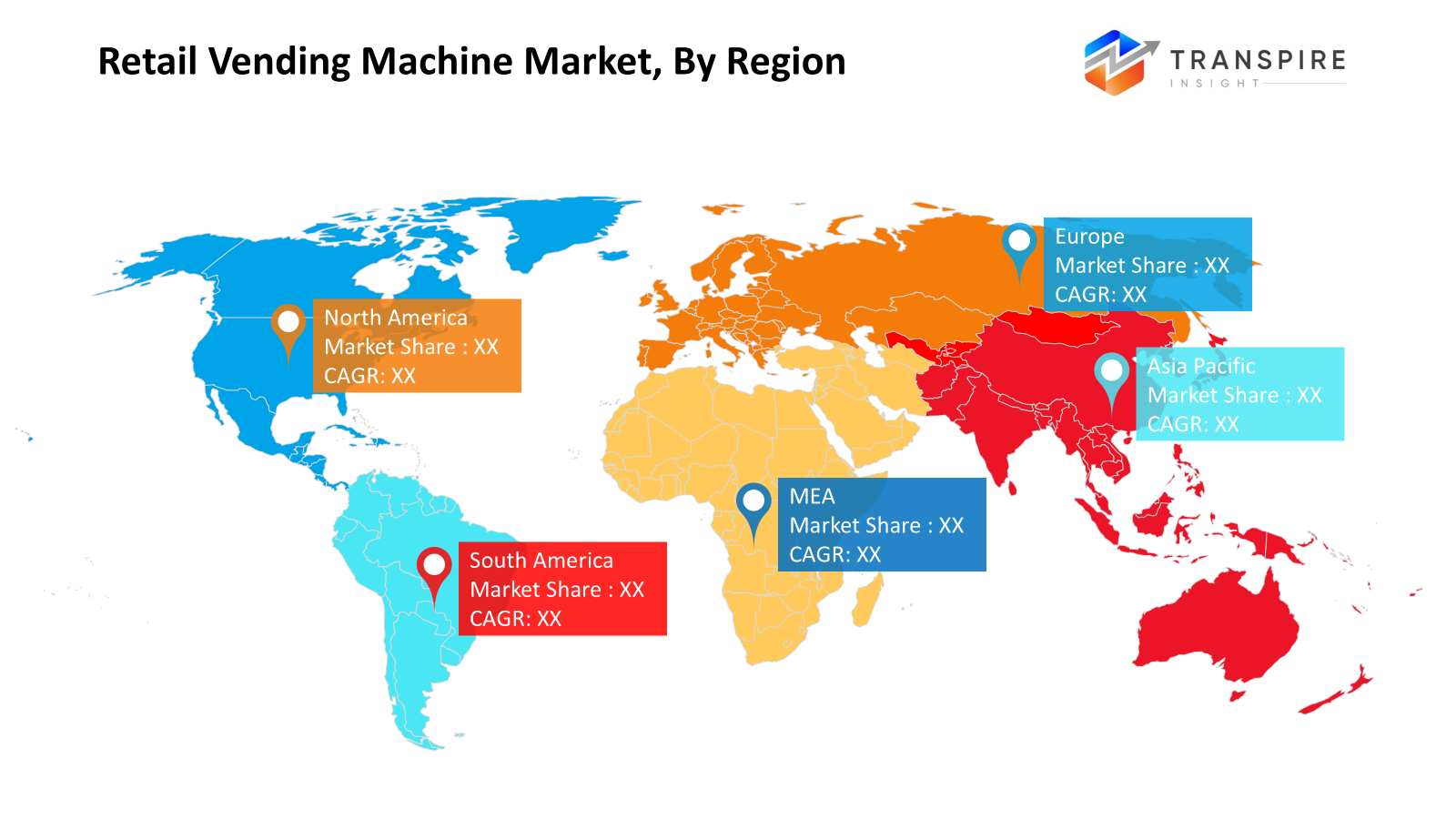

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Smart and cashless vending machines are widely used in North America due to the region's high customer demand for convenience in workplaces, public spaces, and commercial establishments. Beverage and snack vending machines are now the region's top sources of income.

