Market Summary

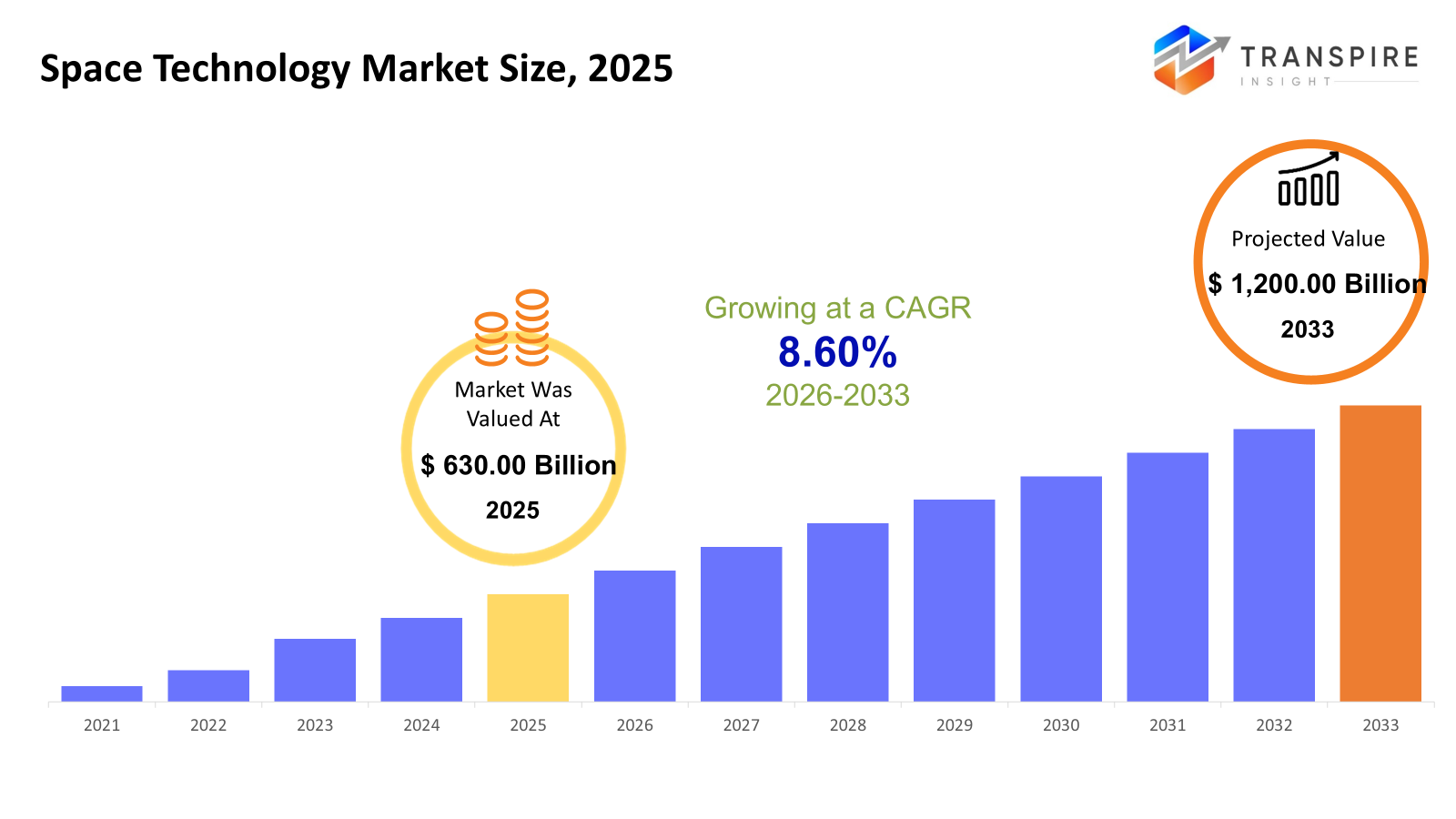

The global Space Technology market size was valued at USD 630.00 billion in 2025 and is projected to reach USD 1,200.00 billion by 2033, growing at a CAGR of 8.60% from 2026 to 2033. The growing use of commercial satellite constellations and reusable launch vehicles is making space more accessible and lowering the cost of operations in space. The increasing involvement of the private sector and government-led exploration initiatives are driving innovation cycles and fueling the long-term growth of the market.

