Market Summary

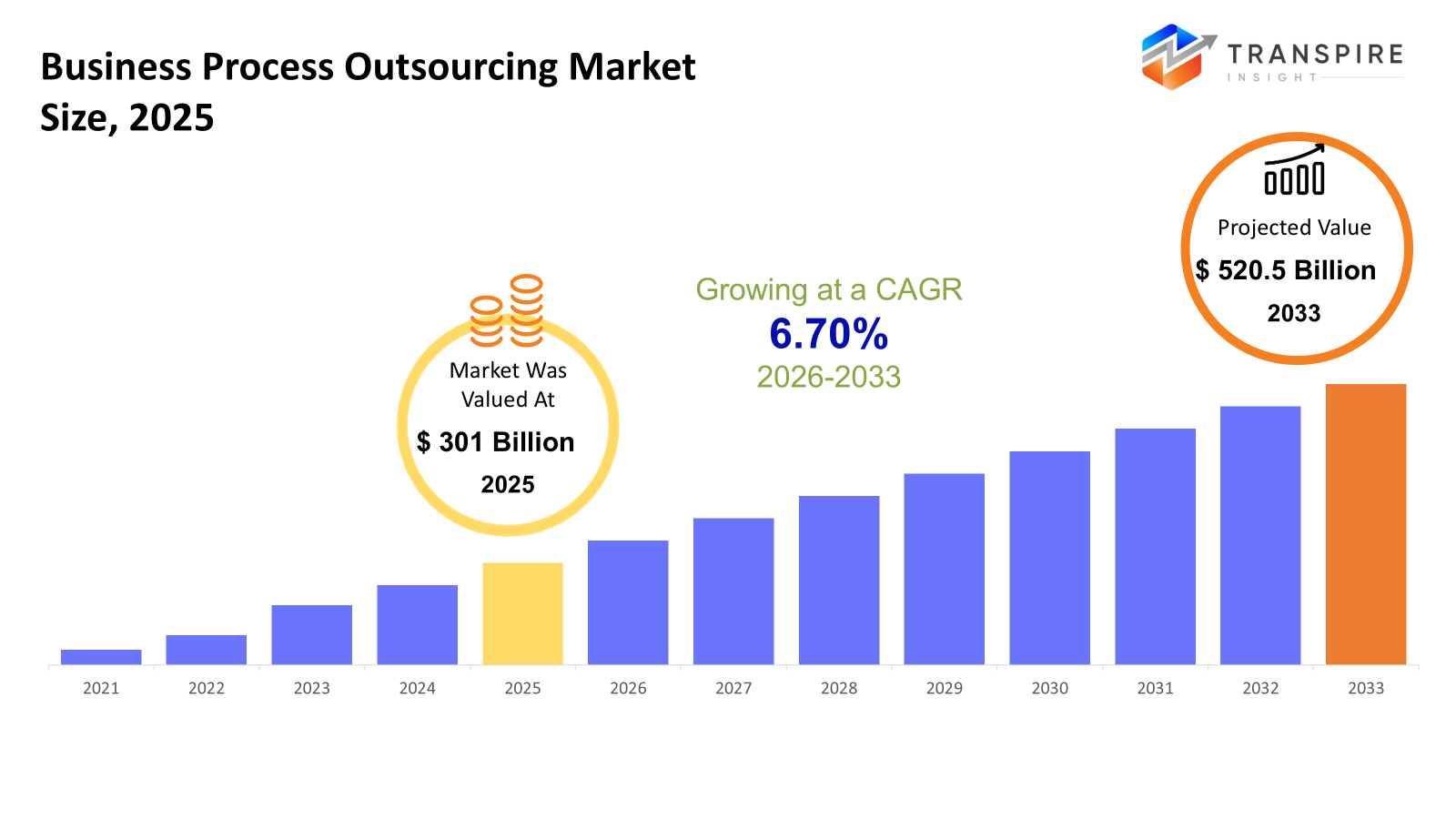

The global Business Process Outsourcing market size was valued at USD 31 billion in 2025 and is projected to reach USD 520.5 billion by 2033, growing at a CAGR of 6.70% from 2026 to 2033. The market’s CAGR growth is driven primarily by the increasing demand for cost efficiency and process optimization. This has led organizations increasingly to outsource their primary as well as non-primary operations like finance, HR, customer service, and procurement. The growing adoption of cloud deployment models and AI-based automation is also adding greater efficiency and service capabilities to processes, thereby enhancing revenue streams for service providers. Another factor is organizations pursuing globalization and 24x7 operations via offshore and nearshore outsourcing models.