- With beverages and ready-to-eat snacks dominating the consumption mix, the US leads North America in implementing AI-enabled vending systems, utilizing IoT connectivity and mobile payments, especially in businesses, educational institutions, and airports.

- Due to factors like dense urban populations, high mobile payment penetration, and robust growth in beverage and food vending machines for commercial, public, and institutional applications, the Asia Pacific market is expanding quickly, especially in China, South Korea, and Japan.

- Beverage vending machines are the most popular product category in the world because to the high frequency of purchases, the robust demand for warm and cold beverages, and the regular deployment of these machines in public areas, offices, and commercial spaces, all of which guarantee steady income creation.

- As operators prioritize real-time inventory tracking, predictive maintenance and individualized customer engagement, smart and AI-enabled vending machines are rapidly gaining traction. This allows for higher machine uptime, better assortment planning, and improved profitability in high-traffic environments.

- As customers favor contactless cards, mobile wallets, and QR-based payments more and more, cashless vending machines are driving trends in payment methods. At the same time, operators gain from quicker transactions, lower expenses associated with handling cash, better sanitation and easier access to customer purchase information.

- Commercial locations continue to be the most popular application segment as shopping centers, retail establishments, and entertainment centers use vending machines to effectively monetize foot traffic, lower staffing needs, and provide 24/7 access to snacks and beverages through multi-product smart machines.

So, Automated dispensing systems that provide beverages, snacks, prepared foods, medications, and other consumer goods in public, institutional, and commercial settings are included in the retail vending machine market. Vending machines increase customer convenience and boost shop efficiency by offering 24-hour access to goods. Traditional vending machines have been turned into smart vending systems with real-time inventory management, tailored suggestions, and cashless payments thanks to technological breakthroughs, especially the integration of AI, IoT, and touchless interfaces. This change is altering operating tactics, allowing operators to collect valuable consumer insights, minimize downtime, and maximize revenues. Targeted deployment in high-traffic areas including offices, schools, hospitals, airports, and shopping centers is made possible by the market's segmentation based on product type, technology, payment method, and application. While food and pharmaceutical vending represent new prospects in institutional settings, beverages and snacks account for the majority of product demand. Due to convenience, hygienic concerns, and the growing use of mobile wallets, payment preferences are shifting toward cashless solutions. Traditional vending machines are being quickly replaced with smart and AI-enabled ones, especially in developed areas with strong infrastructure and digital literacy. Urbanization, growing disposable incomes, and shifting customer preferences for quick, convenient, and contactless retail solutions all contribute to the market's expansion.

