Market Summary

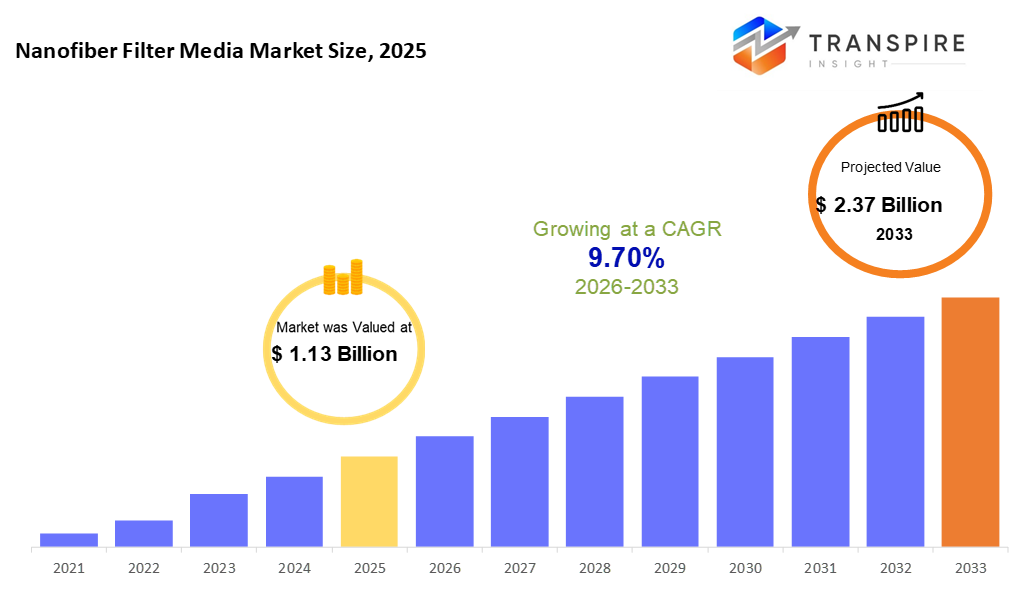

The global Nanofiber Filter Media market size was valued at USD 1.13 billion in 2025 and is projected to reach USD 2.37 billion by 2033, growing at a CAGR of 9.70% from 2026 to 2033. The nanofiber filter media market is growing due to increasing demand for high-efficiency filtration in healthcare, automotive, and industrial sectors. Advanced technologies like electrospinning enable production of fine, durable fibers for superior air and liquid filtration. Rising environmental regulations and the need for contamination control in electronics and energy industries are driving adoption, while expanding applications in biomedical fields further accelerate market growth.

Market Size & Forecast

- 2025 Market Size: USD 1.13 Billion

- 2033 Projected Market Size: USD 2.37 Billion

- CAGR (2026-2033): 9.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 34% in 2026. On top of the map, North America takes the biggest slice. Its edge comes from widely using smart filtering methods. Tough rules push materials made from polymers and spun into tiny fibers. Factories, hospitals, cars, these areas all rely on them now. Standards here shape how others follow. What stands out is how fast new ideas spread across fields.

- Fueled by strong research spending, the United States stands central in North America for developing advanced fiber-based filters. These materials show promise, especially where clean air matters most, also gaining ground in medical uses. Innovation here moves quickly, backed by steady support for turning lab work into real-world products.

- Out here in the Asia Pacific region, industries are expanding fast. As governments implement stricter pollution rules, factories shift toward cleaner methods. Rising need for clean air and pure water drives up usage of tiny fiber filters. Growth does not slow; this area now uses more nanofiber filtering than anywhere else on Earth.

