Market Summary

The global Advanced Driver Assistance Systems (ADAS) market size was valued at USD 359.80 Million in 2025 and is projected to reach USD 710.44 Million by 2033, growing at a CAGR of 8.88% from 2026 to 2033. ADAS market growth is driven by stricter vehicle safety regulations and rising consumer demand for enhanced driving comfort and accident prevention. Automakers are increasingly integrating camera, radar, and LiDAR-based systems to meet safety ratings and regulatory standards. Growing adoption of electric and connected vehicles is further accelerating ADAS deployment. Additionally, falling sensor costs and improvements in real-time data processing are enabling wider penetration across passenger and commercial vehicles through both OEM and aftermarket channels.

Market Size & Forecast

- 2025 Market Size: USD 359.80 Million

- 2033 Projected Market Size: USD 710.44 Million

- CAGR (2026-2033): 8.88%

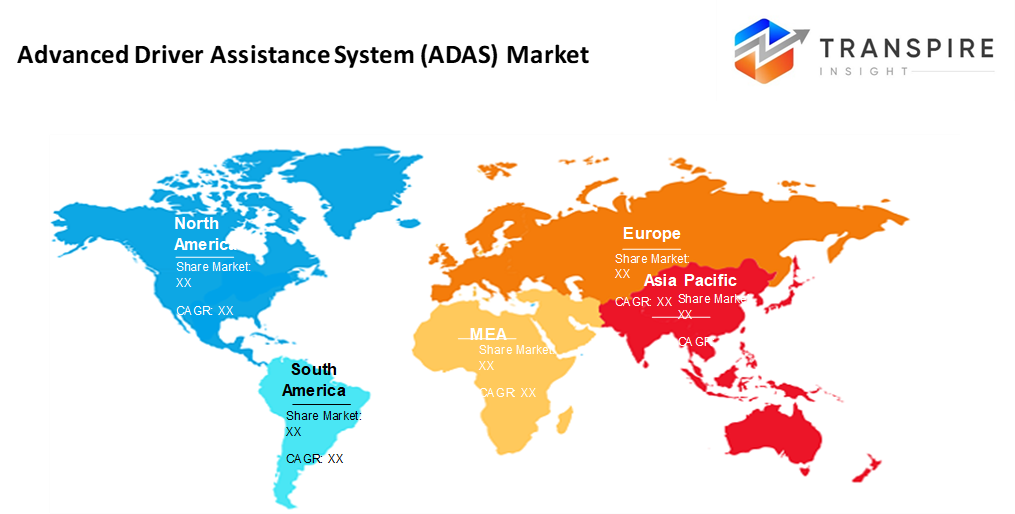

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 34% in 2026. Driving the adoption of features such as adaptive cruise control begins in North America, where rules push innovation. Revenue from these safety tools grows fastest there, tied closely to how quickly people accept new tech. Systems combining radar, cameras, and braking alerts spread widely thanks to local demand patterns.

- Over in the United States, strict rules like requiring automatic emergency braking and lane guidance push carmakers to add more radar and camera systems into vehicles. Buyers who care about safety also help speed things up. Different models, from small cars to trucks, now include these tools more often than before.

- China, Japan, and South Korea see a surge in sensor and ECU output, which fuels ADAS growth across the Asia Pacific. Vehicle builds are climbing here faster than elsewhere on Earth. Safety rules tightening adds momentum.

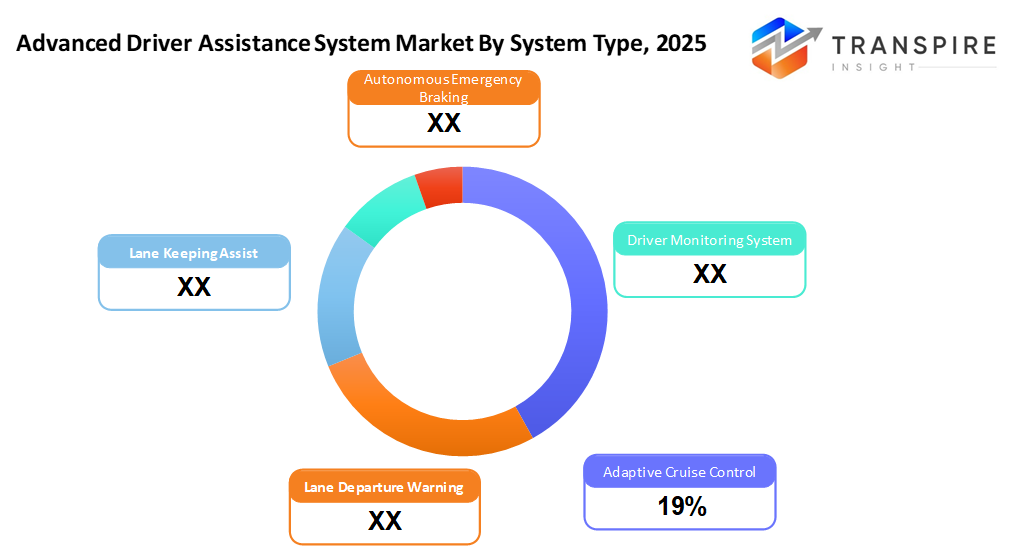

- Adaptive Cruise Control 20% in 2026. Even though newer systems are emerging, ACC still leads global ADAS use because carmakers widely include it plus governments stress safer highways.

