Market Summary

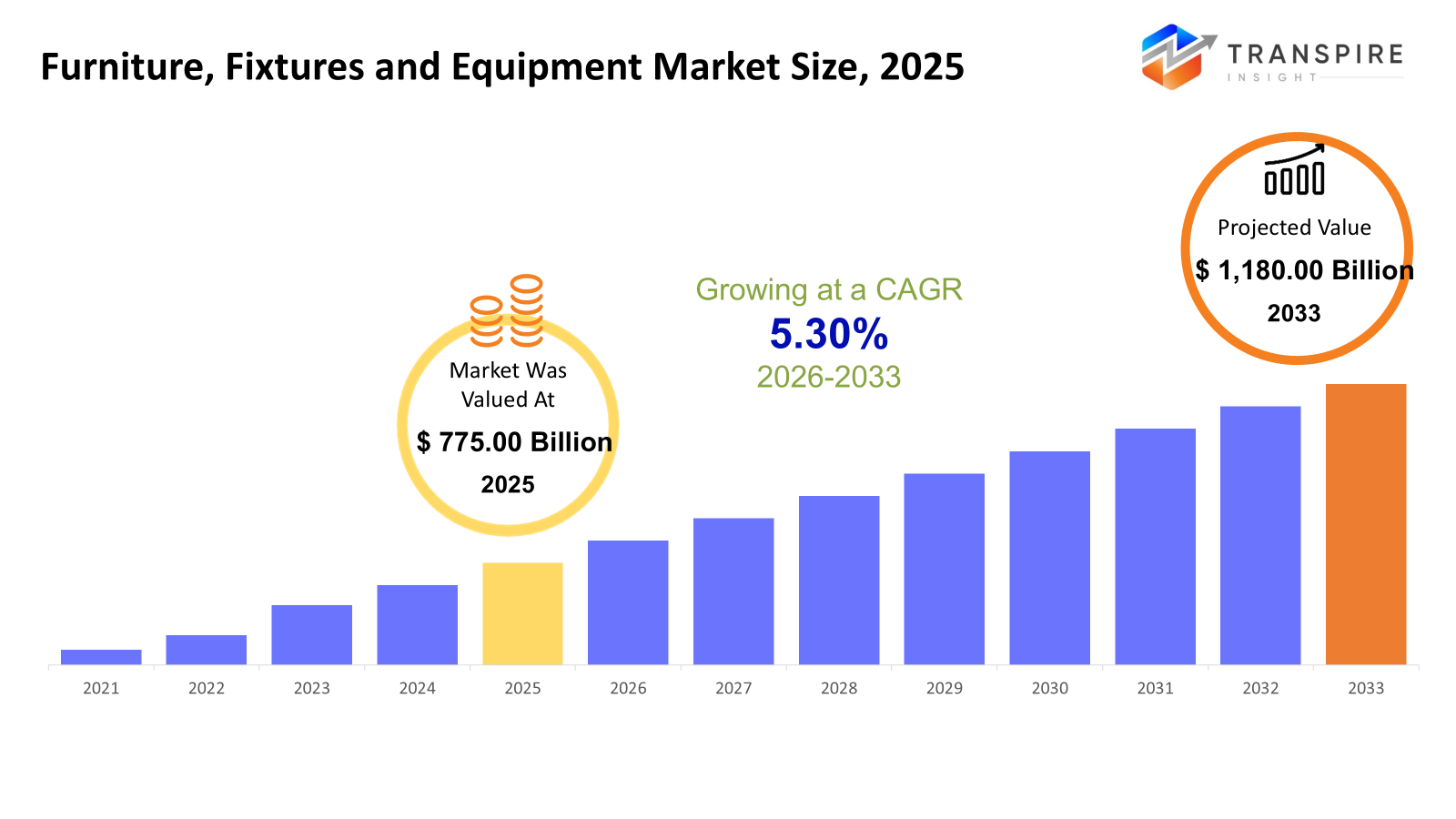

The global Furniture, Fixture, and Equipment market size was valued at USD 775.00 billion in 2025 and is projected to reach USD 1,180.00 billion by 2033, growing at a CAGR of 5.30% from 2026 to 2033. Furniture, fixtures, and equipment around the world keep growing as more hotels seek new setups. Offices spread into fresh spaces, pushing the need higher all by themselves. Renovated shops and updated hospitals bring along extra orders just quietly. Even homes start wanting newer pieces, almost without notice. City life gets denser, which somehow pulls demand up each year. Design shifts matter too clean lines and smart features catch eyes now. Gadgets blend into desks or lights, making gear harder to ignore. Progress in how things are made also helps items sell better.

Market Size & Forecast

- 2025 Market Size: USD 775.00 Billion

- 2033 Projected Market Size: USD 1,180 Billion

- CAGR (2026-2033): 5.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 45% in 2026. Lots of businesses across North America need these systems, especially big office buildings. Hotels are using them more often, too. Retail spaces fit right into this trend, quietly keeping up. Infrastructure growth helps spread their use even further.

