Market Summary

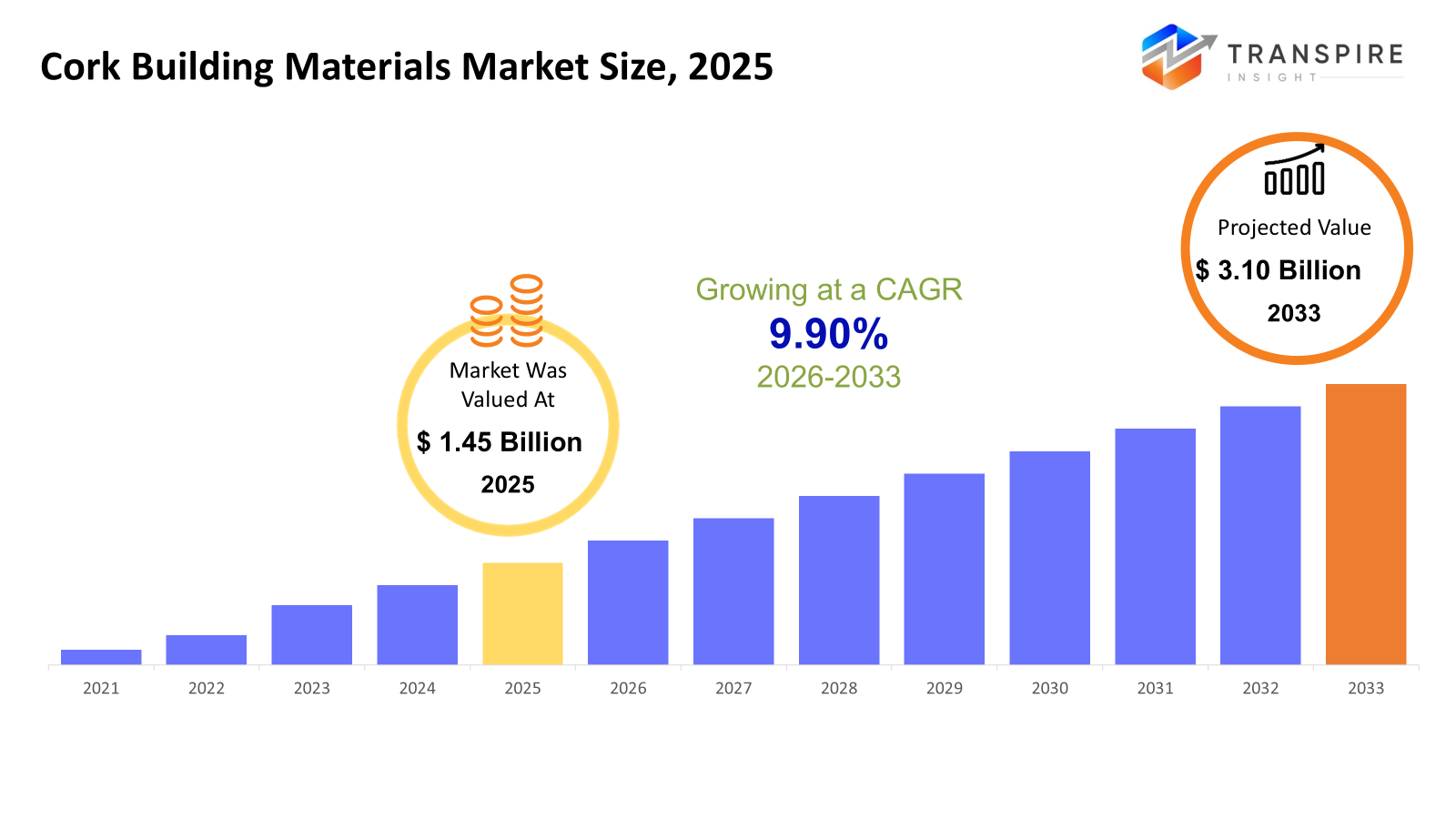

The global Cork Building Materials market size was valued at USD 1.45 billion in 2025 and is projected to reach USD 3.10 billion by 2033, growing at a CAGR of 9.90% from 2026 to 2033. Due to the growing use of eco-friendly and sustainable materials in both residential and commercial construction, the market for cork building materials is anticipated to expand at a robust CAGR. Growth is supported globally by the growing need for energy-efficient building insulation and acoustic solutions. Green building development is being fueled by urbanization, growing disposable income in Asia Pacific, and more stringent environmental laws in North America and Europe. The use of cork in flooring, wall panels, and insulation goods is growing thanks to technological developments in cork processing, such as agglomeration and composite creation.

Market Size & Forecast

- 2025 Market Size: USD 1.45 Billion

- 2033 Projected Market Size: USD 3.10 Billion

- CAGR (2026-2033): 9.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- As green building certifications like LEED and WELL become commonplace for high-end real estate developments, North America is expanding quickly. This is encouraging builders to switch from synthetic polymers to carbon-negative cork substitutes.

- The growth of residential retrofitting projects and federal tax incentives for energy-efficient house modifications, which have dramatically reduced the cost barrier for quality cork flooring and insulation, particularly support the US market.

- Due to enormous urban infrastructure projects in China and India, where cork's fire-retardant and moisture-resistant qualities are highly valued in dense, high-rise residential buildings, Asia Pacific presently holds the greatest market share in the world.

- As customer preferences shift toward "sensory living," emphasizing the material's inherent warmth and acoustic dampening properties to create calmer, more comfortable home office environments in the post-pandemic age, cork flooring continues to be the most popular product category.

- Because its production process uses cork waste and subpar particles, natural cork is the most popular material type by volume. This enables manufacturers to provide high-durability, reasonably priced building components that adhere to the principles of the circular economy.

