Market Summary

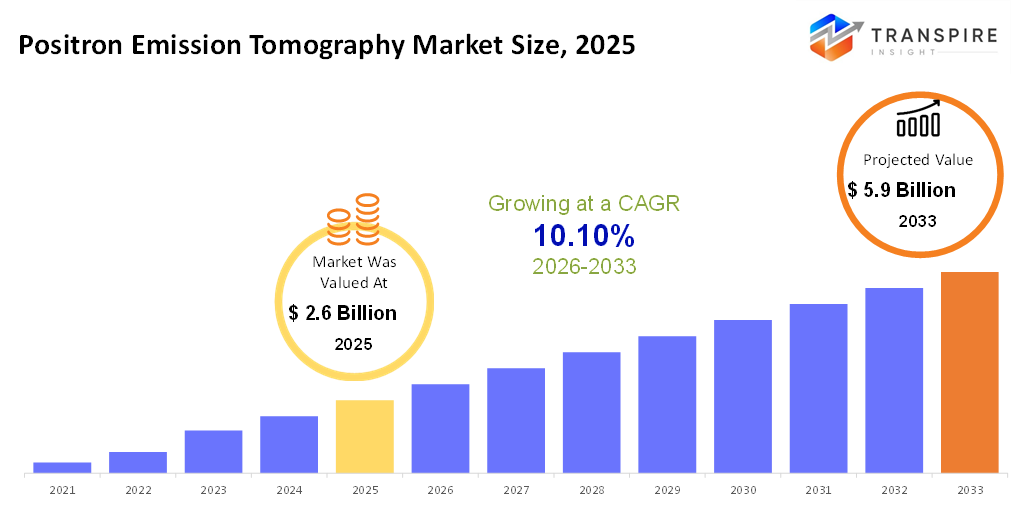

The global Positron Emission Tomography Market size was valued at USD 2.6 billion in 2025 and is projected to reach USD 5.9 billion by 2033, growing at a CAGR of 10.10% from 2026 to 2033. Positron Emission Tomography Scanner is an important part of the entire medical imaging market. PET imaging helps in diagnosing a variety of diseases at an early stage on the molecular level. It provides a chance to visualize metabolic activities happening inside the body with the help of radio tracers, which is impossible with any other imaging procedure. Increasing stakes of chronic diseases, demands for early diagnostic procedures for diseases, and presence of cutting-edge technology in the domain of PET imaging are the major factors driving the growth in the PET market. It includes imaging systems that are designed in a combination of PET scanning along with CT scanning or MR scanning. Increased investment in the construction of healthcare infrastructure and awareness of the requirement for PET imaging within the healthcare industry are two major factors in the positron emission tomography scanner market.

Market Size & Forecast

- 2025 Market Size: USD 2.6 Billion

- 2033 Projected Market Size: USD 5.9 Billion

- CAGR (2026-2033): 10.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is the main driver of the market due to its well-advanced digital healthcare infrastructure, involving the presence of smartphones and the Internet in the region, as well as the dominance of key players in the digital healthcare and pharma market. Moreover, the region is witnessing supportable government reimbursements and acceptance of software-based therapies.

- The United States dominates the regional market in North America with significant investments in digital therapies by healthcare payers, healthcare providers, and employers in validated digital therapies for various diseases. Additionally, regulatory frameworks by government bodies such as the FDA facilitate quicker launches of digital therapies for various diseases through prescriptions.

- The strong digital infrastructure and readiness on the part of consumers drive rapid adoption in the region. Also, patients are increasingly comfortable using treatments driven by software, and healthcare systems are proactive in incorporating digital tools into routine care.

- Regulatory and clinical validation in the US, for example, where doctors could prescribe software solutions to patients affected by chronic and behavioural disorders, supported the wide acceptance and commercial success of digital healthcare.

- The fastest growth is delivered by the Asia Pacific region due to the growing prevalence of chronic diseases, telemedicine, and supportive policies in China, Japan, South Korea, and India. Cellular technology's affordable solutions for the health sector contribute to furthering their growing popularity within the region.

In conclusion, the market for digital therapies is driven by the strong infrastructure of digital healthcare and the uptake of technologies and supports, largely in the North American and US markets. Support from massive digital healthcare and pharma companies and the encouraging reimbursement models help in the fast-tracked commercialization of the large scale. Simultaneously, the Asia-Pacific market experiences a substantial rise in the market because of the rising number of patients suffering from chronic ailments and the digitalization of their strategies of healthcare, led by the governments of these countries. Among all the geographical regions, the chronic disease management is the most prominent application sector of digital therapy solutions owing to the rising ability of digital therapy solutions in closely monitoring and managing the patients at an optimal scale.