- The United States. Offices, hotels, and even homes most often use furniture built for comfort and smart design, because it just makes sense. New models arrive fast, shaped by how people actually move and sit. What sticks around lasts longer, wastes less. A quiet shift, really, one chair at a time.

- Fueled by city growth and new hotels popping up, this part of the world moves quickly. Construction work spreads wider here than in most places. Urban shifts push development forward, one building at a time.

- Furniture shares approximately 58% in 2026. Furniture takes the lead as offices, hotels, and homes ask for more pieces. Demand climbs steadily across workspaces, guest stays, and living areas. More chairs, desks, and shelves appear where people gather to live or work. Spaces shaped by comfort now choose sturdy design over quick fixes. What fills rooms today favors long use and flexible layouts.

- Firmness matters most when picking what to build with wood, which stands out because it lasts long, looks right at home anywhere, and grows back if managed well. Though some choose steel or plastic, few match how quietly a timber frame settles into place without shouting about itself across decades of wind and weather.

- Bulk orders from hotels, yet offices also contribute significantly to healthcare sites add steady demand too; direct sales hold the lead here. Not indirect routes fading, though volume trails far behind those upfront deals shaping output flow. Pressure stays on internal teams rather than third parties handling reach. Most units move without middlemen involved.

- Renovations spark movement here, hospitality leads. Expansions follow close behind, pushing things forward. Modern interiors quietly shift what stays and goes. Growth shows up where updates happen, not before.

Nowhere else has furniture seen such steady growth as around the world, thanks to more buildings going up, cities expanding, followed closely by renewed interest in how spaces look and work. Inside homes, offices, hotels, hospitals - everywhere - design choices matter more now, mainly because people want things that feel good to use while fitting well visually. Change creeps in slowly, yet noticeably: new styles push old ones aside, comfort blends with purpose, and materials evolve without shouting about it. Machines talk to each other these days; lights adjust themselves, chairs respond to weight, not magic, just smarter gear finding its way into daily life. Energy matters too, quietly guiding what gets made, how long it lasts, and which items customers actually bring home instead of passing by.

Fresh upgrades in offices, hotels, and homes keep demand steady across North America. Infrastructure here runs deep, making logistics smoother than in many regions. High earnings allow buyers to choose better-built, long-lasting furnishings. Instead of rushing to cut costs, companies often pick designs that support comfort and movement. Eco-minded choices gain ground not because of trends, but due to real shifts in how spaces are used. Supply routes are already in place, tested over years of consistent orders. Sales happen directly or through large-scale contracts; both work well here. Companies pour resources into warehouses, tech, and delivery systems, quietly strengthening their hold. Leadership is not claimed, it’s maintained through reliability, day after day.

Buildings getting upgrades across Europe help push steady progress, especially in hotels and offices, where green materials now matter more than before. Premium looks lead choices in wealthy parts of Western Europe, tied closely to gear that saves power, plus lighting and taps built tough under tight rules for health and environmental impact.

Out in Asia-Pacific, Latin America, and parts of the Middle East and Africa, momentum is building fast. With cities getting denser, new hotels and shops keep popping up, spurring appetite for fresh interior styles. Big construction ventures pull in more funds now, while sharper attention to how things look and last adds further push. Growth hums louder where tastes evolve, and buildings rise at pace.

Furniture, Fixture and Equipment Market Segmentation

By Product Type

- Furniture

Chairs show up in offices, homes, and living rooms. Desks appear where work happens, sometimes tucked beside windows. Tables stand ready for meals or meetings, depending on the room. Cabinets hold things out of sight, built into walls, or set free. Storage answers clutter, fitting neatly under shelves or behind doors.

- Fixture

Floor lamps brighten corners while shelves hold items off the ground. Glass cases show things clearly under steady bulbs. Signs guide eyes without cluttering walls. Cabinets tuck belongings out of sight yet stay close at hand. Sections snap together, forming custom shapes inside rooms.

- Equipment

Fancy gadgets sit beside tools that cook your meals. Meanwhile, machines for sound and pictures fill another shelf. Office gear hums quietly nearby instead. Each type holds its own space without crowding the others.

To learn more about this report, Download Free Sample Report

By Material

- Wood

Furniture often features solid timber, built to last through seasons. Engineered versions mix layers for stability when shapes shift slightly over time. Thin slices of real wood cover surfaces where cost matters, but look stays key. Each type holds grain patterns that catch light in quiet ways.

- Metal

Crafted from steel, though sometimes aluminum steps in where lighter weight matters. Alloys appear, too, shaped into parts that hold things together or make up fixtures around spaces. Strength often drives the choice, yet form plays a role when design takes shape.

- Plastic & Polymers

Furniture shaped from plastic appears everywhere. Synthetic blends hold pieces together while adding texture. Finishes made of long-chain molecules shine under light. Function drives design just as appearance shapes purpose. Materials behave differently when heated slowly. Structure changes during cooling phases. Smooth surfaces resist wear over time.

- Glass & Stones

- A smooth pane of glass stands beside a slab of cool marble. Granite follows close after, heavy underhand. Stone fixtures rise where walls meet the floor. Panels shine near rough-edged rock forms. Marble curves into place next to rigid frames.