- As more homeowners look for non-toxic, hypoallergenic materials that enhance indoor air quality and offer long-term energy savings through excellent thermal regulation in floors and walls, residential construction remains the main end-use driver.

So, The market for sustainable building solutions made from cork, a renewable natural resource sourced from cork oak trees, is known as the Cork Building Materials Market. Products that are frequently utilized in both home and commercial construction include cork flooring, wall panels, tiles, and insulation boards. The market is expanding quickly as a result of growing awareness of the negative environmental effects of traditional building materials as well as the growing popularity of acoustic and energy-efficient solutions. Cork materials are appropriate for contemporary green buildings because they offer special advantages like moisture resistance, fire retardance, thermal insulation, and acoustic damping. Technological developments in recycled and agglomerated cork products have increased their uses and enhanced their functionality, enabling broader use in home remodeling, commercial projects, and hospitality. In developing regions like Asia Pacific, growing urbanization, infrastructure development, and rising disposable incomes are all contributing to the market's expansion.Sustainability laws and eco-certifications like LEED and BREEAM are encouraging greater usage in developed markets like North America and Europe. Growing customer desire for natural and non-toxic materials in homes and workplaces, especially for flooring and wall panel applications, is also advantageous to the industry. Overall, the market for cork construction materials is growing steadily due to a combination of sustainability, performance advantages, and technological advancements.

Cork Building Materials Market Segmentation

By Product Type

- Cork Flooring

Due to its natural durability, comfort underfoot, and mix of thermal and acoustic insulation, cork flooring continues to be the leading revenue sector. Adoption has grown due to its aesthetic adaptability and growing popularity in interior design for both residential and commercial spaces. The need for new installations and replacements is being driven by wellness-focused renovations and green building trends, especially in North America and Europe. However, near-term expansion may be restrained by greater costs in comparison to synthetic alternatives and supply bottlenecks brought on by geographic raw material concentration.

