Market Summary

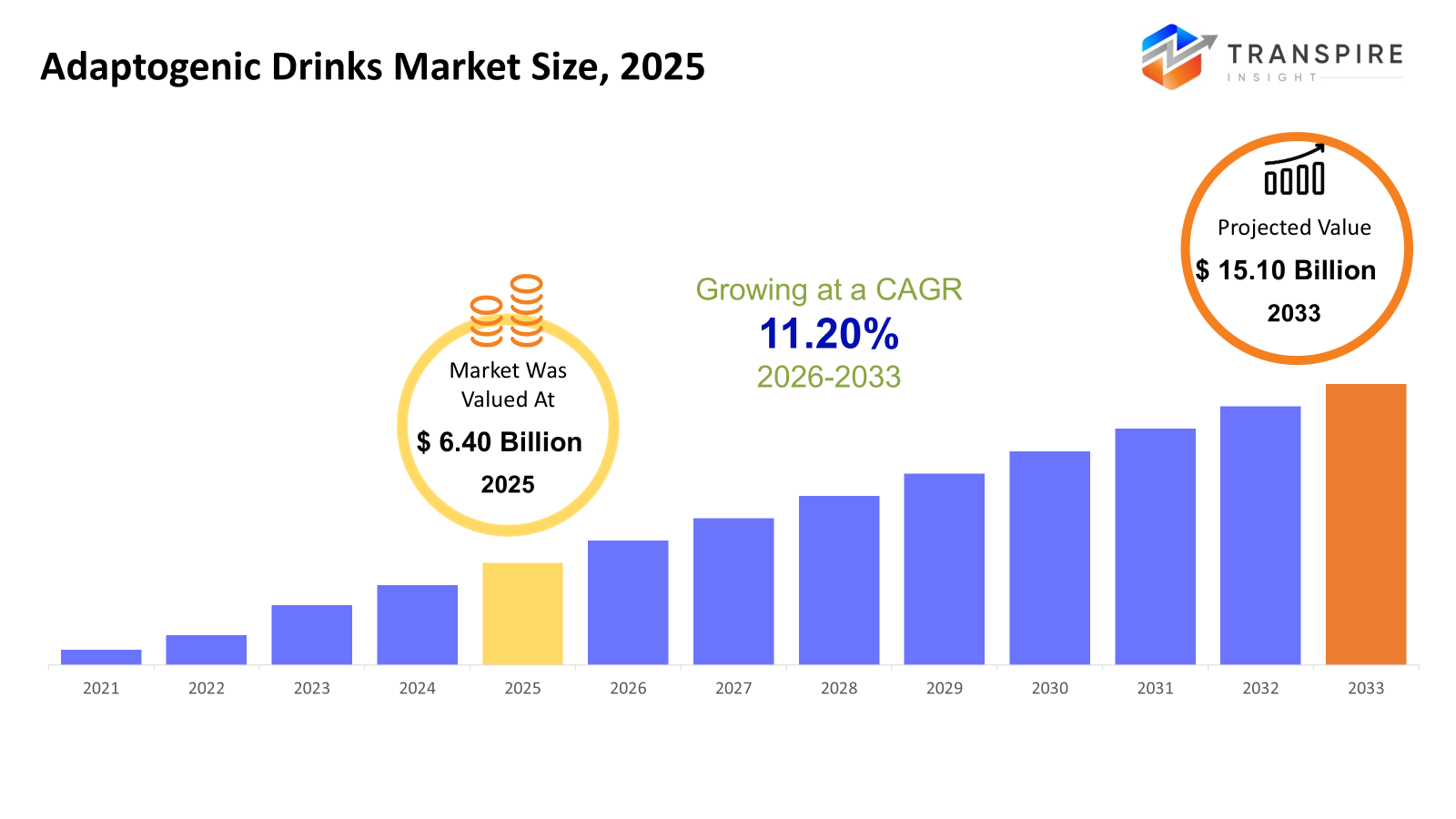

The global Adaptogenic Drinks market size was valued at USD 6.40 billion in 2025 and is projected to reach USD 15.10 billion by 2033, growing at a CAGR of 11.20% from 2026 to 2033. The market for adaptogenic drinks is growing robustly at a strong CAGR as a result of increasing stress levels, the adoption of preventive healthcare, and a consumer shift toward functional beverages. The sustained growth of the market is further fueled by greater acceptance of herbal components, innovative products in RTD formats, and an expanding online distribution network.