Market Size & Forecast

- 2025 Market Size: USD 301 Billion

- 2033 Projected Market Size: USD 520.5 Billion

- CAGR (2026-2033): 6.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America continues leading in outsourcing adoption, as the operational resiliency priority of enterprises, regulatory compliance, and digital transformation keep the demand high for finance, customer services, and cloud-enabled outsourcing. This is supported by mature enterprise and advanced technology infrastructure.

- The United States remains the largest contributor in North America, driven by large BFSI, health care, and IT enterprises that are constantly outsourcing complex processes to efficient third-party vendors to manage compliance requirements and integrate automation and analytics into business processes.

- Finance and accounting is the most prominent service vertical with respect to cost-cutting, regulatory, and real-time finance needs, with the help of automation and cloud technology, resulting in improvement in global finance operations.

- Offshore outsourcing is on the rise, and it is increasingly sought after by businesses in their quest to achieve long-term cost optimization and access to specialized talent pools, thereby facilitating round-the-clock operations in the realms of customer service, finance, IT, and analytics.

- Cloud deployment is at the forefront of the market with a focus on flexibility and speed of implementation and integration with AI and automation solutions, which enable business operations when outsourced to be more efficient and have real-time visibility.

- BFSI continues to be the prime end-user industry because of an immense number of transactions, complexities in regulations, and an increase in digital banking. This triggers a constant need for outsourcing of customer service operations and fraud control functions.

So, The global business process outsourcing and managed services market has transformed into a strategic tool for organizations that look to leverage operational effectiveness and cost savings. organizations are increasingly outsourcing non-core business functions, like finance and HR, procurement, and customer service, to focused service organizations so that core innovation efforts can be dedicated to innovation and growth. The rising demand for digital, cloud, and analytics has contributed to increased adoption of outsourcing services.

Industry is experiencing immense growth owing to the rising requirement for cost optimization, scalability, and specialized know-how in verticals such as BFSI, healthcare, IT, and Retail. Vendors are making use of cloud, automation, and AI-enabled solutions to provide flexible delivery models like onshore, nearshore, and offshore to meet diverse regulatory, cultural, and operational issues. Additionally, there is an emphasis on forging partnerships to provide value-add services on top of basic transactional services, with a focus on knowledge process outsourcing (KPO) and analytics solutions. Innovation in the use of technology, optimized workforce, and increased complexities in the global supply chains are major drivers in this market. More emphasis has been made on the integration of digital technologies in outsourced processes, such as ensuring an optimized level of compliance and competitive advantage in the process of extending market growth.

Business Process Outsourcing Market Segmentation

By Service

- Finance & Accounting

Outsourcing of finance and accounting is on a high as companies look for ways to reduce costs and smoothen their operations. Payroll, bookkeeping, and financial reporting are some of the activities that are being taken care of by more specialized providers so that businesses can focus on growth and strategy.

- Human Resource (HR)

HR outsourcing services include hiring, implementation, management of payrolls, and engaging with employees. Companies are using HR service providers to minimize administrative work and maximize work efficiency, and remain updated with changing laws and regulations regarding employment.

- Knowledge Process Outsourcing (KPO)

KPO encompassing highly valued tasks like market studies, data analytics, and Legal work. More and more organizations have become dependent on experienced third-party teams to provide them with valuable insights and intelligence.

- Procurement & Supply Chain

Procurement & Supply Chain Outsourcing procurement and the supply chain offers companies the opportunity to optimize their procurement operations and manage stocks and logistics effectively. Suppliers improve cost effectiveness and flexibility in a complex global supply chain environment.

- Customer Services

Customer service outsourcing encompasses help desks, support platforms, and call centers. Due to the increasing use of digital engagement, businesses are concentrating on outsourcing to provide services around the clock, personalized support, and efficient answer resolution.

- Sales & Marketing Outsourcing

Sales and marketing services entails lead generation, online campaigning, and market research. Businesses are turning to the services of outsourcing companies in order to expand outreach and create greater brand visibility without having to invest.

