Market Summary

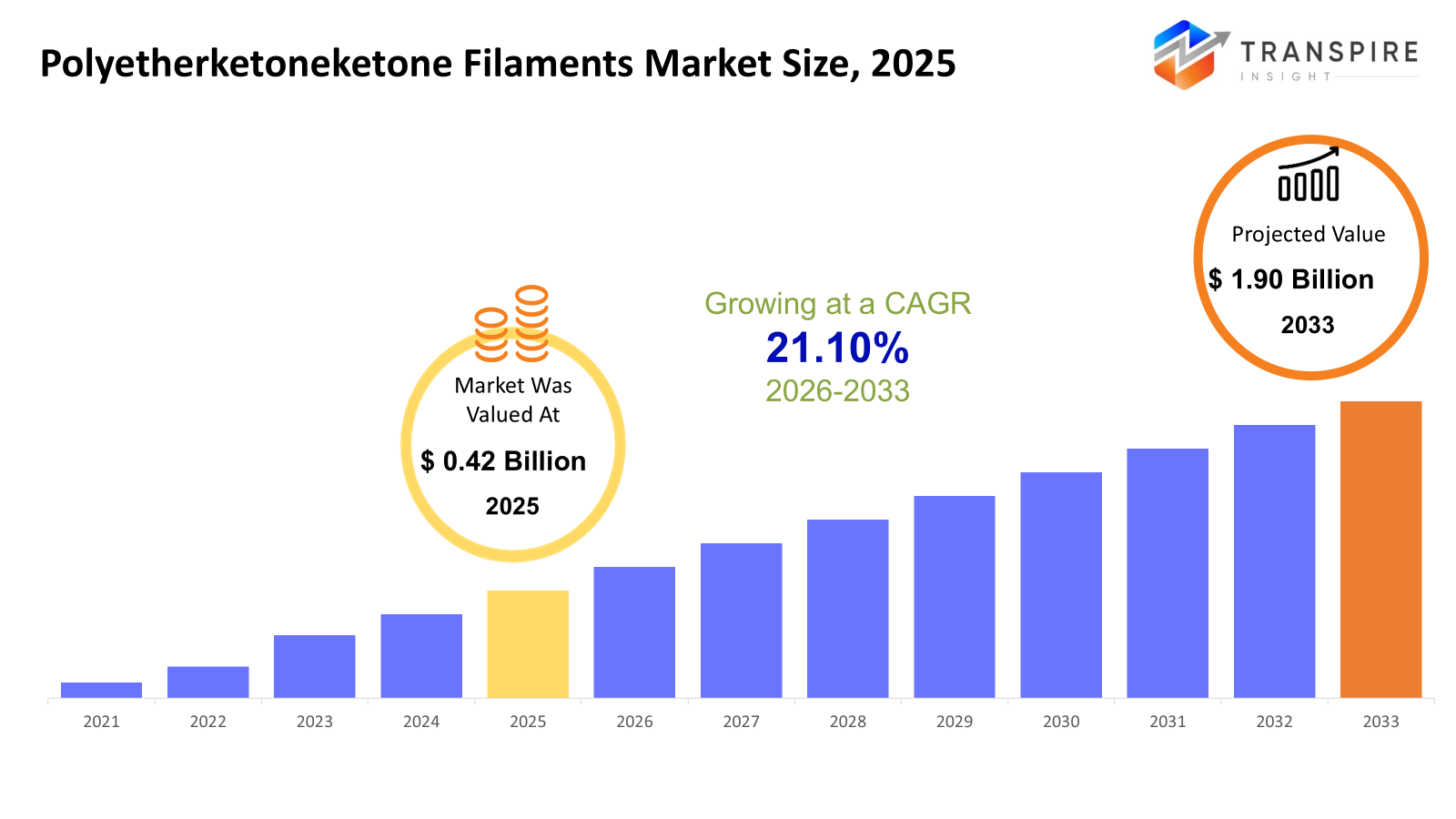

The global Polyetherketoneketone Filaments market size was valued at USD 0.42 billion in 2025 and is projected to reach USD 1.90 billion by 2033, growing at a CAGR of 21.10% from 2026 to 2033. The increasing usage of high-performance thermoplastics in aerospace, automotive, and industrial additive manufacturing is fueling the growth of the market, with PEKK filaments showing superior thermal, chemical, and mechanical properties to conventional polymer filaments

Market Size & Forecast

- 2025 Market Size: USD 0.42 Billion

- 2033 Projected Market Size: USD 1.90 Billion

- CAGR (2026-2033): 21.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has shown high levels of market maturity with the presence of well-developed aerospace manufacturing infrastructures, high adoption rates of additive manufacturing technologies, and ongoing investments in high-performance polymers.

