Market Summary

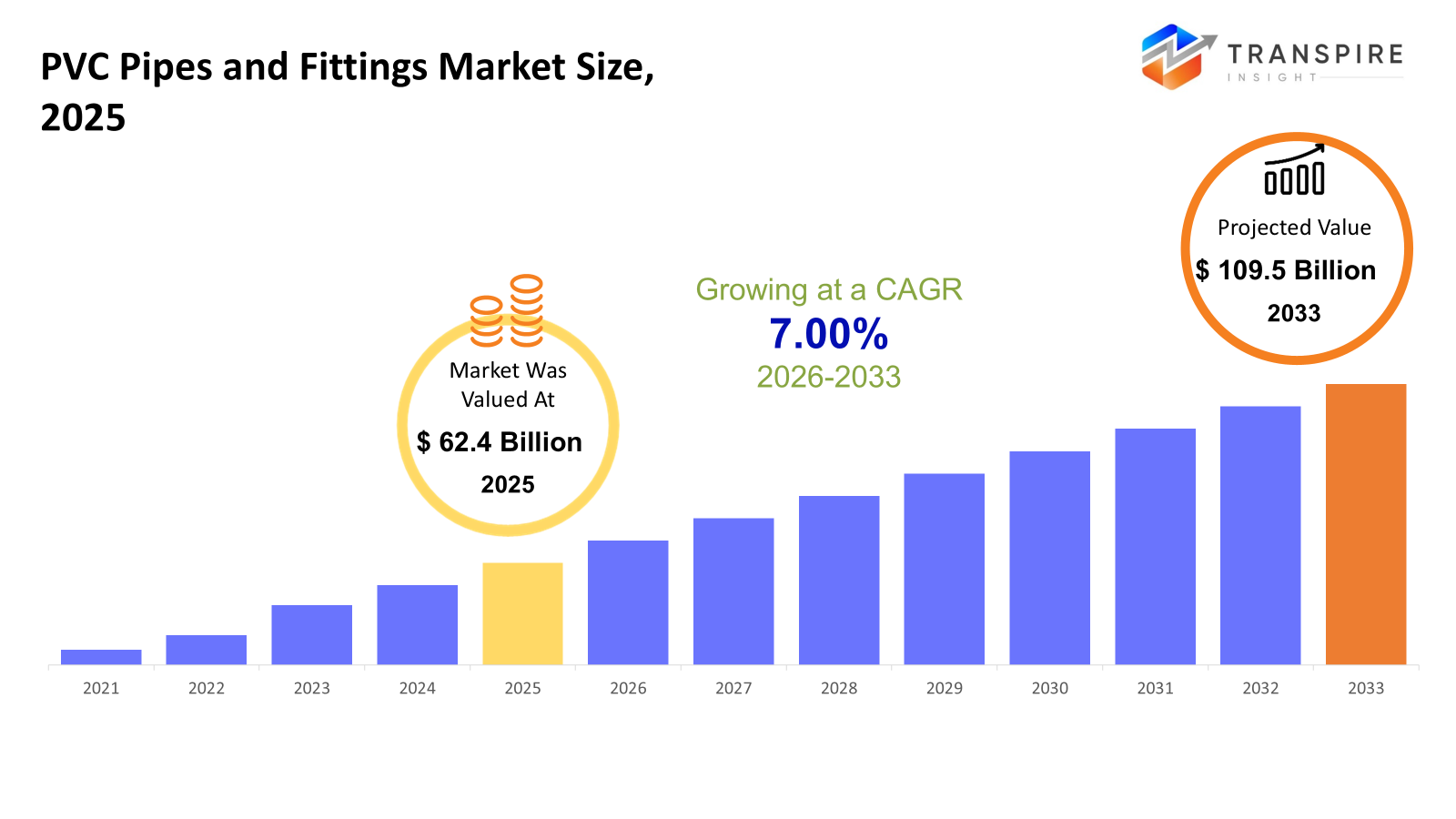

The global PVC Pipes and Fittings market size was valued at USD 62.4 billion in 2025 and is projected to reach USD 109.5 billion by 2033, growing at a CAGR of 7.00% from 2026 to 2033. PVC Pipes and Fittings Market has a steady growth trend measured in terms of a constant growth rate of expansion. This is majorly contributed to by rapid growth in infrastructure development activities. This growth also contributes to increased demand for robust but cost-effective solutions, which PVC Pipes and Fittings meet. Government initiatives promoting sanitation, water conservation, and reduced maintenance also contribute to the growth of this market. This is mainly due to the fact that PVC Pipes and Fittings can be efficiently applied in residential as well as commercial settings. Recently, innovations have also been made in PVC Pipes and Fittings; CPVC is a PVC type developed to increase system efficiency.

