Market Summary

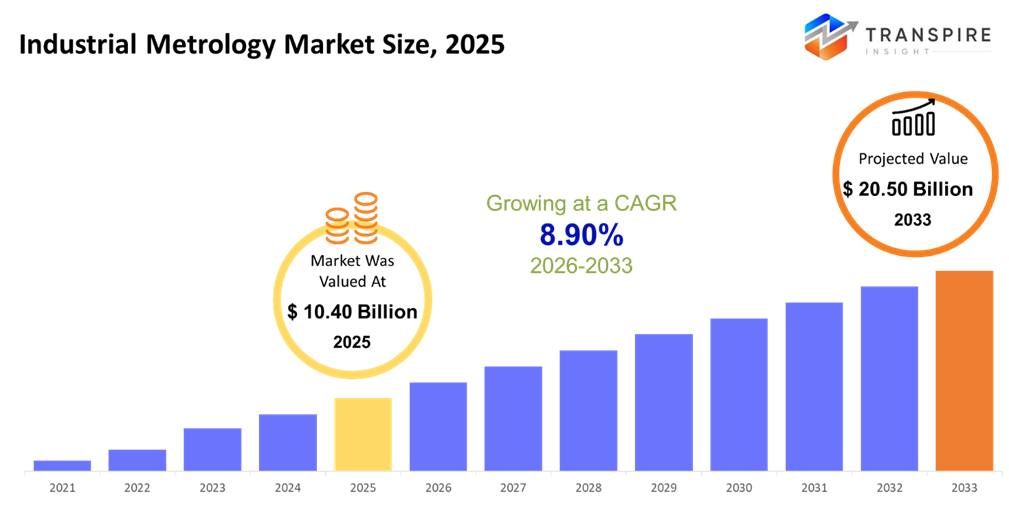

The global Industrial Metrology market size was valued at USD 10.40 billion in 2025 and is projected to reach USD 20.50 billion by 2033, growing at a CAGR of 8.90% from 2026 to 2033. The market for industrial metrology is expanding gradually as a result of manufacturing sectors' rising use of automation and Industry 4.0 technology. Investments in hardware and software are driven by the growing need for high-precision measurement in the automotive, aerospace, and electronics industries. CAGR is further increased by the requirement for digital twins, predictive maintenance, and quality compliance. Long-term growth is also being fueled by the quick technical developments in laser, optical, and non-contact metrology, which are improving efficiency and measurement accuracy.

Market Size & Forecast

- 2025 Market Size: USD 10.40 Billion

- 2033 Projected Market Size: USD 20.50 Billion

- CAGR (2026-2033): 8.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- With a strong focus on automation, digital twins, and regulatory compliance, North America continues to show a steady adoption of advanced industrial metrology solutions. This is due to the region's established automotive, aerospace, and defense manufacturing ecosystems, which sustain a steady demand for high-precision measurement technologies.

- Due to significant investments in smart factories, semiconductor manufacturing, and the production of aerospace components, the United States continues to be a major driver of market expansion. This has accelerated the adoption of coordinate measuring devices, automated optical inspection tools, and software-enabled metrology workflows.

- Industrialization, increased production of automobiles and electronics, and government-backed manufacturing initiatives are driving Asia Pacific's rapid expansion. To support high-volume, precision-driven manufacturing environments, optical, laser, and non-contact metrology systems are being deployed more frequently.

- With a strong focus on automation, digital twins, and regulatory compliance, North America continues to show a steady adoption of advanced industrial metrology solutions. This is due to the region's established automotive, aerospace, and defense manufacturing ecosystems, which sustain a steady demand for high-precision measurement technologies.

- Due to significant investments in smart factories, semiconductor manufacturing, and the production of aerospace components, the United States continues to be a major driver of market expansion. This has accelerated the adoption of coordinate measuring devices, automated optical inspection tools, and software-enabled metrology workflows.

- Industrialization, increased production of automobiles and electronics, and government-backed manufacturing initiatives are driving Asia Pacific's rapid expansion. To support high-volume, precision-driven manufacturing environments, optical, laser, and non-contact metrology systems are being deployed more frequently.

