Market Summary

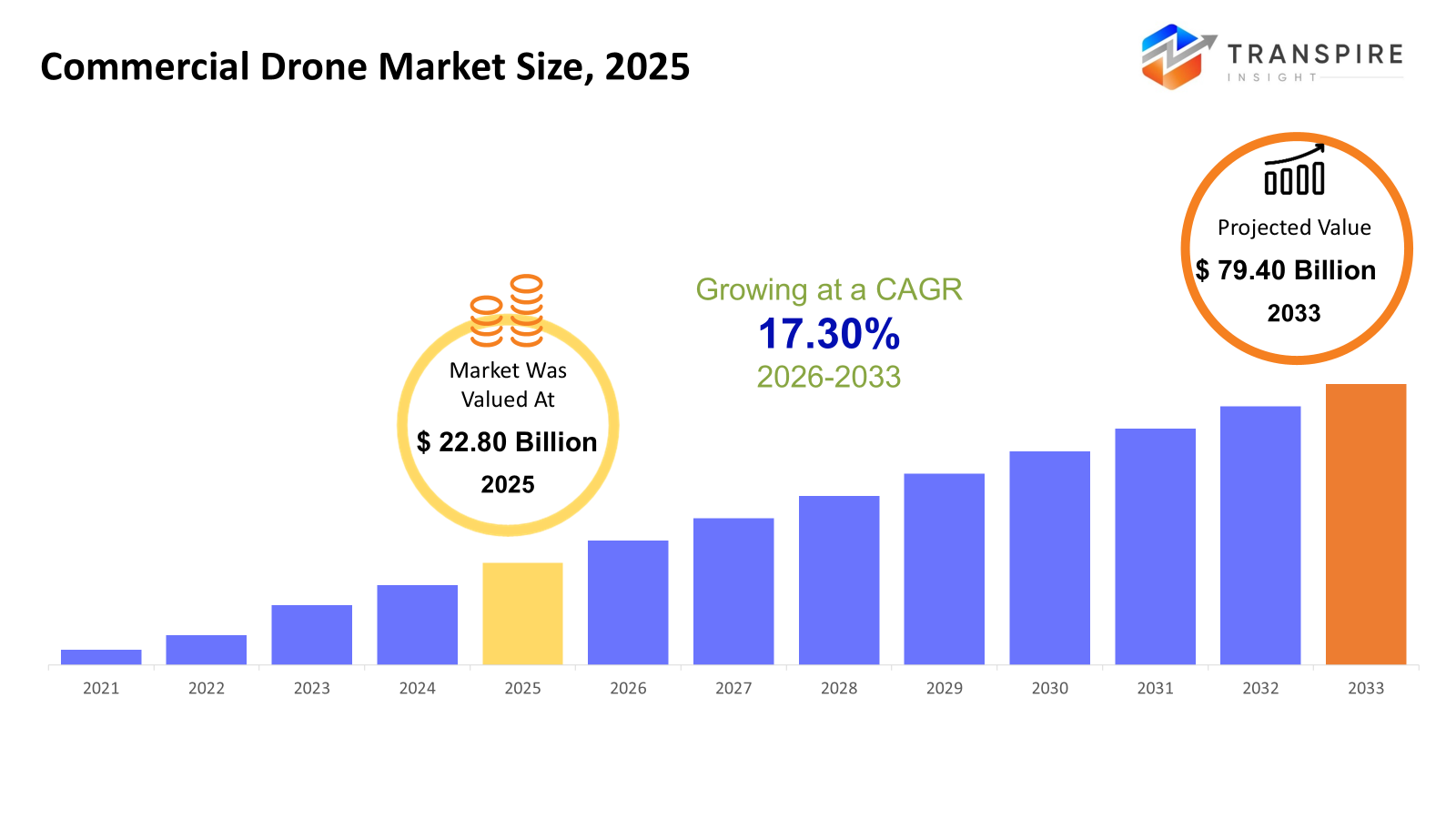

The global Commercial Drone market size was valued at USD 22.80 billion in 2025 and is projected to reach USD 79.40 billion by 2033, growing at a CAGR of 17.30% from 2026 to 2033. Globally, commercial drone adoption is being driven by the growing need for automation in the logistics, industrial, and agricultural sectors. Technological developments in AI, machine learning and autonomous flight are improving operational effectiveness and lowering the cost of physical labor. Market expansion is further supported by rising investments in energy inspection, e-commerce logistics, and smart city infrastructure. Additionally, enterprise drone deployment across several verticals is being encouraged by favorable government legislation and pilot projects in North America, Europe and Asia Pacific.