Market Size & Forecast

- 2025 Market Size: USD 62.4 Billion

- 2033 Projected Market Size: USD 109.5 Billion

- CAGR (2026-2033): 7.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has a steady rate of growth, primarily based on infrastructure investments and replacement of aged and outdated infrastructure with new products. Also, North America supports a strong market in water supply system expansions and residential building projects in the United States.

- S. leads the adoption in North America through water management in municipalities, modernizing the infrastructure in the region, as well as replacing old pipelines. Canada and Mexico follow with residential as well as industrial projects.

- Rapid urbanization in Asia Pacific countries such as China, India, and South Korea, as well as increased agriculture and infrastructure development, is set to generate highest growth potential for PVC and CPVC systems in these regions.

- PVC Pipes is witnessing greater demand for water supply, sewage systems, and industrial applications owing to durability and ease of fitting. Fittings are gaining popularity for providing secure connections and maximum efficiency.

- UPVC usage persists owing to cost-effectiveness and rigid structure; CPVC usage is gaining more appeal to be used in fire sprinkler and hot water systems; advanced PVC blends have started gaining prominence in implementing them in high-pressure and industrial segment usage, reflecting the technological evolution.

- Water supplies and water distributions/services, along with sewerage/s Sewage Systems, continue to be the top application areas with urbanization, sanitary living habits, and changes in irrigation techniques contributing to growth. Plumbing/HVAC Systems and Industrial Systems continue to show steady growth through the construction industry/chemicals.

- The residential and municipal end-use areas are driving market adoptions with building projects creating demand, and industrial, commercial, and agricultural segments providing sustaining market.

So, The PVC Pipes and Fittings Market encompasses industries concerning the manufacturing and marketing of piping systems based on materials derived from or containing polyvinyl chlorides that are typically used for conveying fluids and/or providing drainage and security services for different types of infrastructure and installations at residential homes, commercial complexes, industries or factories, agricultural farms or farmlands, and towns or cities as a whole. The use of PVC and CPVC materials is widespread owing to various influential advantages these materials carry over others primarily metals and concretely-based materials in terms of cost and weight considerations.

Market demand for PVC pipes has a close association with overall construction activities, urbanization trends, and investments made in public infrastructure development. Increases observed in the expansion of residential schemes, upgradations made to local government utilities, and additions made to the portfolio of industrial schemes continue to sustain a demand for PVC products. Similarly, technological improvements made to molecularly oriented PVCs and technological upgrades to overall CPVCs increase the tolerance to specific working conditions, thereby translating to more valuable uses for the product. The graph indicates a smoothly increasing pattern in the growth rate, backed by addition in mature markets as well as addition in emerging markets. Inconsistencies in the prices of Raw Materials as well as environmental compliance are areas of difficulty, however, the fact that diversified uses ensure a resistant nature augurs well in the long run as it would be part of a cornerstone in future development in infrastructure and constructions throughout the world.

PVC Pipes and Fittings Market Segmentation

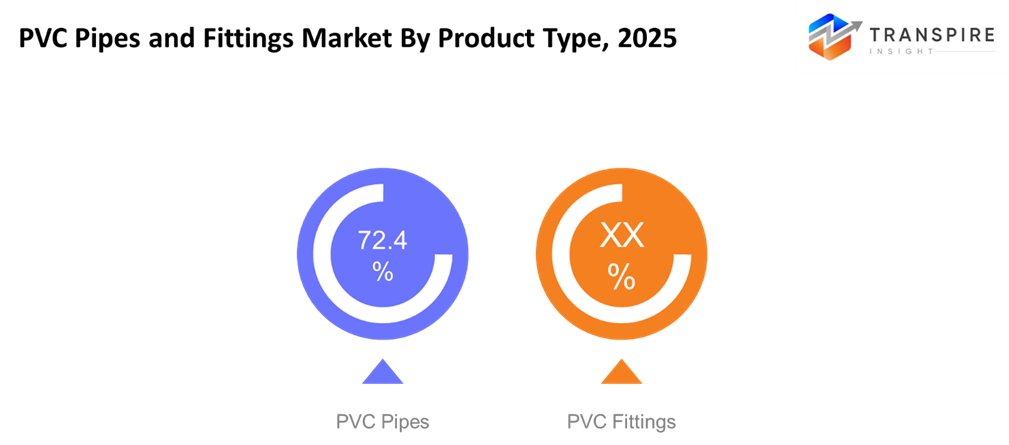

By Product Type

- PVC Pipes

The market share of PVC pipes is quite high due to their long-life, rust-resistant, and easily installable advantage. These pipes are employed in various sectors, from water supply systems to sewerage, irrigation, and industrial sectors, which cover residential as well as municipal needs.