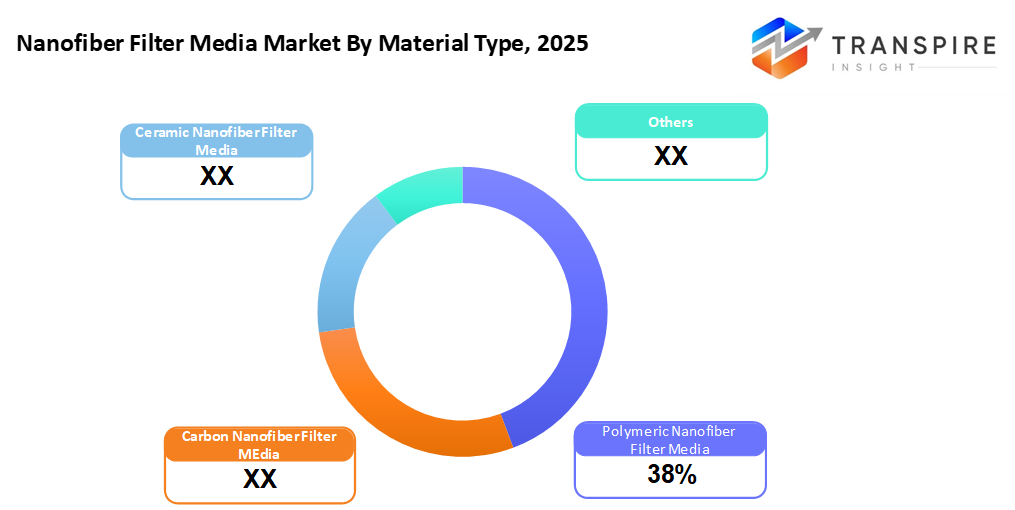

- Polymeric Nanofiber Filter Media share approximately 40% in 2026. Polymeric nanofiber types, such as nylon or polyamide, mostly stay on top. Their reach spans both air and fluid filtering tasks. Cost plays a role, too; they undercut carbon or ceramic options. Simplicity drives their edge.

- Fiber size and pore spacing get fine-tuned easily when electrospinning takes charge, which is why this method stays out front. The way it shapes performance in filters keeps it ahead of others. Precision like that does not come along every day.

- Air filtration leads the pack. Growing needs in vehicles, factories, and heating systems push it forward. Not just one area, it spreads across multiple industries. Performance matters more now than before.

- Fueled by demand in medicine, hospitals, and labs, grab hold of nanofiber filters needed for masks, sterile rooms, where air must stay pure. Their use grows fastest here compared to other fields relying on advanced filtration.

Down to tiny threads, some not even visible under regular microscopes, lies what powers modern filtering tech. Because they are so thin, these strands trap more particles while letting air move through more easily than older thick-fiber versions. Found everywhere from factory vents to home purifiers, their role keeps growing quietly behind the scenes. With each breath filtered or water droplet cleaned, performance climbs without needing extra force. Though unseen, their impact spreads across how we handle cleanliness in machines and living spaces alike.

Concerns about polluted air and contaminated drinking water are driving more people toward nanofiber filters. Stricter rules on workplace safety play a role, too. Cleaner indoor spaces matter now more than before. Hospitals and clinics lead the charge masks and breathing gear rely heavily on these materials. Infection control tools depend on their performance. Factories popping up everywhere add pressure to clean emissions. Cars rolling off assembly lines bring new needs for advanced filtering. Office towers and malls install smarter climate systems. Those upgrades often include nanofiber tech. Growth in one area spills into others without warning.

Out of nowhere, machines that make ultra-thin fibers have gotten better, which means more output, fewer flaws, and less expense. Instead of standing alone, those tiny fiber mats now often sit on top of regular materials, boosting filtering while keeping air moving freely. Places like chip factories, sterile rooms, bottling plants, and water cleanup sites are swapping in these new filters because they trap junk more effectively and last longer.

What stands out is how North America plus Europe lead because they’ve had strict rules, solid industrial setups, and long-standing tech use in filtering systems. On the flip side, Asia Pacific races ahead fast, with factories spreading, cities growing, and more money flowing into cleaning air and building clinics. Competition stays balanced; big names push new products, team up smartly, and grow factories just enough to hold ground worldwide.

Nanofiber Filter Media Market Segmentation

By Material Type

- Polymeric Nanofiber Filter Media

Fabric made from tiny plastic threads often shows up in filters because it traps particles well, works in both water and air, and fits many shapes without breaking the bank. This material bends easily yet holds its structure while filtering stuff out. People pick it a lot since it does the job right without costing too much.

