Market Summary

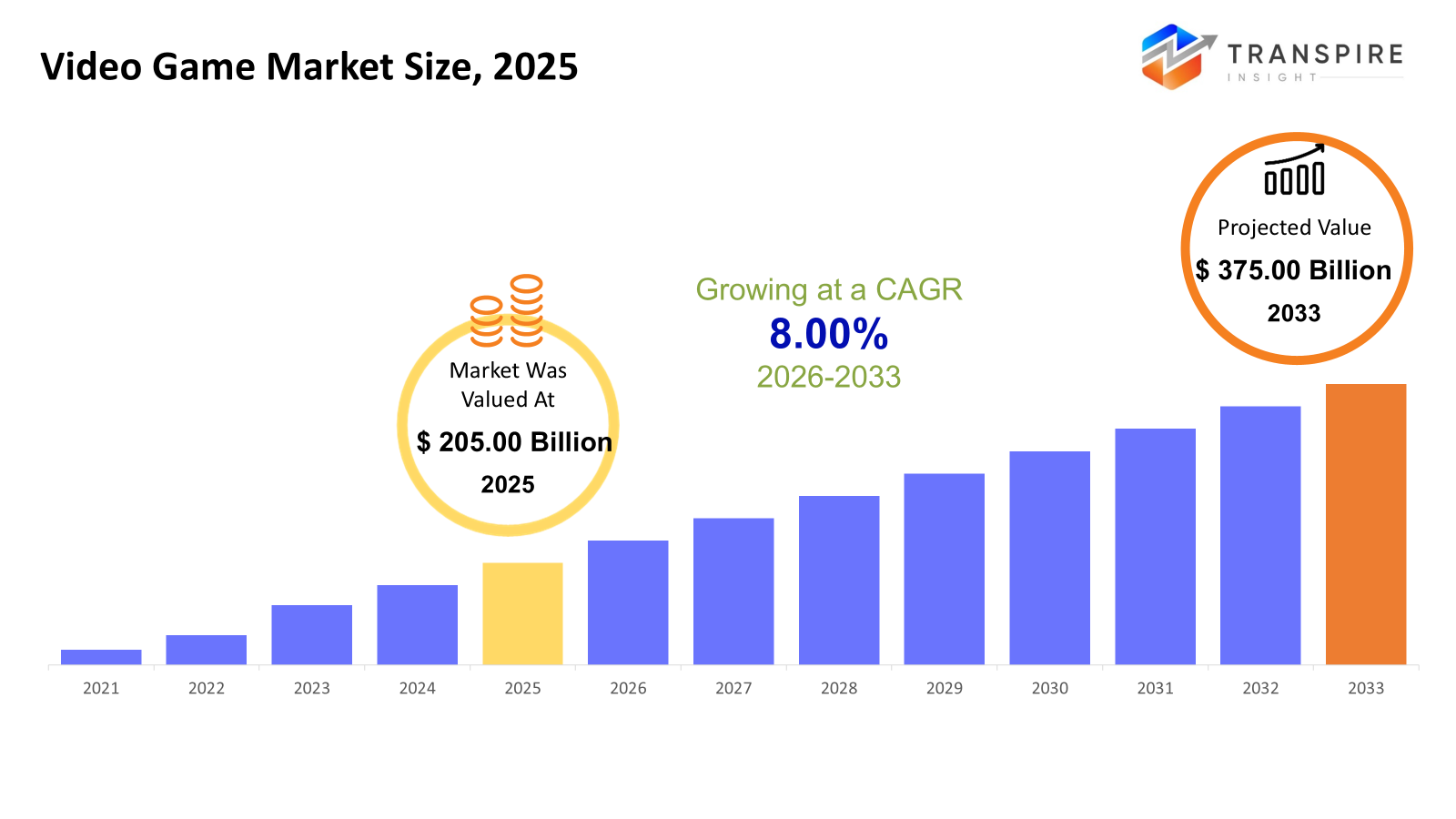

The global Video Game market size was valued at USD 205.00 billion in 2025 and is projected to reach USD 375.00 billion by 2033, growing at a CAGR of 8.00% from 2026 to 2033. Factors such as growing smartphone adoption, the expansion of broadband networks, and the adoption of digital payments are driving the efficiency of user acquisition and monetization. Revenue streams such as subscriptions and in-app purchases improve lifetime value, contributing to compound annual growth rates.

