Market Summary

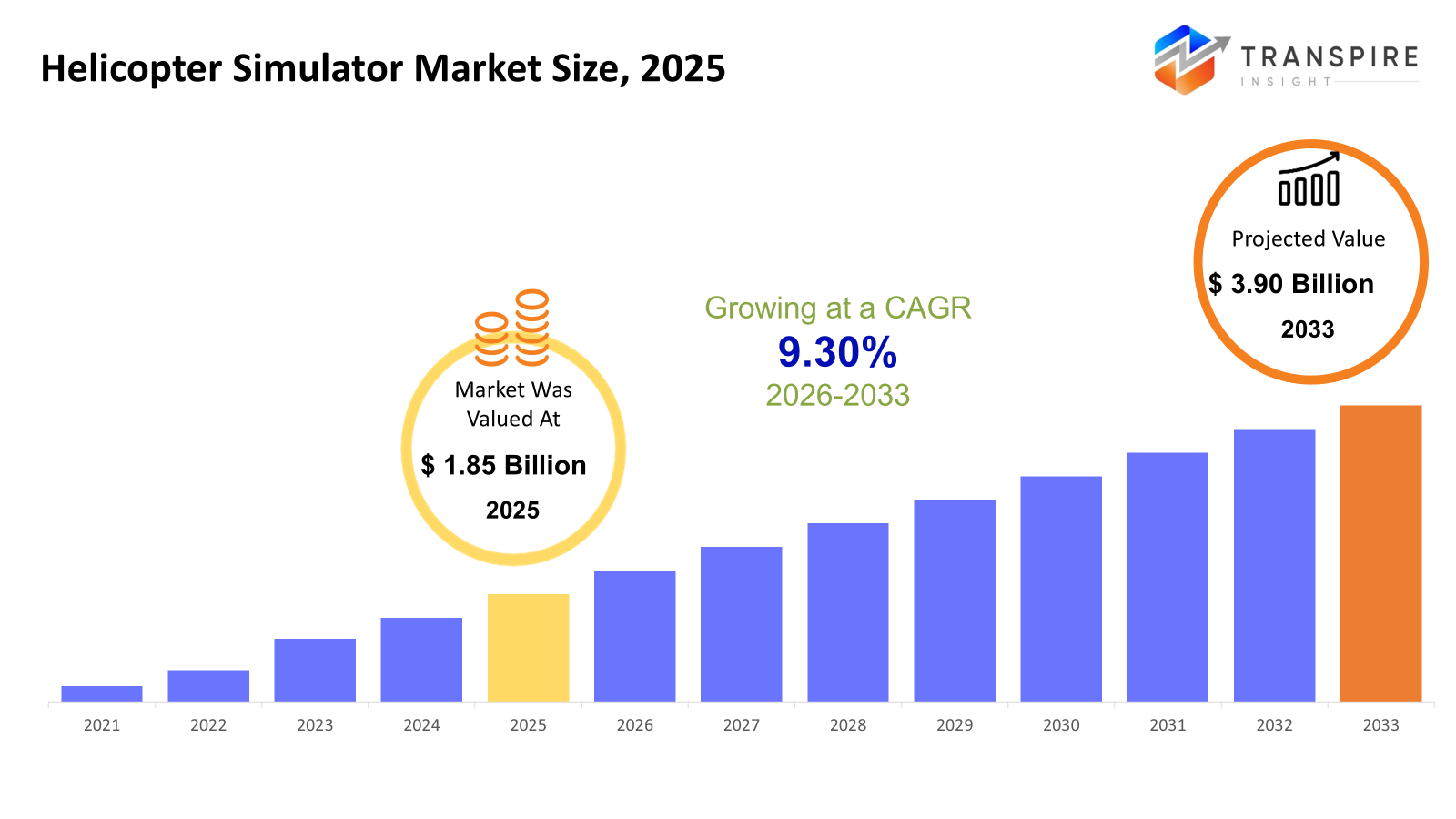

The global Helicopter Simulator market size was valued at USD 1.85 billion in 2025 and is projected to reach USD 3.90 billion by 2033, growing at a CAGR of 9.30% from 2026 to 2033. The rising need for cost-effective pilot training solutions in the global market is also fueling the adoption of simulators, as companies aim to minimize fuel consumption, aircraft wear, and operational risks while still adhering to strict aviation safety regulations.

Market Size & Forecast

- 2025 Market Size: USD 1.85 Billion

- 2033 Projected Market Size: USD 3.90 Billion

- CAGR (2026-2033): 9.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market shows robust adoption of simulators backed by mature aviation infrastructure, high defense spending, and government focus on certified pilot training, making the region a stable revenue generator with steady procurement of advanced full flight simulators.

- The United States market is a major growth driver with large-scale military helicopter operations, OEM-supported pilot training facilities, and widespread adoption of motion-based and mission rehearsal simulators in the military and commercial helicopter sectors.

- The Asia Pacific market shows accelerated growth trends driven by the growing number of helicopters in use, increasing pilot shortages, and growing investments in local defense capabilities, fueling fast-paced adoption of fixed base and virtual reality simulators.