Market Size & Forecast

- 2025 Market Size: USD 6.40 Billion

- 2033 Projected Market Size: USD 15.10 Billion

- CAGR (2026-2033): 11.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Because of its well-established wellness culture, significant purchasing power, and high awareness of functional beverages, North America continues to lead the world in adoption. Brand-led innovation, premium pricing acceptance promote continuous demand growth across the area.

- The United States leads regional momentum through early acceptance of adaptogens, robust DTC channels and quick innovation in RTD and coffee-based formats. Frequent consumption and recurrent purchases are encouraged by consumers that have high stress lifestyles and are focused on fitness.

- Due to growing awareness of urban health and historic familiarity with adaptogenic herbs, Asia Pacific exhibits the quickest development trajectory. Expanding middle class demographics, local ingredient sourcing and rising modern retail presence boost long-term demand fundamentals.

- Product type trends indicate accelerated demand for ready-to-drink and blended adaptogenic beverages due to convenience and multi-benefit positioning. Formulations that jointly treat immunity, energy and stress within a single functional offering are becoming more popular among consumers.

- Ingredient trends reveal considerable growth for ashwagandha and mushroom-based adaptogens, driven by stress management and cognitive health positioning. Wider integration across beverage formats is supported by cross-cultural acceptance, clean-label demand and scientific validation.

- RTD, coffee-based, and tea-based adaptogenic drinks are becoming more popular, according to beverage type trends. These forms correlate well with regular consumption habits, flavor innovation and functional caffeine replacement making them more scalable than specialized smoothie-based alternatives.

- Distribution trends indicate an rapid expansion of online retail and specialty health stores. Digital engagement, subscription models, and influencer-driven discovery boost brand visibility, while physical wellness-focused outlets strengthen credibility and premium positioning

So, the adaptogenic drinks market consists of functional beverages that contain natural adaptogens, which assist the body in coping with stress, enhancing resilience and promoting overall health. These drinks are placed at the crossroads of herbal nutrition and functional refreshment, attracting consumers with a focus on preventive health. The increasing awareness of mental health issues, exposure to urban stress, and the rising inclination towards natural substitutes for synthetic energy or relaxation products are fueling market demand. Adaptogenic drinks are being seen more by consumers as daily wellness solutions.

Innovations in formulations, flavors and delivery formats like RTD beverages have broadened the occasions for consumption. The market continues to derive advantages from premiumization, clean-label claims, and the incorporation of adaptogens into mainstream beverage categories like tea, coffee, and functional waters.

Adaptogenic Drinks Market Segmentation

By Product Type

- Single-Herb Adaptogens

Single-herb adaptogenic beverages emphasize a single key adaptogen, providing distinct functional positioning and ingredient clarity. These items attract consumers who are looking for specific health advantages and uncomplicated formulations. The growing awareness of traditional herbs like ashwagandha and ginseng bolsters demand. Due to a limited functional breadth, growth is relatively moderate compared to blended offerings.

- Blended Adaptogens

Blended adaptogenic beverages incorporate various adaptogens to provide combined health benefits. This segment thrives due to a robust consumer inclination towards comprehensive wellness solutions that tackle stress, energy, and immunity at the same time. Manufacturers utilize blends to set their products apart and validate higher prices. The segment displays vigorous innovation endeavors and robust market traction.

- Functional Adaptogens

Adaptogens are combined with vitamins, minerals, probiotics, or nootropics in these products. The sector corresponds closely with the broader functional beverage trend and wellness lifestyle acceptance. Strong demand is fueled by customers seeking multifunctional benefits in a single beverage. This segment demonstrates greater growth due to increased perceived value and efficacy.

- Ready-to-Drink (RTD) Adaptogens

Convenience, portability, and instant consumption are key components of RTD adaptogenic beverages. This market is heavily supported by urbanization, hectic lives, and on-the-go consumption habits. RTD products also enable larger retail penetration and impulse purchases. This is one of the fastest-growing product types internationally.

- Concentrate / Powdered Adaptogens

Concentrated and powdered formats cater to cost-conscious and customization-oriented consumers. These products offer longer shelf life and flexibility in dosage and preparation. Direct-to-consumer business methods and the spread of online shopping encourage growth

To learn more about this report, Download Free Sample Report

By Ingredient

- Ashwagandha

Ingredient demand is dominated by ashwagandha because of its strong links to stress relief and mental wellness. Its foundation in Ayurveda fosters a high level of acceptance in both Eastern and Western markets. Enhancing clinical validation fortifies its commercial uptake. It continues to be a fundamental ingredient in high end adaptogenic beverages.