Retail Vending Machine Market Segmentation

By Product Type

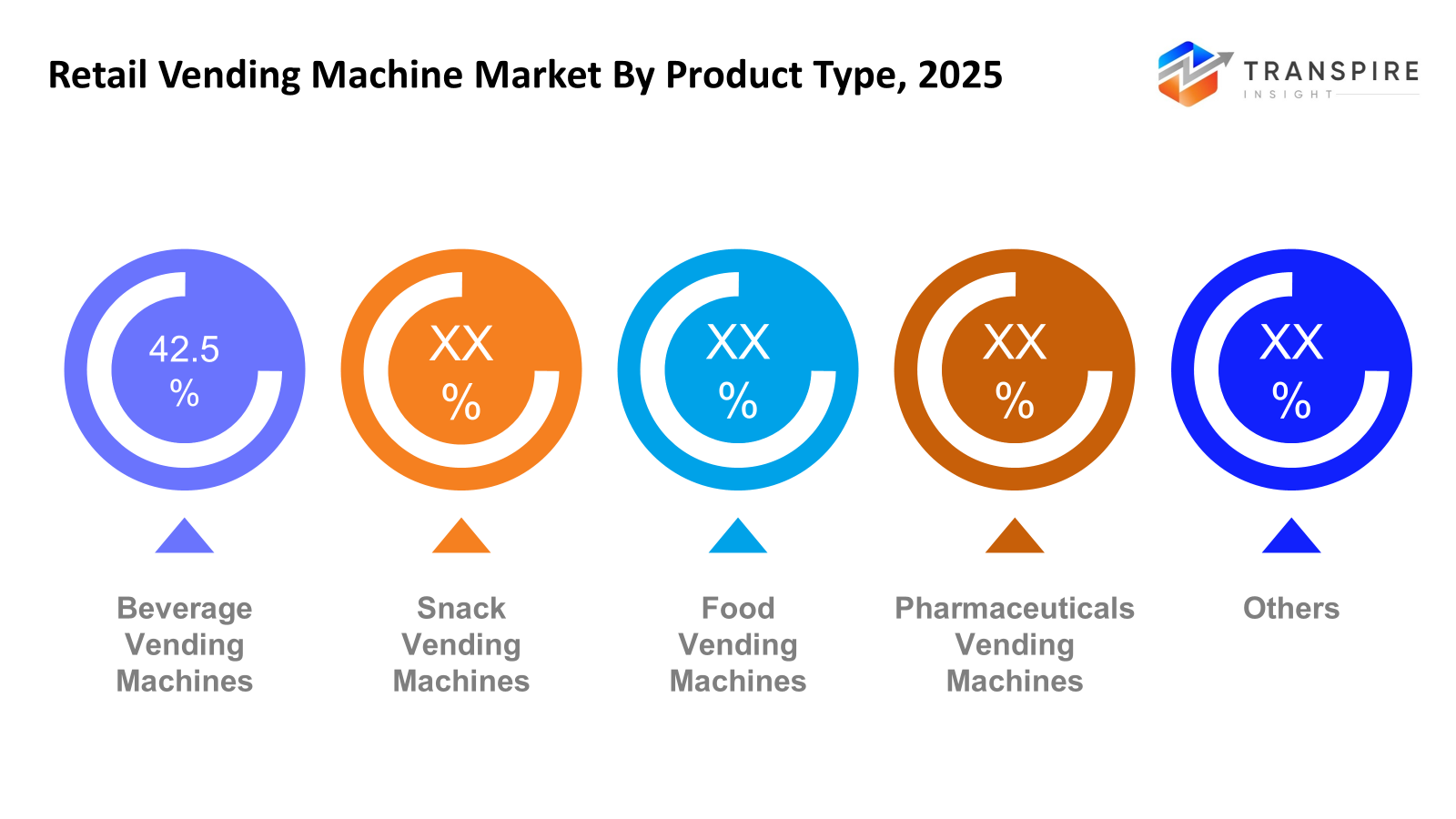

- Beverage Vending Machines

Due to the high frequency of on-the-go drink purchases, beverage vending holds a leading share globally. Refreshments, such as soft drinks, bottled water, and gourmet coffee, encourage regular use in public spaces, transit hubs, and businesses. The growth of this market is also supported by functional and health-conscious beverages.

- Snack Vending Machines

As consumer demand for quick and accessible food options increases, snack vending is growing. Campuses, offices, and retail locations experience strong development in this market, which is frequently combined with beverage machines to increase basket size per transaction. Snacks are often identified in growth estimates as one of the product mix's faster CAGR contributors.

- Food Vending Machines

Food vending machines are becoming more popular in high-traffic areas like hospitals, transit hubs, and universities, particularly those that serve fresh or prepared meals. To go beyond standard snacks and beverages, operators are increasingly using refrigerated and heated equipment.

- Pharmaceuticals Vending Machines

Pharmaceutical vending is a new market, especially in institutional settings (such offices and hospitals) where having access to over-the-counter medications and health items around-the-clock can improve convenience and service offerings. Although adoption is still smaller than for beverages and snacks, it is increasing as smart vending is integrated.

