Market Summary

The global Flame Retardants market size was valued at USD 9.20 billion in 2025 and is projected to reach USD 15.60 billion by 2033, growing at a CAGR of 6.70% from 2026 to 2033. A push for stricter fire rules in buildings, gadgets, cars, and fabrics lifts the worldwide flame retardants business. Because cities spread and new structures rise, needs climb too. Electronics lean heavily on these chemicals now, pulling the market higher. Newer types that behave better around nature find more space to grow during the years ahead.

Market Size & Forecast

- 2025 Market Size: USD 9.20 Billion

- 2033 Projected Market Size: USD 15.60 Billion

- CAGR (2026-2033): 6.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 40% in 2026. Fire rules shape how flame retardants are used in North America. Because standards demand safety, companies in building work, tech gear production, and vehicle making now lean toward greener types without halogens. Rules push change, yet shifts also come from inside industries, finding better ways. What grows here ties closely to what laws allow, plus what materials can do today.

- Near every home, office, or factory across America, tough fire rules stay in place, so materials must resist flames well. Because plastic products fill daily life, strict standards hold firm. Electronics use keeps rising there too, which means more need for effective retardant chemicals shows up regularly. Tough regulations mix with heavy material use, pushing steady interest in better solutions year after year.

- Fueled by fast-moving factories, the region meets the worldwide need. Electronics work meets auto production here, tied through growing cities. Fire-safe supplies gain ground as buildings rise. Industrial growth pushes material demands ahead. This part of the world sets the pace, driven by construction jumps and machine-based output

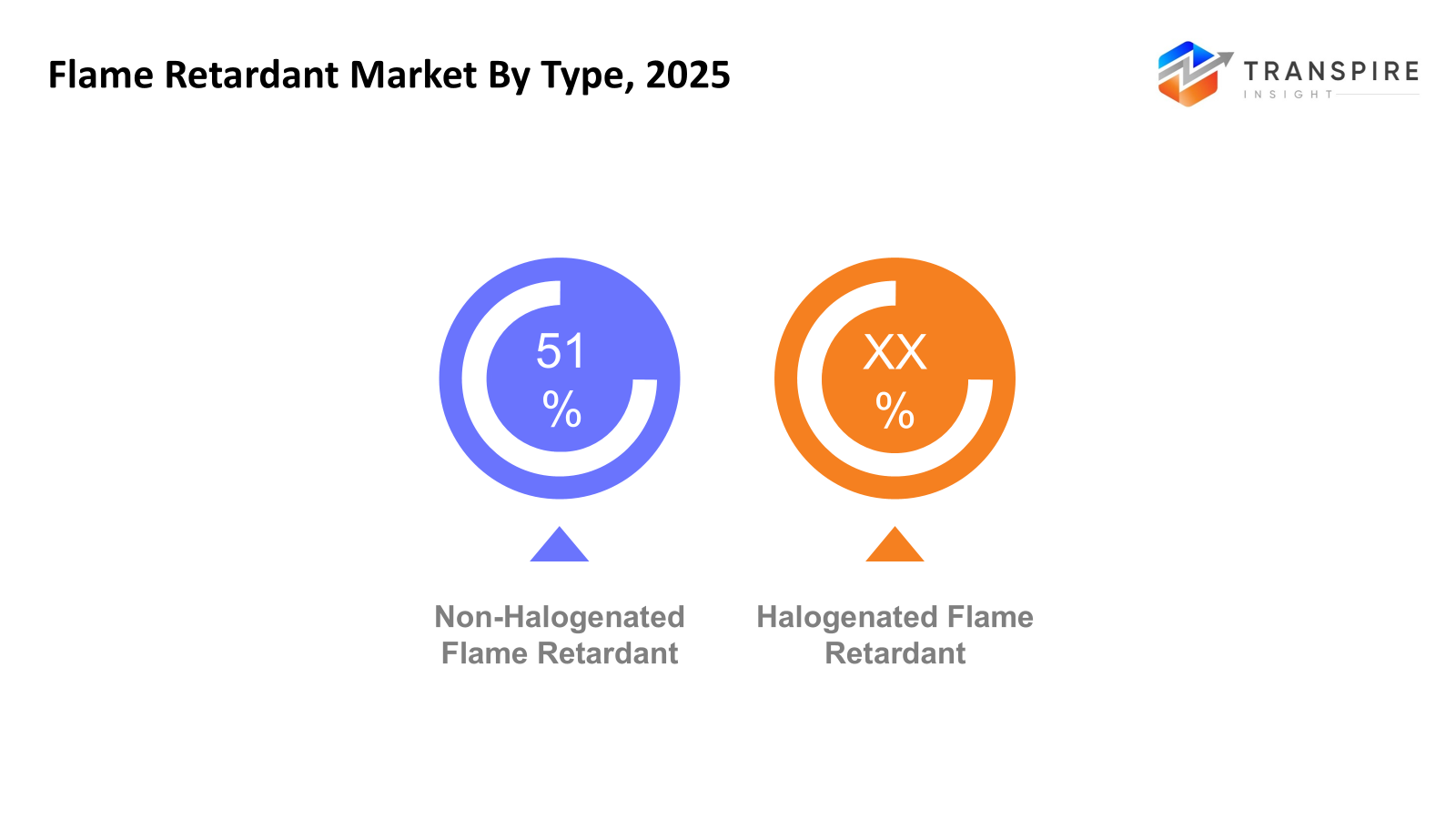

- Non-Halogenated Flame Retardants share approximately 53% in 2026. Rising preference for safer, greener options edges out older halogen-based types. These newer materials dodge toxicity concerns linked to past formulas. Performance meets regulation without relying on harsh chemistry. Market shift leans hard toward sustainability; this group benefits most.