Market Size & Forecast

- 2025 Market Size: USD 22.80 Billion

- 2033 Projected Market Size: USD 9.40 Billion

- CAGR (2026-2033): 1.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Due to regulatory clarity, enterprise-scale deployments, robust investments in inspection, logistics, and public safety use cases, and mature infrastructure that facilitates the quicker integration of semi-autonomous and BVLOS-enabled drone operations, North America continues to lead the world in the adoption of commercial drones.

- Because of its early embrace of cutting-edge UAV technologies, robust defense-to-commercial technology transfer, and growing usage of drones for energy inspection, construction monitoring, and pilot-stage delivery projects, the United States continues to be the primary growth engine in North America.

- Asia Pacific is witnessing the quickest expansion driven by large-scale agricultural deployment, manufacturing supremacy, and rapid e-commerce growth, with China and India pushing volume adoption while Japan and South Korea focus on automation, robotics integration, and regulatory advancement.

- As businesses emphasize agility, vertical takeoff capabilities, and precise hovering for inspection, surveillance, filmmaking and urban operations where fixed-wing platforms face operational limits, rotary blade and multi-rotor drones dominate the product market.

- Because it strikes a compromise between automation and regulatory compliance, semi-autonomous technology is becoming the ideal operating model. This allows businesses to increase productivity, flight safety, and data accuracy while maintaining human control throughout inspection, mapping and agriculture operations.

- As utilities, energy, and infrastructure operators use drones more frequently to minimize downtime, improve worker safety and cut operating costs through real-time aerial monitoring and predictive maintenance capabilities, inspection and maintenance continues to be the most popular use.

So, The commercial drone market refers to the use of unmanned aerial vehicles for business purposes such as logistics, agriculture, security, media and industrial inspection. Technological advancements such as the use of AI for autonomous flight, real-time analytics and sensors are improving the efficiency and lowering the costs of operation for a wide range of industries. The rising need for precision agriculture, fast delivery services and inspection in the energy and utility industries is one of the major drivers of the commercial drone market. The integration of drones with IoT and cloud technology enables easy monitoring and collection of data, thus increasing the adoption of drones in enterprise segments. Approvals and pilot projects in North America and the Asia Pacific are making it easier to use drones safely and rising investments in hybrid and long-endurance drones are increasing the use cases. The rising interest in environmental monitoring, smart city initiatives and security applications further highlights the growing commercial use of drones.

Commercial Drone Market Segmentation

By Product Type

- Rotary Blade / Multi‑rotor Drones

Because of their exceptional maneuverability, ease of use, and vertical take-off and landing (VTOL) capability, these drones dominate the commercial drone market. They are favored for short-range missions and are perfect for urban operations, filming, and inspection activities. Because of their versatility and accuracy, multi-rotor drones are ideal for applications that need for low-altitude stability and hovering.

- Fixed‑Wing Drones

Fixed-wing drones are designed for large-scale coverage and long-range missions. They are perfect for mapping, surveying, agricultural, and environmental monitoring because of their longer flying times and energy economy. Their use is restricted to businesses with specific requirements due to their higher initial cost and operating complexity.

- Hybrid Drones

Hybrid drones offer both long-range flight efficiency and VTOL capability by combining the benefits of rotary and fixed wings. Because of this, they are becoming more and more common in precision agriculture, surveying, and logistics. Because of their adaptability, they can do intricate tasks that call for both stamina and agility.

- Others

Emerging technologies such as solar-powered drones, nano-drones, and experimental configurations fall under this category. These are frequently customized solutions aimed at particular industries, such as indoor surveillance, environmental monitoring, and research. They are distinguished by their potential for innovation but their present low market penetration.

By Technology

- Remotely Piloted / Operated

Due to their ease of use and regulatory clarity, traditional drones with human pilots supervising operations in real-time dominate commercial operations. They are frequently employed in short-range delivery, inspection and filming. Although their reliance on knowledgeable operators restricts scalability it guarantees accurate completion of crucial activities.

