Market Summary

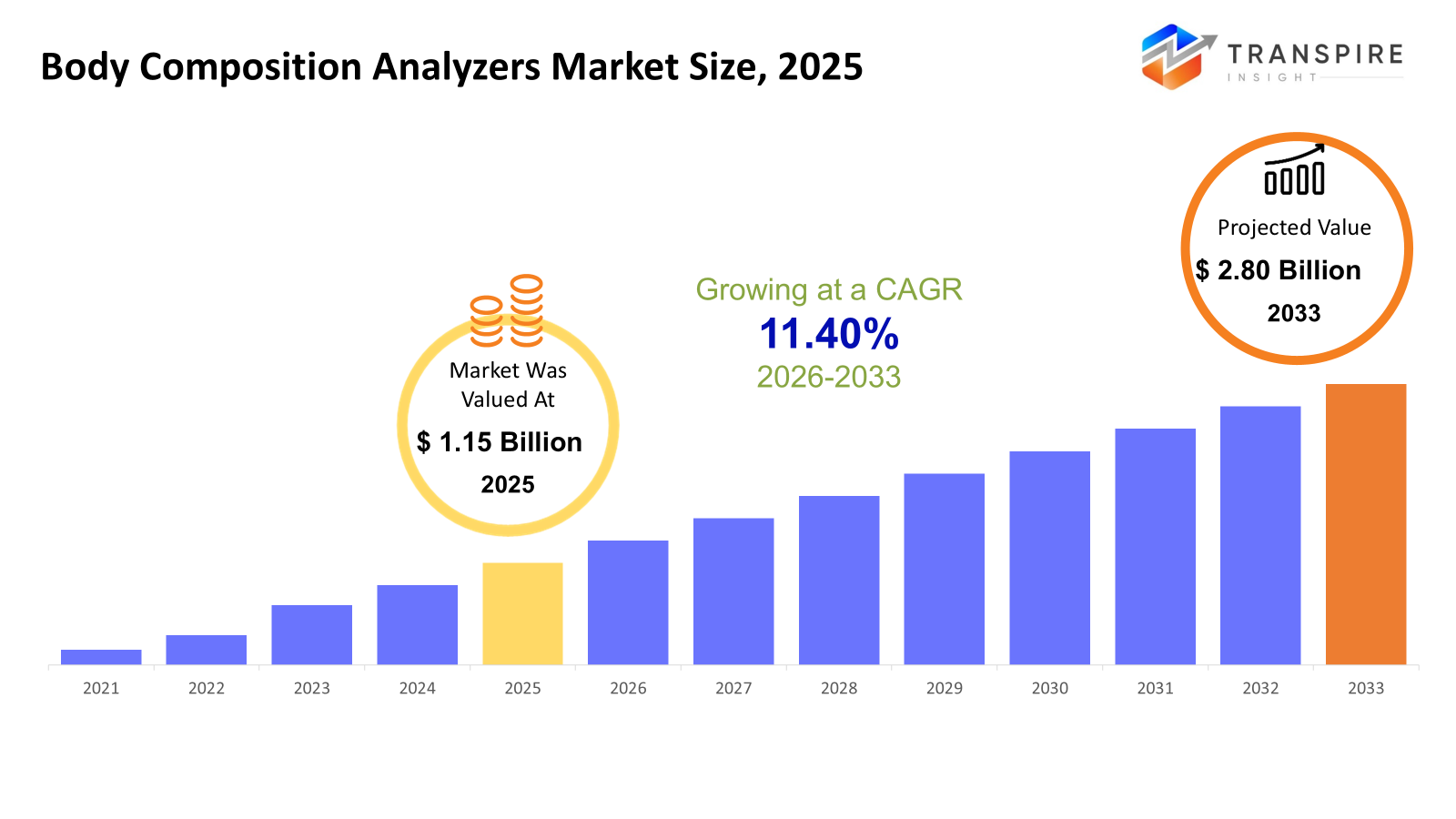

The global Body Composition Analyzers market size was valued at USD 1.15 billion in 2025 and is projected to reach USD 2.80 billion by 2033, growing at a CAGR of 11.40% from 2026 to 2033. The increasing prevalence of obesity, metabolic disorders, and lifestyle-related diseases worldwide fuels the need for accurate body composition assessment tools both in clinical and fitness environments. The increasing emphasis on preventive healthcare and personalized wellness programs continues to support the sustained adoption of advanced analyzers. Other reasons contributing to market growth include portable devices, digital connectivity, and improvement in measurement accuracy.