- Most flame retardants you see are solid stuff, simple to mix into plastics, useful nearly everywhere. Though liquids exist, these dry kinds still lead the pack when companies pick protection. Their staying power comes from fitting smoothly into manufacturing routines. The fact is, versatility keeps them on the top shelf despite newer options popping up.

- Built into plastics and polymers, flame retardants play a key role where fire resistance matters most - inside wires, coatings, and everyday items. This sector takes up the biggest share because materials used there must resist burning under stress. Safety standards push demand higher every year across homes and industries alike.

- Because of tough safety rules, plus heavy demand for fire protection in gadgets and wiring, the electrical and electronics field takes top spot among users. Devices like circuit boards and power cords need these materials most. Safety needs push usage higher here than elsewhere. This group stays ahead simply because of how much it relies on such compounds.

Fire slows down when certain chemicals mix into everyday products, helping keep people safe. Because flames move more slowly through treated items, factories add these substances to fabrics, wires, plastic parts, and surface layers. Safety rules now expect protection built in, so makers include them as standard instead of skipping them. What once seemed like an extra step has become part of how things get made. Over time, avoiding fire damage shifted from being just smart to being required.

A fresh wave of tech change now pushes companies to craft smarter materials - ones that work well without harming people or planet. Because safety rules tighten, firms shift toward flame blockers free of halogens and built with less toxicity. These shifts respond to demands blending protection, lawfulness, and long-term thinking. Progress rolls forward as science teams fine-tune how these substances mix into new plastics, standing up better under heat and wear.

Not just rules, but real-world needs shape how flame-resistant products grow across industries. Wherever safety codes apply, be it wires, walls, or vehicle materials, they must meet strict performance levels. Because of these requirements, buyers keep returning, especially in car making, housing, and gadgets. Over time, laws do more than enforce; they guide choices toward lasting solutions. Growth follows where oversight stays firm.

Fueled by sharper attention to fire risks, both makers and buyers are leaning harder into flame-resistant options. Because electric transport keeps spreading, alongside gadgets that think and materials built to push limits, shielding against flames grows more urgent. When change hits an industry, these additives stick around doing quiet work to keep things safe, steady, and within the lines set by rules.

Flame Retardants Market Segmentation

By Type

- Halogenated Flame Retardants

Burning slows when these chemicals step into their role, across industries needing protection. Efficiency drives adoption, yet price helps too whenever safety's the goal. Fire risks drop because of how they interfere with combustion. Common doesn’t mean unnoticed, especially where performance counts.

- Non-Halogenated Flame Retardants

Finding favor now, tighter eco-rules push shift away from halogen-based options. Growing interest comes not just from policy but also a real pull toward longer-lasting, cleaner alternatives.

To learn more about this report, Download Free Sample Report

By Form

- Solid

Steady growth comes from how simple it is to work with. Plastics plus buildings rely on it heavily. Main player because folks reach for it again and again.

- Liquid

Coatings see it more often these days. Textiles follow close behind. Flexible polymers take up the trend just as fast. Its presence grows without drawing attention.

By Application

- Plastic & Polymers

Fueled by everyday products, plastics and polymers dominate the field. Their role in gadgets, cars, and household items keeps them ahead. What pushes their lead is not just volume - integration into essential parts matters more. Driven by demand, they outpace other materials simply by being everywhere needed.

- Building & Construction

Built environments see shifts because of tough rules around fire protection in homes and offices. Fire risks shape how structures rise, influencing materials chosen across projects, large and small. Safety codes tighten, pushing builders toward solutions that resist flames more effectively than before. Regulations evolve, nudging entire sectors to rethink how they assemble spaces meant for people every day.

- Electricals & Electronics

Production of gadgets lifts the need for electrical gear. Wiring setups grow, pulling demand along. More electronics made means more parts ordered. Factories churn out devices, shops stock up. Rising output feeds steady appetite for circuits. Equipment orders climb as assembly lines hum. Devices multiply, so do connections. Output rises, purchases follow close behind.

- Textiles

Fabric treatments help slow flames in couches, curtains, and also workwear. Some materials resist ignition when exposed to heat, keeping wearers safer during emergencies.

- Automotive & Transportation

More cars now use these materials because they must pass tougher safety rules. Heavy metal gets swapped out for lighter stuff that still holds up well. New models roll off lines faster when the weight drops without cutting strength. Safety stays high even when parts weigh less than before.

