Market Summary

The global E-Commerce Packaging Materials market size was valued at USD 79.83 billion in 2025 and is projected to reach USD 141.83 billion by 2033, growing at a CAGR of 7.45% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 79.83 Billion

- 2033 Projected Market Size: USD 141.83 Billion

- CAGR (2026-2033): 7.45%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 34% in 2026. Fueled by widespread online shopping, North America sees steady gains. Still, it is the push for eco-friendly materials that keeps the momentum going. Protection matters just as much as sustainability here. Growth holds on, backed by consumer habits shifting faster than expected.

- Fueled by a hunger for speed and flawless packages, the United States sets the pace across the region. Its edge comes from high-tech shipping networks that move goods smoothly. Customers here expect quick arrivals without dents or delays. This mix pushes demand higher than elsewhere nearby.

- From bustling cities to rural towns, online shopping surges across the Asia Pacific. Retail spaces grow larger and more widespread here each year. Environmental concerns push companies toward greener wrapping materials. A shift in consumer habits fuels demand at every level.

- Corrugated boxes are expected 41% market share in 2026. Firm, Corrugated Boxes stand out, built tough, kind to the planet, then priced right for shipping online orders safely. These boxes hold up well, break down easily after use, yet still guard contents through long hauls across distances.

- That role belongs to primary packaging, which keeps goods intact during shipping while shaping how customers feel when they open their purchase.

- Packaging that shields items gains importance because shipping more goods mean fewer broken arrivals. Customers now expect everything to arrive unharmed, so protection matters more than ever.

- Shopping and household items still top the list. Because more people buy daily essentials online, they need more packaging. That keeps this retail and consumer goods sector number one.

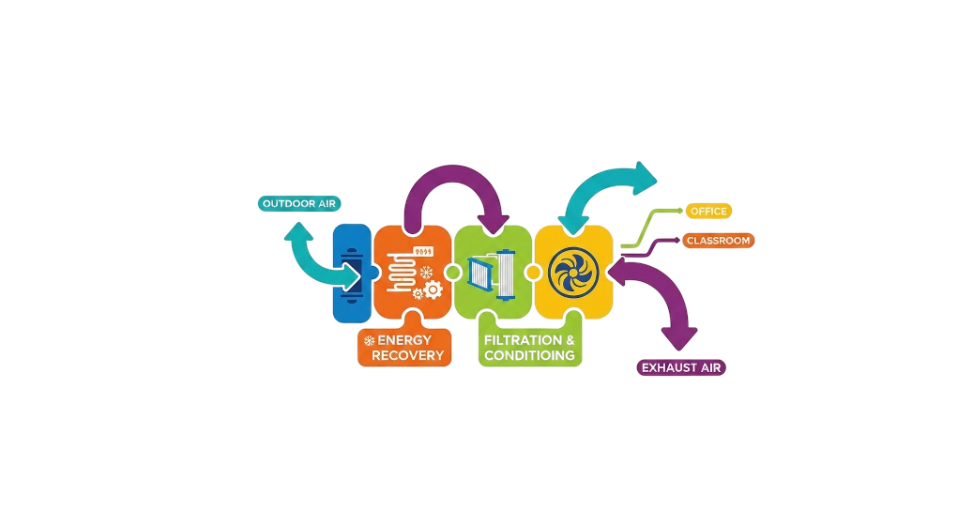

Packaging stuff for online shops makes up a worldwide business focused on shipping needs. From cardboard boxes to bubble wrap, each piece keeps items safe while stored or moved around. Plastic mailers, stiff boards, and foam inserts come together so things arrive without damage. Online buying grew fast, and so did demand for strong yet light wrapping options. How well something is packed affects how customers feel when they open their orders. Protection during transit matters just as much as smooth handling in warehouses. Lightweight designs help cut down shipping costs over time. Materials must work reliably at every step of the journey. This sector adapts constantly to match changes in digital shopping habits. Durability meets practicality in ways that support modern delivery systems.

Online shopping keeps growing around the world, so businesses now look for packaging strong enough to survive shipping while keeping goods intact. Because more types of products like gadgets, clothes, meals, and medicine are bought online, companies must use many different kinds of wraps, boxes, and fillers that last long without costing too much. Lately, shoppers have shown they prefer eco-friendly solutions, pushing firms to switch toward materials that either break down naturally or can be recycled after use.