- The United States is the leading contributor to the North American market with high aerospace, defense, and medical manufacturing industries, driven by research and development activities, early adoption of high-performance materials, and ongoing developments with the addition of high-temperature thermoplastics to additive manufacturing applications.

- The Asia-Pacific market is the fastest-growing market with high growth rates driven by the expansion of industrial manufacturing capacities, growth of automotive manufacturing industries, and ongoing investments in aerospace developments in countries like China, Japan, Korea, and India, where additive manufacturing technology is showing high growth rates of adoption.

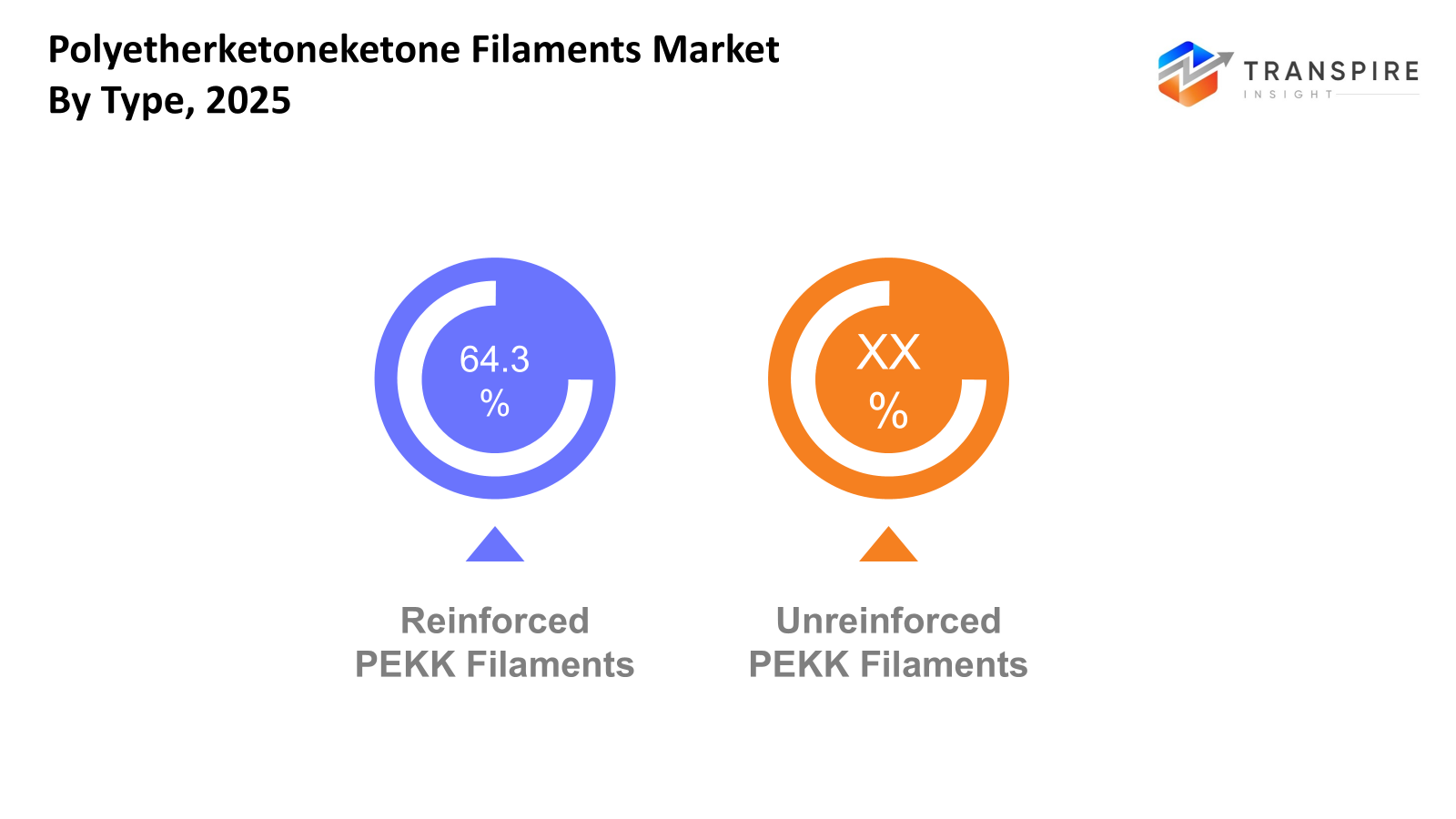

- Reinforced PEKK holds the largest share of the market, with industries focusing on improving mechanical performance, reducing weights, and improving the durability of structures, especially in the aerospace and manufacturing industries, where the addition of reinforcements offers better performance in the lifecycle of the components.

- Carbon Fiber Reinforced PEKK Filaments are expected to witness promising growth trends, as they offer the ability to optimize performance, especially in the pursuit of improving the strength-to-weight ratios and thermal performance, thus aiding the development of lightweight structures in the aerospace and automotive industries.

- Aerospace components again form a key application segment, as PEKK filaments help in the production of lightweight, flame-retardant, and high-temperature-resistant components, allowing companies to simplify assembly complexity while ensuring regulatory compliance and operational efficiency in advanced aircraft manufacturing and maintenance operations.

- Aerospace and defense end-use industry demand for PEKK filaments will continue to be driven by the increasing adoption of additive manufacturing by companies, allowing for rapid production, component optimization, and efficiency, thereby facilitating the adoption of advanced thermoplastic filaments meeting strict mechanical and environmental performance demands.

So, The Polyetherketoneketone (PEKK) filaments market is a niche segment of the market for advanced polymer materials, which are used in various applications, particularly in additive manufacturing. PEKK filaments are desirable materials in the market due to their superior thermal, chemical, and mechanical properties. These materials are desirable in various applications where conventional thermoplastics cannot meet the performance demands. The compatibility of the materials with industrial-grade 3D printing technologies has also fueled the adoption of the filaments in various industries.