- Logistics

There are transport, warehousing, and fulfillment types of logistics outsourcing. Firms are resorting to outsourcing in order to increase the speed of delivery, lower costs associated with logistics operations, and achieve visibility of their logistics efforts in e-commerce growth.

- Training & Development Outsourcing

Training outsourcing combines learning management systems and employee development activities. This outsourcing ensures experts help employees of an organization stay up-to-date and remain agile in a rapidly growing environment.

- Others

This segment also involves numerous other services, such as IT support, facility management, and legal process outsourcing. This will enable the organization to work on its core competencies by reassigning specialized functions to the experts who are more qualified to carry them out.

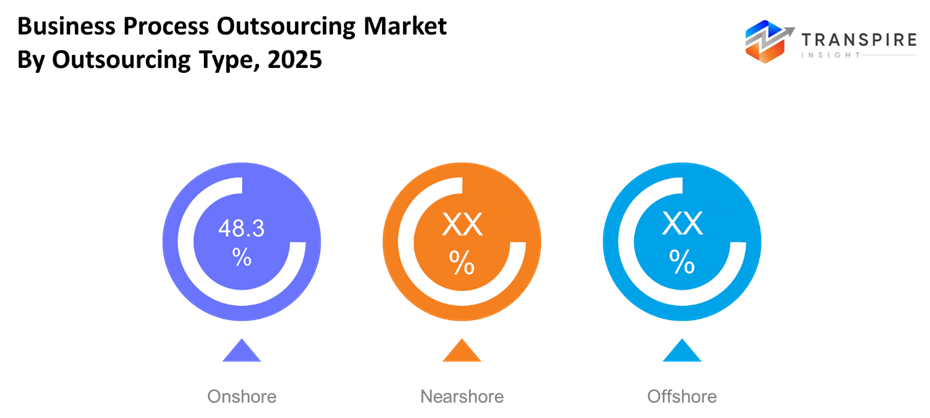

By Outsourcing Type

- Onshore

Onshore outsourcing is done within the country and provides advantages of proximity and cultural fit, which are suitable for jobs requiring tight controls and are of a sensitive nature.

- Nearshore

Nearshore outsourcing tends to involve countries near their own countries, with a combination of cost savings and similar time zones and/or languages. The organization chooses nearshore outsourcing because of collaboration efficiency and cost considerations.

- Offshore

Offshore outsourcing exploits the distant country, sometimes with lower labor costs. It is preferred for large-scale business operations and computer-based processes but needs effective management to overcome cultural and time differences.

To learn more about this report, Download Free Sample Report

By Deployment

- Cloud

Cloud-based deployment models are gaining acceptance owing to their scalability, adaptability, and remote accessibility. Organisations are finding cloud-based solutions cost-effective and more cooperative with regard to data collaboration.

- On-premise

On-premise systems have relevance for organizations considering data security and control. Sectors dealing with sensitive data choose on-premise deployment even at an additional cost of infrastructure.

By End Use

- BFSI

The Banking, Financial Services, and Insurance industry has adopted outsourcing significantly for customer care, transaction processing, and regulatory compliance services. This has been propelled by the desire for cost reduction and digital transformation.

- Healthcare

The various types of healthcare outsourcing are billing, telemedicine, patient services, and medical transcription. Health providers assist clients in reducing the paperwork, allowing them to concentrate on providing the best healthcare.

- Manufacturing

The manufacturers outsource procurement, logistics, and quality tests. This is to enable efficiency and minimize downtime. It is supported by lean manufacturing as it helps the company concentrate on innovation and manufacturing.

- IT and Telecommunications

IT and telecommunication firms outsource help desk services, networking, and application development. Tech outsourcing ensures rapid technology adoption, cost-effectiveness, and service continuity for companies.

- Retail

Retailers outsource customer service, logistics, and inventory management operations in order to improve the customer experience and meet the dynamic demands of the market effectively.

- Government & Defense

The defense and government industries apply outsourcing in the area of back office processing, IT, and provision of services. It enables the agencies to lower their expenses and devote time to their important tasks.

- Others

This covers industry segments such as education, energy, and travel, where vertical or industry-related outsourcing solutions improve efficiency and help companies focus on innovating and delivering to their customers.

