Market Summary

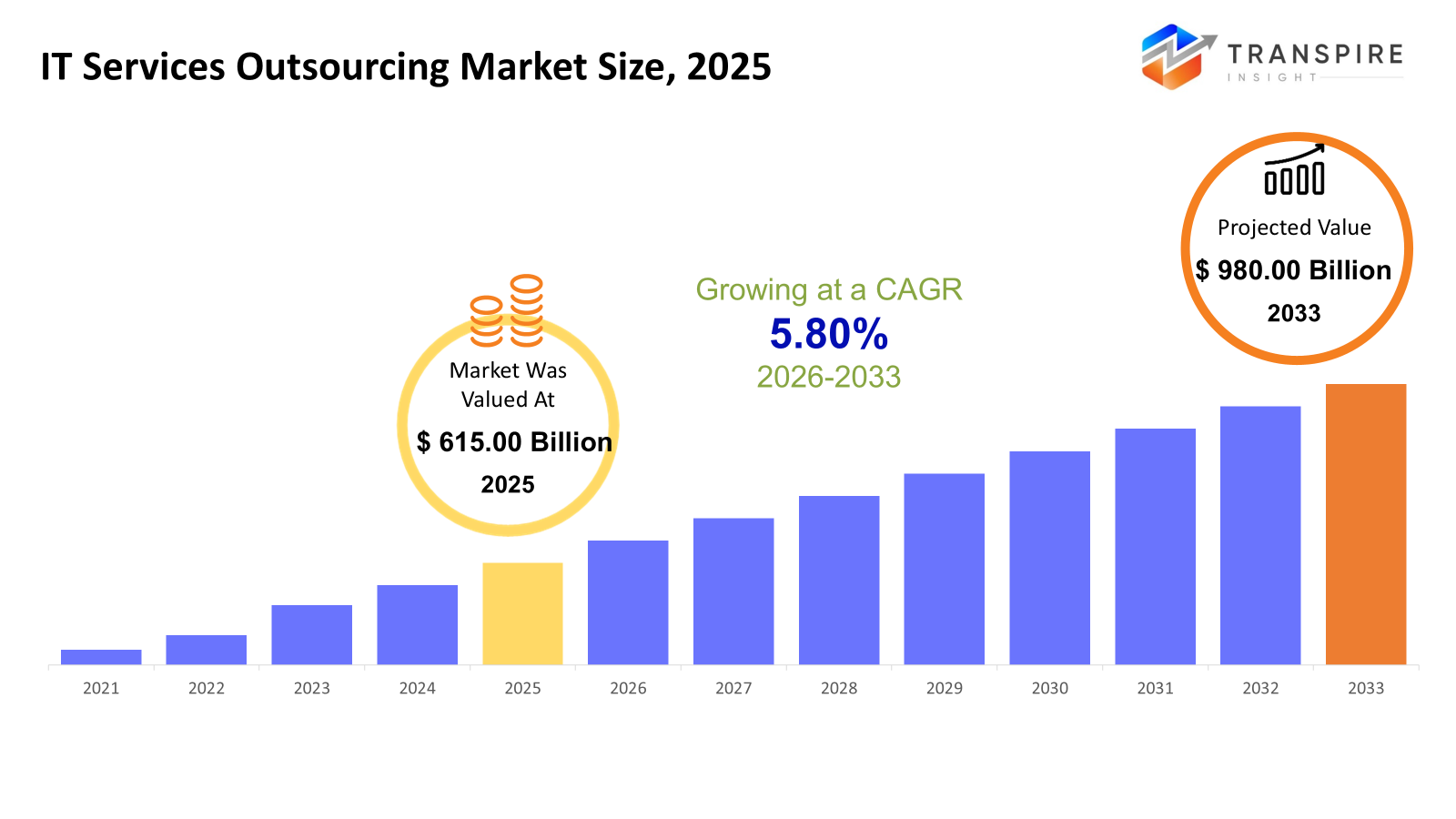

The global IT Services Outsourcing market size was valued at USD 615.00 billion in 2025 and is projected to reach USD 980.00 billion by 2033, growing at a CAGR of 5.80% from 2026 to 2033. Fueled by tight budgets, firms now lean heavily on outside tech teams to scale fast while tapping niche skills. Cloud shifts, smarter security needs, data crunching, plus intelligent systems pull more sectors toward outsourced help. Talent gaps in richer nations make reaching overseas almost routine for many companies.

