Market Summary

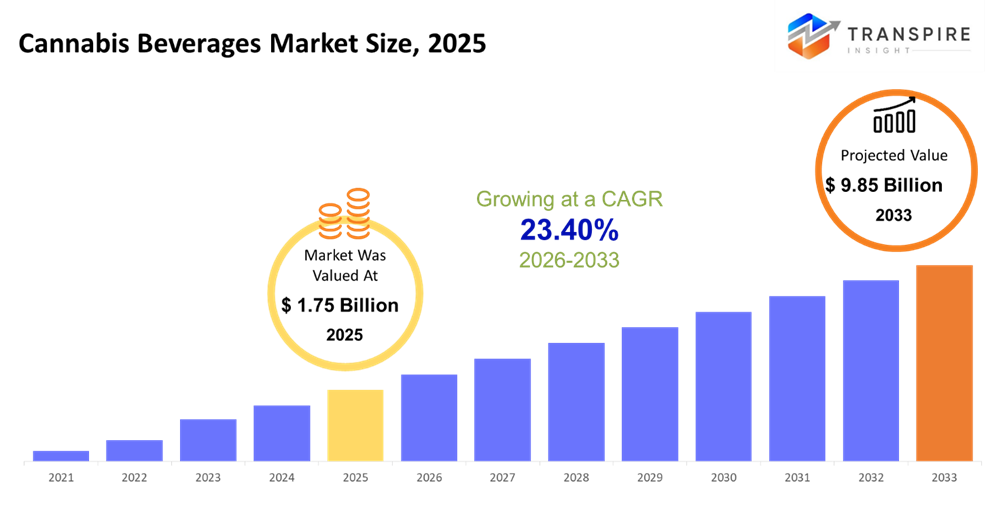

The global Cannabis Beverages market size was valued at USD 1.75 billion in 2025 and is projected to reach USD 9.85 billion by 2033, growing at a CAGR of 23.40% from 2026 to 2033 The market for cannabis drinks is expected to grow with a higher CAGR because of the increasing legalization of cannabis products for both medicinal and recreationa lpurposes. Moreover, a preference for alternate ways of using cannabis without smoking has accelerated the preference for drinks. Furthermore, the increasing consciousness about health and wellness has increased the use of CBD-based non-alcoholic drinks acting as functional drinks. Innovations related to product development related to formulation, flavor, and dosing technology have also increased the acceptability of the product, thereby increasing the market growth over the forecasted period.

Market Size & Forecast

- 2025 Market Size: USD 1.75 Billion

- 2033 Projected Market Size: USD 9.85 Billion

- CAGR (2026-2033): 23.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The market in North America remains at the forefront of the cannabis beverages market due to the rise in legalization, awareness, and collaboration between cannabis brands and beverage companies that have driven innovation in CBD and THC-infused drinks.

- The United States leads as the most impactful domestic market, with state legalization, the continued need for alcohol alternatives, and the acceptance of micro-dosed THC drinks in the consumer market, especially among the younger generation with the need to experience controlled dosing.

- The market in the Asia-Pacific region is also turning out to be highly promising, driven by countries like Australia, New Zealand, Japan, and China, where health-oriented consumers are gradually starting to embrace CBD-infused drinks.