- Carbon Nanofiber Filter Media

Fine fibers made of carbon stand up well when things get hot or chemicals show up. These filters work where the industry needs tough cleanup for gases. Heat does not break them down, nor do strong substances pass through. Their job is to trap what shouldn’t move forward. Long life comes from staying stable under pressure.

- Ceramic Nanofiber Filter Media

When things get really hot or chemicals are around, ceramic nanofibers still hold up well. These filters last a long time under tough demands because they resist damage from heat and rust alike. Toughness comes naturally when the material is built at such a tiny scale.

- Others

Some of these are mixed or layered nanofibers, built for specific filtering jobs that need a unique touch.

To learn more about this report, Download Free Sample Report

By Technology Type

- Electrospinning

A method called electrospinning leads the field, shaping fibers with careful accuracy. This approach adjusts how thick or open those tiny threads are, fitting tough filtering needs well. Most rely on it because fine-tuning comes naturally here.

- Centrifugal Spinning

This method moves more material while costing less to run. Efficiency rises when speed meets scale.

- Coaxial Electrospinning

Fiber layers built with a central core happen through coaxial electrospinning. This method improves how well filters work while lasting longer under stress.

- Coaxial Electrospinning

Some newer techniques fall into this group, like using liquid-based spinning when specific needs come up.

By Filtration Type

- Air Filtration

Needs from heating-cooling units, car interior filters, sterile rooms, plus efforts to cut airborne contaminants. That is what shapes it.

- Liquid Filtration

Pouring liquids through filters shows up where clean water matters, also when making drinks or medicines safe. Places like plants that treat wastewater rely on it just as much as factories shaping pills do. Moving fluids past barriers traps gunk - common in kitchens, turning raw juice into bottled goods too.

- Gas Filtration

Filtration of gases shows up in purifying industrial streams, making chemicals, and building semiconductors.

- Biomedical Filtration

Fine mesh filters help stop tiny particles in healthcare gear like face covers and breathing tools. These materials play a key role in preventing germs from passing through. Protection levels rise when invisible bits get trapped inside layered fabrics.

- Others

Things like cleaning up pollution or gear that shields people from harm fall into this group.

By End-Users

- Healthcare and Life Science.

Folks in healthcare rely on it a lot, think protective gear, sterile rooms, or making medicine. Labs and hospitals keep using it because it works where cleanliness matters most.

- Automotive

Inside cars, filters clean the air people breathe while separate systems handle airflow for engines, both helping vehicles follow pollution rules and keep interior air fresh.

- Industrial Manufacturing

Factories use these systems because cleaner air helps machines work better. Dust gets pulled away fast before it causes problems. Filtering airflow keeps everything running smoothly most of the time. Smoke and fumes don’t build up when controls are active.

- Electronics & Energy

Machines hum inside sterile rooms where dust stays out on purpose. Power cells take shape under careful conditions far from contamination. Tiny circuits form in spaces built to keep everything exact and untouched by outside air.

- Consumer Goods

These items show up in purifiers, hop into vacuums, and also slip inside filters people use every day.

- Others

From jet engines to security systems, some industries stand apart. These areas handle complex manufacturing needs. Think military tech or high-precision machinery. Work here often demands strict standards. Specialized tools and materials are common. Performance under extreme conditions matters most.

Regional Insights

Even though rules on air and water get tighter, North America keeps pulling ahead in using tiny fiber filters. What stands out is how fast new filtering methods spread there, backed by solid research networks. Mostly, it's the United States leading the way; hospitals, car factories, big plants, and sterile rooms all rely heavily on these materials. Over time, Canada has quietly built up its own usage, especially where cities and industries upgrade their cleaning systems. Behind much of this push are environmental rules like those from the EPA, along with funding shifts toward cleaner power sources. Growth does not roar but creeps forward, shaped by efficiency needs and quiet advances in material science.