Market Size & Forecast

- 2025 Market Size: USD 630.00 Billion

- 2033 Projected Market Size: USD 1,200.00 Billion

- CAGR (2026-2033): 8.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America maintains its position in the adoption of space technology due to robust commercial launch services, sophisticated satellite manufacturing capabilities, and continued government investment. Established infrastructure and investment drive innovation cycles and the rapid adoption of next-generation space solutions across diverse applications.

- The United States is at the forefront of market development because of extensive defense spending, commercial satellite constellation development, and technological prowess in reusable launch solutions. Public-private partnerships are boosting the development of sophisticated space solutions and commercialization strategies.

- The Asia Pacific market is experiencing a growth spurt because of government-initiated space programs, growing launch activity, and the development of satellite communication infrastructure. Regional investments in navigation, earth observation, and commercial space initiatives are improving technological competitiveness and market development dynamics.

- Satellite technology continues to be the most prominent technology type, driven by the growing need for communication, navigation, and observation services. Advances in satellite payload density, miniaturization, and longevity are improving the economic feasibility of satellite services and encouraging more commercial players to enter the market.

- Satellites are the most prominent platform type, driven by their multi-service nature in communication, defense, and environmental observation. The growing trend of small satellites and modular designs is improving deployment flexibility and lowering the cost of production and launch for commercial and government satellites.

- Communication services continue to be the largest application type, driven by the growing global demand for data and the need for broadband connectivity in rural areas. The growing low earth orbit satellite constellation is revolutionizing communication infrastructure, enabling the efficient transmission of high-capacity data and fueling long-term market growth.

- Government and military organizations continue to be the most prominent demand sources, driven by continued investments in national security, surveillance, and strategic communication infrastructure. Long-term planning, stable funding models, and the growing geopolitical emphasis on space capabilities continue to solidify leadership in the market across global regions.

So, The space technology market relates to the technologies, platforms, and services that are connected with the deployment of satellites, launch vehicles, communication systems, and space exploration missions. The space technology market has shifted from a government-led initiative to a hybrid model where the private sector is also contributing to innovation and optimization. The growing dependence on satellite-based services is broadening the scope of the market in the telecommunication, navigation, and earth observation sectors. Advances in space technology, including reusable launch vehicles, electric propulsion systems, and smaller satellite components, are making space technology more cost-effective and accessible. The convergence of advanced analytics and automation is further optimizing the performance and use of data in space-based application. The market is also driven by the increasing investment in national security, climate observation, and scientific exploration. There is a growing collaboration between governments and other entities to accelerate mission timelines and mitigate development risks. With the continued expansion of commercialization, the market is expected to see continued innovation, diversification, and global engagement in space activities.

Space Technology Market Segmentation

By Technology

- Satellite Technology

Satellite technology is the backbone of the space technology market, enabling communication, navigation, and earth observation. Technological innovations in miniaturization, reusability, and high-throughput satellites are improving the efficiency of deployment and decreasing the cost of missions. The rise of commercial satellite constellations is driving innovation cycles.

- Launch Vehicle Technology

Launch vehicle technology is centered on providing reliable and affordable access to space via reusable and heavy-lift launchers. Ongoing innovation in propulsion and launch rates is decreasing the barrier to entry. The rise of the private sector is increasing competition and the number of launch services offered.

- Space Robotics and Automation

Space robotics and automation allow for autonomous mission execution, including satellite servicing, planetary exploration, and in-orbit assembly. AI-powered navigation and control systems minimize human presence and mission complexity. The need for space robotics and automation is growing with deep space missions and long-duration exploration programs.

- Space Propulsion Systems

Space propulsion systems are undergoing a transition towards electric and hybrid propulsion systems to enhance fuel efficiency and mission duration. Such systems promote the longevity of satellites and the exploration of deep space. The trend towards sustainable propulsion systems is shaping the future of mission economics.

- Space Communication Systems

Space communication systems facilitate the transfer of data among satellites, ground stations, and space vehicles. The increasing demand for broadband satellite communications and global connectivity projects is fueling investments. High-frequency communication systems are improving bandwidth and latency.

- Space Navigation and Positioning Systems

Navigation and positioning systems provide precise geolocation, timing, synchronization, and navigation functions for civilian and military purposes. The convergence of autonomous systems and transportation infrastructure is broadening applications. The global dependence on satellite navigation systems is increasing demand.

By Platform

- Satellites

Satellites are the biggest platform segment because of their widespread use in communication, navigation, and observation. The emergence of small satellites and mega-constellations is changing the way satellites are deployed. Commercial companies are increasingly driving the demand for satellites, in addition to government projects.

