Market Summary

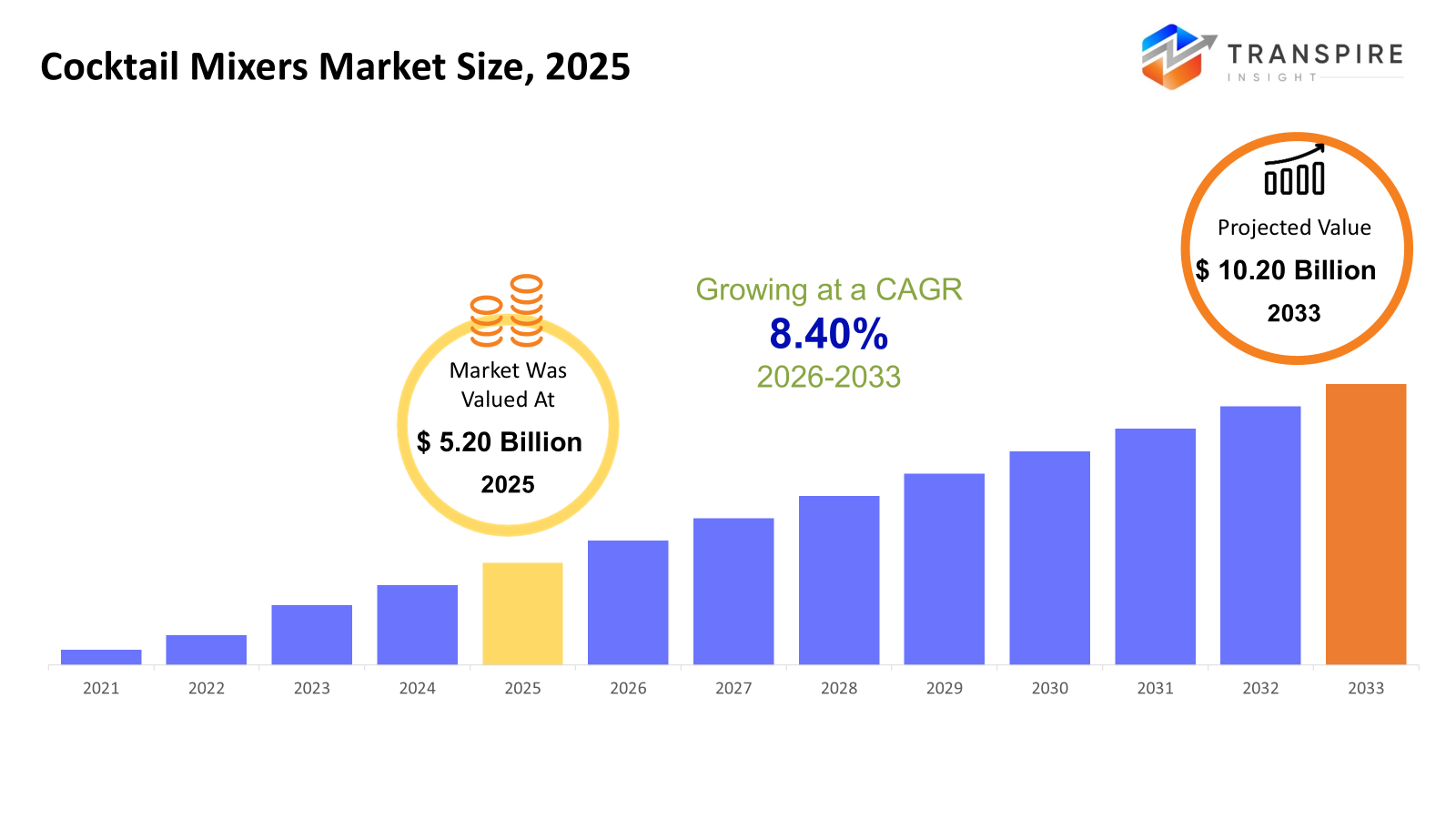

The global Cocktail Mixers market size was valued at USD 5.20 billion in 2025 and is projected to reach USD 10.20 billion by 2033, growing at a CAGR of 8.40% from 2026 to 2033. The market for cocktail mixers is expanding steadily due to rising consumer demand for upscale and practical beverage options. Consistent demand is being supported by growing innovation with tastes, expanding hospitality infrastructure, and rising at-home cocktail consumption. Furthermore, health-conscious customers are drawn to clean-label products and low-sugar substitutes, which is fueling the market's steady growth in both developed and developing nations.