Not far behind, Italy and Spain pour more funds into modern HVAC setups along with drug production filters, nudged by broader European rules on cleaner air and greener practices. The push in Germany comes from factories needing sharp filtration tools, especially under heavy output in vehicles and machinery sectors. Across the region, growth ticks upward as tiny fiber-based filtering draws attention where tough pollution limits meet real-world needs. France channels energy into medical settings and sterile rooms, relying on ultra-thin fibers to trap contaminants. Rules tied to recycling goals and fumes shape much of what drives change here. Strong appetite in industries keeps demand steady, anchored by nations at the front lines of regulation.

Nowhere else is demand climbing like it is across the Asia Pacific, thanks to factories spreading fast, cities tackling dirty air, and widespread use of tiny fiber filters in China and India. These two alone take up most of the region's share. High-end production in Japan and South Korea adds momentum, especially in making gadgets and tech gear clean. Places such as Southeast Asia aren’t far behind, fueled by new buildings going up and more people caring about nature. On another track entirely, Latin America, with Brazil and Argentina out front, and parts of the Middle East & Africa, notably the United States, Saudi Arabia, and South Africa, are starting to move, slowly pulling in similar technologies for handling oil, cleaning water, and filtering air, even though shaky economies and weak systems keep progress uneven.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 16, 2025 – Atmus launched advanced NanoNet® N3 Filter Media Technology.

- October 31, 2024 – Gessner launched the MecNa air filter media with a 3D nanofiber design.

- June 8, 2024 – Mann+Hummel has launched Mann-Filter FreciousPlus featuring nanofibers for cabin air filtration.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.13 Billion |

|

Market size value in 2026 |

USD 1.24 Billion |

|

Revenue forecast in 2033 |

USD 2.37 Billion |

|

Growth rate |

CAGR of 9.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Donaldson Company Inc., Hollingsworth & Vose, Ahlstrom, Toray Industries Inc., Mann + Hummel, Teijin Limited, Lydall, Dupont, Camfil, Elmarco, Nederman, Hifyber, Acouspin, Nanofiltech, Matregenix, and Lyneyi Filtration |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Polymeric Nanofiber Filter Media, Carbon Nanofiber Filter Media, Ceramic Nanofiber Filter Media, Others) By Technology Type (Electrospinning, Centrifugal Spinning, Coaxial Electrospinning, Others) By Filtration Type (Air Filtration, Liquid Filtration, Gas Filtration, Biomedical Filtration, Others), By End-Users (Healthcare & Life Sciences, Automotive, Industrial Manufacturing, Electronics & Energy, Consumer Goods, Others) |

Key Nanofiber Filter Media Company Insights

One name that stands out when it comes to filtering solutions made in the United States is Donaldson. Their expertise stretches back years, focusing on smart materials that trap tiny particles across industries like manufacturing, transport, health tech, and pollution control. That is the Ultra-Web® method: using ultra-thin threads crafted by electric fields, each about one-fifth of a millimeter thick. These strands grab microscopic contaminants more effectively than older types of filters ever could. Because airflow meets less resistance, machines run more easily, last longer, and waste less power. Behind the scenes, dozens of protected inventions reveal deep know-how in how fibers settle and layers form. Growth has not slowed; they are teaming up, launching new versions, and refining performance. With operations around the world and a broad range of specialized products, they stay ahead without chasing trends.

Key Nanofiber Filter Media Companies:

- Donaldson Company Inc.

- Hollingsworth & Vose

- Ahlstrom

- Toray Industries Inc.

- Mann + Hummel

- Teijin Limited

- Lydall

- Dupont

- Camfil

- Elmarco

- Nederman

- Hifyber

- Acouspin

- Nanofiltech

- Matregenix,

- Lyneyi Filtration

Global Nanofiber Filter Media Market Report Segmentation

By Material Type

- Polymeric Nanofiber Filter Media

- Carbon Nanofiber Filter Media

- Ceramic Nanofiber Filter Media

- Others

By Technology

- Electrospinning

- Centrifugal Spinning

- Coaxial Electrospinning

- Others

By Filtration Type

- Air Filtration

- Liquid Filtration

- Gas Filtration

- Biomedical Filtration

- Others

By End-Users

- Healthcare & Life Sciences

- Automotive

- Industrial Manufacturing

- Electronics & Energy

- Consumer Goods

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636