Market Summary

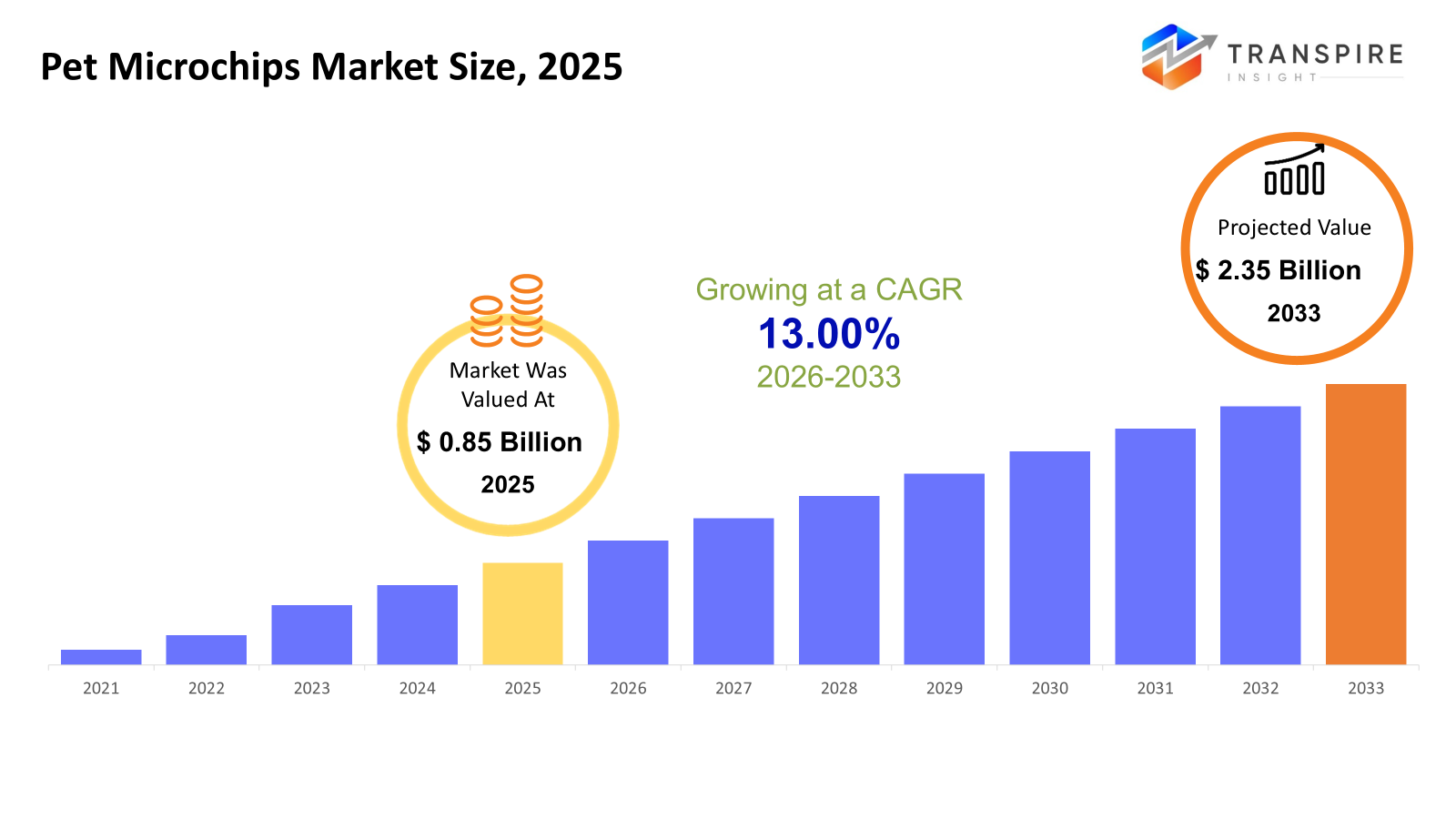

The global Pet Microchips market size was valued at USD 0.85 billion in 2025 and is projected to reach USD 2.35 billion by 2033, growing at a CAGR of 13.00% from 2026 to 2033. The Pet Microchips Market is expected to demonstrate a positive growth trajectory owing to rising pet ownership trends in global populations, focus on animal welfare, and ever-increasing regulatory requirements pertaining to animal identification. Moreover, technological advancements in microchip products and rising veterinary infrastructure will also support the market’s continuous growth.

