Market Summary

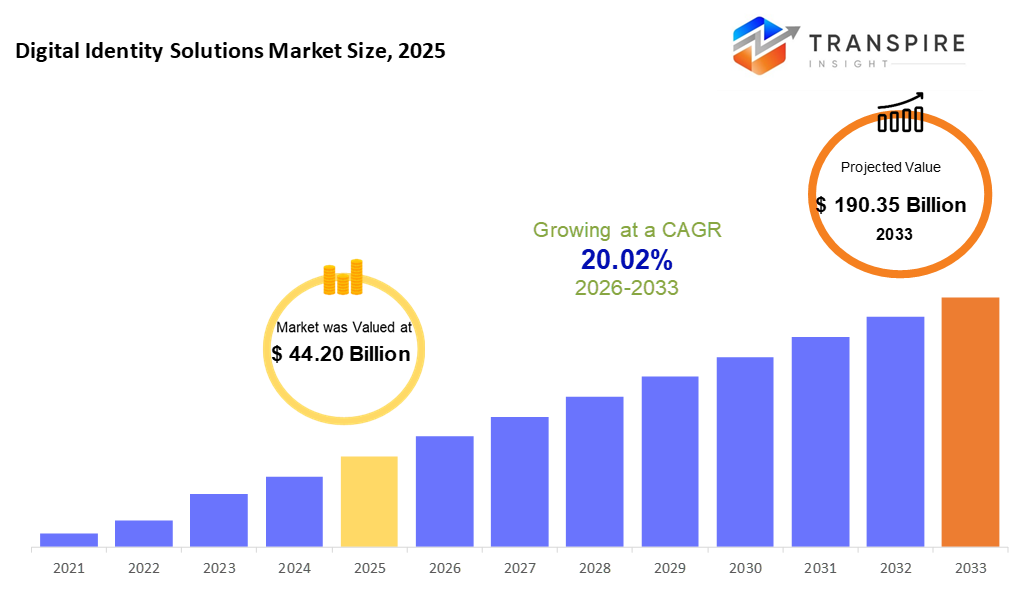

The global Digital Identity Solutions market size was valued at USD 44.20 billion in 2025 and is projected to reach USD 190.35 billion by 2033, growing at a CAGR of 20.02% from 2026 to 2033. The rapid expansion of the Digital Identity Solutions market is driven by widespread digital transformation, rising online transactions, and the growing need for secure identity verification to prevent fraud and data breaches. Additionally, stricter KYC/AML regulations, increasing adoption of biometric and AI-enabled authentication, and cloud-based identity platforms are accelerating market growth globally.

Market Size & Forecast

- 2025 Market Size: USD 44.20 Billion

- 2033 Projected Market Size: USD 190.35 Billion

- CAGR (2026-2033): 20.02%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market share is estimated to be approximately 40% in 2026. Leads the market due to advanced digital infrastructure, strong regulatory frameworks, and early adoption by the BFSI and government sectors.

- Dominates regional growth with high investments in AI-powered identity verification, fraud prevention, and cloud-based solutions.

- Asia Pacific is the fastest-growing region, driven by digital banking adoption, government ID programs, and increasing cybersecurity awareness

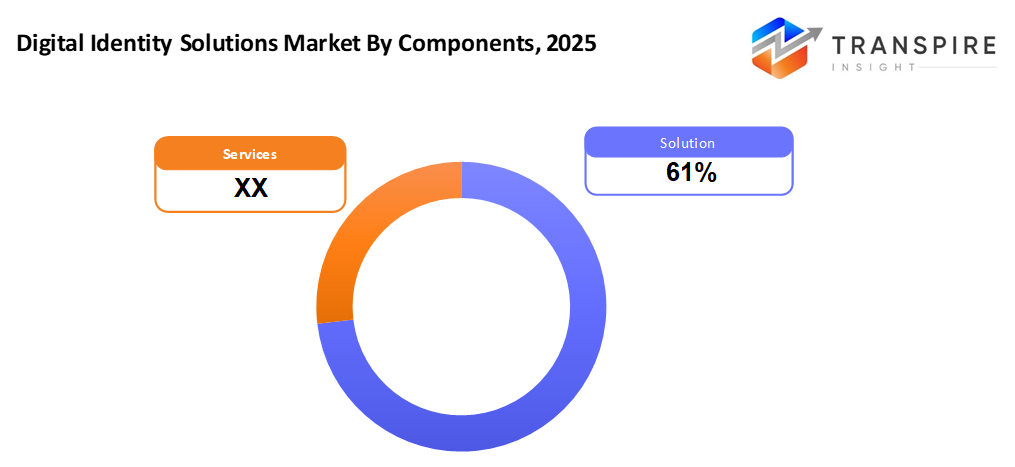

- Solutions share approximately 63% in 2026. Leads market growth due to high demand for integrated identity management platforms over standalone services.

- Identity Verification is the fastest-growing segment driven by regulatory compliance (KYC/AML) and increasing digital onboarding.

- Cloud-Based dominates growth owing to scalability, cost efficiency, and real-time updates.

- BFSI holds the largest share, as banks and financial institutions are early adopters of secure digital identity solutions.

The Digital Identity Solutions market is experiencing strong growth as organizations increasingly shift toward digital platforms for customer onboarding, authentication, and secure access management. The rapid expansion of online services, digital payments, and remote interactions has made identity verification a critical requirement across industries. Governments and enterprises are adopting digital identity systems to enhance security, reduce fraud, and improve user experience while ensuring compliance with evolving regulatory standards.

Technological advancements such as biometrics, artificial intelligence, machine learning, and blockchain are transforming digital identity solutions. Biometric authentication methods, including facial recognition, fingerprint scanning, and voice recognition, are gaining traction due to their high accuracy and user convenience. AI-driven analytics enable real-time identity verification, behavioral analysis, and fraud detection, significantly reducing identity theft and cybercrime risks. These innovations are making digital identity platforms more reliable, scalable, and efficient.