The market has been driven by the increasing demand for materials that are lightweight and possess superior properties. The materials are in demand in various industries, particularly in the aerospace, automotive, and healthcare sectors. The materials allow the production of complex geometries while minimizing waste materials. Moreover, the materials enable the enhancement of efficiency in the production process. The materials also enable the reduction of production lead times. Advances in additive manufacturing technologies also enable the expansion of the potential applications of the materials in functional and end-use components. Moreover, the focus on customization, rapid prototyping, and decentralized manufacturing is also helping to drive the market. As the industries are moving more and more towards digital manufacturing technologies, the role of PEKK filaments is becoming more important as these can provide performance under high mechanical and thermal stress conditions. The innovation being achieved in reinforcement technology is also helping to drive the market.

Polyetherketoneketone Filaments Market Segmentation

By Type

- Reinforced PEKK Filaments

Reinforced PEKK filaments are the most popular filaments because they possess higher strength, thermal stability, and dimensional stability. These filaments are commonly used in applications where high-performance materials are needed, which are also lightweight and possess higher strength. Reinforced PEKK filaments are commonly used in the aerospace industry and industrial manufacturing.

- Unreinforced PEKK Filaments

Unreinforced PEKK filaments are commonly used in applications where design flexibility, chemical resistance, and ease of processing are needed. These filaments are commonly used in prototyping and applications where temperature resistance is a requirement. The increasing demand from the medical and electrical industries also contributes to the increasing demand for unreinforced PEKK filaments, which are pure materials.

To learn more about this report, Download Free Sample Report

By Reinforcement Type

- Carbon Fiber Reinforced

Carbon fiber reinforced PEKK filaments have a major market share due to their high strength to weight and thermal stability. These materials are used in the aerospace and automotive industries to minimize weight and maximize strength. The increasing demand for these materials in performance-driven industries is fueling their growth.

- Glass Fiber Reinforced

Glass fiber reinforced PEKK filaments have a high stiffness and dimensional stability, and they are relatively inexpensive compared to carbon fiber reinforced filaments. These materials are used in industrial tooling and electrical components, where mechanical strength and insulation are critical. Their cost efficiency is fueling their growth in industrial applications.