- Mushroom-Based

Adaptogens derived from mushrooms, like reishi and lion’s mane, are becoming more popular for their cognitive and immune health advantages. This segment gains from the increasing interest in natural nootropics and functional fungi. Growth is aided by product innovation and a clean-label positioning. In North America and Asia Pacific demand is especially robust.

- Holy Basil (Tulsi)

Holy basil is widely renowned for its soothing and immune-support effects. Its longstanding use in herbal medicine improves customer trust particularly in Asia Pacific regions. Stress and detox focused drinks frequently contain this substance. Growth is still consistent although focused in certain areas.

- Maca

Energy, stamina, and hormonal balance are the main advantages of maca. Younger and fitness focused customer segments find it quite appealing. Usage is expanding in smoothies and performance beverages. But compared to core adaptogens, awareness is still lower which prevents widespread implementation.

- Lavender & Other Herbs

Lavender and related herbs are typically used for relaxing and mood-enhancing compositions. Tea-based and relaxing beverage styles frequently include these ingredients. Instead of clinical positioning, lifestyle and wellness branding drives demand. Growth is niche-focused and moderate.

- Ginseng, Rhodiola, Schisandra, etc.

Applications for energy, endurance, and mental focus are supported by these adaptogens. Their widespread use in conventional medicine increases the legitimacy of functional drinks. Adoption is rising in premium and sports oriented items. However, mass-market penetration may be constrained by formulation complexity and expense.

By Beverage Type

- Ready-to-Drink (RTD)

Due to their easy handling and ubiquitous retail availability, consumption is dominated by RTD drinks. Robust branding and flavor innovation encourage repeat purchases. This segment is greatly aided by urban lifestyles and a demand driven by convenience. It stands for an essential category that generates income.

- Tea-based Beverages

Drinks featuring tea as a base that have adaptogenic properties fit well with a focus on wellness and herbal remedies. They are viewed by consumers as soothing, natural, and culturally familiar. Growth is bolstered by the premiumization of products and innovations in functional tea. This segment demonstrates stable yet sustainable growth.

- Smoothies & Juices

Adaptogenic smoothies and drinks target health-conscious and fitness-focused consumers. They allow smooth integration of adaptogens into daily eating practices. Demand is fuelled by clean-label and plant-based trends. Shorter shelf life, however, may limit widespread dissemination.

- Coffee-based Adaptogen Drinks

The need for long-lasting energy without jitters is met by coffee-based adaptogenic drinks. They are well-liked by working professionals looking for healthy substitutes for caffeine. Growth is supported by café culture and premium coffee advances. There is a lot of possibility for distinction in this area.

- Others

Tonics, injections, and customized formulas fall under this category. These goods frequently emphasize certain advantages like immunity or relaxation. Instead of volume sales, growth is driven by innovation and specialty positioning. The market contribution is still rather low.

By Distribution Channel

- Hypermarkets & Supermarkets

These channels provide a high degree of visibility and accessibility for adaptogenic beverages. They facilitate bulk sales and brand awareness among the general consumer base. Growth is propelled by the expansion of shelf space for functional beverages. Nevertheless, competition in terms of pricing is still fierce.

- Convenience Stores

Convenience stores mainly facilitate sales of RTD products and impulse buys. Demand is fueled by pedestrian movement in urban areas and the need for convenience. Product variety is limited due to restricted shelf space. Growth is consistent, yet selective.

- Specialty / Health Food Stores

These shops serve knowledgeable and health-conscious customers. They are in favor of premium pricing and branding that emphasizes ingredients. Credibility of the product is increased by strong personnel recommendations. For specialized and early-stage brands, this channel is still essential.

- Online Retail / E-commerce

Direct customer interaction, subscription arrangements, and broad product access are all made possible by e-commerce. Influencer marketing and the adoption of digital wellness are the main drivers of growth. This channel promotes speedy market access for new brands. It is one of the distribution channels with the quickest rate of growth.

- Others

This covers direct sales outlets, wellness facilities, and pharmacies. These publications place a strong emphasis on customer interaction and health credibility. Growth is slow and localized. Their function is helpful rather than dominant.

Regional Insights

North America represents a mature and high-value industry, driven by the United States as a tier-1 country due to strong functional beverage acceptance and innovation depth. Canada and Mexico operate as tier-2 markets with growing wellness penetration and retail expansion. Europe exhibits consistent development with Germany, the United Kingdom, France, Italy, and Spain constituting tier-1 markets driven by clean-label demand and herbal beverage adoption. The rest of Europe remains tier-2, backed by moderate health awareness improvements.