- Others

Others refers to specialist vending such as ticketing kiosks, electronics, cosmetics, and personal care products. These draw in certain customers (commuters buying phone chargers at stations, for example) and assist operators in taking advantage of non-food retail opportunities.

To learn more about this report, Download Free Sample Report

By Technology

- Traditional Vending Machines

These are still common in markets where digital penetration is lower or when deployments are cost-sensitive. In order to remain competitive, some traditional machines are updated with digital components, although most still rely on simple mechanical mechanisms and cash payment.

- Smart/AI‑Enabled Vending Machines

With their integration of IoT connectivity, touchless interfaces, remote diagnostics, and analytics for inventory optimization, smart machines represent the quickest frontier in innovation. AI elements that improve user experience and operational efficiency include dynamic pricing and tailored recommendations. Although it is growing quickly globally, adoption is higher in developed areas.

By Payment Mode

- Cash‑Based Vending Machines

Cash-based machines continue to service areas or contexts where the adoption of digital payments is lagging, notwithstanding their global decline. They are nonetheless useful for purchases with lesser transaction values and for people who are less accustomed to using cashless technologies.

- Cashless Vending Machines

Many established markets are now dominated by cashless choices, such as NFC, mobile wallets, and QR payments, due to convenience and hygienic preferences. Additionally, digital payments provide dynamic pricing and loyalty linkages, as well as deeper data collection on purchase behavior.

By Application

- Commercial Places

Due to their large foot traffic and wide range of customer needs, commercial areas such as malls, retail stores, and entertainment venues contribute significantly to income. In order to increase transaction volumes, multi-category machines (food + drinks) are becoming more prevalent here.

- Offices & Workplaces

Vending is a top priority in workplaces for employee convenience, and smart and cashless machines are commonly used to guarantee payment convenience and minimize service disruptions. Placement in industrial parks and corporate campuses has been steadily increasing.

- Public Places

Vending is used in parks, transit hubs, and other public spaces to offer 24/7 access to necessities and refreshments. In order to accommodate a variety of passenger profiles, sturdy, weather-resistant equipment and digital payments are recommended.

- Educational Institutions

Key adopters of vending machines that provide food, drinks, and increasingly healthful options include schools and institutions. Institutions may manage inventory and customize assortments to suit student tastes with the aid of smart equipment.

- Hospitals & Healthcare Facilities

Drinks and quick-need items (snacks, over-the-counter medications) must be consistently available in healthcare environments. Hygienic and cashless machine types are frequently preferred, and installation techniques prioritize simple maintenance and adherence to health regulations.

- Restaurants, Bars & Clubs

Vending machines in the hotel industry provide supplementary services, such as specialized beverages and late-night munchies, which improve customer convenience and operating income. Venue loyalty programs can be linked with smart vending to increase patron interaction.

- Others

This category includes places where vending provides additional retail options, such as residential complexes, gyms, and recreation centers. Changes in lifestyle and higher expectations for on-site shops are linked to growth in this area.

Regional Insights

The mature vending machine market in North America, which is dominated by the US, is distinguished by a strong uptake of cashless, smart, and AI-enabled systems. Similar patterns, but with slower penetration, are seen in Canada and Mexico, which concentrate on workplaces and metropolitan areas. Commercial, office, and transit hub applications are dominated by beverage and snack vending machines, while AI-driven solutions boost productivity and customer involvement. Europe is growing steadily, with its main markets being Germany, the UK, France, Spain, and Italy. While the use of smart and cashless vending machines is growing, sustainability and energy-efficient devices are becoming more and more important. Demand is continuously driven by public areas, workplaces, and commercial buildings, while the rest of Europe is progressively coming up in terms of digitalized vending infrastructure.