Market Size & Forecast

- 2025 Market Size: USD 0.85 Billion

- 2033 Projected Market Size: USD 2.35 Billion

- CAGR (2026-2033): 13.00%

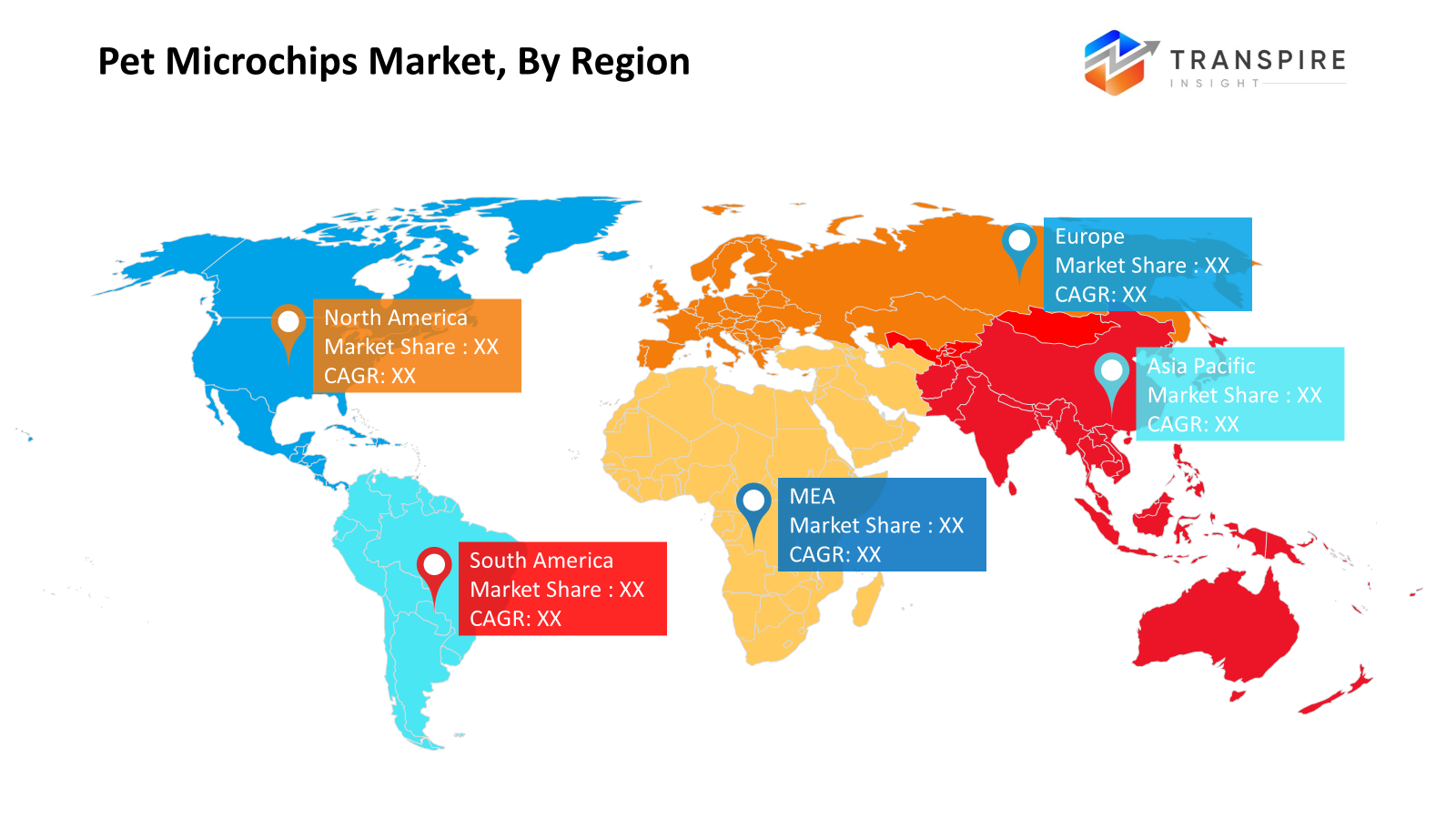

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has retained its place as one of the most important geography segments due to increased compliance with pet identification legislation, a high density of pet ownership, and well-developed veterinary infrastructure. The United States is the primary driver of trends in the North American geography due to its mandatory microchipping laws and pet registries, as well as the awareness campaigns enacted within the region.