- PVC Fittings

Fitting sets complete the various piping systems, allowing a leak-proof and flexible design to be achieved. It also increases the demand because of expanding construction needs, as well as industries that require joint fitting systems.

To learn more about this report, Download Free Sample Report

By Material Type

- Unplasticized PVC/UPVC

UPVC is preferred due to its rigidity and cost-effectiveness. PVC is used to distribute water and to make sewage systems. Its consumption is dominated by construction needs.

- CPVC (Chlorinated PVC)

CPVC has good heat resistance properties; hence, it is used in hot water systems and fire sprinkler systems. Though CPVC has better properties than regular PVC, it is expensive.

- Other Material Blends

PVC-O, Modified PVC: Advanced material blends such as PVC-O boast improved pressure tolerances as well as impact resistance capabilities. These material blends find application in industrial and municipal projects.

By Application

- Water Supply & Distribution

The largest application segment is still water supply and distribution, especially owing to urbanization and development of infrastructures, replacement of old pipes with corrosion-free PVC alternatives.

- Sewerage and Drain Systems:

Due to rising awareness of sanitation hygiene and government initiatives, the PVC pipe is widely used in municipal and industrial drainage projects to replace conventional pipes on account of their longevity and chemical resistance.

- Plumbing & HVAC

The segment positively benefits from the growth in residential and also commercial construction, where the PVC and CPVC pipes are a cost-effective, light, and easy-to-handle solution.

- Agricultural Irrigation

An increase in the scale of agriculture and the development of irrigation infrastructure are driving growth in the market, especially in the Asian Pacific and Latin American regions.

- Industrial Fluid Handling

PVC's resistance to chemicals provides it with excellent capability to handle corrosive fluids, acids, and chemicals in industrial settings, thus fueling industry growth in this field.

- Cable Protection & Conduit

PVC cables are becoming more prominent in the upkeep of both telecommunication cables and electricity cables due to the rise in smart city infrastructures.

- Chemical Processing

PVC as well as CPVC piping materials are used in chemical processing systems to handle corrosive fluids.

- Fire Sprinkler Systems (CPVC)

CPVC is widely selected for fire safety systems, as it has resistance to heat, is safe, and performs better in high-heat applications.

By End Use

- Residential Construction

PVC products seem to gaining acceptance and growth in line with the development of apartment buildings.

- Commercial Construction

With many commercial sites like office complexes, shopping malls, and hotels relying on PVC/CPVC pipes to carry out their water supply, HVAC, and drainage work, their preference stems largely from the cost-efficient nature of this material.

- Municipal & Utilities

Large city projects and government programs require PVC pipes for water, wastewater, and storm water needs because of their longevity and reduced maintenance.

- Industrial & Manufacturing

In industrial plants, PVC pipes are generally used to handle chemicals, water, and process fluids, incorporating the resilience of the material.

- Agriculture

PVC is in use in the agricultural sector for irrigation systems as well as the distribution of water in various agricultural settings, with a major emphasis on enhancing farming practices in targeted regions.

Regional Insights

North America, including the United States, Canada, and Mexico, has a developed market with infrastructure upgrades, regulatory mandates, replacements, as well as a robust market within municipal water treatment systems, residential construction, and fire sprinklers. Though the United States is a major contributor in this region due to a huge volume of rehabilitation activities for aging infrastructure, Canada focuses on water treatment compliance, while Mexico boasts of growth rates resulting from increased city expansion and industrial development. Overall, the region comprising Europe, including countries such as Germany, the United Kingdom, France, Spain, Italy, and Rest of Europe, reflects relatively stable demand. These economies have high building standards to follow and sustainability requirements. Western European countries have the highest quality-driven adoption rates. On the other hand, eastern European countries have seen gradual growth in terms of developing new infrastructures.