Market Size & Forecast

- 2025 Market Size: USD 615.00 Billion

- 2033 Projected Market Size: USD 980.00 Billion

- CAGR (2026-2033): 5.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 39% in 2026. Heavy interest across North America in premium tech solutions. United States companies are actively seeking help with security, moving systems to the cloud, and also weaving in artificial intelligence tools. Though some remain cautious, most large firms now treat these upgrades as essential, pushing steady need despite economic shifts. Providers report fuller pipelines, especially where expertise eases complex transitions.

- Fueled by steady spending on tech upgrades, outsourced work grows across American industries. Finance leads the shift, followed closely by clinics adopting new systems. Stores rethink operations, leaning into external support. Digital changes push hospitals to partner outside more often. Growth here ties back to reliance on remote experts handling complex tasks.

- Across the Asia Pacific, fast shifts toward outsourcing come as online shopping surges. Digital networks rise alongside new tech hubs in China and India. E-commerce climbs while cities build smarter systems. Growth pulses through service sectors powered by innovation. Outsourcing spreads where internet access widens. Tech progress fuels demand for flexible solutions.

- Application Development & Maintenance share approximately 33% in 2026. Even now, fixing and updating apps takes top spot because companies keep swapping old tech for smoother, user-focused tools. What sticks around is how much effort goes into making software that actually works well day after day.

- Offshore takes the lead when it comes to outsourcing type costs weigh less there, while talent runs deep across major hubs. Still, distance does not stop demand; skills spread wide where expenses shrink. A pattern held steady by leaner budgets paired with ready workforces far away.

- Big companies lead the way in spending on outside services, using international teams to handle tough tech upgrades. Their scale makes it easier to manage big changes across borders, relying on external experts instead of internal staff. Global reach matters here, where long-term projects demand steady support beyond local capacity.

- Banks and financial firms top the list when it comes to buying tech services, focusing hard on safety rules, legal standards, and also on how well data gets analyzed.

Outside firms now handle more tech work than before because businesses want smoother operations while concentrating on what they do best. Instead of building everything themselves, many companies pass tasks like software creation, system upkeep, data handling, or firewall protection to skilled teams elsewhere. Growing reliance on online platforms pushes demand higher, since flexible technology setups become essential. Long-term trends show this setup sticking around, mainly due to rising needs for adaptable digital frameworks.

OFast moves toward digital tools across industries. Companies pour resources into cloud setups, studying data, smart software, protection online, along with automated workflows - this pushes the need for outside tech help. Building and fixing apps still takes up most of the work, since older systems get upgrades and new user-focused platforms go live. Firms lean increasingly on ongoing support deals, drawn by steady pricing and reliable assistance over time.

Big companies spend heavily on outside tech services because their systems are complicated and they work across many countries. Yet it is smaller firms that now grow faster as clients, since getting help from vendors lets them use strong tools without high upfront costs. Lower prices play a role, along with capable workers found in places like India and China.

North America leads the IT Services Outsourcing scene; its edge comes from big tech budgets, quick uptake of digital tools, and it is also home to top outsourcing firms. In that mix, the United States stands out; demand surges from banking, health care, stores, and tech companies, pushing activity higher. Over in the Asia Pacific, things move fast. Now, countries serve double roles: providers and users, lifted by better internet systems, rising company spending on tech, and wider use of cloud platforms, reshaping how work gets done.

IT Services Outsourcing Market Segmentation

By Service Type

- Application Development & Maintenance

Building apps takes center stage here, followed by regular updates that keep systems running smoothly under pressure. Old tools get refreshed so they work faster, while new features grow step by step behind the scenes. Systems stay strong even when demand spikes without warning. Each upgrade happens quietly, making sure nothing breaks during busy moments. Performance checks happen often, woven into daily workflows like routine tune-ups.