By Distribution Channel

- Direct Sales

Facing businesses head-on, selling straight to workplaces where desks fill rooms. Offices open doors to bulk orders without middle steps. Hotels bring needs that repeat month after month. Hospitals require a steady supply under strict rules. Big construction jobs pull in volume when contracts land.

- Retail & Online Stores

Where furniture, fixtures, and equipment appear, some spaces welcome a touch before buying. Others live behind screens where images stand in. A few shops focus only on certain pieces people keep coming back for.

- Contract & Project-Based

A single room or an entire building, each project gets its own approach. Work moves step by step, shaped by need, not templates. Size doesn’t set the pace; clarity does. Every detail lines up before anything takes form. Solutions arrive built only for what stands in front.

By End-Users

- Hospitality

Hospitality means places like hotels where people stay. Resorts offer rest and fun by lakes or beaches. Restaurants serve meals to guests who walk in. Convention centers host big groups for meetings instead.

- Commercial Offices

Office buildings where companies work. Shared desks for freelancers or small teams. Places made for meetings and daily tasks.

- Healthcare Facilities

Hospitals come first, then clinics pop up in neighborhoods, followed by places where older people live full-time.

- Retail & Entertainment

Stores and movie halls sit inside shopping centers. Malls mix fun with buying things. Amusement spots join shops under one roof. Places to watch films link up with market aisles. Fun rides connect to storefronts in big buildings.

- Residential

Living spaces come in many forms - apartments tucked into city blocks, family houses on quiet streets, and then there are grand villas set apart by design and space.

Regional Insights

Even with older buildings everywhere, North America still leads in FF&E spending because businesses keep expanding and people have money to spend. Offices, hotels, and homes get redone often, which keeps buying steady, especially for comfy, long-lasting, eco-friendly pieces. Because delivery routes are reliable and suppliers know their roles, products reach buyers without delay. Growth holds firm thanks to these behind-the-scenes systems that quietly support demand.

Home renovations spark change across Europe, where updates in offices, hotels, and houses push progress. Instead of chasing trends, Western nations lean toward green choices that save power. Rules around safety shape what people buy, nudging buyers toward long-lasting gear. Fancy finishes catch eyes here, making well-built items more appealing. Materials matter; solid ones sell better, feeding interest in top-tier fittings and built-in systems.

Fresh momentum builds in parts of Asia–Pacific, Latin America, and across the Middle East, plus Africa. Cities grow fast - sparking wider networks of hotels, shops, and office spaces. More people spend on updated interior setups than before. Big building efforts rise, lifting needs for furniture, fixtures, and gear. Standards matter more now to workers, buyers, and inspectors. New tools arrive alongside smarter materials, shifting how spaces take shape. Movement spreads - not sudden, but steady.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 24, 2025 – Kilter Space launched an end-to-end fit-out service to the student and hotel sector.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 775.00 Billion |

|

Market size value in 2026 |

USD 820.00 Billion |

|

Revenue forecast in 2033 |

USD 1,180.00 Billion |

|

Growth rate |

CAGR of 5.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Herman Miller, Steelcase, Haworth, Knoll, HNI Corporation, Teknion, Kimball International, IKEA, La-Z-Boy, Ashley Furniture, Sunon Group, Okamura Corporation, Allsteel, Arper, HON Company, Global Furniture Group, and Teknion Studio |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Furniture, Fixtures, Equipment), By Material (Wood, Metal, Plastic & Polymer, Glass & Stones), By Distribution Channel (Direct Sales, Retail & Online Stores, Contract & Project-Based), By End-Users (Hospitality, Commercial Offices, Healthcare Facilities, Retail & Entertainment, Residential) |

Key Furniture, Fixture and Equipment Company Insights

Office spaces often feel stiff until you see how Herman Miller shapes them differently. Their work begins where comfort meets clever structure, not just looks. From desks to chairs, each piece follows body movements as if it knows what comes next. Ideas grow out of deep study, not guesswork, making function part of every curve and joint. You find their designs in busy city buildings, quiet meeting rooms, and in places people gather to think. Sustainability slips into materials quietly, without fanfare or slogans. Sales happen through clear channels across continents, but never lose local touch. What stands out is not fame, but how they shift space without shouting about change. Trends bend near their influence, slowly adapting to what these products already live by.

Key Furniture, Fixture and Equipment Companies:

- Herman Miller

- Steelcase

- Haworth

- Knoll

- HNI Corporation

- Teknion

- Kimball International

- IKEA

- La-Z-Boy

- Ashley Furniture

- Sunon Group

- Okamura Corporation

- Allsteel

- Arper

- HON Company

- Global Furniture Group

- Teknion Studio

Global Furniture, Fixture, and Equipment Market Report Segmentation

By Product Type

- Furnitures

- Fixtures

- Equipment

By Material

- Wood

- Metal

- Plastic & Polymer

- Glass & Stones

By Distribution Channel

- Directs Sales

- Retail & Online Stores

- Contract & Project-Based

By End-Users

- Hospitality

- Commercial Offices

- Healthcare Facilities

- Retail & Entertainment

- Residential

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636