- Semi‑Autonomous

Drones that are semi-autonomous combine automatic functions like GPS navigation, obstacle avoidance and pre-programmed flight paths with human control. These are becoming more popular in the fields of agriculture, surveying and logistics since they save operating costs and boost productivity without posing full automation hazards.

- Fully Autonomous

Fully autonomous drones use artificial intelligence (AI), machine learning and sophisticated sensors to do tasks without human involvement. For large scale activities like BVLOS deliveries, infrastructure inspection and industrial monitoring, they are strategically crucial. Regulatory and safety challenges remain a barrier to wider use.

To learn more about this report, Download Free Sample Report

By Application

- Filming & Photography

The need for reliable, high-precision drones is driven by aerial imaging for movies, real estate, advertising, and events. Due to their ability to hover, multirotor drones are the most popular, and developments in autonomous flight are opening up new creative possibilities.

- Inspection & Maintenance

Drones are essential for industrial facilities, utilities, and oil and gas companies because they offer quicker, safer, and more economical inspections. For large-scale infrastructure and pipeline surveys, long-endurance fixed-wing and hybrid drones are recommended.

- Mapping & Surveying

Drones improve geospatial accuracy and shorten manual survey times in mining, urban planning, and construction. Multi-rotor drones enable precise, low-altitude mapping, but fixed-wing drones predominate because of their durability and coverage effectiveness.

- Accurate Farming

With sensor integration, drones facilitate agricultural monitoring, spraying, and yield prediction. Cost reductions, increased productivity, and data analytics capabilities are the main drivers of adoption, especially in North America and Asia Pacific.

- Observation and Monitoring

Drones are used in environmental monitoring, wildlife tracking, and security to effectively cover broad areas. Depending on the intricacy of the job and the regulatory environment, both autonomous and remotely piloted drones are used.

- Logistics & Delivery

Hybrid and completely autonomous drones are being used in e-commerce and warehouse management. With investments in BVLOS infrastructure and regulatory frameworks, North America and Asia Pacific are at the forefront of adoption.

- Additional Niche Applications

Comprises environmental research, insurance inspections, emergency response, and catastrophe management. Although adoption is still low, it is increasing as technology advances and costs come down.

By End‑Use Industry

- Agriculture

Drones boost production through real-time crop analysis, pest monitoring, and automated spraying. Because of government incentives and large-scale farming, precision agriculture is most popular in the US, China, and India.

- Delivery & Logistics

Drones are used by businesses for supply chain optimization, warehouse management, and last-mile deliveries. Due to e-commerce demand and regulatory trials, adoption is focused in North America and Europe.

- Energy & Utilities

Power lines, pipelines, and wind turbines are all inspected by drones. Because of their stringent safety regulations, they lower operational risks and expenses, particularly in distant places, with North America and Europe leading the way in deployment.

- Media & Entertainment

Aerial filming, live streaming, and event coverage are made possible by drones. In North America and Europe, where creative media investments are strong, multi-rotor drones are widely used in this market.

- Real Estate & Construction

Drones help with progress tracking, site monitoring, and land surveys. They provide efficiency, lessen the need for manual labor, and increase project accuracy, especially in the developed construction markets of North America and Europe.

- Security & Law Enforcement

Utilized for situational awareness, border security, and crowd surveillance. With North America making significant investments in public safety applications, autonomous and semi-autonomous drones offer improved operational efficiency.

- Public Safety & Government

Drones are used in environmental monitoring, emergency response, and catastrophe management to improve readiness. Because of frequent natural disasters and encouraging government programs, adoption is highest in North America and Asia Pacific.

- Others

Comprises industries such as research institutes, insurance, and environmental studies. Although use is currently limited, it is anticipated to increase as drone payloads, sensors, and autonomous operations progress.

Regional Insights

Due to early adoption, favorable FAA regulations, and investment in autonomous drone solutions, North America dominates the worldwide commercial drone market, with the United States being the largest sub-region. UAVs are being used more frequently in logistics, agriculture, and surveillance in Canada and Mexico to increase operational effectiveness. With Germany, the UK, France, Spain, and Italy making significant investments in media apps, infrastructure monitoring, and industrial inspections, Europe exhibits consistent growth. Driven by precision agriculture, e-commerce logistics, and government programs encouraging drone adoption, Asia Pacific continues to be the fastest-growing area, with China, India, Japan, South Korea, and Australia leading the way.