- The Full Flight Simulator product family remains the market leader due to acceptance for type rating and recurrent training, providing high-fidelity motion cues and cockpit replication necessary for advanced pilot training.

- Military Helicopter Simulator solutions are a prominent market segment, as defense organizations are increasingly focusing on affordable combat preparedness, mission rehearsal, and multi-crew coordination training in simulated battlefield conditions.

- Pilot Training is the largest market segment, which is driven by the need for certification, the growing need for pilots worldwide, and the focus on minimizing risks and costs associated with live flight training.

- Defense Organizations are the main market segment for Military Helicopter Simulator solutions due to their focus on tactical preparedness and modernization of their rotary-wing aviation training simulation infrastructure.

So, The helicopter simulator market includes advanced training solutions that aim to simulate actual operational conditions for pilots and crew members. The simulator solutions include motion platforms, visual simulation systems, avionics simulation, and mission software. The helicopter simulator market benefits the civil and military aviation industry by decreasing the need for actual flight hours while improving safety, cost-effectiveness, and training consistency. The growing use of helicopters in transporting patients for emergency medical services, disaster relief, and defense operations has increased the need for advanced simulation solutions.

Technological advancements in virtual and augmented reality simulation, performance analysis, and network simulation are changing the way training is conducted. With the increasing need for compliance and recurrent certification by aviation regulatory bodies, simulation training is becoming a promising area of investment for helicopter operators and defense organizations worldwide.

Helicopter Simulator Market Segmentation

By Type

- Full Flight Simulator (FFS)

Full flight simulators are the most realistic form of training, which combines motion platforms, visual systems, and aircraft-specific avionics. They are largely used for pilot training because of their acceptance by aviation regulations and the optimization of costs in comparison to actual flight time. The growing demand from the defense and airline industry is expected to fuel adoption.

- Fixed Base Simulator (FBS)

Fixed base simulators are cockpit simulators that lack motion platforms. They are largely used for pilot training due to their cost-effectiveness in procedural training. These simulators are widely used for initial pilot familiarization and recurrent pilot training.

- Virtual Reality (VR) Simulator

VR simulators are becoming popular because of their immersive training environment and flexible deployment options. They offer scenario-based training and remote training solutions, which were not possible before. Technological innovations in graphics processing and wearable technology are increasing the realism of VR simulators and their usage in various training domains.

- Augmented Reality (AR) Simulator

AR simulators offer real-world environments with digital overlays, which increase situational awareness and the efficiency of maintenance training. They are being increasingly used for mission rehearsal and technical training, where real-time visualization has improved learning outcomes.

To learn more about this report, Download Free Sample Report

By Platform

- Civil Helicopter Simulator

Civil helicopter simulators are mainly utilized for commercial pilot training, emergency response training, and offshore training. Market expansion is fueled by the growing use of helicopters in the tourism, medical evacuation, and energy logistics sectors. Standardization in training and the need for safety compliance are also contributing factors.

- Military Helicopter Simulator

Military helicopter simulators are mainly focused on tactical training, mission simulation, and combat preparedness, while minimizing the risks and expenses associated with actual flight missions. The growing need for military modernization initiatives and the complexities of mission requirements are fueling the need for increased spending.

By Application

- Pilot Training

Pilot training is the most prominent application area because of the need for compliance with regulations and the growing emphasis on flight safety. Simulators enable the development of skills, training for emergency situations, and efficient certification procedures. The growing need for pilots worldwide is driving investments in simulation facilities.

- Maintenance Training

Maintenance training applications revolve around enhancing technical skills and minimizing aircraft downtime by using simulated troubleshooting environments. Such environments enable technicians to comprehend complex helicopter systems without any risks. Airlines and military organizations are increasingly adopting simulation-based maintenance training.

- Mission Rehearsal

Mission rehearsal simulators enable teams to train for specific operational missions in a controlled environment. They are commonly used in military and emergency services organizations where the complexity of the mission is high. The capacity to simulate various environmental and operational factors improves readiness and efficiency.

- Search and Rescue (SAR) Training Simulators

SAR training simulators mimic adverse weather conditions and emergencies that are hard to simulate in actual missions. They enhance crew coordination and decision-making skills. Rising investments in disaster management and emergency response organizations are fueling the growth of the segment.

- Combat Training Simulators

Combat training simulators create authentic battlefields for tactical and weapons system training. The defense sector uses simulation to reduce risks and maximize readiness. Rising geopolitical tensions and military modernization initiatives are driving demand.

By End User

- Commercial Training Institutes

Commercial training institutes are a significant end-user market owing to the rising demand for trained pilots and recurrent training sessions. These institutes emphasize providing scalable and economical training solutions. Collaborations with simulator manufacturers are increasing the reach of training worldwide.

- Defense Organizations

Defense organizations employ helicopter simulators for training and mission preparation. Simulators lower the operational expenses related to fuel and maintenance of aircraft. Ongoing investments in latest training technology are boosting the long-term acceptance of simulators.