Japan, China, South Korea, Australia, and New Zealand are the main drivers of the largest and fastest-growing Asia Pacific area, with India and the rest of the region following closely behind. Smart food and beverage vending machines are being adopted in commercial, educational, and public settings due to high population density, urbanization, and mobile payment usage. Vending expansion is centered in metropolitan areas and business settings in South America, a rising sector led by Brazil and Argentina. Airports, shopping centers, and the hospitality industry are driving the slow adoption of the Middle East and Africa, which includes Saudi Arabia, the United Arab Emirates, and South Africa. Modernization of the infrastructure and tourism are also assisting in the growth of the market.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Building on legacy brands like Crane Merchandising Systems, National Vendors, and Dixie-Narco with a new identity and an increased emphasis on convenience and operator experience, Crane formally announced the rebranding of its vending business to Crane Convenience in order to strengthen market leadership and highlight future focus on integrated unattended retail solutions.

(Source:https://www.cranepi.com/en/news)

- In January 2026, According to Crane's official Crane Payment Innovations website, the BevMAX vending portfolio has been relaunched in the United States, bringing product lines into compliance with the National Automatic Merchandising Association's (NAMA) new energy criteria. In order to improve sustainability and compliance, this action updates beverage vending machines.

(Source:https://www.craneconvenience.com/spotlight/article/press-release)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 24.50 Billion |

|

Market size value in 2026 |

USD 26.80 Billion |

|

Revenue forecast in 2033 |

USD 51.20 Billion |

|

Growth rate |

CAGR of 9.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Fuji Electric Co., Ltd., Crane Merchandising Systems Ltd., Sanden Holdings Corp., Azkoyen Group, Royal Vendors, Inc., Seaga Manufacturing, Inc., Bianchi Industry S.p.A., Jofemar Corporation, FAS International S.p.A., Sielaff GmbH & Co. KG, N&W Global Vending S.p.A. (Evoca Group), Westomatic Vending Services Ltd., Automated Merchandising Systems, AUCMA, Deutsche Wurlitzer GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Beverage Vending Machines, Snack Vending Machines, Food Vending Machines, Pharmaceuticals Vending Machines, Others), By Technology (Traditional Vending Machines, Smart/AI‑Enabled Vending Machines), By Payment Mode (Cash‑Based Vending Machines, Cashless Vending Machines) and By Application (Commercial Places, Offices & Workplaces, Public Places, Educational Institutions, Hospitals & Healthcare Facilities, Restaurants, Bars & Clubs, Others) |

Key Retail Vending Machine Company Insights

One of the top manufacturers of vending machines in the world, Fuji Electric Co., Ltd. is known for its cutting-edge, intelligent, and energy-efficient systems that are used in North America, Europe, and Asia Pacific. IoT-enabled beverage and snack vending machines with cashless payment interfaces, telemetry, and remote monitoring are part of the company's offering, which improves uptime and operational efficiency. Fuji Electric is a popular option for high-traffic commercial and public settings because of its excellent engineering pedigree, which supports innovations like bilingual touchscreens and hydrogen-powered vending machines.

Key Retail Vending Machine Companies:

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems Ltd.

- Sanden Holdings Corp.

- Azkoyen Group

- Royal Vendors, Inc.

- Seaga Manufacturing, Inc.

- Bianchi Industry S.p.A.

- Jofemar Corporation

- FAS International S.p.A.

- Sielaff GmbH & Co. KG

- N&W Global Vending S.p.A. (Evoca Group)

- Westomatic Vending Services Ltd.

- Automated Merchandising Systems

- AUCMA

- Deutsche Wurlitzer GmbH

Global Retail Vending Machine Market Report Segmentation

By Product Type

- Beverage Vending Machines

- Snack Vending Machines

- Food Vending Machines

- Pharmaceuticals Vending Machines

- Others

By Technology

- Traditional Vending Machines

- Smart/AI‑Enabled Vending Machines

By Payment Mode

- Cash‑Based Vending Machines

- Cashless Vending Machines

By Application

- Commercial Places

- Offices & Workplaces

- Public Places

- Educational Institutions

- Hospitals & Healthcare Facilities

- Restaurants, Bars & Clubs

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636