Market Size & Forecast

- 2025 Market Size: USD 5.20 Billion

- 2033 Projected Market Size: USD 10.20 Billion

- CAGR (2026-2033): 8.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America demonstrates strong market maturity supported by established cocktail culture, premium mixer consumption, and strong retail penetration. Due to advancements in craft beverage innovation and rising consumer demand for high-end, natural cocktail mixer formulations, the US leads the world in demand.

- Growing at-home mixology trends, the popularity of premium brands, and the expansion of e-commerce distribution all help the US market. Long-term category growth is being supported and product innovation is being influenced by consumers' growing preference for mixers made with natural, low-calorie ingredients.

- Urbanization, increased disposable income, and increased exposure to Western drinking culture are the main drivers of Asia Pacific's faster rise. Convenient and flavored cocktail mixer solutions are becoming more and more popular in emerging economies due to growing hospitality sectors and shifting social consumption patterns.

- Since it works well with a variety of spirits and is a staple in traditional cocktails, tonic water continues to be the most popular product category. Low-sugar and premium-flavored varieties are becoming more popular as consumers seek out more upscale and health-conscious beverage experiences.

- The nature segment is dominated by conventional mixers because they are inexpensive and widely accessible, but the increase of organic and clean-label items is accelerating. Manufacturers are being encouraged to develop natural and preservative-free alternatives as consumers' understanding of ingredients and sugar levels grows.

- Because of its broad availability across retail channels, ease of use, and operational convenience in hospitality environments, liquid form dominates the industry. Both home consumers looking for convenience and professional bartenders are increasingly using ready-to-use liquid mixes.

- Off-trade distribution channels account for significant market share as consumers increasingly purchase mixers through supermarkets and online platforms. Growing trends in home entertainment and increased product visibility through digital retail channels are driving growth.

So, The cocktail mixers market includes non-alcoholic beverage ingredients that improve the flavor, aroma, and overall drinking experience of cocktails. Tonic water, syrups, juices, bitters, and pre-mixed solutions for both home and commercial use are examples of these mixers. Through facilitating product diversity and fostering changing mixology trends, the market plays a significant role in the larger beverage sector. The spread of social drinking culture throughout urban areas, rising desire for premium beverage experiences, and shifting consumer lifestyles are all factors that are directly related to market growth. While bars and restaurants continue to spur innovation through novel taste combinations and unique offers, the increasing popularity of making cocktails at home has had a big impact on retail sales. Additionally, producers are putting more of an emphasis on developing innovative products with natural ingredients, lower-sugar recipes, and useful flavor profiles. Market penetration is being further reinforced by the rise of organized retail and e-commerce platforms, as well as the advent of craft cocktail culture. Cocktail mixers continue to become more and more popular in both developed and emerging economies as consumer preferences move toward premiumization and convenience.

Cocktail Mixers Market Segmentation

By Product Type

- Tonic Water

- Due to its close ties to traditional cocktails and high-end spirits, tonic water commands a substantial portion of the cocktail mixer industry. Product innovation is being aided by the growing demand for flavored and low-sugar tonic varieties. Craft cocktail culture and premiumization tendencies are still driving demand in both on-trade and off-trade channels.

- Club Soda / Soda Water

- Owing to their neutral flavor and adaptability, club soda and soda water are still necessary mixers. These goods support consistent demand because they are frequently utilized in both alcoholic and non-alcoholic beverages. Consistent market expansion is facilitated by consumers' growing choice for lighter beverages and low-calorie beverage options.

- Ginger Ale / Ginger Beer

Ginger-based mixers are becoming more popular because of its potent flavor and growing appeal in artisan cocktails. Growing consumer interest in spicy and botanical taste experiences is driving demand. Premium ginger beer varieties are becoming more and more popular in bars and high-end retail markets.