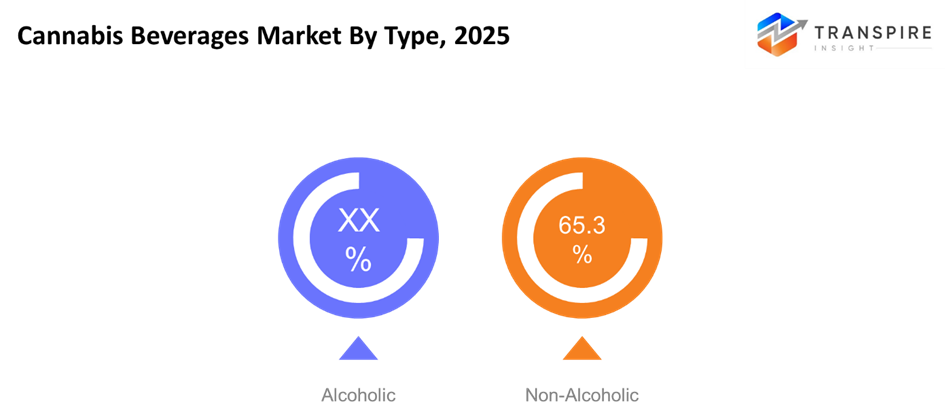

- Non-alcoholic cannabis beverages are the leading type segment, driven by a global sober-curious movement, increasing health awareness, and a preference for functional drinks among consumers that can provide them with feelings of relaxation and stress relief without side effects related to alcohol consumption.

- The segment of components governs the respective domain under CBD-based beverages because of wider legal acceptance, non-psychoactive properties, and strong fitting to wellness trends, making them suitable for everyday consumption and expansion through mainstream retail and online distribution channels.

So, Cannabis beverages are a rapidly expanding sector of the functional and recreational beverages sector. This is because they incorporate beverages that are infused either with cannabidiol (CBD) or tetrahydrocannabinol (THC). These products vary from functional beverages that are not alcoholic to alcoholic beverages. This is because they offer consumers a new way of consuming recreational products that can serve as a compliment to their alcoholic content. However, growth is supported by new policies that are being developed regarding legalized recreational drug use especially in North America. Investors are increasingly engaging in research and development work with the aim of producing safe, standardized, healthy, and flavorful drinks. Non-cannabis beverages are gaining popularity, especially in health concerns, while cannabis beverages are expected to appeal to people looking for novel social events. THC/CBD standards have become major factors in the regulation of these drinks. Cannabis drinks will move from niche markets to mainstream markets given increasing legalization, especially in North America, which leads, followed by Europe in CBD wellness, with Asia Pacific emerging as a new market.

Cannabis Beverages Market Segmentation

By Type

- Alcoholic

Alcoholic cannabis beverages combine cannabis extracts with THC/CBD and low-level alcohol, thus creating a hybrid drink experience between traditional alcohol and cannabis-infused drinks. These beverages are purchased by consumers who seek alternatives to beer and wine, finding relief in their usage when trying to relax without the heaviness of alcohol consumed alone. They appeal especially to those with social usages, desiring the familiar format now with a new psychoactive twist.

- Non-Alcoholic

These are cannabis drinks that are non-alcoholic and have cannabis elements of either CBD or THC or a combination of the two. The rise in health awareness and sobriety interest has led to the rising demand for non-alcoholic cannabis drinks. They are perfect solutions for those who wish to enjoy the cannabis experience without any of the negative consequences associated with alcohol.

To learn more about this report, Download Free Sample Report

By Component

- Cannabidiol (CBD)

CBD beverages incorporate the use of cannabidiol, a non-psychoactive element of the cannabis plant, for relieving stress, inducing calmness, as well as overall wellness. The mainstream popularity of CBD, owing to its legality, has spiked the demand for functional beverages, especially those used for relieving stress, inducing calmness, or providing overall wellness without any intoxication effects.

- Tetrahydrocannabinol (THC)

THC beverages include tetrahydrocannabinol, a psychoactive element, and are targeted at both recreational and therapeutic users in legal markets. THC beverages tap into demand from consumers that want a controlled, social, drinkable format of cannabis, with the ability to engage with a well-known beverage format and avoid smoking or edibles. The legalization trends in North America and parts of Europe fuel this demand even more.

Regional Insights

North America leads the market in cannabis beverages, with the United States being the leading country due to their well-developed legal frameworks regarding THC and CBD, in addition to Canada’s regulated market for recreational use and Mexico’s new framework that legalizes the adult-use market, making it a tier-1 market. The Canadian market is concentrated on high-end beverages, while the United States market has shown rapid innovation and availability in retail stores, bars, and online.