Market Size & Forecast

- 2025 Market Size: USD 205.00 Billion

- 2033 Projected Market Size: USD 375.00 Billion

- CAGR (2026-2033): 8.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is characterized by a strong spend per user, a mature console market, and high subscription adoption. The United States is the key revenue driver in the region, fueled by the commercialization of esports, the release of franchise-driven titles, and the dominance of digital stores. Canada and Mexico also support regional revenue, fueled by mobile-first and cross-platform adoption trends.

- The United States continues to be the single largest country revenue contributor worldwide, fueled by its advanced broadband networks, robust intellectual property ownership, and monetization strategies that include premium, subscription, and live service models, which collectively support the stability of recurring revenue.

- Asia Pacific is the key growth driver in terms of volume, fueled by mobile-first consumption habits in China and India, high console loyalty in Japan, and esports intensity in South Korea. The region is collectively the key driver of incremental global revenue growth.

- Mobile platforms lead in user penetration and downloads, capitalizing on free-to-play business models and advertising-driven monetization. Emerging markets are major contributors to scale, thanks to the availability of affordable smartphones and content localization strategies that expand the addressable audience.

- Action and Shooter genres lead in engagement share, thanks to multiplayer frameworks, esports exposure, and periodic content refreshes. Their business models are increasingly dependent on cosmetic microtransactions, battle passes, and competitive play integration across platforms.

- Free-to-play monetization models are the fastest-growing business models, thanks to microtransactions and data-driven personalization. Subscription-based services are gaining popularity in console and cloud-based ecosystems, improving the predictability of revenue streams and engagement retention.

- Individual consumers drive the majority of revenue share, driven by the prevalence of personal device ownership and digital distribution channels. Commercial markets, such as esports venues and gaming centers, are largely confined to the Asia Pacific region with organized competitive frameworks.

- Offices are the largest end-use market because of the growing focus on occupant comfort, zoning, and efficiency, which promotes the use of variable air volume systems that provide precise temperature control while consuming less energy in modern office spaces.

So, The Video Game Market is defined as the area of HVAC technology developed to control the airflow in different zones of a building, thus providing efficient temperature control. These systems control air volume according to real-time requirements, thus increasing the efficiency of operation and comfort in commercial, institutional and industrial buildings. Market development is directly associated with the growing need for energy conservation and the increasing adoption of intelligent building management systems. Video Gamees help in energy conservation by efficiently controlling airflow distribution, thus becoming a crucial part of the HVAC system infrastructure. The growing need for sustainability and compliance with regulations is further increasing adoption in developed and developing countries. Technological developments such as smart sensors, automated controllers, and monitoring systems are further improving the efficiency and reliability of these systems. The market is also experiencing the benefits of increased retrofitting in existing buildings for energy efficiency improvements along with the increasing development of commercial buildings that require advanced airflow control systems.

Video Game Market Segmentation

By Platform

- Console

The console market continues to be a major revenue generator, with the support of high-quality exclusives and hardware refresh cycles. Mature ecosystems, driven by the likes of Sony Interactive Entertainment and Microsoft Gaming, keep users engaged. Monetization strategies are increasingly converging towards a mix of upfront sales and digital content and subscription-based services.

- PC

The PC gaming market is aided by flexibility in performance, modding communities, and esports integrations. The dominance of digital storefronts and live service business models is driving recurring revenues. Emerging markets are exhibiting robust PC café ecosystems, which are supporting multiplayer and free-to-play adoption.

- Mobile

Mobile gaming has the largest installed base, driven by smartphone adoption and low barriers to entry. Monetization patterns are predominantly in-app and advertising-driven. Asia Pacific is the fastest-growing region, with localized content and microtransactions fueling scale.