- Others

Other reinforcements used in these filaments are mineral and specialty fibers, which are used for customized performance requirements. These materials meet the performance requirements of industrial applications. These materials have a relatively low market share, but the development of hybrid reinforcements is fueling their growth.

By Application

- Aerospace Components

PEKK filaments are being used in the production of aerospace components because they provide good heat resistance, flame retardability, and lightweighting capabilities. Additive manufacturing offers the advantage of creating complex shapes while maintaining the requirements for high-performance standards. The growing demand for aircraft production and maintenance is also boosting the demand for PEKK filaments.

- Automotive Parts

PEKK filaments are used in the production of automotive parts, especially in the lightweighting industry, which focuses on improving fuel efficiency and reducing emissions. PEKK filaments provide good chemical and heat resistance, making them suitable for automotive parts. The use of PEKK filaments in the automotive industry is growing with the improvement in industrial 3D printing technologies.

- Medical Implants & Devices

PEKK filaments are used in medical devices because they provide good biocompatibility, resistance to sterilization, and radiolucency. PEKK filaments are used in the production of customized medical devices and implants, especially in the medical industry, where precision and durability are required. The growing trend in customized medical devices and implants is boosting the demand for PEKK filaments.

- Electrical & Electronics

PEKK filaments find application in electrical and electronics sectors, as they offer good insulation and withstand high temperatures. They help in developing advanced electrical connectors and casings, which perform under extreme conditions. The increasing trend of advanced electronic devices will fuel the growth of this segment.

- Industrial & Engineering Parts

Industrial and engineering sectors offer a large market potential for PEKK filaments, as there is a constant need for durable and resistant components. They help in producing functional components and tooling through additive manufacturing technologies, which are increasingly being adopted by various industries.

By End-Use Industry

- Aerospace & Defense

The aerospace and defense industry is a significant end-use industry for PEKK filaments, given its high performance and lightweight characteristics. These filaments enable the implementation of advanced manufacturing technologies without compromising mechanical properties. Investment in new generation aircraft and defense equipment is fueling growth in the industry.

- Automotive

The automotive industry uses PEKK filaments for high-performance components, particularly for parts that require heat resistance and mechanical strength. In addition, the automotive industry is witnessing a significant shift to electric vehicles, thus providing a positive impact on the growth of high-performance polymers and components with longer lifespan. Adoption of additive manufacturing technologies is fueling the growth of these filaments.

- Healthcare

The healthcare industry uses PEKK filaments for implants, surgical guides, and medical devices, particularly for parts that require high precision and compatibility. In addition, the high sterilization resistance of these filaments is a positive attribute for the growth of the healthcare industry. Increasing demand for customized healthcare products is fueling growth in the market.

- Electrical & Electronics

The Electrical and Electronics segment is another sector where the material’s insulation properties and high-temperature resistance are beneficial. The demand for the material in this segment is likely to rise in line with the increasing need for miniaturized and reliable electronic equipment.

- Industrial Manufacturing

- The Industrial Manufacturing segment is another major consumer of PEKK material in the form of filaments. The material helps in faster production cycles and enhances the performance of tooling, jigs, fixtures, and parts. The increasing trend of integrating additive manufacturing in the production process is a positive factor for the segment.

Regional Insights

The North American region, which comprises the United States, Canada, and Mexico, exhibits robust adoption with strong backing from the region’s advanced aerospace, defense, and industrial manufacturing sectors. The United States dominates the region, driven by high investments in additive manufacturing technologies and research activities, while the Canadian and Mexican markets are driven by the growing industrial supply chain and the expansion of the manufacturing industry.Europe, which comprises Germany, the United Kingdom, France, Spain, Italy, and the rest of Europe, exhibits stable growth driven by the region’s advanced automotive and aerospace manufacturing industry. The region’s regulatory push for lightweight materials and sustainable manufacturing practices also contributes to the demand for high-performance thermoplastics, with Germany and France dominating the region’s demand for high-performance thermoplastics driven by their advanced engineering and industrial capabilities.Asia Pacific, including countries like Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific, is found to be the fastest-growing region with the increasing trend of industrialization and the adoption of additive manufacturing technologies. Countries like China and Japan are leaders in the production and development of additive manufacturing technologies, and countries like India and South Korea are showing increasing trends of demand in the automotive and engineering industries.