The European cannabis beverage market is primarily based on CBD wellness drinks and gradually expanding to tier-2 countries from the current tier-1 countries, which include Germany, the UK, France, Spain, and Italy. However, the regulatory environment concerning the use of THC is holding back the sector’s pace.

In the Asia Pacific is driven by beverages of CBD in Japan, China, Australia & New Zealand, South Korea, and India. Most urban and metropolitan centers are tier-1 regions for early adoption of such drinks. The South American markets, dominated by Brazil and Argentina, are demonstrating nascent interest in the adoption of CBD beverages while THC beverages will remain highly restricted.

In Middle East & Africa South Africa being the most progressive tier-1 subregion, provide immense opportunity for beverages related to the wellness segment of CBD. GCC countries like the UAE and Saudi Arabia are cautiously exploring functional formats of CBD. The growth is influenced by legal frameworks, consumer awareness, and lifestyle trends.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, Congress in the US acted to close a regulatory loophole that allowed the broader sales of hemp-based THC drinks, which is a significant shift in policy that has the potential of significantly affecting product distribution and strategies of business entities in the market. Regulatory ambiguities put pressure on business entities regarding adaptation in relation to new federal limits.

(Source:https://www.fooddive.com/news/congress-close-loophole-delta-thc-beverages-alcohol/805449/

- October 2025, The cannabis beverage industry is breaking out of the mold of traditional ready-to-drink 12-ounce cans into new formats such as shots, sticks of powdered drinks and sampler packs. The innovative new offerings are a hit with consumers and retailers-but they also reflect a broader shift in the cannabis beverage space, operators in the rapidly expanding product category say.

(Source: https://mjbizdaily.com/news/convenience-meets-innovation-in-evolution-of-cannabis-beverages/407655/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.75 Billion |

|

Market size value in 2026 |

USD 2.3 Billion |

|

Revenue forecast in 2033 |

USD 9.85 Billion |

|

Growth rate |

CAGR of 23.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Canopy Growth Corporation, Tilray Brands, Inc., Truss Beverage Co., Keef Brands, Lagunitas Brewing Co. (THC Division), Rebel Coast,, BevCanna Enterprises, Cann Social Tonics, Aphria Inc.,New Age Beverages Corporation, The Alkaline Water Company,Phivida Holdings Inc., Aurora Cannabis Inc., VCC Brands,Dixie Brands |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Alcoholic, Non-Alcoholic), By Component (Cannabidiol (CBD), Tetrahydrocannabinol (THC) |

Key Cannabis Beverages Company Insights

Canopy Growth Corporation has established itself as one of the dominant players in the cannabis beverages industry, using its vast knowledge in plant grow, cannabinoid extraction, and product development to formulate a broad variety of cannabis-infused beverages, ranging from CBD to THC products. The collaborative approach adopted by the company with Constellation Brands has encouraged the accessibility of cannabis beverages to the mainstream market. Quality, standardization, and adaptability to the complex regulatory environment in North America and Europe are being highlighted by Canopy’s diversified product offerings, aimed at tapping large market share in the wellness or relaxation segments. Strong emphasis on research & development.

Key Cannabis Beverages Companies:

- Canopy Growth Corporation

- Tilray Brands, Inc.

- Truss Beverage Co.

- Keef Brands

- Lagunitas Brewing Co. (THC Division)

- Rebel Coast

- BevCanna Enterprises

- Cann Social Tonics

- Aphria Inc.

- New Age Beverages Corporation

- The Alkaline Water Company

- Phivida Holdings Inc.

- Aurora Cannabis Inc.

- VCC Brands

- Dixie Brands

Global Cannabis Beverages market Report Segmentation

By Type

- Capsules/Tablets

- Powder

- Drinks

- Others

By Component

- Offline

- Online

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636