- Due to large production volumes, electrification trends, the adoption of lightweight materials, and an increasing reliance on automated metrology systems to guarantee performance, safety, and compliance with international regulations, the automotive industry continues to be the dominant end-use segment.

So, The industrial metrology market encompasses technologies, equipment, software, and services designed to measure, inspect, and analyze physical components and manufacturing processes. In the automobile, aerospace, semiconductor and heavy machinery industries, it is essential for guaranteeing dimensional accuracy, quality control and regulatory compliance. The increasing demand for high-precision measurement, improved production efficiency, and the incorporation of digital technologies like Industry 4.0, IoT, and digital twins are driving the market. While software platforms for data processing, reporting, and virtual simulation are rapidly gaining traction, hardware solutions such as coordinate measuring machines, laser measurement systems and optical scanners dominate the industry.

Ongoing hardware and software support is provided by services including calibration, maintenance, and operator training, guaranteeing long-term compliance and operating effectiveness. High-quality standards in aerospace and medical devices, growing EV usage, and the complexity of produced components all contribute to market expansion. Faster and more precise measurements are becoming possible because to technological developments like cloud-based analytics, AI-enabled flaw identification, and non-contact scanning. Overall, the market shows strong growth potential due to increased global manufacturing activity, digital transformation, and industrial automation.

Industrial Metrology Market Segmentation

By Component

- Hardware

The market for industrial metrology is dominated by hardware due to the increasing demand for accurate measurement and inspection in various production industries. For dimensions and quality control, tools including CMMs, laser trackers, and vision systems are frequently used. Hardware investments are being fueled by increasing automation in production lines.

- Software

Software, which offers solutions for data processing, modeling, and reporting, is a vital enabler of digital metrology. Digital twin support and integration with CAD/CAM systems enable manufacturers to streamline operations and lower mistakes. Cloud-based metrology platforms, AI-assisted inspection, and advanced analytics are becoming more and more in demand.

- Services

Services Supporting the adoption of hardware and software, services include calibration, maintenance, training, and consultation. While training increases operator efficiency, routine calibration guarantees adherence to international standards. Outsourcing trends and the requirement for metrology asset lifecycle management are driving up service revenue.

To learn more about this report, Download Free Sample Report

By Product Type

- Coordinate Measuring Machines (CMMs)

With its great accuracy for intricate parts, CMMs continue to be the foundation of precision measurement. The automobile, aerospace, and heavy machinery industries make substantial use of them. The use of portable and multi-sensor CMMs is growing in a variety of production environments.

- Optical Digitizers & Scanners

For intricate geometries, optical scanners and digitizers offer quick, non-contact measurements. They are being used more and more in 3D modeling, quality assurance, and reverse engineering. Their application in the automotive and aerospace industries is being propelled by technological advancements in resolution and speed.

- Vision & Laser Measurement Systems

For precise, quick inspection, these devices make use of cameras and lasers. Because of their automated defect identification and non-contact functioning, they are favored in semiconductor applications and high-volume production. The precise engineering and electronics sectors are seeing an increase in adoption.

- Measuring Instruments

Comprises surface testers, gauges, micrometers, and profilometers for simple surface and dimensional tests. They continue to be affordable and adaptable, especially in small and medium-sized production. Their continued demand is supported by increasing production process uniformity.

- X‑Ray & Computed Tomography (CT) inspection systems

CT and X-ray systems allow internal component inspection without disassembly. They are essential for the semiconductor, aircraft, and medical device industries, where finding flaws in individual parts is vital. Adoption is restricted to businesses with strict quality requirements due to high capital costs.

- Automated Optical Inspection (AOI) tools

High-speed visual inspection using AOI equipment is common in the electronics and semiconductor manufacturing industries. They reduce human mistake by identifying dimensions discrepancies and surface flaws. Inspection time is decreased and detection accuracy is improved by integration with AI and machine learning.

- 2D Equipment & Other Specialized Devices

These tools concentrate on specific jobs, surface roughness, and flat measurements. They are used in laboratory and precision industrial environments and serve as a supplement to 3D measurement instruments. The market is still growing moderately due to niche applications.