- Helicopter Operators

Helicopter operators employ simulators to enhance safety standards, lower operational hazards, and maintain compliance with regulations. Simulation-based training reduces aircraft downtime and increases pilot productivity. Offshore, medical, and utility helicopter operators are increasingly adopting simulators for recurrent training.

- OEM Training Centers

OEM training centers offer simulator-based training solutions that are model and avionics system-specific. The OEM training centers support customer training, maintenance familiarization, and product lifecycle services. The growing integration of digital training environments is enhancing this market.

Regional Insights

North America, comprising the United States, Canada, and Mexico, is a mature market with high military expenditure and commercial training infrastructure. The United States leads Tier 1 demand, with Canada supporting offshore and utility training requirements, and Mexico indicating emerging adoption. Europe, comprising Germany, United Kingdom, France, Spain, Italy, and the Rest of Europe, indicates steady growth due to sophisticated aerospace production and stringent regulatory requirements. Germany, the United Kingdom, and France comprise Tier 1 markets, with Southern and Eastern European countries indicating moderate Tier 2 demand.

The Asia Pacific region, including Japan, China, Australia & New Zealand, South Korea, India, and the Rest of Asia Pacific, indicates the highest growth rate. China, Japan, and India are Tier 1 growth engines because of their expanding military fleets and defense modernization initiatives, while Southeast Asian countries indicate Tier 2 growth opportunities. South America, including Brazil, Argentina, and Rest of South America, is moderately adopting. Brazil is a Tier 1 market because of its offshore operations, while Argentina and the rest of South America are Tier 2 markets with increasing procurement. Middle East & Africa, including Saudi Arabia, United Arab Emirates, South Africa, and Rest of Middle East & Africa, indicates increasing investments in defense and aviation infrastructure. Saudi Arabia and UAE are Tier 1 markets, while Africa is comprised of mostly Tier 2 markets.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2025, Airbus Helicopters is also adding training capacity in Malaysia with a third full flight simulator (H175 FFS) at the Airbus Helicopters Training Academy in Subang, Malaysia, improving type rating and mission readiness training for pilots in the Asia Pacific region.

(Source:https://www.airbus.com/en/newsroom/press-releases/2025-05-new-airbus-h175-simulator-for-malaysia)

- In April 2025, Thales has officially inaugurated a flight training facility that uses its AW139 Reality H Level D Full Flight Simulator, which includes mixed reality hoist training, enhancing realism for adverse weather operations and pilot qualification.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.85 Billion |

|

Market size value in 2026 |

USD 2.10 Billion |

|

Revenue forecast in 2033 |

USD 3.90 Billion |

|

Growth rate |

CAGR of 9.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

CAE Inc., Thales Group, FlightSafety International, L3Harris Technologies, Inc., Indra Sistemas S.A., TRU Simulation + Training Inc., Frasca International Inc., Airbus SE, Leonardo S.p.A., Textron Inc., Havelsan A.S., Lockheed Martin Corporation, Collins Aerospace, Elite Simulation Solutions AG, and Reiser Simulation and Training GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Full Flight Simulator (FFS), Fixed Base Simulator (FBS), Virtual Reality (VR) Simulator, Augmented Reality (AR) Simulator), By Platform (Civil Helicopter Simulator, Military Helicopter Simulator), By Application (Pilot Training, Maintenance Training, Mission Rehearsal, Search and Rescue (SAR) Training, Combat Training) and End User (Commercial Training Institutes, Defense Organizations, Helicopter Operators, OEM Training Centers) |

Key Helicopter Simulator Company Insights

CAE Inc. is a leader in the helicopter simulator industry because of its large installed base, diversified product line of full-flight simulators, and extensive network of training centers around the globe. The company has strong ties with defense organizations, original equipment manufacturers, and commercial training organizations, which helps it generate steady revenue streams through long-term training and support services contracts. The company continues to invest in digital training platforms, artificial intelligence-driven performance analysis, and simulation technologies, which further enhances its competitive position in the industry. The company’s presence in over 50 countries and its large installed base of simulators help it achieve economies of scale.

Key Helicopter Simulator Companies:

- CAE Inc.

- Thales Group

- FlightSafety International

- L3Harris Technologies, Inc.

- Indra Sistemas S.A.

- TRU Simulation + Training Inc.

- Frasca International Inc.

- Airbus SE

- Leonardo S.p.A.

- Textron Inc.

- Havelsan A.S.

- Lockheed Martin Corporation

- Collins Aerospace

- Elite Simulation Solutions AG

- Reiser Simulation and Training GmbH

Global Helicopter Simulator Market Report Segmentation

By Type

- Full Flight Simulator (FFS)

- Fixed Base Simulator (FBS)

- Virtual Reality (VR) Simulator

- Augmented Reality (AR) Simulator

By Platform

- Civil Helicopter Simulator

- Military Helicopter Simulator

By Application

- Pilot Training

- Maintenance Training

- Mission Rehearsal

- Search and Rescue (SAR) Training

- Combat Training

By End User

- Commercial Training Institutes

- Defense Organizations

- Helicopter Operators

- OEM Training Centers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636