- Cork Wall Panels & Tiles

Particularly in high-end and environmentally concerned projects, cork wall panels are being used more frequently for sustainable construction, attractive finishes, and acoustic enhancement. With the help of well-established industrial and ecological rules, Europe leads the world in both production and consumption. While North America is seeing an increase in the restoration and hospitality sectors, Asia Pacific is experiencing fast urbanization and increased interior design expenditures that are driving demand. The expansion of the market is indicative of broader trends for multipurpose interior materials with environmental credentials.

- Cork Insulation Materials

One of the fastest-growing market categories is cork insulating materials, driven by the global focus on energy efficiency and green building certifications (such as LEED and BREEAM). They are perfect for walls, roofs, and retrofits because of their exceptional thermal and acoustic performance, moisture resistance, and biodegradability. Due to urbanization and more stringent efficiency regulations, Asia Pacific is predicted to grow quickly, and demand is further supported by Europe's developed sustainability standards. Climate-aligned construction strategies revolve around this section.

- Others

Composite materials, cork underlayment, and other items designed to meet particular finishing or insulation requirements are all included in the "Others" category. These products, which frequently serve specialized or custom applications in both residential and commercial construction, profit from cork's inherent compressibility and environmentally favorable character. The demand for multipurpose sustainable materials, growing customization, and technological advancements in composite fabrication are all factors contributing to growth.

To learn more about this report, Download Free Sample Report

By Material

- Natural Cork

The primary component is still natural cork, which is extracted straight from the bark of cork oaks and is valued for its natural insulating qualities, renewability, and biodegradability. Its cellular structure offers superior performance in wall, flooring, and insulation applications. Due to the abundance of cork oak woods in Europe, especially in Portugal and Spain, supply is dominated, but global demand is still growing as sustainability is prioritized in buying. However, there are sporadic cost pressures due to supply limitations and difficulties with hand harvesting.

- Agglomerated Cork

When compared to natural cork sheets, agglomerated cork, which is made by binding cork grains, offers better homogeneity, a higher density, and customized performance. It is becoming more and more used in insulation and flooring boards where engineering qualities and dimensional consistency are crucial. This kind gives builders and architects more design and performance possibilities by bridging the natural advantages of raw cork with enhanced manufacturability. As material innovation increases, so does its adoption.

- Recycled Cork

In line with the ideas of the circular economy, recycled cork makes use of post-industrial and post-consumer cork waste. By limiting waste streams and relying less on fresh harvests, it promotes sustainability goals. Recycled cork is becoming more popular in eco-brand initiatives and green construction projects, although having a smaller market share than natural or agglomerated cork. Material circularity and rising eco-certification standards are two factors that could contribute to its expansion.

By End‑Use

- Residential Construction

Due to growing concerns about wellness, thermal comfort, and indoor air quality, the residential market has the largest demand share. Cork is becoming more and more popular among homeowners for insulation, wall treatments, and flooring in both new construction and renovations. Millennials and affluent consumers are particularly drawn to sustainability and natural materials in urban and peri-urban markets in Europe, North America, and Asia Pacific. Cork's insulating qualities significantly improve household value propositions when energy costs climb.

- Non-Residential Construction

Due to corporate sustainability goals and certification requirements, non-residential use, such as offices, hotels, schools, and retail establishments, is growing quickly. Cork's eco-credentials help earn LEED/BREEAM ratings, and its thermal and acoustic performance promotes asset economy and occupant comfort. Cork's significance in large-scale projects is being elevated as a result of commercial and institutional procurement frameworks that increasingly specify renewable resources. Asia Pacific and a few Middle Eastern markets are experiencing very rapid growth in terms of tourism and services.