Due to their cultural familiarity with adaptogens, China, Japan, India, South Korea, Australia, and New Zealand are classified as tier-1, making Asia Pacific the fastest-growing region. Tier-2 markets with growing urban consumption are formed by other Asia Pacific nations. Brazil and Argentina are the top tier-2 markets in South America, which is still an expanding continent. While other nations exhibit early-stage adoption growth is bolstered by rising imports of functional beverages and urban wellness trends. Saudi Arabia, the United Arab Emirates, and South Africa are tier-2 markets in the Middle East and Africa, which shows niche growth. Demand is driven by premium wellness consumption in urban areas, the rest of the region is still in the early stages of adoption.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Josie Beverages has officially launched a new line of adaptogen-infused energy drinks in the United States, featuring blends of lion’s mane, cordyceps, and vitamin B12 for clean, focused energy without sugar, calories, or crashes. The launch features four flavor profiles (Tangerine, Lemon Lime, Mixed Berry, Cucumber) and increased online availability through DrinkJosie.com, Amazon, and TikTok Shop, highlighting the brand’s focus on functional alternatives to conventional energy drinks.

- In July 2025, Ruby Red Ranch Water, a THC spritz powered by adaptogenic mushrooms including lion's mane, cordyceps, and reishi, was introduced by Upstate Elevator, a clean-crafted marijuana beverage business. This product represents a major extension in adaptogen-infused beverage innovation available online and rolling out to important U.S. markets. It combines hemp-derived THC for uplifting effects with functional mushrooms for cognitive support and stress resilience.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.40 Billion |

|

Market size value in 2026 |

USD 7.20 Billion |

|

Revenue forecast in 2033 |

USD 15.10 Billion |

|

Growth rate |

CAGR of 11.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Four Sigmatic, REBBL, Kin Euphorics, Sunwink Adapt Drinks, Om Mushroom,Peak and Valley, Rasa,HUMANITEA,Vybes,Moment,Humm Kombucha,DirtyLemon,Buddha Teas,Goodmylk Co. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Single-Herb Adaptogens, Blended Adaptogens, Functional Adaptogens, Ready-to-Drink (RTD) Adaptogens, Concentrate / Powdered Adaptogens), By Ingredient (Ashwagandha, Mushroom-Based, Holy Basil (Tulsi), Maca, Lavender & Other Herbs, Ginseng, Rhodiola, Schisandra, etc.), By Beverage Type (Ready-to-Drink (RTD),Tea-based Beverages, Smoothies & Juices, Coffee-based Adaptogen Drinks, Others) and By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Specialty / Health Food Stores, Online Retail / E-commerce, Others) |

Key Adaptogenic Drinks Company Insights

Four Sigmatic has emerged as a market leader by strategically positioning itself at the intersection of functional beverages and mushroom-based wellness offerings. The company’s offerings include coffee alternatives, elixirs and adaptogenic blends with reishi, lion’s mane and chaga. Four Sigmatic has secured a strong retail presence across multiple regions, including North America and Europe, due to its focus on organic sourcing, scientifically supported ingredients and a variety of product formats. Transparent marketing and a lifestyle-driven approach bolster its brand credibility fostering consumer loyalty and category growth in the adaptogenic drinks market.

Key Companies:

- Four Sigmatic

- REBBL

- Kin Euphorics

- Sunwink

- Adapt Drinks

- Om Mushroom

- Peak and Valley

- Rasa

- HUMANITEA

- Vybes

- Moment

- Humm Kombucha

- Dirty Lemon

- Buddha Teas

- Goodmylk Co.

Global Adaptogenic Drinks Market Report Segmentation

By Product Type

- Single-Herb Adaptogens

- Blended Adaptogens

- Functional Adaptogens

- Ready-to-Drink (RTD) Adaptogens

- Concentrate / Powdered Adaptogens

By Ingredient

- Ashwagandha

- Mushroom-Based

- Holy Basil (Tulsi)

- Maca

- Lavender & Other Herbs

- Ginseng, Rhodiola, Schisandra, etc.

By Beverage Type

- Ready-to-Drink (RTD)

- Tea-based Beverages

- Smoothies & Juices

- Coffee-based Adaptogen Drinks

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty / Health Food Stores

- Online Retail / E-commerce

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636