- Fog or rain, radar keeps working its long reach makes it a top pick among ADAS sensors.

- Fewer trucks than cars carry advanced safety tech today. Still, automakers now fit nearly every new family vehicle with collision warnings or lane control tools. These features, once felt rare, are now routine on showroom floors.

- Fitted at the factory, OEM setups dominate rules demand them, people expect them. Built-in trust plus real-world need.

Speed settings shift on their own when cars ahead slow down, thanks to a tool called Adaptive Cruise Control. This system keeps the distance steady without constant pedal adjustments by the driver. Found often in modern autos, it helps reduce strain on long trips or heavy city roads. Part of a larger group of driving aids, this tech shows up frequently in today’s vehicles. Available either built-in or as add-ons, many sedans, SUVs, and even certain trucks now carry it.

One big reason the ACC part matters so much in today's ADAS world. Car makers keep choosing it, and buyers like what it offers. Safety rules across countries are getting stricter that pushes more demand. People now expect their cars to help them drive more easily, avoid crashes, and better machines stepping up where humans slow down. This is not just about new laws; it is about habits shifting behind the wheel.

Most makers in the United States. Fit newer cars, especially bigger ones, with adaptive cruise control right out of the factory. This trend thrives because rules demand safer rides, drivers lean toward electric models, plus sensors keep improving. The region leads in using such tech, helped by firm regulations and quick uptake across car types. Trim levels often decide how rich the package gets, yet even base versions sometimes carry these tools.

Fusion of radar and camera data helps cars see better, especially when paired with smart software that learns from surroundings. Systems like traffic jam helper and lane keep work more smoothly because of these upgrades. Rules pushing safer driving tech mean features like adaptive cruise control stay central in new safety packages. Progress here opens doors to more self-driving abilities down the road.

Advanced Driver Assistance Systems (ADAS) Market Segmentation

By System Type

- Adaptive Cruise Control

Faster highways push demand. OEMs now fit most new cars with Adaptive Cruise Control. Safety gains on long drives make it a top choice among driver aids.

- Lane Departure Warning

That system gives a heads-up when you start to wander out of your lane. Alerts kick in if the vehicle moves without signaling. A common feature found on many modern vehicles today.

- Lane Keeping Assist

Steering was gently corrected when drifting near the lines on the road. Keeps the vehicle centered during routine driving moments. A small nudge happens only if needed. Works without sudden movements. Focus stays on staying within boundaries. Light intervention occurs before crossing lanes. Helps reduce driver effort over long stretches. The system watches edges constantly. Minimal support is offered every few seconds. Gentle guidance applied under normal conditions.

- Autonomous Emergency Braking

Faster stops happen when systems react before crashes. Rules now expect these safeguards to be built into vehicles.

- Driver Monitoring Systems

Watching drivers closely becomes more common, spotting tiredness or lack of focus. Systems now check alertness simply, catching slips before they grow serious.

- Others

Some cars come with extras like seeing in the dark or spotting people nearby, features usually found on higher-end models.

To learn more about this report, Download Free Sample Report

By Sensor Type

- Camera

Cameras take in visual data to help vehicles see lanes clearly. These sensors spot road signs so systems know speed limits or warnings. Instead of just shapes, they figure out what objects are around the car. Seeing things ahead allows better decisions while driving.

- Radar

From a distance, radar spots objects better than most systems. It keeps cars at steady gaps on highways by adjusting speed automatically. When danger appears ahead, it helps avoid crashes before they happen.

- LiDAR

Bouncing light beams help map surroundings in fine detail, where accuracy matters most. These setups guide machines through space without human input, relying on split-second reflections to decide direction. Not every system uses them, yet those that do gain an edge in spatial awareness.

- Ultrasonic Sensors

Sitting quietly beneath bumpers, ultrasonic sensors help cars sense nearby objects when crawling into tight spots. These small tools work best at slow speeds, gently alerting drivers to unseen walls or poles. Often found in modern vehicles, they handle close-range detection without fuss.

By Vehicle Type

- Passenger Cars

Luxury sedans lead the pack, tech once reserved for high-end models now shows up even in budget-friendly rides.