Positron Emission Tomography Market Segmentation

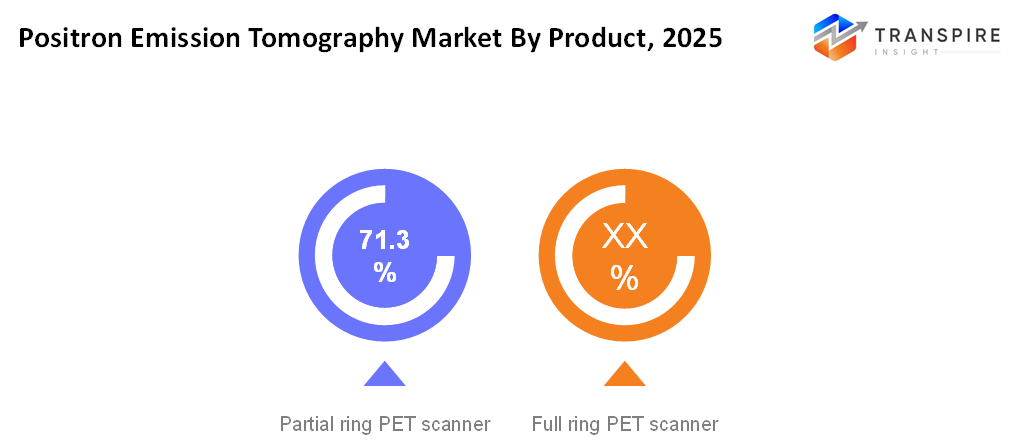

By Product Type

- Partial Ring PET Scanner

In partial ring PET scanners, there are fewer detector modules. This helps to reduce the cost of the machines and has found applications in applications that call for only limited or specialized imaging.

- Full Ring PET Scanner

Full-ring scanners provide full detector coverage and allow higher sensitivity, fast scanning time, and better image quality for routine clinical purposes.

To learn more about this report, Download Free Sample Report

By Detector Type

- LSO (Lutetium Oxyorthosilicate)

LSO crystals are widely used in PET scanners due to their high light output and fast decay time.

- Silicon Photomultiplier (SiPM)

SiPM technology improves the resolution and timing performances in PET images, while enabling designs of compact, energy-efficient, and digital PET systems.

- Lutetium Yttrium Orthosilicate (LYSO)

LYSO is one of the highly PET detector materials because of its excellent sensitivity, high stopping power, and reliability in hybrid PET systems.

- Digital Photon Counters

DPCs enable fully digital PET imaging with improved timing resolution, reduced noise, and increased image sharpness for new clinical applications.

- Others

This includes other scintillators and detector technologies that are considered for specialized or cost-sensitive PET systems, as well as on-going research applications.

By End-User

- Hospitals

Inflow of patients is high in hospitals along with a growing demand for advanced imaging in cancer, cardiac, and neurological diagnosis, as well as in treatment monitoring.

- Diagnostic Centers

These centers provide specialty, high-volume PET imaging with improved access through referral-based and cost-efficient diagnostic solutions.

- Ambulatory Surgical Centers

ASCs, on the other hand, use PET scans mainly for pre-operative assessment and follow-up care; this finds support in the growing shift toward outpatient procedures.

- Others

Most of the research institutes and academic centers use PET imaging for clinical research, development of new radio tracers, and advanced disease studies.