- Infrastructure Management Services

Running your tech backbone day to day takes coordination. Think servers housed in physical locations where cooling and power matter just as much as uptime. Connections between systems need constant tuning so information flows without hiccups. Remote computing spaces hosted online require monitoring like any local setup. Each piece fits into how work gets done across teams.

- Business Process Outsourcing

Besides cutting expenses, handing off routine tasks lets companies focus elsewhere. Efficiency often rises when outside teams handle what is not central to the main work. Shifting these duties frees up time, energy, and resources sometimes without adding strain. Outside providers take on pieces that are not tied directly to core goals. Operations keep moving, just managed differently.

- Network & Security Services

Firms get help keeping systems running smoothly when they work with these services. Protection from online threats comes built into the package, not added later. Guarding information remains a top priority across every part of operations.

To learn more about this report, Download Free Sample Report

By Outsourcing Type

- Onshore Outsourcing

Folks keep things local when they choose onshore outsourcing, working inside national borders to match rules more smoothly. Teamwork flows more easily since everyone operates under one country's roof, avoiding cross-border tangles while staying aligned through shared systems.

- Nearshore Outsourcing

Finding teams nearby often means easier chats across fewer hours apart. Savings show up when work moves just across the region, not halfway round the world.

- Offshore Outsourcing

Finding help far away often cuts expenses while opening doors to many skilled workers. Distance brings down costs, yet expands access to capable people across borders.

By Enterprise Size

- Large Enterprises

Big companies turn to outside teams when handling heavy tech workloads becomes tough. Handling major shifts in digital systems often means bringing in external help. Outside experts step in so internal staff can focus elsewhere. Shifting big projects forward sometimes requires skills not found inside the company. Dealing with complicated infrastructure pushes firms to seek partners beyond their walls.

- Small & Medium-Sized Enterprises

Out there, smaller businesses find tech help by working with outside teams. Instead of spending loads upfront, they tap into skilled workers elsewhere. This way, getting strong IT support does not drain their budget. Some choose this path to stay flexible while growing. Others skip building big internal departments altogether. Working beyond company walls opens doors once out of reach.

By End-Users

- Healthcare

Fueled by patient needs, healthcare pushes growth in protected tech setups. Systems handling records evolve under pressure to stay safe. Digital tools for wellness gain ground as clinics adapt. Behind every update lies a push for better control of information flow.

- BFSI

Out there, banks and financial firms turn to outside experts when they need help with security, crunching numbers, or staying within legal lines.

- Telecom & IT

Out of necessity, telecom and IT rely on outside teams to handle how networks run. Innovation takes shape when separate groups step in to build new tools. Software creation often flows through external partners instead of staying inside one company.

- Retail & E-Commerce

Shoppers now move between online and physical stores - technology support helps keep that shift smooth. Instead of handling everything in-house, companies turn elsewhere for help with digital tools. Data is studied carefully so businesses understand buying habits better. Smoother interactions come from focused upgrades behind the scenes. Tech tasks go outside when internal teams lack capacity or skill.

- Energy & Utilities

Fuel and power firms outsource tasks to fine-tune their systems while boosting daily performance. Equipment upgrades often come through third-party help, smoothing how things run behind the scenes.

- Media & Entertainment

Streaming shows up through rented tech help. Cloud space holds the files. Outside teams run what plays online.

Regional Insights

Home to the biggest share of global IT service contracts, North America sees heavy activity thanks to the United States leadership. Spending big on tech helps companies stay ahead. Early embrace of new tools gives them an edge over others elsewhere. Industries like banking, health care, stores, and software fuel steady expansion. Firms turn more toward outside help for apps, online systems, digital protection, and ongoing support. Saving money while running more smoothly pushes many down this path.