Market Size & Forecast

- 2025 Market Size: USD 1.15 Billion

- 2033 Projected Market Size: USD 2.80 Billion

- CAGR (2026-2033): 11.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America's mature market growth is supported through the advancement of healthcare systems, strong adoption of preventive health technologies, and increasing integration of body composition analysis into both clinical and fitness programs. Sustained innovation and high consumer awareness continue to support consistent demand expansion.

- The United States leads regional revenue generation, impelled by high prevalence of obesity, deep penetration of the fitness industry, and widespread adoption of connected health devices. Healthcare providers increasingly use body composition data in personalized treatment and wellness monitoring strategies across both clinical and commercial settings.

- The fastest growth trajectory is seen in the Asia Pacific; rapid urbanization, an increase in middle-class populations, and rising awareness of lifestyle diseases are the key end drivers; high investment in healthcare infrastructure and participation in physical fitness accelerates the adoption of affordable, portable body composition analyzers.

- Bioimpedance analyzers make up the largest share of products, attributable to factors like cost efficiency, non-invasive methods, and versatility applicable to medical, fitness, or home settings, with wireless connectivity continuing to play an important role in connecting with various devices.

- Whole body measurement is showing the highest rate of demand from lead applications, particularly for its capability to provide rapid assessments for routine screening and fitness evaluation, as well as its usage in weight management and chronic disease programs.

- Portable modality shows the most dynamic segment in terms of expansion due to increased customer demand for user-friendly and portable devices for point-of-care and home use, as well as developments in technology to improve the accuracy and greater energy efficiency of the sensor.

- Hospitals continue to maintain their position as the largest end-user segment as a result of the integration of body composition parameters into the management of metabolic disorders, as well as the improvement of healthcare provider relationships with wellness programs

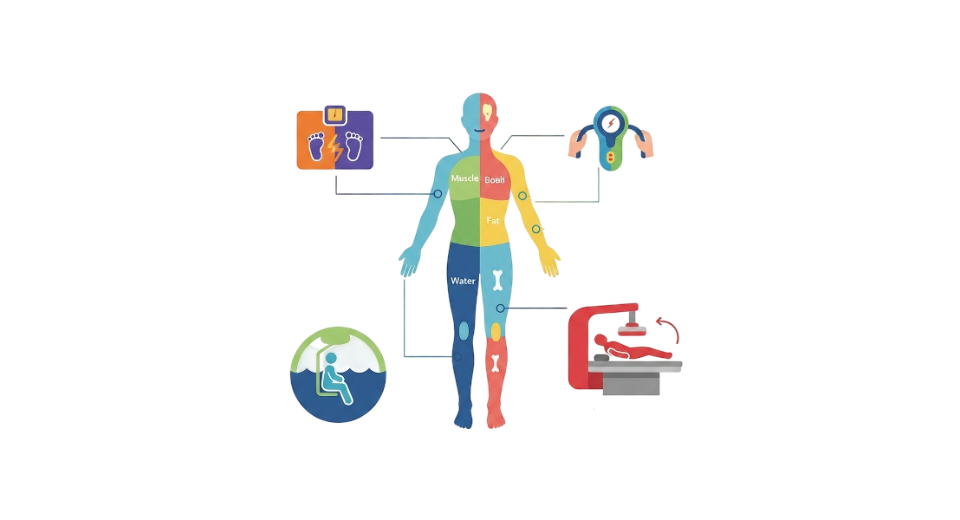

The body composition analyzers market comprises devices that measure key body metrics such as body fat percentage, muscle mass, and body water content. These analyzers play a vital role in health assessments and performance monitoring across hospitals, fitness centers, research institutes, and home settings. Unlike traditional weighing scales, body composition analyzers provide detailed physiological insights, enabling more comprehensive health evaluation.

Growing awareness of obesity-related health risks and the increasing focus on preventive healthcare are major factors driving global demand in the body composition analyzers market. Technological advancements have significantly improved accessibility and ease of use, particularly with portable bioimpedance-based systems integrated with digital platforms. Rising demand for personalized fitness programs, sports performance tracking, and rehabilitation monitoring further supports market growth. Healthcare professionals are increasingly incorporating body composition data into treatment planning, expanding clinical adoption.

Additionally, growing consumer interest in health and wellness tracking is transforming body composition analyzers into widely adopted home-use products. Manufacturers continue to enhance measurement accuracy and user-friendly interfaces to strengthen market penetration. As healthcare systems shift from a curative approach to a preventive model, the body composition analyzers market is expected to gain further momentum in long-term health monitoring applications.