- The case of the United States demonstrates accelerated adoption, facilitated by municipal regulations, animal welfare programs, and the acceptance of microchip data in veterinary healthcare systems, characterized by a strong level of disposable income supported by synergy between shelters and vet clinics in urban and suburban environments.

- Rapid growth in the Asia Pacific region is attributable to high rates of urbanization, increasing middle-class population, and increasing rates of adoption of pets. In addition, countries in the region, including Australia, China, and India, are improving their regulations, and this coupled with access to veterinary services, will increase the penetration of identification technologies.

- While RFID pet microchips form the bulk of the product market due to their affordability, regulatory acceptance, and forward compatibility with existing scanning equipment, their prevalence in veterinary clinics and animal shelters provides a guaranteed market, and of course, their ISO compliance.

- Low-frequency microchip technology drives the adoption rate because of its guaranteed tissue penetration capabilities with minimal interference. It fits in well with the international veterinary standards; therefore, low-frequency technology is the preferred option for carrying out mass implantation programs backed by the government in the registration of pet animals.

- The pet identification and tracking aspect leads the list as a priority segment since lost pets are directly related to the use of microchipping devices. The control of stray animals and awareness of pet recoveries also boost the importance of this segment for market growth.

- Veterinary clinics and hospitals are the largest end-users, driven by their importance in the process of implanting, registering, and educating. An increase in veterinary visits, better diagnostic tools and digital health records are adding to the demand from this sector.

So, The Pet Microchips Market is a system of electronic identification that is designed to facilitate permanent identification of pets. The market involves the use of microchips implanted in the pets to store unique identification numbers linking the pets to databases holding information about ownership and veterinary records. The market is vital in the improvement of pet recovery rates and in enhancing animal welfare in different regions around the world. The trend of pet humanization and the amount spent on their welfare have a considerable impact on the overall dynamics of the market. Various government and animal welfare body initiatives to promote microchipping as a means of controlling stray animal populations, curbing the illegal trade of pets, and keeping track of the vaccination status of the population have a profound effect. Veterinarians play a crucial role in this regard as service providers. Technical advances, such as increased chip durability, expanded data storage, and global compatibility with scanning systems, will significantly improve adoption. RFID-based solutions dominate demand at present, but emerging GPS-enabled and state-of-the-art identification technologies are making inroads into the higher-end market segments. Overall, the market is so placed that it would witness consistent growth supported by building regulatory momentum, growing awareness, and widening veterinary infrastructure across the world.