South America, including countries like Brazil and Argentina, is found to be experiencing gradual growth with the increasing trend of industrial modernization and investments in the manufacturing sector. The major areas of demand are found to be engineering and automotive industries, with the increasing awareness of the benefits of advanced materials. The Middle East & Africa, including countries like Saudi Arabia, the United Arab Emirates, South Africa, and the rest of the Middle East & Africa, are found to be experiencing steady growth with the increasing trend of industrial diversification and aerospace maintenance activities. Increasing trends of advanced manufacturing are expected to boost the growth of the market in the coming years.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 2025, Arkema and Hexcel presented a thermoplastic composite aerospace demonstrator with PEKK-based materials to provide faster production cycles, design flexibility, and lightweight structural components. The technology is a step towards the increasing use of PEKK materials in aerospace manufacturing and composite materials for high-rate aircraft production.

- In June 2024, Arkema has entered into an exclusive technology licensing agreement with SEQENS for the manufacture of PEKK materials, which will be utilized for long-term implantable medical device applications. The partnership will leverage Arkema's technology expertise in PEKK, as well as SEQENS's pharmaceutical polymers manufacturing capabilities.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.42 Billion |

|

Market size value in 2026 |

USD 0.50 Billion |

|

Revenue forecast in 2033 |

USD 1.90 Billion |

|

Growth rate |

CAGR of 21.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Arkema S.A., Solvay S.A., Evonik Industries AG, BASF SE, Victrex plc, 3DXTECH LLC, Essentium Inc., INTAMSYS Technology Co., Ltd., Stratasys Ltd., EOS GmbH, Lehmann & Voss & Co. (LUVOCOM), IEMAI 3D Technology Co., Ltd., 3DAMSS, Apium Additive Technologies GmbH, and Roboze S.p.A. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Reinforced PEKK Filaments, Unreinforced PEKK Filaments), By Reinforcement Type (Carbon Fiber Reinforced, Glass Fiber Reinforced, Others), By Application (Aerospace Components, Automotive Parts, Medical Implants & Devices, Electrical & Electronics, Industrial & Engineering Parts) and By End-Use Industry (Aerospace & Defense, Automotive, Healthcare, Electrical & Electronics, Industrial Manufacturing) |

Key Polyetherketoneketone Filaments Company Insights

Arkema S.A. is one of the major players in the PEKK Filament business environment with its Kepstan PEKK resins, which act as the primary material for several other PEKK Filament manufacturers and Additive Manufacturing Solution Providers. It enjoys strong Vertical Integration and Polymer Chemistry know-how, and it has strong relationships with Aerospace and Industrial OEMs. PEKK Filaments are used for several applications requiring thermal, flame, and chemical resistance. Continuous investments by Arkema in expanding its manufacturing capacities and working with Additive Manufacturing Solution Providers enhance its competitive advantage and help the PEKK Filament business environment expand its reach into the Additive Manufacturing Industry.

Key Polyetherketoneketone Filaments Companies:

- Arkema S.A.

- Solvay S.A.

- Evonik Industries AG

- BASF SE

- Victrex plc

- 3DXTECH LLC

- Essentium Inc.

- INTAMSYS Technology Co., Ltd.

- Stratasys Ltd.

- EOS GmbH

- Lehmann & Voss & Co. (LUVOCOM)

- IEMAI 3D Technology Co., Ltd.

- 3DAMSS

- Apium Additive Technologies GmbH

- Roboze S.p.A.

Global Polyetherketoneketone Filaments Market Report Segmentation

By Type

- Reinforced PEKK Filaments

- Unreinforced PEKK Filaments

By Reinforcement Type

- Carbon Fiber Reinforced

- Glass Fiber Reinforced

- Others

By Application

- Aerospace Components

- Automotive Parts

- Medical Implants & Devices

- Electrical & Electronics

- Industrial & Engineering Parts

By End-Use Industry

- Aerospace & Defense

- Automotive

- Healthcare

- Electrical & Electronics

- Industrial Manufacturing

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636