By End-Users

- Automotive

Fires stay contained because materials inside cars resist spreading flames. Wires tucked beneath dashboards use coatings that slow burning. Seats, panels, and trim choose substances tested against heat. Safety rules shape how parts are built under real conditions.

- Electronics

Fires resist better when materials inside gadgets stand up to heat. Circuit panels, wires, or outer shells often need that protection. Heat blockers go where sparks might fly.

- Construction Industry

Built tough, homes often hide it within walls, locking warmth where it belongs. Panels rise faster when this material joins the frame early on. Sometimes you won’t see it, yet beams rely on its quiet strength day after day.

- Consumer Goods

From kitchen gadgets to cleaning tools, these materials help slow flames. Fire safety gets a boost in everyday items found around the home. Some parts inside your dryer or toaster rely on this protection. Even trash cans and storage bins use it quietly behind the scenes. Safety hides where you might not expect, inside common things people touch each day.

- Industrial Manufacturing

- Factories rely on tough materials built to last, because protection matters when machines run nonstop. Heavy tools need strong parts, so systems stay secure during intense work cycles. Built-in safeguards help avoid breakdowns, since durability supports steady production lines.

Regional Insights

Even though it is not the only player, North America still leads in flame retardant use because strict fire rules push the need in buildings, cars, and gadgets. Because safety laws require protection, builders often pick modern types that are less harmful. New ideas pop up regularly, guided by goals to make safer formulas that also treat nature better. Big chemistry companies work here, backed by labs and research networks that quietly steer how products evolve. Rules change slowly, yet each shift nudges material design toward cleaner options without making noise about progress.

Across Europe, rules around flame retardants center heavily on safety and ecological responsibility in many sectors. Because of tough chemical standards, companies now lean toward non-halogen options - especially where cars and electronics are involved. Driven by these laws, new eco-friendly materials keep emerging while industry interest holds strong.

A surge in factory output across the Asia Pacific sets the stage for lively market movements. Because industries grow fast, roads and buildings multiply quickly too. Electronics and cars roll out nonstop, pushing material needs higher. Safety rules gain attention slowly, yet steadily shaping how things are built. More people want gadgets and homes protected from fire risks. Newer nations begin using smarter ways to resist flames. These shifts spark fresh competition among makers. Chances open up where few existed before.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 9, 2026 – CAI launched High-Efficiency Halogen-Free Flame Retardant.

(Source:https://www.plasticstoday.com/materials/cai-launches-high-efficiency-halogen-free-flame-retardant)

- September 16, 2025 – New Cesa™ max flame retardant additives developed by Avient for strict industry standards.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 9.20 Billion |

|

Market size value in 2026 |

USD 9.90 Billion |

|

Revenue forecast in 2033 |

USD 15.60 Billion |

|

Growth rate |

CAGR of 6.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Albemarle Corporation, BASF SE, ICL Group Ltd., LANXESS AG, Clariant AG, Italmatch Chemicals S.p.A., Huber Engineered Materials, Nabaltec AG, Dow Inc., Adeka Corporation, Avient Corporation, Thor Group Ltd., Akzo Nobel N.V., Daihachi Chemical Industry Co., Ltd., Zhejiang Wansheng Co., Ltd., RTP Company, and Sinochem Group |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Halogenated Flame Retardants, Non-Halogenated Flame Retardants), By Form (Solid, Liquid), By Application (Plastics & Polymers, Building & Constructions, Electrical & Electronics, Textiles, Automotive & Transportation), By End-Users (Automotive, Electronics, Construction Industry, Consumer Goods, Industrial Manufacturing), |

Key Flame Retardants Company Insights

From its roots in specialty chemistry, Albemarle serves markets worldwide where fire protection matters most. Flame retardants are used to protect materials across plastics, tech gear, buildings, and vehicles. Solutions blend bromine-based compounds alongside halogen-free alternatives tailored for modern demands. Meeting tough safety rules goes hand in hand with protecting ecosystems. New formulas emerge constantly, born from labs aiming higher on performance and lower on harm. Factories spread across continents back this push, tied to research hubs fine-tuning each compound. Industries rely on these advances not just to pass inspections but to build safer items people touch daily.

Key Flame Retardants Companies:

- Albemarle Corporation

- BASF SE

- ICL Group Ltd.

- LANXESS AG

- Clariant AG

- Italmatch Chemicals S.p.A.

- Huber Engineered Materials

- Nabaltec AG

- Dow Inc.

- Adeka Corporation

- Avient Corporation

- Thor Group Ltd.

- Akzo Nobel N.V.

- Daihachi Chemical Industry Co., Ltd.

- Zhejiang Wansheng Co., Ltd.

- RTP Company

- Sinochem Group

Global Flame Retardants Market Report Segmentation

By Type

- Halogenated Flame Retardants

- Non-Halogenated Flame Retardants

By Form

- Solid

- Liquid

By Application

- Plastics & Polymers

- Building & Constructions

- Electrical & Electronics

- Textiles

- Automotive & Transportation

By End-Users

- Automotive

- Electronics

- Construction Industry

- Consumer Goods

- Industrial Manufacturing

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636