North of Africa, Europe takes up a solid chunk of the market, led by the United Kingdom, Germany, and France. Strong IT systems already in place give it an edge. As companies push forward with upgrading their tech setups, needs shift quickly. Rules around data and security are tough here, so firms often turn outside for help. Cloud tools get heavy use. So do methods for studying information flows. Protection against online threats also drives service requests across business hubs.

Countries like India, China, and the Philippines stand out as key go-to spots for tech talent. Behind the scenes, a deep bench of qualified workers helps keep momentum going. Savings on costs play a role too, making operations more attractive. On top of that, better digital networks are taking shape across the area. More companies now rely on cloud systems and outsourced management solutions. Even smaller businesses in developing parts of the region are stepping up spending on technology. Demand among these mid-sized firms for external support keeps climbing steadily.

On the rise in Latin America: steady progress fueled by more spending on information technology, especially in Brazil and Mexico, where cloud platforms and online tools are gaining ground. Not far behind, parts of the Middle East and Africa are stepping into the spotlight, quietly building momentum as places companies look to for support work. Driven less by sudden change and more by practical needs like affordable tech fixes and stronger internal systems, growth sneaks forward in nations such as the United Arab Emirates, South Africa, and Saudi Arabia. Government-backed upgrades add fuel, while businesses seek smarter ways to operate without overspending.

To learn more about this report, Download Free Sample Report

Recent Development News

- March 18, 2025 – de Novo Solutions launched artificial intelligence-driven next-generation shared services operations with the first payroll outsourcing service for the United Kingdom education sector.

(Source:https://cleanroomtechnology.com/life-science-solutions-launches-cleanroom-design-guide-to)

- July 24, 2025 – NTT Data launched security management outsourcing services.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 615.00 Billion |

|

Market size value in 2026 |

USD 660.00 Billion |

|

Revenue forecast in 2033 |

USD 980.00 Billion |

|

Growth rate |

CAGR of 5.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Accenture, Tata Consultancy Services (TCS), Infosys, IBM, Cognizant, Capgemini, Wipro, HCL Technologies, NTT DATA, DXC Technology, Tech Mahindra, Fujitsu, CGI Inc., Mphasis, LTIMindtree, Oracle, and Genpact |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Service Type (Application Development & Maintenance, Infrastructure Management Services, Business Process Outsourcing, Network & Security Services), By Outsourcing Type (Onshore Outsourcing, Nearshore Outsourcing Offshore Outsourcing), By Enterprise Size (Large Enterprises, Small & Medium-Size Enterprises), By End-Users (Healthcare, BFSI, Telecom & IT, Retail & E-Commerce, Energy & Utilities, Media & Entertainments) |

Key IT Services Outsourcing Company Insights

A big name in worldwide tech support, Accenture builds apps while handling cloud setups and digital upgrades. Though rooted in traditional systems work, it now pushes forward using smart software and data tools that reshape how businesses operate. From banks to hospitals, stores to tech firms, many rely on its reach across continents for steady results. Instead of just fixing problems, the firm shapes long-term plans by teaming up closely with customers. With offices nearly everywhere and skills covering almost every need, it stays ahead without chasing trends.

Key IT Services Outsourcing Companies:

- Accenture

- Tata Consultancy Services (TCS)

- Infosys

- IBM

- Cognizant

- Capgemini

- Wipro

- HCL Technologies

- NTT DATA

- DXC Technology

- Tech Mahindra

- Fujitsu

- CGI Inc.

- Mphasis

- LTIMindtree

- Oracle

- Genpact

Global IT Services Outsourcing Market Report Segmentation

By Service Type

- Application Development & Maintenance

- Infrastructure Management Services

- Business Process Outsourcing

- Network & Security Services

By Outsourcing Type

- Onshore Outsourcing

- Nearshore Outsourcing

- Offshore Outsourcing

By Enterprise Size

- Large Enterprises

- Small & Medium-Size Enterprises

By End-Users

- Healthcare

- BFSI

- Telecom & IT

- Retail & E-Commerce

- Energy & Utilities

- Media & Entertainments

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636