Asia Pacific, including Japan, China, Australia & New Zealand, South Korea, India, and Rest of Asia Pacific, is a growing market with rapid growth in terms of urbanization, industrialization, and modernization in agriculture. China and India are focusing on large-scale water supply and sanitation projects, and developed countries are focusing on more efficient and technologically advanced piping products. While South America including Brazil, Argentina, and Rest of South America registers a moderate growth rate due to investments in municipal water infrastructure investments and irrigation systems, its major contributor is Brazil. The Middle East & Africa, including Saudi Arabia, United Arab Emirates, South Africa, and Rest of MEA, is also registering a healthy growth rate due to investments in urban development, water management, and infrastructure investments in water-scarce and high-temperature regions.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, After facing flat revenue growth in the previous year, manufacturers of polyvinyl chloride (PVC) pipe and fittings in the organized sector are anticipated to show improvement in the present fiscal year amidst healthy demand in major end-user segments and a stable pricing scenario. The improvement in demand situations has prompted dealers to begin restocking, thereby allowing pipe & fittings manufacturers to clear high inventory built up during a volatile pricing scenario in the previous year. This normalisation in inventory levels is likely to help partially absorb the almost 130 basis point operating margin decline reported during the last fiscal.

- In May 2024, Westlake Pipe & Fittings, a division of Westlake Corporation (NYSE: WLK), has made an important announcement regarding its further expansion into the industry by planning to establish a state-of-the-art production site for molecular-oriented polyvinyl chloride (PVCO) resin at its existing site in Wichita Falls, TX. The company’s expansion project clearly indicates its further direction in the industry by focusing on more innovative technologies for creating high-quality pipelines to maximize its workforce within the state itself.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 62.4 Billion |

|

Market size value in 2026 |

USD 68 Billion |

|

Revenue forecast in 2033 |

USD 109.5 Billion |

|

Growth rate |

CAGR of 7.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

JM EAGLE, INC., Aliaxis Holdings SA, China Lesso Group Holdings Limited, Orbia, Georg Fischer Ltd., The Supreme Industries Limited, Sekisui Chemical Co., Ltd., Finolex Industries Ltd., Astral Limited, Westlake Corporation, NIBCO Inc., IPEX Inc., Formosa Plastics Corporation, Wavin, Prince Pipes and Fittings Ltd |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (PVC Pipes, PVC Fittings), By Material Type (UPVC (Unplasticized PVC), CPVC (Chlorinated PVC), Other material blends (PVC‑O, modified PVC)), By Application (Water Supply & Distribution, Sewage & Drainage Systems, Plumbing & HVAC, Agricultural Irrigation, Industrial Fluid Handling, Cable Protection & Conduit, Chemical Processing, Fire Sprinkler Systems) and By End Use (Residential Construction, Commercial Construction, Municipal & Utilities, Industrial & Manufacturing, Agriculture) |

Key PVC Pipes and Fittings Company Insights

JM EAGLE, INC. substantially acknowledged as a prominent player in the PVC Pipes and Fittings Market in consideration of its overall strength as a major manufacturer with deep reach in America as well as increasing global presence; the overall portfolio of its offerings in the PVC Pipes and Fittings Market also presents diversified scope for end-use segments in consideration of its overall application scope in water supply systems, sewage systems, irrigation systems, industrial systems, electric conduits, as well as natural gas systems. Apart from this, its key area of emphasis on innovation in line with high-performance as well as sustainable application would also essentially inject a higher level of operational resilience as well as overall business sustainability in a highly competitive PVC Pipes and Fittings Market.

Key PVC Pipes and Fittings Companies:

- JM EAGLE, INC.

- Aliaxis Holdings SA

- China Lesso Group Holdings Limited

- Orbia

- Georg Fischer Ltd.

- The Supreme Industries Limited

- Sekisui Chemical Co., Ltd.

- Finolex Industries Ltd.

- Astral Limited

- Westlake Corporation

- NIBCO Inc.

- IPEX Inc.

- Formosa Plastics Corporation

- Wavin

- Prince Pipes and Fittings Ltd

Global PVC Pipes and Fittings Market Report Segmentation

By Product Type

- PVC Pipes

- PVC Fittings

By Material Type

- UPVC (Unplasticized PVC)

- CPVC (Chlorinated PVC)

- Other material blends (PVC‑O, modified PVC)

By Application

- Water Supply & Distribution

- Sewage & Drainage Systems

- Plumbing & HVAC

- Agricultural Irrigation

- Industrial Fluid Handling

- Cable Protection & Conduit

- Chemical Processing

- Fire Sprinkler Systems

By End Use

- Residential Construction

- Commercial Construction

- Municipal & Utilities

- Industrial & Manufacturing

- Agriculture

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr.png)

APAC:+91 7666513636

APAC:+91 7666513636