- Commercial Vehicles

Fleet operators now prioritize safety more than before. Because of this shift, commercial vehicles see rising demand. Telematics systems play a key role here. These tools connect directly to daily operations. Safety rules push change across transport companies. Technology fits naturally within these updates. Adoption spreads steadily through the sector.

By Sales Channel

- Original Equipment Manufacturer

Fitted right at the factory, most advanced driver systems roll out through OEMs first. What stands out is how these setups come either included by default or as a choice--an own option when buying new. This path dominates simply because vehicles arrive ready, with no extra installation needed

- Aftermarket

Used mainly to add simple ADAS features to older cars. This part of the market is less common.

Regional Insights

Across North America, more cars now include driver assistance tech because rules push safer vehicles, people pay attention, and companies invest heavily in new car features. In the United States, most brands already build models with automatic braking, systems that keep pace with traffic, and tools helping stay centered in lanes. Moving north into Canada, factories produce more automobiles equipped with smart functions while programs aim to raise road protection standards. Down south in Mexico, interest grows for digital linkups inside cars, plus partial self-driving abilities alongside rising manufacturing output.

Still moving forward, Europe sees a consistent rise in ADAS use, especially in nations like Germany and the United Kingdom, while France follows close behind. Manufacturing strength here combines with tough safety rules to push progress. Behind them come Italy, Spain, along with Nordic spots, slowly adopting similar tech due to pressure from Euro NCAP targets, plus a growing need for safer roads. On top of that, buyers show real curiosity about safety tools, while public funding supports efforts tied to smart and self-driving cars across the area.

China, Japan, and South Korea lead the charge across the Asia Pacific, the region surging ahead thanks to big spending on factory-installed driver aids and self-driving research. Not far behind, places like India, Australia, and nations across Southeast Asia see quick gains as more cars roll out amid expanding cities and stronger safety pushes from authorities. In parts of the Middle East and Latin America, early steps into advanced driving systems emerge, fueled by newer commercial fleets and tighter rules around how safe vehicles must be.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 15, 2025 – ADAS launched the Tata Nexon in India

(Source: https://www.carwale.com/news/adas-equipped-tata-nexon-launched-in-india/

- June 27, 2025 – Mahindra introduced advanced driver assistance systems in Scopio-N

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 359.80 Million |

|

Market size value in 2026 |

USD 391.75 Million |

|

Revenue forecast in 2033 |

USD 710.44 Million |

|

Growth rate |

CAGR of 8.88% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Bosch Mobility, Altera, Autoliv, Denso Corporation, Continental AG, Garmin Ltd, Magna International, Mobiliye, Valeo, Wabco Customer Centre, ZF Friedrichshafen AG, Aptiv, Autoliv, Harman International, Dow, Sasken, and Luxoft |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By System Type (Adaptive Cruise Control, Lane Departure Warning, Lane Keeping Assist, Autonomous Emergency Braking, Driver Monitoring System, Others) By Sensor Type(Camera, Radar, LiDar, Ultrasonic Sensors) By Vehicle Type (Passenger Cars, Commercial Vehicles) By Sales Channels (Original Equipment Manufacturer, Aftermarket) |

Key Advanced Driver Assistance Systems (ADAS) Company Insights

Bosch runs deep in the world of smart car systems, shaping how vehicles sense their surroundings across continents. What powers much of today’s driving aids comes from their range sensors, brains behind decisions, and code that interprets motion and space. Radar hums under highway speed adjustments. Cameras track edges when lanes blur at dusk. Tiny sound pulses detect nearby objects during slow maneuvers. Light beams scan distances ahead, feeding data before brakes act on instinct. Car builders rely on these tools to embed help into daily drives, whether sedans, trucks, or EVs charging toward tomorrow. Working shoulder to shoulder with manufacturers keeps integration smooth, functional, and responsive. Pushing boundaries through constant testing and lab work fuels progress without fanfare. Leadership is not claimed; it shows up in every mile driven more safely because systems react faster than reflexes.

Key Advanced Driver Assistance Systems (ADAS) Companies:

- Bosch Mobility

- Altera

- Autoliv

- Denso Corporation

- Continental AG

- Garmin Ltd

- Magna International

- Mobiliye

- Valeo

- Wabco Customer Centre

- ZF Friedrichshafen AG

- Aptiv

- Autoliv

- Harman International

- Dow

- Sasken

- Luxoft

Global Advanced Driver Assistance Systems (ADAS) Market Report Segmentation

By System Type

- Adaptive Cruise Control

- Lane Departure Warning

- Lane Keeping Assist

- Autonomous Emergency Braking

- Driver Monitoring System

- Others

By Sensor Type

- Camera

- Radar

- LiDar

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Sales Channel

- Original Equipment Manufacturer

- Aftermarket

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636