Pet Microchips Market Segmentation

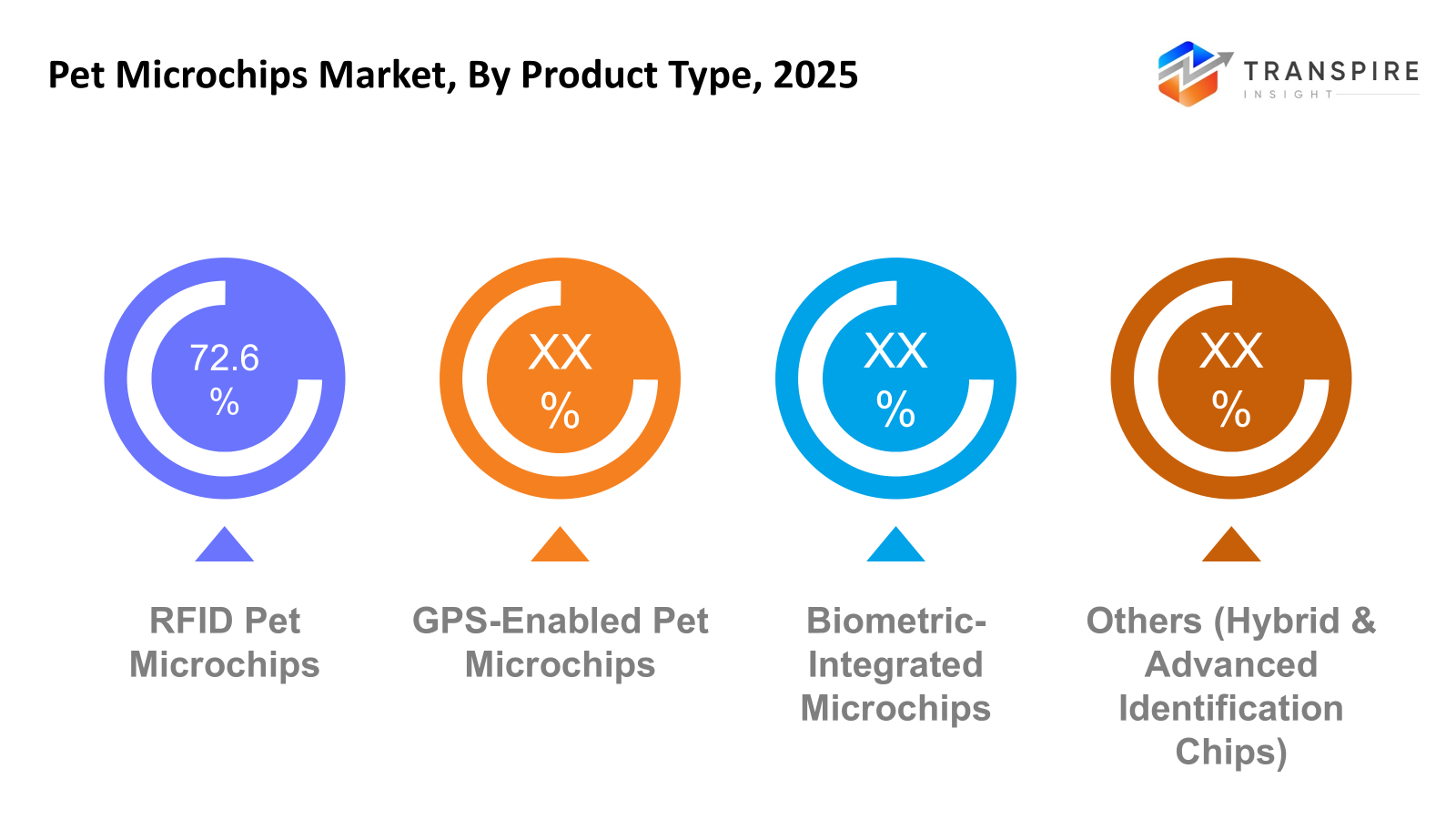

By Product Type

- RFID Pet Microchips

RFID-based microchips appears to thrive as the most widely used product type given its cost-effectiveness, reliability, and the favorable reception it receives from the authorities in developed countries. These microchips have commonly been used in pet clinics and shelters for the permanent identification of pets. The microchip is set to continue enjoying steady growth, courtesy of in-laws requiring the procedure and the rise in the number of pet owners.

- GPS Enabled Pet Microchips

GPS technology-enabled pet microchips are becoming increasingly popular, mainly because of the increased interest in tracking and improved pet security. Unlike traditional products, which provide inactive RFID chips, GPS technology pet microchips provide active monitoring value, which is attractive to high-end pet owners. These have been more successful in urban and technologically advanced markets.

- Biometric-Integrated

Biometric integrated microchips are emerging as a niche technology, providing identification capabilities in association with health and physiological data storage. These have limited application in research, breeding, and high-value animal tracking. Although the technology is in its infancy, development in sensory integrations and pet diagnosis is expected to contribute to long-term growth prospects. Regulatory approvals play a significant role in influencing this technology.

- Others (Hybrid & Advanced Identification Chips)

This segment comprises hybrid technologies which incorporate features such as RFID, GPS, and data analysis. While adoption is still limited, it is seeing increased acceptance among specific end-user groups like breeders. The major contributing factors to the development of this market include technology innovativeness as well as its customizability potential. For this market to develop, affordability is required, together with regulatory environment acceptance.

To learn more about this report, Download Free Sample Report

By Technology

- Low-Frequency (LF) Microchips

LF microchips have the largest market share due to their higher penetration in animal identification systems. These microchips provide better performance with minimum chances of interference from tissues. Compliance with ISO standards also helped them gain popularity over the rest of the world. Their low cost and long service life make them the most popular choice.