- Cloud Gaming

Cloud gaming is less dependent on hardware, as it allows users to stream their gaming experiences. Adoption is tied to broadband penetration and subscription bundling. Strategic investments by technology companies are intended to reach a wider audience in emerging markets.

To learn more about this report, Download Free Sample Report

By Game Type

- Action

Action games lead engagement rates because of engaging gameplay and competitive elements. High-end productions and franchise-based game releases continue to drive revenue on consoles and PCs. Multiplayer elements improve monetization strategies with downloadable content and season passes.

- Adventure

Adventure games focus on story richness and single-player experiences. Though premium-priced, they also adopt monetization strategies based on episodes or expansions. The genre is in high demand in North America and Europe, where story-based franchises consistently perform well.

- Role-Playing Games (RPG)

RPGs have high lifetime value per user because of rich content and character development. Online multiplayer RPGs continue to generate revenue through subscriptions or microtransactions. The Asia Pacific region leads in consumption, with robust IPs in the fantasy and anime genres.

- Shooter

Shooter games continue to have a strong esports and live streaming presence, which helps increase engagement cycles. The monetization strategy includes cosmetic sales and battle passes. Cross-platform play has helped increase the addressable audience worldwide.

- Sports

Sports games continue to benefit from annualized release schedules and licensing deals with international sports leagues. Digital content and player card games help increase recurring revenue streams. The genre continues to be popular in Europe and North America.

- Strategy

Strategy games continue to appeal to dedicated niche audiences, especially on PC platforms. Monetization strategies include premium pricing and expansion packs. Online multiplayer and simulation sub-genres help increase growth rates.

- Simulation

Simulation games appeal to dedicated audiences interested in realism, including life simulation and vehicle simulation games. High PC adoption rates help increase customization and mod-based communities. Monetization strategies include downloadable content and user-generated content integration.

- Casual

The casual genre leads the mobile market. Monetization is based on advertising and micro-transactions. New markets demonstrate high download numbers with low data usage.

- Others

Other categories, such as horror and educational games, add incremental diversity. Indie game development encourages innovation and niche audience creation. Digital distribution makes it easier for smaller developers to enter the market.

By Revenue Model

- Premium (One-time Purchase)

The sales of Premium continue to be important in the console and PC markets. The high upfront cost is justified by the quality of production and the value of the franchise. Expansion packs and downloadable content enhance the extended lifecycle revenue streams.

- Free-to-Play

Free-to-play business models are highly prevalent in the mobile and online multiplayer markets. The revenue streams are driven by microtransactions, cosmetic items, and progression boosters. The Asia/Pacific region contributes substantially to the global free-to-play market revenues.

- Subscription-Based

Subscription-based business models offer access to large content libraries for a recurring fee. Ecosystems driven by platforms enhance retention and cross-selling. The growth of subscription-based models is linked to cloud integration and digital adoption trends.

- Advertising-Based

Advertising-driven monetization is highly prevalent in the mobile casual games market. The revenue streams are driven by the number of users, as opposed to per-user spending. Data analytics and targeted advertising enhance the efficiency of revenue yield.

By End User

- Individual

Individual consumers generate the most revenue, thanks to personal device ownership and online purchasing. Engagement trends differ according to age groups and platform preferences. In-app ecosystems foster long-term engagement.

- Commercial

Commercial use involves gaming cafes, arcades, and esports arenas. The Asia Pacific region is the leader in organized gaming arenas, thanks to the competitive gaming culture. Revenue models integrate ticket sales, sponsorships, and hardware collaborations.