Regional Insights

The market for cork flooring and insulation materials is being driven by home renovations, commercial construction, and green building programs in North America, which is a major growing region led by the United States. Canada makes a contribution through eco-friendly building techniques and sustainable housing initiatives, whereas Mexico gradually adopts these methods due to urban development and imported cork products. The majority of natural cork is supplied by Portugal and Spain, and Europe leads the world in production. Strict environmental regulations and rising demand for both residential and non-residential applications in Germany, the UK, France, Italy, and Spain drive use, while cork is used in specialized eco-conscious projects throughout the rest of Europe. The fastest-growing market is Asia Pacific, where China and India are at the forefront of adoption in both the residential and commercial sectors because to government sustainability regulations, infrastructural expansion, and urbanization. Particularly for flooring and insulation in high-end buildings, Japan, South Korea, and Australia & New Zealand exhibit niche but high-value demand. Brazil and Argentina are in the vanguard of residential and hospitality adoption in South America, an emerging region, while other nations are gradually gaining market share. Due to luxury and green construction initiatives, the Middle East and Africa markets which include Saudi Arabia, the United Arab Emirates, and South Africa are expanding. Insulation and aesthetic uses are propelling adoption in both commercial and residential projects.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2023,Corticeira Amorim's cork flooring division, Wicanders Wise, achieved its goal of having a 100% PVC-free product portfolio. By removing synthetic polymers from all product lines, the company is reaffirming its commitment to sustainability and achieving decarbonization goals in the construction industry. The new line offers eco-friendly flooring options without sacrificing durability or beauty by fusing digital printing technology with the performance of natural cork.

(Source:https://www.xn--transcosmos-pf3f.co.jp/english/company/news/251212.html)

- In October 2021, At a significant urban regeneration symposium, Corticeira Amorim's Amorim Cork Insulation business unit showcased its cork-based insulation products, showcasing how cork solutions support sustainable building rehabilitation and energy efficiency. The company reaffirmed cork's position in environmentally friendly building and highlighted its adaptability in walls, roofs, floating floors, and decorative uses for both new and retrofit projects..

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.45 Billion |

|

Market size value in 2026 |

USD 1.60 Billion |

|

Revenue forecast in 2033 |

USD 3.10 Billion |

|

Growth rate |

CAGR of 9.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Corticeira Amorim SGPS SA,Wicanders,Jelinek Cork Group,Manton Cork,Green Building Supply, iCork Floor, Capri Collections, Beach Bros Ltd, ThermalCork Solutions,Expanko Resilient Flooring, Corksribas, Muratto, Globus Cork, Granorte, Nu‑Cork |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Cork Flooring, Cork Wall Panels & Tiles, Cork Insulation Materials, Others) By Material (Natural Cork, Agglomerated Cork, Recycled Cork) and By End Use (Residential Construction, Non-Residential Construction& Entertainment, Finance & Enterprise Search) |

Key Cork Building Materials Company Insights

Corticeira Amorim SGPS SA has established itself as the global leader in cork building materials, leveraging over a century of vertical integration from cork oak forest management to finished products. Cork flooring, composite cork solutions and insulation boards that serve the global residential and commercial building sectors are all part of the company's diverse portfolio. Amorim is able to produce high-performance cork solutions that enhance thermal and acoustic efficiency because of its substantial R&D investment, rigorous sustainability programs, and global distribution networks. Consistent quality control, savvy acquisitions and a solid reputation as a brand in building projects with a sustainability focus support its market leadership.

Key Cork Building Materials Companies:

- Corticeira Amorim SGPS SA

- Wicanders

- Jelinek Cork Group

- Manton Cork

- Green Building Supply

- iCork Floor

- Capri Collections

- Beach Bros Ltd

- ThermalCork Solutions

- Expanko Resilient Flooring

- Corksribas

- Muratto

- Globus Cork

- Granorte

- Nu‑Cork

Global Cork Building Materials Market Report Segmentation

By Product Type

- Cork Flooring

- Cork Wall Panels & Tiles

- Cork Insulation Materials

- Others

By Material

- Natural Cork

- Agglomerated Cork

- Recycled Cork

By End‑Use

- Residential Construction

- Non-Residential Construction

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636