Cloud-based deployment models are playing a crucial role in market expansion, offering flexibility, scalability, and cost efficiency. Organizations prefer cloud-based digital identity solutions for faster implementation, seamless updates, and integration with existing digital ecosystems. While on-premises solutions remain relevant in high-security environments, especially within government and defense sectors, cloud adoption continues to accelerate across BFSI, retail, telecom, and healthcare industries.

From an end-user perspective, the BFSI sector leads adoption due to stringent KYC, AML, and customer authentication requirements. Governments are also major contributors, implementing national digital ID programs and e-governance initiatives to streamline citizen services. Meanwhile, Asia Pacific is emerging as a high-growth region driven by rapid digitalization, expanding fintech ecosystems, and large-scale government identity projects, positioning the Digital Identity Solutions market for sustained global growth over the coming years.

Digital Identity Solutions Market Segmentation

By Component

- Solution

Core platforms and software for identity verification, authentication, and fraud prevention.

- Services

Integration, consulting, managed services, and support for digital identity deployments.

To learn more about this report, Download Free Sample Report

By Solution Type

- Identity Verification

Tools for KYC, AML compliance, and customer onboarding.

- Authentication & Access Management

Multi-factor authentication, SSO, and privileged access solutions.

- Fraud & Risk Management

AI-powered transaction monitoring and behavioral analytics.

- Biometric Solutions

Fingerprint, facial, iris, and voice authentication technologies.

- Others

Digital signatures, blockchain-based identity, and e-passports.

By Deployment Mode

- Cloud-Based

SaaS or cloud-hosted identity solutions for scalability and real-time updates.

- On-Premises

Locally installed systems for secure, controlled environments.

By End-Users

- BFSI

Banks, financial institutions, and insurance companies are using digital identity for compliance and secure access.

- Government & Public Sector

National ID programs, citizen authentication, and e-governance solutions.

- Healthcare

Secure patient identification and access to medical records.

- Telecom & IT

Subscriber authentication and fraud prevention.

- Retail & E-Commerce

Customer onboarding, secure payments, and fraud management.

- Others

Education, travel, energy, and other sectors require identity verification.

Regional Insights

The North America region leads the Digital Identity Solutions market, driven by advanced digital infrastructure, high adoption of cloud and AI-based security technologies, and strict regulatory requirements related to data protection and identity verification. The United States dominates the regional market due to strong demand from BFSI, government, healthcare, and retail sectors, while Canada contributes through growing adoption in public services and financial institutions. The presence of major technology providers and early implementation of biometric and multi-factor authentication solutions further strengthen North America’s market position.

Europe represents a significant market, supported by robust regulatory frameworks such as GDPR and strong government initiatives around digital identity and eID programs. Countries including the UK, Germany, France, and the Nordic nations are actively deploying national digital identity systems and secure authentication platforms across banking and public services. Increasing cross-border digital services and a focus on privacy-by-design solutions are driving steady adoption of digital identity technologies across both public and private sectors in the region.

The Asia Pacific region is the fastest-growing market, fueled by rapid digitalization, expanding fintech ecosystems, and large-scale government-led identity programs. Countries such as China, India, Japan, Australia, and Southeast Asian nations are investing heavily in biometric identity systems, mobile authentication, and cloud-based platforms to support digital banking, e-commerce, and e-governance. Growing internet penetration, smartphone adoption, and rising awareness of cybersecurity are positioning the Asia Pacific as a key growth engine for the global digital identity solutions market.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 24, 2025 – Signicat launched ReuseID, a comprehensive digital identity solution enabling organisations.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 44.20 Billion |

|

Market size value in 2026 |

USD 53.13 Billion |

|

Revenue forecast in 2033 |

USD 190.35 Billion |

|

Growth rate |

CAGR of 20.02% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

NEC Corporation, Thales, GB Group Plc, Telus, Tessi, Daon Inc., Idemia, ForgeRock Inc., Imageware, Jumio, Samsung SDS, HID Global, CrowdStrike, DXC Technology, Experian, Equifax, Entrust, and Duo Security |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Solutions, Services), By Solution Type(Identity Verification, Authentication & Access Management, Fraud & Risk Management, Biometric Solutions, Others), By Deployment Mode (Cloud-Based, On-Premises), By End-Users (BFSI, Government & Public Sector, Healthcare, Telecom & IT, Retail & E-Commerce, Others) |

Key Digital Identity Solutions Company Insights

Thales Group is a leading global provider of digital identity solutions, offering advanced identity verification, biometric authentication, and digital credentialing platforms. The company serves governments, financial institutions, and enterprises with secure technologies such as facial recognition, document verification, and multi-factor authentication. Thales’ solutions support large-scale national ID programs, digital wallets, and secure customer onboarding. With strong expertise in cybersecurity and continuous investment in AI-driven identity technologies, Thales holds a prominent position in the global digital identity solutions market.

Key Digital Identity Solutions Companies:

- NEC Corporation

- Thales

- GB Group Plc

- Telus

- Tessi

- Daon Inc.

- Idemia

- ForgeRock Inc.

- Imageware

- Jumio

- Samsung SDS

- HID Global

- CrowdStrike

- DXC Technology

- Experian

- Equifax

- Entrust

- Duo Security

Global Digital Identity Solutions Market Report Segmentation

By Component

- Solutions

- Service

By Solution Type

- Identity Verification

- Authentication & Access Management

- Fraud & Risk Management

- Biometric Solutions

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By End-Users

- BFSI

- Government & Public Sector

- Healthcare

- Telecom & IT

- Retail & E-Commerce

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636