Regional Insights

The outsourcing market has shown different levels of growth patterns in various regions around the globe. North America, comprising the US and Canada and Mexico, has strong service demand and well-developed IT infrastructure. Europe, comprised of Germany, UK, France, Span, and Italy, is more focused on optimizing and adhering to regulatory requirements. The Rest of Europe market is expected to follow similar patterns in smaller markets. The same pattern is observed in other geographic regions.

Asia Pacific, comprising tier-1 countries such as Japan, China, and Australia, and tier-2 countries such as South Korea and new entrants India and New Zealand, is a rapidly growing zone characterized by lower labor costs, the availability of qualified talent, and their growing need for customer services, KPO, and product Manufacturing Outsourcing. South America, including countries like Brazil and Argentina, portrays burgeoning markets in IT, finance, and logistics sectors for outsourcing; and the balance of South America is steadily embracing services. The Middle East & Africa, consisting of Saudi Arabia, UAE, South Africa, and other regional markets, also focuses on outsourcing of various processes in government operations, healthcare, and BFSI for the purpose of achieving cost-efficient service delivery and digital adoption. Within each region, both tier-1 and tier-2 sub-regions play a complementary yet important role in market development: while quality and compliance are higher in developed markets, cost efficiency and scalability can be achieved in emerging regions, resulting in consistent growth across the global outsourcing market.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, Grant Thornton US has agreed to the acquisition of Auxis, a Fort Lauderdale, FL-based business process outsourcing firm. The accounting and consulting firm for the middle-market also announced the addition of Marc Chase as the head of the private equity practice.

- In July 2025, Capgemini, a global business and technology transformation partner, and WNS (NYSE: WNS), a leading digital-led business transformation and services company, announced that their boards of directors have reached a definitive transaction agreement whereby Capgemini will acquire WNS for an all-cash consideration of 76.50 USD per share of WNS, which is an premiums of 28% over the last 90 days average share price, 27% over the last 30 days average share price, and 17% over last closing share price on July 3, 2025.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 301 Billion |

|

Market size value in 2026 |

USD 330 Billion |

|

Revenue forecast in 2033 |

USD 520.5 Billion |

|

Growth rate |

CAGR of 6.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Accenture, Cognizant Technology Solutions, IBM Corporation,Wipro Limited, Genpact Limited, Concentrix Corporation, TCS (Tata Consultancy Services), Capgemini SE, Infosys Limited, HCL Technologies, EXL Service, Sitel Group, Teleperformance SE, DXC Technology, Tech Mahindra |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Service (Finance & Accounting, Human Resource, KPO, Procurement & Supply Chain, Customer Services, Sales & Marketing, Logistics, Training and Development Outsourcing, Others), By Outsourcing Type (Onshore, Nearshore, Offshore), By Deployment (Cloud, On-premise), By End Use (BFSI, Healthcare, Manufacturing, IT & Telecommunications, Retail, Government & Defense, Others) |

Key Business Process Outsourcing Company Insights

Accenture is a market leader in business process outsourcing. It has in-depth knowledge in its business area, along with technology-based solutions. It provides holistic services in the fields of finance, human resources, procurement, and customer engagement, using the power of artificial intelligence, cloud, and automation. Its ability to carry out effective acquisitions, geographically diversify, and establish its presence in North America, Europe, and Asia Pacific helps Accenture provide scalable, efficient, and superior-quality outsourcing services. Its emphasis on innovation and digital transformation helps Accenture build stronger business ties with its customers, allowing enterprises to devote their time to strategic growth rather than spending time and resources on transactional business activities.

Key Business Process Outsourcing Companies:

- Accenture

- Cognizant Technology Solutions

- IBM Corporation

- Wipro Limited

- Genpact Limited

- Concentrix Corporation

- TCS (Tata Consultancy Services)

- Capgemini SE

- Infosys Limited

- HCL Technologies

- EXL Service

- Sitel Group

- Teleperformance SE

- DXC Technology

- Tech Mahindra

Global Business Process Outsourcing Market Report Segmentation

By Service

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

By Outsourcing Type

- Onshore

- Nearshore

- Offshore

By Deployment

- Cloud

- On-premise

By End Use

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636