By Application

- Reverse Engineering

Product innovation and redesign are supported by reverse engineering technologies, which assist in creating CAD models from real components. It is used by sectors including aerospace and automotive to shorten design cycles. Software analytics and high-precision scanners drive growth.

- Mapping & Modeling

Accurate geometric data collection is necessary for simulations, process planning, and quality enhancement in mapping and modeling. This is being used more and more in virtual prototyping and the construction of digital twins. The semiconductor, aerospace, and heavy machinery industries are seeing an increase in adoption.

- Dimensional Measurement

Dimensional measuring is essential for quality control since it guarantees that items fulfill design standards. It is essential in precision manufacturing, automotive, and aerospace because to its high accuracy and dependability. Measurement process automation involves increasing throughput and decreasing human error.

- Virtual Simulation / Digital Twin Support

Metrology data facilitates virtual simulations and digital twins, enabling process improvement and predictive maintenance. Manufacturing efficiency is increased through integration with CAD/CAM and IoT sensors. With the installation of smart factories and the acceptance of Industry 4.0, demand is increasing.

- Other Specialized Applications

Comprises shape analysis, color measurement, and surface roughness assessment. These specialty applications meet specific quality needs in precision engineering, electronics, and medical devices. Adoption is frequently fueled by high standards of quality and regulatory compliance.

By End-Use Industry

- Automotive

The adoption of metrology is dominated by the automotive industry because of its intricate parts and stringent quality standards. Engine, chassis, and body inspection frequently uses CMMs, vision systems, and laser trackers. Automation, lightweight materials, and EV production are the main drivers of growth.

- Aerospace & Defense

Critical components in aerospace require ultra-precise metrology. CMMs, CT scans, and X-rays guarantee both safety and legal compliance. In industries where flaws might have disastrous consequences, such as satellite manufacture, defense equipment, and airplanes, adoption is strong.

- Semiconductor & Electronics

Nanoscale precision is required in semiconductor production. Laser measurement systems, AOI tools, and optical inspection are widely employed. Miniaturization and increased electronics production are fueling this segment's market expansion.

- Medical Devices & Healthcare

Implants, surgical instruments, and diagnostic equipment all require exact surface and dimensions measurements. The use of CT inspection, CMMs, and non-contact metrology is growing. High-accuracy measurement solutions are required by regulations.

- Metal & Heavy Machinery / Manufacturing

For massive components, this industry needs reliable, highly accurate machinery. Engine, turbine, and industrial machinery quality monitoring is made possible by CMMs, laser trackers, and optical systems. Metrology adoption is being accelerated by automation and Industry 4.0 integration.

- Energy & Power

For dependability and efficiency, metrology is utilized in generators, turbines, and other vital power components. Contact and laser measurement systems are widely used. Inspection and quality control needs are also fueled by the expansion of renewable energy infrastructure.

- Consumer Goods, Glass & Ceramics, Others

For dimensions and surface quality inspections, smaller enterprises employ optical scanners and measuring devices. Due to worldwide standardization and rising consumer demands for high-quality products, adoption is moderate but growing.

Regional Insights

The use of CMMs, laser systems, and digital metrology software is driven by the automotive, aerospace, and defense industries in North America, which is still a mature and highly developed market led by the United States. With its automobile manufacturing and industrial modernization, Canada and Mexico provide the region with supplementary services and calibration solutions. The automotive, aerospace, and precision engineering industries in Europe require sophisticated measurement equipment, and Germany, the UK, and France have high penetration rates. Initiatives for automation and manufacturing standardization are another way that Italy, Spain, and the rest of Europe contribute. With China, Japan, and South Korea in the forefront of the adoption of heavy machinery, electronics, and automobiles, Asia Pacific is the region with the quickest rate of growth.

APAC countries including Australia, New Zealand, India, and others are investing more in digital twins, smart factories, and non-contact measurement technology. With prospects in the automotive, metal, and manufacturing modernization sectors, South America which includes Brazil, Argentina, and its bordering countries shows moderate growth. Investments in energy, aerospace, and industrial infrastructure are driving the Middle East & Africa market, which includes South Africa, Saudi Arabia, the United Arab Emirates, and the larger area. All things considered, industrial automation, regulatory compliance, and the growing global need for accuracy and quality across manufacturing levels encourage geographic development.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 2025, In order to support data-driven decisions on manufacturing floors around the world, Hexagon's Manufacturing Intelligence division announced the release of its Autonomous Metrology Suite, software that significantly speeds up quality control workflows by centralizing measurement data on a cloud dashboard, integrating digital twins of CMMs, and simplifying coordinate measuring machine (CMM) programming.