Body Composition Analyzers Market Segmentation

By Product Type

- Bioimpedance Analyzer (BIA)

Bioimpedance analyzers hold a large market share due to their ease of use, cost-effectiveness, and non-invasive application. Besides, the shift towards bioimpedance analysis for wellness monitoring and home healthcare services enhances their demand. Additionally, technology has contributed to the growth of this segment.

- Dual-Energy X-ray Absorptiometry (DEXA)

DEXA systems are commonplace in hospitals and research facilities because of the accuracy they show in the level of fats, muscle, and bone density. The demand is rising from the increased interest in the management of obesity and the evaluation of osteoporosis. Higher costs are a drawback.

- Skinfold Calipers

The use of skinfold calipers can be seen in cost-sensitive markets, fitness, due to low cost factors, and portability. The accuracy of these devices may be limited, though, as they are often used in basic fitness evaluations as well as educational institutions.

- Air Displacement Plethysmography (ADP)

ADP systems are becoming popular for use in research and sports performance applications, driven by the reliability of the systems in measuring body fat compositions. The segment enjoys the increasing trend of obtaining in-depth analytics of body compositions. The systems are restricted from widespread adoption owing to the high cost of equipment and space requirements.

- Hydrostatic Weighing Equipment

Hydrostatic weighing is regarded as a gold-standard technique for body composition analysis. It finds major application in research or among sports centers. However, though hydrostatic weighing is fairly accurate, complexity and discomfort restrict its commercial application. It has limited application to date.

- Others

Other technologies, such as ultrasound technology and emerging imaging technology-based analyzers, are gradually being introduced in the market. In addition, innovation in sensor technologies, as well as AI-based analysis, supports growth potential for these products in the future. They are designed to provide ease of access along with accuracy for different end-users

By Application

- Segmental Body Measurement

Segmental body measurement is becoming increasingly important as it will allow for detailed analysis of fat and muscle distribution in different body segments. The requirement is on the rise for fitness training, rehabilitation, and sports science. The advanced analytics capabilities are a key factor for premium devices.

- Whole-Body Measurement

Whole body measurement has greater market size due to its usage in routine health evaluation and clinical assessments. Simplicity in the interpretation and analysis process helps expand this segment in more hospitals and fitness centers. Increasing health consciousness and prevention practices also help this segment.

To learn more about this report, Download Free Sample Report

By Modality

- Portable

Portable analyzers: With the increasing demand for point-of-care diagnostics and home-based health monitoring, portable analyzers are growing enormously. In addition, they are well adapted for fitness centers and personal uses because of their compact design and ease of operations. More applications with mobile integration are supporting market growth.

- Fixed

Fixed systems are mainly installed in hospitals, diagnostic centers, and research facilities that demand high accuracy and leading-edge analytical capabilities. These systems allow for comprehensive assessments and long-term monitoring. The higher capital investment restricts the growth to institutional users.

By End User

- Hospitals

Hospitals constitute a large end-user group following an increase in obesity, monitoring of chronic diseases, and nutritional assessment requirements. It finds traction with hospitals through integration with clinical workflows and electronic healthcare records. It is further supported by preventive healthcare initiatives.

- Fitness Clubs & Wellness Centers

Fitness clubs and wellness centers are important adopters driven by the increasing consumer focus on body composition rather than weight. Analyzers help with personalization of fitness activities and tracking exercises. The increasing health-conscious population and the membership model of fitness clubs create demand.

- Academic & Research Institutes

Academic and research institutes require body composition analyzers. This is mainly driven by the rising research funds in the fields of health and human performances. In this segment, high-precision body composition analyzers are preferred.

- Home Users

The user segment of home users is growing fast, driven by strong awareness of "personal health monitoring" and "integrated digital health." "Easy-to-connect smart devices" and "user-friendly interfaces" indeed promote this segment. "Affordability improvements" are enhancing penetration among consumers too.

- Others

Other forms of end users include sports organizations and corporate wellness programs, along with rehabilitation facilities. They are also increasingly using analyzer devices for performance optimization and employee health programs. The trend towards preventive health management activities also adds to the growth of the segment.