- High-Frequency (HF) Microchips

HF microchips provide higher transfer rates for the transfer of data and moderate reading ranges over LF chips. They have found moderate usage in situations that require higher capacity to be stored, such as storing veterinary information. They find moderate use due to compatibility issues faced by existing scanners. Usage is boosted by technological advancements in the veterinary industry.

- Ultra-High Frequency (UHF) Microchips

UHF microchips support longer reading ranges and thus better data transmission; therefore, these are suitable for large-scale tracking applications. Presently, however, limitations include higher costs and the chips' sensitivity to environmental interference. Adoption is mainly seen in research, breeding, and advanced tracking applications. Further growth will depend on refinement of technology and reduction of costs.

By Application

- Pet Identification and Tracking

This segment is the largest due to the rise in pet ownership and the incidence of lost pets. Regulatory requirements in some countries will also drive the market in this segment favorably. Permanently identified pets offer better recovery rates, thus reducing overcrowding in shelters. Awareness campaigns will continue to aid this segment.

- Veterinary Information Storage

Microchips for veterinary and vaccination records are rising in prominence with the growth of digital healthcare adoption. They ensure accurate and consistent treatment for animals. The expansion is fueled by the rising cost of pet treatment and digitalization measures.

- Ownership Verification

Ownership verification applications are on an upward trend in legal disputes, breeding authentication, and pet trade regulation. Microchip technology offers tamper-evident proof of ownership. The trend has been well received in areas with stringent animal welfare legislation. This segment has seen a rise in awareness about pet ownership.

- Lost & Found Recovery

This segment is closely linked to identification and tracking, and it plays a vital role in animal welfare schemes. Microchipping is fruitful in improving the reunion rates of pets and owners. Shelters and municipalities are actively involved in the adoption process. Its growth is fueled by the partnerships between shelters and clinics.

- Regulatory & Compliance Identification

The applications of regulatory identification are fueled by government regulations in pet registration and disease control. The use of microchips facilitates the effective monitoring of the population and vaccination. The adoption rate is high in the developed regions. The developing nations are improving regulatory identification as well.

By End User

- Veterinary Clinics & Hospitals

Veterinary clinics are the main end-users of the technology and act as primary implantation and registration points. Higher patient traffic and trust levels among pet owners towards veterinary professionals are significant factors contributing to market dominance. The clinics are also the focal point for educating end-users, pet owners. Technological upgrades add to this.

- Animal Shelters & Rescue Organizations

Shelters greatly depend on microchips as identifiers. Microchips help reduce stray animals. It also helps increase adoption success rates. In addition, government or NGO support is a large factor. The availability of funds is an important condition.

- Pet Owners

Direct adoptions by pet owners are on an increase as awareness of pet safety, as well as compliance with legal demands, is on the rise. This is also driven by urbanization and an increase in incomes. However, adoptions are subject to cost considerations and awareness. Educational efforts are essential for this market.

- Research & Breeding Centers

This segment utilizes microchips for pedigree identification, behavioral analysis, and health monitoring. Adoption is specialized and consistent. Purchases are made on the basis of accuracy, traceability, and legal requirements. Sophisticated technology is a basis for purchase.

Regional Insights

The market in North America is seen as mature, with regulations in place, particularly in the US, where microchipping is mandatory, and efforts are made to integrate pet registries. The Canadian and Mexican markets also provide steady growth, thanks to the increasing number of services offered by veterinarians.Europe experiences high regulatory-driven demand, mainly within Germany, the UK, France, Italy, and Spain, due to the mandatory microchipping of dogs and cats. Rest of Europe also demonstrates moderate growth rates due to the improvement of compliance structures with respect to responsible ownership of pets. Asia Pacific is the fastest-growing market, primarily fueled by the growth in pet adoption in countries like Japan, China, India, Australia, and New Zealand. The Australian and New Zealand markets thrive under the strict enforcement, whereas the Chinese and Indian markets hold vast growth opportunities due to the changing urbanization scenarios with respect to pet welfare laws.