Ginger-based mixers are becoming more popular because of its potent flavor and growing appeal in artisan cocktails. Growing consumer interest in spicy and botanical taste experiences is driving demand. Premium ginger beer varieties are becoming more and more popular in bars and high-end retail markets.

- Cordials & Syrups

Because they allow for flavor customisation, syrups and cordials are highly favored in mixology and at-home cocktail mixing. Growing experimentation with flavors and seasonal products is what propels growth. The market is benefited by the growth of premium and artisanal syrup products aimed at cocktail connoisseurs.

- Concentrates and Juices

Because of their natural flavor basis and ease of usage while making cocktails, juices and concentrates are frequently used. Consumer preference for fresh-tasting, fruit-based beverages supports demand. The growing demand for natural ingredients and clean-label trends also have an impact on growth.

- Bitters

Bitters are a specialized but crucial component in cocktail making, especially for high-end and traditional concoctions. The rise of premium bar culture and artisan mixology is directly linked to their demand. Flavored bitters are becoming more widely available, which is extending their use outside of conventional recipes.

- Mixers for pre-mixed cocktails

Convenience and growing at-home consumption trends are driving the rapid expansion of pre-mixed cocktail mixers. Ready-to-use solutions that cut down on preparation time without sacrificing flavor are preferred by customers. Product uptake is being boosted by innovations in high-end and low-sugar formulations.

- Others

New mixer forms created for certain cocktail recipes or flavor profiles are included in this category. Product innovation and rising consumer demand for distinctive flavor profiles are the main drivers of growth. Specialty mixers support premium beverage positioning and experimental mixology.

By Nature

- Conventional

The market is dominated by traditional cocktail mixers because they are more affordable, widely accessible, and have a longer shelf life. Their substantial market position is supported by extensive production and well-established distribution networks. Manufacturers are, nevertheless, progressively changing product formulations to cut down on artificial additives and sugar.

- Organic / Natural / Clean-label

As customers place a greater value on natural ingredients and transparency, organic and clean-label mixers are becoming more and more popular. Trends in luxury beverages and health-conscious customers are driving demand. Innovation in preservative-free formulations and natural sweeteners is taking place in this market.

To learn more about this report, Download Free Sample Report

By Form

- Liquid

Due to their ease of use and suitability for both home and professional applications, liquid mixers enjoy the biggest market share. Liquid formats are used by bars and restaurants for consistency and operational efficiency. Growth is further supported by ready-to-use formats and expanding retail availability.

- Powder

Powder has a longer shelf life and simplicity of storage, powdered cocktail mixers are becoming more and more popular in travel, events, and budget-conscious markets. They provide logistical benefits for bulk handling and transportation. Nonetheless, demand for premium cocktail categories is still rather low.

- Concentrate

For commercial applications where cost effectiveness and dilution flexibility are crucial, concentrated mixers are recommended. They provide portion control and flavor intensity modification. Growing usage in the hospitality and catering industries supports growth.

By Distribution Channel

- In-Trade

Bars, restaurants, hotels, and clubs that employ cocktail mixers for expert beverage preparation are included in the on-trade segment. Premium beverage products and changing cocktail trends have an impact on demand. Expansion of the hospitality industry and trends in experience eating are closely related to growth.

- Off-Trade

As a result of increased household consumption, off-trade channels like supermarkets, specialized shops, and internet retail are growing quickly. Cocktail mixers are becoming more and more popular among consumers for convenience and pleasure at home. E-commerce platforms are essential for increasing brand awareness and product accessibility.