Regional Insights

North America, comprising the United States, Canada, and Mexico, makes up a mature market, given its strong medical care systems, fitness culture, and adoption of new innovative technologies. Over time, the United States has remained the dominant earner, given its emphasis on health care and body composition analysis, while Canada and Mexico are improving, given their focus on health care and fitness. Europe, comprising Germany, the United Kingdom, France, Spain, Italy, and the rest of the European countries, is showing promising growth due to preventive health measures and movement towards the management of metabolism-related health issues. Germany and the United Kingdom are holding top positions, while Southern and Eastern European markets have shown steady growth due to heightened participation in health and fitness clubs, as well as developments within the healthcare sector.The most rapidly growing regional market is Asia Pacific, including Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific, because of rapid urbanization, growing middle-class populations, and increasing prevalence of lifestyle-related diseases. Significant contributions from China and Japan are entrenched in technological adoption and healthcare investments; at the same time, India and Southeast Asia exhibit strong growth opportunities caused by an expanding fitness industry and better access to healthcare.

The Rest of South America, including Brazil and Argentina, has shown a good growth rate with increasing awareness of health and wellness, along with the expansion of private healthcare facilities. Brazil dominates regional demand owing to its large fitness industry, whereas in Argentina, demand is gradually catching up as economic conditions and the development of healthcare infrastructure proceed. The growth of the Middle East & Africa region, which includes Saudi Arabia, the United Arab Emirates, South Africa, and the rest of the Middle East & Africa, is emerging, driven by healthcare infrastructure investments and government-led wellness initiatives. The UAE and Saudi Arabia are leading adoption through premium healthcare and fitness facilities, while other countries demonstrate gradual market penetration based on growing awareness of lifestyle disease management.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 2025, seca GmbH & Co. KG announces their latest achievement: launching a new product from the next-generation series, called the seca TRU Alpha, which is a next-generation body composition analysis product for fitness training purposes, signifying another achievement for the company in the line of body composition analysis devices.

(Source:https://www.seca.com/en_us.html)

- In January 2025, InBody officially said on their official press page that InBody will be attending CES 2025 in Las Vegas to exhibit the latest generation of body compositions, such as professional and home-use devices InBody 380 and InBody 580, and health monitoring devices and applications.

(Source:https://inbody.com/en/press_release/contents/view/16/)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.15 Billion |

|

Market size value in 2026 |

USD 1.30 Billion |

|

Revenue forecast in 2033 |

USD 2.80 Billion |

|

Growth rate |

CAGR of 11.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

InBody Co., Ltd., Tanita Corporation, OMRON Corporation, seca GmbH & Co. KG, GE HealthCare Technologies Inc., and Hologic, Inc. Other prominent participants operating with validated product offerings include Bodystat Ltd., COSMED Srl, RJL Systems, Inc., Maltron International Ltd., Beurer GmbH, Withings SA, DMS Imaging SA, Jawon Medical Co., Ltd., and Akern S.r.l. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Bioimpedance Analyzer (BIA), Dual-Energy X-ray Absorptiometry (DEXA), Skinfold Calipers, Air Displacement Plethysmography (ADP), Hydrostatic Weighing Equipment, Others), By Application (Segmental Body Measurement, Whole-Body Measurement), By Modality( Portable, Fixed) and By End User (Hospitals, Fitness Clubs & Wellness Centers, Academic & Research Institutes, Home Users, Others) |

Key Body Composition Analyzers Company Insights

InBody Co., Ltd. has maintained its leading position in the global body composition analyzer market in terms of its expertise in bioelectrical impedance analysis technology and extensive range of body composition products for medical use, fitness and well-being. It has established itself as a global body composition analytic technology leader with products deployed in hospitals, fitness centers, and research centers around the world. InBody has expanded its business by building strong relationships with fitness centers and healthcare institutions. Having an even distribution of customers among fitness enthusiasts and professionals, the organization is able to tap into the preventive health segment and personalized health monitoring solutions.

Key Body Composition Analyzers Companies:

- InBody Co., Ltd.

- Tanita Corporation

- OMRON Corporation

- seca GmbH & Co. KG

- GE HealthCare Technologies Inc.

- Hologic, Inc.

- Bodystat Ltd.

- COSMED Srl

- RJL Systems, Inc.

- Maltron International Ltd.

- Beurer GmbH

- Withings SA

- DMS Imaging SA

- Jawon Medical Co., Ltd.

- Akern S.r.l.

Global Body Composition Analyzers Market Report Segmentation

By Product Type

- Bioimpedance Analyzer (BIA)

- Dual-Energy X-ray Absorptiometry (DEXA)

- Skinfold Calipers

- Air Displacement Plethysmography (ADP)

- Hydrostatic Weighing Equipment

- Others

By Application

- Segmental Body Measurement

- Whole-Body Measurement

By Modality

- Portable

- Fixed

By End User

- Hospitals

- Fitness Clubs & Wellness Centers

- Academic & Research Institutes

- Home Users

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636