South America is growing moderately, driven by countries such as Brazil and Argentina, where improvements in veterinary facilities and public awareness campaigns are fueling the pet trade. Although regulatory enforcement varies, it is steadily improving in the Rest of South America. The Middle East & Africa regional market is emerging, with Saudi Arabia, UAE, and South Africa being leaders in adopting this technology due to enhancements in veterinary access. At the same time, the Rest of region has long-term potential.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, AKC Reunite, the largest non-profit pet identification and reunification service the leading provider in the United States and affiliate of the American Kennel Club, is thrilled to announce the release of a new temperature-sensing microchip, which will soon be available across the country in midOctober. This ISO standard 134.2 kHz microchip will identify your pet with a special microchip identification number and read their temperature by scanning them with an AKC Reunite ProScan + Temp or equivalent temperature-sensing microchip scanner.

(Source:https://www.akcreunite.org/wp-content/uploads/AKC-Reunite-Microchip-TEMP_PRESS-RELEASE.pdf)

- In June 2024, Merck Animal Health, a division of Merck & Co., Inc., Rahway, N.J., USA (NYSE:MRK), is privileged to announce a microchip milestone of 50,000, as part of their continued relationship with the United States Trotting Association, also known as USTA. In 2018, the organization teamed with Merck Animal Health to become the first registry to formally include temperature scanning as part of their microchip identification system and is now using Merck Animal Health Bio-Thermo microchips exclusively to identify Standardbred racehorses in the United States.

(Source:https://www.merck-animal-health.com/blog/2024/06/18/usta-partnership-50000microchip/)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.85 Billion |

|

Market size value in 2026 |

USD 1 Billion |

|

Revenue forecast in 2033 |

USD 2.35 Billion |

|

Growth rate |

CAGR of 13.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Merck & Co., Inc., Pethealth Inc., HomeAgain, Datamars SA, Allflex USA, Inc., AVID Identification Systems, Inc., Bayer AG, Trovan Ltd., Virbac, Animalcare Ltd., Microchip4Solutions Inc., PeddyMark Ltd., EIDAP Inc., Micro-ID, Ltd., PetLink |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (RFID Pet Microchips, GPS-Enabled Pet Microchips, Biometric-Integrated Microchips, Others (Hybrid & Advanced Identification Chips)), By Technology (Low-Frequency (LF) Microchips, High-Frequency (HF) Microchips, Ultra-High Frequency (UHF) Microchips), By Application (Pet Identification & Tracking, Veterinary Information Storage, Ownership Verification, Lost & Found Recovery, Regulatory & Compliance Identification) and By End User (Veterinary Clinics & Hospitals, Animal Shelters & Rescue Organizations, Pet Owners, Research & Breeding Centers) |

Key Pet Microchips Company Insights

Merck & Co., Inc., under the brand name HomeAgain, is the market leader in pet microchips, providing comprehensive services with its RFID technology. The company’s services greatly improve the effectiveness of pet identification. HomeAgain’s services consist of ISO-compliant microchip technology, pet health records, and comprehensive recovery services, thereby creating a strong platform for its services. Extensive brand recognition, wide partnerships with animal welfare organizations, and ongoing innovations in pet microchip technology readability contribute to the strength of the company’s market penetration strategy, especially in North American and European countries. Its services-based business model creates high chances of retaining the competitive edge in the face of hardware-based competitors.

Key Pet Microchips Companies:

- Merck & Co., Inc.

- Pethealth Inc.

- HomeAgain

- Datamars SA

- Allflex USA, Inc.

- AVID Identification Systems, Inc.

- Bayer AG

- Trovan Ltd.

- Virbac

- Animalcare Ltd.

- Microchip4Solutions Inc.

- PeddyMark Ltd.

- EIDAP Inc.

- Micro-ID, Ltd.

- PetLink

Global Pet Microchips Market Report Segmentation

By Product Type

- RFID Pet Microchips

- GPS-Enabled Pet Microchips

- Biometric-Integrated Microchips

- Others (Hybrid & Advanced Identification Chips)

By Technology

- Low-Frequency (LF) Microchips

- High-Frequency (HF) Microchips

- Ultra-High Frequency (UHF) Microchips

By Application

- Pet Identification & Tracking

- Veterinary Information Storage

- Ownership Verification

- Lost & Found Recovery

- Regulatory & Compliance Identification

By End User

- Veterinary Clinics & Hospitals

- Animal Shelters & Rescue Organizations

- Pet Owners

- Research & Breeding Centers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636