Regional Insights

North America, consisting of the United States, Canada, and Mexico, is a high-value market with developed infrastructure and powerful consumer spending. The United States is a Tier 1 revenue center, while Canada and Mexico are Tier 2 contributors through mobile and cross-platform growth. Europe is home to Tier 1 markets like Germany, the United Kingdom, and France, which have mature console and PC markets. Spain, Italy, and the Rest of Europe are Tier 2 markets with balanced digital adoption and regulatory power that impacts monetization transparency. The Asia Pacific region is the largest in terms of total revenue and user scale. China and Japan are Tier 1 markets with robust homegrown publishing markets, while South Korea, Australia & New Zealand, and India are Tier 2 high-growth markets fueled by mobile and esports. South America, with Brazil and Argentina as key contributors, is a Tier 2 growth opportunity that is supported by the enhancement of connectivity and digital payments. The Rest of South America indicates the emerging behavior of adoption that is driven by cost-conscious monetization strategies. Middle East & Africa is an emerging growth region that is led by Saudi Arabia and the United Arab Emirates as Tier 2 investment-driven markets. South Africa and the Rest of Middle East & Africa indicate steady growth that is driven by a young population and enhanced broadband penetration.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, Johnson Controls (NYSE: JCI), the world leader in smart, healthy, and sustainable buildings, is pleased to announce its attendance at the HVACR World 2025, scheduled to take place from 24th to 27th November 2025 at the Dubai World Trade Centre (DWTC) at Stand No - Z5 A61, Za'abeel Hall 5. It is the first event in the MEASA region that focuses solely on heating, ventilation, air conditioning, and refrigeration (HVACR).

(Source:https://www.gamespress.com/Sony-Interactive-Entertainment-Reveals-PlayStation-5-Pro-the-Most-Visu)

- In December 2024, LG Electronics has made an announcement regarding a collaboration that will make Xbox cloud gaming available through in-car infotainment systems, which will enable users who have Xbox Game Pass Ultimate subscriptions to play games directly from the vehicles. This move indicates that the adoption of cloud gaming services and platforms is increasing, and the industry is moving towards making gaming more accessible and available through various devices and engagement models.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 205.00Billion |

|

Market size value in 2026 |

USD 218.00 Billion |

|

Revenue forecast in 2033 |

USD 375.00 Billion |

|

Growth rate |

CAGR of 8.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Sony Interactive Entertainment, Microsoft Corporation, Nintendo Co., Ltd., Tencent Holdings Ltd., NetEase, Inc., Activision Blizzard, Inc., Electronic Arts Inc., Take-Two Interactive Software, Inc., Ubisoft Entertainment SA, Epic Games, Inc., Valve Corporation, Bandai Namco Entertainment Inc., Square Enix Holdings Co., Ltd., Krafton, Inc., and Roblox Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Platform (Console, PC, Mobile, Cloud Gaming), By Game Type (Action, Adventure, Role-Playing Games (RPG), Shooter, Sports, Strategy, Simulation, Casual, Others), By Revenue Model (Premium (One-time Purchase), Free-to-Play, Subscription-Based, Advertising-Based) and By End User (Individual, Commercial) |

Key Video Game Company Insights

Tencent Holdings Ltd. has a leading position in the global video game industry through diversified investments, equity stakes in overseas studios, and a strong publishing presence in their home market. The company enjoys the benefit of massive mobile game revenue, expertise in live service monetization, and seamless connectivity with social and digital payment platforms. The company’s strategy of emphasizing global partnerships and minority investments enables market entry without the risks associated with full-scale acquisition. The key to Tencent’s success is its ability to utilize data analysis and engagement with the gaming community to drive long-term retention of gamers, especially in the Asia Pacific region, while gradually increasing its reach in console and PC gaming markets through global partnerships and intellectual property investments.

Key Video Game Companies:

- Sony Interactive Entertainment

- Microsoft Corporation

- Nintendo Co., Ltd.

- Tencent Holdings Ltd.

- NetEase, Inc.

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Ubisoft Entertainment SA

- Epic Games, Inc.

- Valve Corporation

- Bandai Namco Entertainment Inc.

- Square Enix Holdings Co., Ltd.

- Krafton, Inc.

- Roblox Corporation

Global Video Game Market Report Segmentation

By Platform

- Console

- PC

- Mobile

- Cloud Gaming

By Game Type

- Action

- Adventure

- Role-Playing Games (RPG)

- Shooter

- Sports

- Strategy

- Simulation

- Casual

- Others

By Revenue Model

- Premium (One-time Purchase)

- Free-to-Play

- Subscription-Based

- Advertising-Based

By End User

- Individual

- Commercial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636