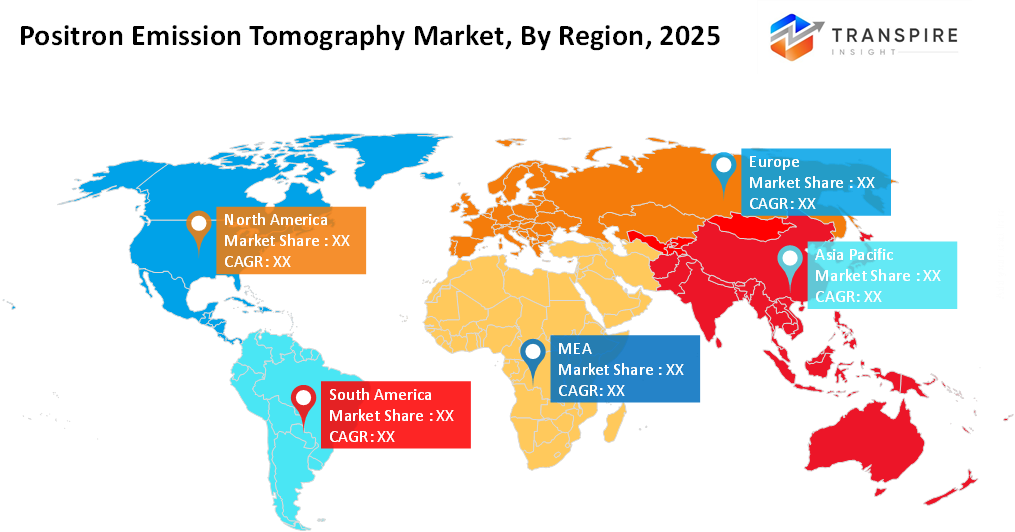

Regional Insights

The global PET market is dominated by North America owing to its superior healthcare infrastructure, high prevalence of cancers and neurological disorders, and adoption of latest advancements in diagnostic equipment such as PET scans. Additonally, reimbursement policies and widespread use of combined models such as PET-CT and PET-MRI, along with high R&D investments, also bolster the leadership of North America in the market. The United States has a major role in North America’s dominating position in the global PET market due to established clinical use and strong oncology and cardiovascular imaging facilities in the country.

Europe The European market has an important role in the PET market. Well-established healthcare infrastructure and supportable government programs for cancer screening and treatment in the European regions are responsible for the growth of the PET market. Western European countries such as Germany, France, the UK, and Italy support the PET market in the European regions. Even though reimbursement varies from country to country in the European regions, investments in the field of medical imaging are fostering the PET market. The Asia Pacific market represents one of the fastest-growing PET markets because of increasing healthcare infrastructure, healthcare spending, and awareness of early diagnosis of diseases by patients in this region. China, Japan, India, and South Korea are experiencing a significant adoption of PET imaging because of rapidly increasing cancer care facilities in this region and government support for such medical services in their countries. The presence of untapped markets in this region also supports expansion in this region.

To learn more about this report, Download Free Sample Report

Recent Development News

- In November 2024, Positron partnered with Upbeat Cardiology Solutions in order to expand its cardiac PET-CT offerings. The strategy aimed at utilizing company’s NeuSight PET-CT 64 slice scanner to offer highest level of imaging care to the patients. Thus, gaining competitive advantage.

- In November 2025: GE HealthCare received CE Mark for its Omni 128 cm total-body PET/CT system, enhancing precision oncology imaging.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.6 Billion |

|

Market size value in 2026 |

USD 3 Billion |

|

Revenue forecast in 2033 |

USD 5.9 Billion |

|

Growth rate |

CAGR of 10.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Canon Medical Systems Corporation, CMR Naviscan, Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips, Mediso, Minfound Medical Systems, Molecubes, Neusoft Corporation, Oncovision, Positron, Radialis, Siemens Healthineers, Toshiba International Corporation, Yangzhou Kindsway Biotech |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Partial ring PET scanner, Full ring PET scanner), By Detector Type (Lutetium oxyorthosilicate (LSO), Silicon photomultiplier (SiPM), Lutetium yttrium orthosilicate (LYSO), Digital photon counters (DPC), Other) By End Use (Hospitals, Diagnostic centers, Ambulatory surgical centers, Other) |

Key Positron Emission Tomography Company Insights

With its broad portfolio-including IoT-enabled precision equipment, autonomous machinery, and data analytics platforms-Deere & Company is a clear market leader. Its global presence and significant investment in research and development allow the company to continue to innovate, providing scalable solutions for farmers that help improve operational efficiency and sustainability. Deere's ability to integrate hardware and software ecosystems provides a competitive advantage, which fosters wide diffusion across large commercial farms worldwide.

Key Positron Emission Tomography Companies:

- Canon Medical Systems Corporation

- CMR Naviscan

- Fujifilm Holdings Corporation

- GE Healthcare

- Koninklijke Philips

- Mediso

- Minfound Medical Systems

- Molecubes

- Neusoft Corporation

- Oncovision

- Positron

- Radialis

- Siemens Healthineers

- Toshiba International Corporation

- Yangzhou Kindsway Biotech.

Global Positron Emission Tomography Market Report Segmentation

By Product

- Partial ring PET scanner

- Full ring PET scanner

By Detector Type

- Lutetium oxyorthosilicate (LSO)

- Silicon photomultiplier (SiPM)

- Lutetium yttrium orthosilicate (LYSO)

- Digital photon counters (DPC)

- Other

By End User

- Hospitals

- Diagnostic centers

- Ambulatory surgical centers

- Other

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636