- In May 2023, The 2025 package of metrology software upgrades from ZEISS Industrial Quality Solutions include improvements to the CONNECTED QUALITY, CALYPSO, and PiWeb tools. For CMM measurement, quality control, and inspection activities across industries, these enhancements increase accuracy, teamwork, and data analysis efficiency.

(Source:https://www.zeiss.com/metrology/en/about-us/newsroom/2025/quality-software-release.html)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 10.40 Billion |

|

Market size value in 2026 |

USD 11.30 Billion |

|

Revenue forecast in 2033 |

USD 20.50 Billion |

|

Growth rate |

CAGR of 8.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Hexagon AB, Carl Zeiss AG, Nikon Metrology NV, FARO Technologies, Inc., Mitutoyo Corporation, Renishaw plc, Keyence Corporation, KLA Corporation, Perceptron, Inc., Creaform Inc., GOM GmbH, Jenoptik AG, WENZEL Group GmbH & Co. KG, Automated Precision Inc., Bruker Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Hardware, Software, Services), By Product Type (Coordinate Measuring Machines (CMMs), Optical Digitizers & Scanners, Vision & Laser Measurement Systems, Measuring Instruments, X‑Ray & Computed Tomography (CT) inspection systems, Automated Optical Inspection (AOI) tools, 2D Equipment & Other Specialized Devices.), By Application(Reverse Engineering, Mapping & Modeling, Dimensional Measurement, Virtual Simulation / Digital Twin Support, Other Specialized Applications) and By End-Use Industry (Automotive, Aerospace & Defense, Semiconductor & Electronics, Medical Devices & Healthcare, Metal & Heavy Machinery / Manufacturing, Energy & Power, Consumer Goods, Glass & Ceramics, Others) |

Key Industrial Metrology Company Insights

With a diverse offering that includes hardware, software, and services, Hexagon AB stands out as a global leader in the industrial metrology sector, further solidifying its competitive advantage. The growing demands of the automotive, aerospace, and electronics industries are satisfied by the company's line of high-precision coordinate measuring devices, laser trackers and cutting-edge software solutions like PC-DMIS and digital inspection suites. Its digital metrology skills are improved by strategic acquisitions like the Geomagic package, which enable integrated workflows from scanning to CAD analytics. Hexagon continuously promotes innovation in automated and smart industrial metrology technologies, supporting production accuracy and quality control, thanks to its robust global distribution and R&D investment.

Key Industrial Metrology Companies:

- Hexagon AB

- Carl Zeiss AG

- Nikon Metrology NV

- FARO Technologies, Inc.

- Mitutoyo Corporation

- Renishaw plc

- Keyence Corporation

- KLA Corporation

- Perceptron, Inc.

- Creaform Inc.

- GOM GmbH

- Jenoptik AG

- WENZEL Group GmbH & Co. KG

- Automated Precision Inc.

- Bruker Corporation

Global Industrial Metrology Market Report Segmentation

By Component

- Hardware

- Software

- Services

By Product Type

- Coordinate Measuring Machines (CMMs)

- Optical Digitizers & Scanners

- Vision & Laser Measurement Systems

- Measuring Instruments

- X‑Ray & Computed Tomography (CT) inspection systems

- Automated Optical Inspection (AOI) tools

- 2D Equipment & Other Specialized Devices

By Application

- Reverse Engineering

- Mapping & Modeling

- Dimensional Measurement

- Virtual Simulation / Digital Twin Support

- Other Specialized Applications

By End-Use Industry

- Automotive

- Aerospace & Defense

- Semiconductor & Electronics

- Medical Devices & Healthcare

- Metal & Heavy Machinery / Manufacturing

- Energy & Power

- Consumer Goods, Glass & Ceramics, Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636