A fresh wave of change sweeps through how products get packed on shelves. Because rules tighten around plastic trash while buyers lean into greener picks, recycled paper wraps, compostable layers, and planet-smart cardboard rise fast in use. Alongside, companies weave special labels, boxes built for comebacks, digital tools that log journeys or fight fakes, mixing daily ease with a polished feel people notice.

Across regions, Asia Pacific holds the biggest portion of the market, fueled by fast-growing online shopping in China, India, and Southeast Asian nations, along with more people getting online and spending more. Close behind is North America, where well-developed delivery networks, widespread digital retail use, and interest in high-quality, eco-friendly wraps keep activity strong. In Europe, forward-moving rules favoring green materials help push progress. Meanwhile, Latin America and parts of the Middle East plus Africa are slowly gaining ground as buying online climbs and package demands grow.

E-Commerce Packaging Materials Market Segmentation

By Material Type

- Corrugated Boxes

Common choice when moving goods tough enough to handle rough trips, simple to break down after use, and cheap to produce at scale. Strength matters here, so does what happen once they are empty.

- Paper and Paperboard

Paper and paperboard often fit the bill when green choices matter. Brands lean on them just as much for looks as for their earth-friendly rep.

- Foam & Cushioning Materials

Packed inside, soft foams guard delicate goods when moving. Bumps and shakes meet resistance through padded layers. Inside each box, cushioned wraps take the hit instead of the contents.

- Plastic Packaging

A plastic wrap keeps things dry while bending easily around different shapes. Tough enough to last, it handles rough treatment without failing. Its strength holds up across many kinds of goods.

- Flexible Packaging

Lightweight packages like pouches take up less room during shipping. These flat designs help move products faster without heavy materials slowing things down.

- Protective Packaging

Stuff inside boxes -like padding, dividers, or coverings keeps items safe during shipping. These pieces stop things from bumping around too much.

- Others

Molded pulp shows up here, along with mix-style packaging types. These fit into a broader category of niche materials.

To learn more about this report, Download Free Sample Report

By Product

- Primary Packaging

The container touches the item first, keeping it safe while making the opening feel satisfying. A snug fit guards against damage during handling, yet allows smooth access when needed.

- Secondary Packaging

Wrapped bundles keep things safer during moves. These outer layers make lifting batches simpler. Protection grows when pieces travel as one unit.

- Tertiary Packaging

Packed in groups, this layer moves goods safely through storage plus shipping routes. It shows up where big loads need moving without damage during long trips.

By Packaging Function

- Protective Packaging

Stuff inside stays safe when it travels. Fewer things come back damaged. Boxes keep everything secure on the way.

- Branding & Presentation Packaging

Enhances brand visibility and customer engagement.

- Transit & Logistic Packaging

Boxes built tough, made to move fast through storage and shipping lanes. How they hold up matters just as much as how quickly they get there.

- Sustainable Packaging

From nature's rhythm comes packaging that lives again through reuse, breakdown, or recycling. Materials bend back into the cycle instead of ending up stranded in waste streams.

- Tamper Evidence Packaging

Security wraps show if someone opened the package before. These packs help make sure nothing changed inside after they left the factory.

By End-Users

- Retail and Consumer Goods

Every day, shopping drives big numbers online, so retail uses it most. Because people buy things constantly, consumer goods follow close behind.

- Electronic Appliances

Fragile gadgets need strong padding along with materials that block static buildup.

- Food & Beverages

Uses hygienic, insulated, and temperature-resistant packaging solutions.

- Healthcare and Pharmaceutical

Medical supplies need wraps that stay clean, meet rules, and follow safety steps. These packs must resist changes once sealed. Every detail matters under strict standards.

- Fashion & Apparel

Lightweight materials help fashion brands ship items faster. Packaging often shows off logos clearly. What matters most is keeping it simple yet recognizable. Delivery works better when boxes are easy to handle.

- Home & Furnishing

Needs durable and protective packaging for bulky or fragile items.

- Others

Things like books or toys show up here, along with gear for factories and niche items made for specific uses.