Regional Insights

The United States, Canada, and Mexico continue to dominate the North American cocktail mixer market. The area benefits from sophisticated retail infrastructure, a robust cocktail culture, and significant consumer expenditure on luxury beverages. The largest market is the United States, but Canada and Mexico are growing steadily thanks to the rise of the hospitality industry and changing customer tastes. Germany, the UK, France, Spain, Italy, and the rest of Europe show consistent demand, which is bolstered by long-standing beverage customs and the growing use of high-end mixers. Natural and clean-label products are growing rapidly in the region as customers place a higher value on product quality and ingredient transparency. Asia Pacific is emerging as a high-growth region, driven by markets such as Japan, China, Australia & New Zealand, South Korea, and India. Demand is being supported by growing middle-class populations, rising urbanization, and increased exposure to global beverage trends. The demand for flavored beverages and social consumption patterns are driving expansion in South America, which includes Brazil and Argentina. The Middle East and Africa region, which is dominated by South Africa, Saudi Arabia, and the United Arab Emirates, is gradually growing thanks to investments in the hospitality industry, increased demand for high-end non-alcoholic mixer choices, and tourism growth.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 2025, Dabur India announced its entry into the cocktail mixer category with the launch of the Réal Cheers range, expanding its beverage portfolio into premium mixers targeting evolving consumer preferences and at-home cocktail consumption. In order to appeal to millennials and Gen Z consumers, the new line features variations like Jamuntini, Green Apple Mojito, Ginger Ale, and Tonic Water, with an emphasis on convenience, flavor balance, and premium ingredients. The introduction underscores the growing demand for ready-to-mix solutions and the diversification of well-known beverage firms into the mixer market.

(Source:https://www.dabur.com/press-releases/real-enters-cocktail-mixer-category-with-Real-cheers)

- In November 2024, Bourbon Barrel-Aged Manhattan and Espresso Martini mixers have been added to Bittermilk Bottling Co.'s selection of high-end cocktail mixers. The product extension responds to the increased demand from consumers for convenient, high-quality cocktail preparation at home and demonstrates ongoing innovation in the premium and craft mixer market. The debut is in line with the general market trend toward artisanal beverage experiences and premiumization, especially during home entertainment and seasonal events.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 5.20 Billion |

|

Market size value in 2026 |

USD 5.80 Billion |

|

Revenue forecast in 2033 |

USD 10.20 Billion |

|

Growth rate |

CAGR of 8.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Fever-Tree Drinks Plc, The Coca-Cola Company, Keurig Dr Pepper Inc., Britvic plc, Monin Inc., The London Essence Company, Fentimans Ltd., Q Mixers, East Imperial Beverage Corp., Three Cents Co., Thomas Henry GmbH, Master of Mixes (American Beverage Marketers), Finest Call (American Beverage Marketers), White Rock Products Corporation, Belvoir Fruit Farms Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Tonic Water, Club Soda / Soda Water, Ginger Ale / Ginger Beer, Syrups & Cordials, Juices & Concentrates, Bitters, Pre-mixed Cocktail Mixers, Others), By Nature (Conventional, Organic / Natural / Clean-label), By Form (Liquid, Powder, Concentrate) and By Distribution Channel (On-Trade, Off-Trade) |

Key Cocktail Mixers Company Insights

Fever-Tree Drinks Plc has positioned itself as a leading premium mixer brand by emphasizing high-quality ingredients, natural formulations, and premium brand positioning. Growth in the premium and artisan cocktail sectors, especially in North America and Europe, is supported by its strong position in the tonic water and ginger beer segments. In order to increase distribution networks and capitalize on growing trends in at-home cocktail consumption, the company's strategy is centered on innovation, product diversity, and strategic alliances. Through distinct flavor profiles and brand perception, Fever-Tree strengthens its competitive advantage against mass-market beverage firms and gets prolonged market influence from consumers' growing preference for premiumization and clean-label products.

Key Cocktail Mixers Companies:

- Fever-Tree Drinks Plc

- The Coca-Cola Company

- Keurig Dr Pepper Inc.

- Britvic plc

- Monin Inc.

- The London Essence Company

- Fentimans Ltd.

- Q Mixers

- East Imperial Beverage Corp.

- Three Cents Co.

- Thomas Henry GmbH

- Master of Mixes (American Beverage Marketers)

- Finest Call (American Beverage Marketers)

- White Rock Products Corporation

- Belvoir Fruit Farms Ltd.

Global Cocktail Mixers Market Report Segmentation

By Product Type

- Tonic Water

- Club Soda / Soda Water

- Ginger Ale / Ginger Beer

- Syrups & Cordials

- Juices & Concentrates

- Bitters

- Pre-mixed Cocktail Mixers

- Others

By Nature

- Conventional

- Organic / Natural / Clean-label

By Form

- Liquid

- Powder

- Concentrate

By Distribution Channel

- On-Trade

- Off-Trade

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636