Cost-effective solutions are helping to expand the market for UAVs used in mining and agricultural in South America, especially Brazil and Argentina. Saudi Arabia, the United Arab Emirates, and South Africa are leading the Middle East and Africa in the progressive adoption of drones for security operations, smart city initiatives, and oil and gas inspection. Other regional nations are beginning to show interest in commercial uses. While Tier 2 regions in South America and MEA are anticipated to spur incremental growth through infrastructure investments and regulatory assistance, Tier 1 sub-regions in North America and Asia Pacific exhibit greatest penetration.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, In order to fulfill the growing demand for real-time drone-based intelligence across public safety and essential industries, Rapid Drone, a new specialized aerial intelligence and drone services provider, formally launched in early 2026. In order to position itself for quick adoption as drone use grows worldwide, the company's news release stresses its objective to build, run, and manage mission-ready drone programs focused on reliable, real-time aerial data delivery.

- In December 2025, Dynamic Aerospace Systems and Unusual Machines signed a strategic supplier agreement enabling Unusual Machines to provide NDAA-compliant commercial drone components for DAS's growing UAV platforms. In addition to supporting DAS's deployments in the Middle East and Europe, the news release highlights components for autonomous pilot delivery, commercial logistics, and critical infrastructure monitoring drones. It also reflects broader industry shifts toward domestically supplied, scalable solutions.

(Source:https://www.gea.com/en/news/trade-press/2023/new-twin-screw-pump-novatwin-plus)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 22.80 Billion |

|

Market size value in 2026 |

USD 26.00 Billion |

|

Revenue forecast in 2033 |

USD 79.40 Billion |

|

Growth rate |

CAGR of 17.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

SZ DJI Technology Co., Ltd., Parrot SA, Skydio, Inc., AeroVironment, Inc., senseFly (AgEagle Aerial Systems), Insitu (a Boeing Company), 3D Robotics, Inc., Yuneec International Co., Ltd., Teledyne FLIR (now Teledyne FLIR Solutions), Delair, PrecisionHawk, Inc., Autel Robotics, EHang Holdings Ltd., Wingcopter GmbH, Kespry, Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Rotary Blade / Multi‑rotor Drones, Fixed‑Wing Drones, Hybrid Drones, Others), By Technology (Remotely Piloted / Operated, Semi‑Autonomous, Fully Autonomous), By Application (Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Delivery & Logistics, Other Niche Uses) and By End-Use Industry (Agriculture, Delivery & Logistics, Energy & Utilities, Media & Entertainment, Real Estate & Construction, Security & Law Enforcement, Public Safety & Government, Others) |

Key Commercial Drone Company Insights

SZ DJI Technology Co., Ltd. is the global market leader in commercial drones, delivering an extensive portfolio covering industrial, mapping, inspection, logistics and media UAV platforms with advanced imaging and autonomous capabilities. The company's solutions are appropriate for enterprise adoption in the fields of public safety, energy, agriculture and construction since they incorporate advanced sensors, artificial intelligence and real time data analytics. DJI's dominance is reinforced by its robust worldwide distribution and R&D expenditure which guarantee quick hardware and software iterations. DJI's extensive ecosystem support and end-to-end solutions sustain its dominant market position and industry influence despite geopolitical and regulatory headwinds.

Key Commercial Drone Companies:

- SZ DJI Technology Co., Ltd.

- Parrot SA

- Skydio, Inc.

- AeroVironment, Inc.

- senseFly (AgEagle Aerial Systems)

- Insitu (a Boeing Company)

- 3D Robotics, Inc.

- Yuneec International Co., Ltd.

- Teledyne FLIR (now Teledyne FLIR Solutions)

- Delair

- PrecisionHawk, Inc.

- Autel Robotics

- EHang Holdings Ltd.

- Wingcopter GmbH

- Kespry, Inc.

Global Commercial Drone Market Report Segmentation

By Product Type

- Rotary Blade / Multi‑rotor Drones

- Fixed‑Wing Drones

- Hybrid Drones

- Others

By Technology

- Remotely Piloted / Operated

- Semi‑Autonomous

- Fully Autonomous

By Application

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Delivery & Logistics

- Other Niche Uses

By End‑Use Industry

- Agriculture

- Delivery & Logistics

- Energy & Utilities

- Media & Entertainment

- Real Estate & Construction

- Security & Law Enforcement

- Public Safety & Government

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636