Regional Insights

On top of everything, North America takes up a big chunk of the e-commerce packaging scene thanks to widespread online shopping, solid delivery networks, and more people wanting wraps that protect goods plus care for the planet. What stands out is how the United States leads within this space, fueled by giant digital retailers and shoppers who expect fast arrivals without dents or scratches. Meanwhile, just behind, Canada and Mexico see steady growth as internet buying climbs, international shipping picks up, and companies put money into greener wrapping options. Over here, stores and freight movers lean toward packing stuff that's light yet tough, keeping items safe while also cutting down emissions.

Across Europe, more people buying things online pushes growth in how packages are made. Because rules about waste are tough here, firms pick materials that break down easily. Countries like Germany, the United Kingdom, France, Italy, and Spain drive demand through busy digital markets. Their sellers care about earth-safe wraps thanks to Europe's plans for less trash. In cities and towns west and central, shipping services now choose lighter boxes, kinder to nature. Laws shape choices, so do shoppers who want cleaner options.

Across the Asia Pacific, more people buy online every year. That pushes the need for stronger, cheaper, eco-friendly wraps and boxes. Countries like China, India, Japan, plus nations across Southeast Asia lead this shift. Fast tech uptake and bigger city populations fuel the trend. In Latin America, Brazil stands out, followed by Argentina. Online shopping grows there slowly but surely. Better delivery routes help it move forward. The Middle East and Africa show early signs of change, too. Young buyers spend time on phones, making purchases easier. Places such as Saudi Arabia, the United Arab Emirates, and South Africa see new warehouses and faster shipping. This opens space for smart, safe packaging options.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 18, 2025 – Sealed Air to go private in $10.3 billion deal with a big push for e-commerce.

(Source: https://www.digitalcommerce360.com/2025/11/18/sealed-air-corp-private-acquisition-10-billion-deal/

- October 30, 2024 – Thimm developed exclusive e-commerce packaging for multi-platform Mytheresa.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 79.83 Billion |

|

Market size value in 2026 |

USD 85.78 Billion |

|

Revenue forecast in 2033 |

USD 141.83 Billion |

|

Growth rate |

CAGR of 7.45% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Amcor, DS Smith, Ranpack Holding, Pregis LLC, Stora Enso Oyj, Sealed Air, Mondi Group, Georgia Pacific, Westrock Company, International Paper Company, Sonoco Product Company, Cascades Inc., ProAmpac, UFP Packaging, Shiprocket, and others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Corrugated Boxes, Paper & Paperboard, Foam & Cushioning Materials, Plastic Packaging, Flexible Packaging, Protective Packaging, Others), By Product(Primary Packaging, Secondary Packaging, Tertiary Packaging), By Packaging Function (Protective Packaging, Branding & Presentation Packaging, Transit & Logistic Packaging, Sustainable Packaging, Tamper Evidence Packaging), By End-User (Retail & Consumer Goods, Electronic Appliances, Food & Beverages, Healthcare & Pharmaceutical, Fashion & Apparel, Home & Furnishing, Others) |

Key E-Commerce Packaging Materials Company Insights

A major force in worldwide e-commerce packaging, International Paper Company specializes in corrugated boxes made from renewable fibers. Thanks to factories spread across many regions and a tightly linked supply network, they deliver reliably to big online sellers and shipping firms. Because their materials are light, tough, and easy to recycle, more businesses choose them as eco-awareness grows. By putting money into new ideas and tailoring packages to specific needs, the company stays deeply woven into fast-expanding digital shopping systems. Their steady push forward keeps them close to how modern delivery networks actually work.

Key E-Commerce Packaging Materials Companies:

- Amcor

- DS Smith

- Ranpack Holding

- Pregis LLC

- Stora Enso Oyj

- Sealed Air

- Mondi Group

- Georgia Pacific

- Westrock Company

- International Paper Company

- Sonoco Product Company

- Cascades Inc.

- ProAmpac

- UFP Packaging

- Shiprocket

- Others

Global E-Commerce Packaging Materials Market Report Segmentation

By Material Type

- Corrugated Boxes

- Paper & Paperboard

- Foam & Cushioning Materials

- Plastic Packaging

- Flexible Packaging

- Protective Packaging

- Others

By Product

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Packaging Function

- Protective Packaging

- Branding & Presentation Packaging

- Transit & Logistic Packaging

- Sustainable Packaging

- Tamper Evidence Packaging

By End-Users

- Retail & Consumer Goods

- Electronic Appliances

- Food & Beverages

- Healthcare & Pharmaceutical

- Fashion & Apparel

- Home & Furnishing

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636