- Launch Vehicles

Launch vehicles are the enabling technology for space exploration, facilitating satellite deployment and exploration missions. Advances in reusability and quick turnaround are enhancing cost-effectiveness. The increasing number of launches indicates a growing need for satellite deployment.

- Space Probes

Space probes are mainly used for scientific exploration and deep space missions. They facilitate the collection of data from planets, asteroids, and other celestial bodies without human presence. Government agencies remain the biggest investors in probe development for scientific missions.

- Space Stations

Space stations serve as research platforms that enable long-term human spaceflight and microgravity research. Commercial collaborations are on the rise as companies begin to explore opportunities for research and manufacturing in orbit. Modular designs for space stations are being developed to lower development expenses.

- Rovers and Landers

Rovers and landers enable planetary exploration by providing surface mobility and in-situ analysis. Technological advancements in autonomy and robustness have made it possible to conduct longer missions. This market is associated with lunar and Mars exploration programs initiated by national space agencies.

- Ground Support Equipment

Ground support equipment encompasses tracking, control, and communication networks required for conducting missions. The increasing number of satellites demands more advanced ground support systems for data processing and monitoring. Cloud-based analytics integration is enhancing ground support equipment efficiency.

- Space-Based Observation and Imaging

Space-based observation and imaging capabilities are used for environmental observation, disaster response, and intelligence gathering. Advances in image resolution and analysis are driving the adoption of space-based observation and imaging in commercial applications. Governments and companies are launching earth observation satellite constellations for real-time data analysis.

To learn more about this report, Download Free Sample Report

By Application

- Communication

Communication systems continue to be the leading application because of the growing need for global broadband connectivity and broadcasting. Communication via satellites makes it possible to connect even the most distant areas. The development of low earth orbit constellations is revolutionizing the global communication landscape.

- Earth Observation and Remote Sensing

Earth observation and remote sensing applications include agriculture, environment, and urban planning. High-frequency data acquisition improves decision-making for governments and businesses. Climate observation programs are major drivers of demand for observation technology.

- Navigation and Positioning

Navigation and positioning applications are critical for transportation, military, logistics, and autonomous vehicles. The increasing reliance on accurate geolocation capabilities is fueling system upgrades. The integration of the technology with smart mobility platforms is opening up new business opportunities.

- Space Exploration

Space exploration applications are centered on planetary exploration, lunar exploration, and deep space research. Growing cooperation between government and commercial organizations is shortening the time frame for missions. Advances in technology are making it possible to undertake more complex and longer-term missions.

- Scientific Research

Scientific research applications employ space platforms for research in physics, biology, and material sciences. Microgravity conditions facilitate research that cannot be conducted on Earth. Global cooperation is fueling research spending and technological progress.

- Space Tourism

Space tourism is a niche but rapidly evolving application that is being fueled by reusable launch technology. Commercial organizations are investing in suborbital and orbital space travel. Reducing costs and improving safety is expected to gradually increase participation.

- Defense and Security

Defense and security applications are based on the use of space technologies for surveillance, intelligence, and secure communication. Growing geopolitical rivalries are fueling government spending on robust space infrastructure. Space resources are becoming essential elements of national security policies.

By End User

- Government and Military

Government and military organizations lead market demand with significant investments in exploration, surveillance, and national security infrastructure. Funding stability enables the advancement of research and development. Space capabilities are a high priority for national defense programs.

- Commercial Enterprises

Commercial companies are quickly increasing their presence in the market with satellite services, launch services, and data analytics solutions. Private investment is driving innovation and efficiency. The space market is changing the way the industry operates.

- Research and Academic Institutions

Research and academic institutions are contributing to the market with scientific missions, experimental payloads, and technology development. Partnerships with government space agencies and commercial companies are enabling innovation pipelines. Academic involvement is increasing with accessible small satellite programs.

Regional Insights

The international market portrays different levels of maturity in various regions. North America continues to be technologically adept with well-established aerospace sectors in the United States of America, Canada, and Mexico. Europe has been steadily developing with joint initiatives and robust production capacities in Germany, United Kingdom, France, Spain, and Italy. The Asia Pacific region is also developing at a fast pace with significant government investments and increasing commercial engagement in Japan, China, Australia & New Zealand, South Korea, and India. The rise in satellite launches and regional navigation projects is enhancing regional competitiveness, and new markets in the Asia Pacific region are also developing capacities through global collaboration. South America is progressing steadily with increased investment in satellite communication and observation initiatives, especially in Brazil and Argentina. The Middle East & Africa region is also emerging with strategic investments in national space programs in Saudi Arabia, United Arab Emirates, and South Africa, as a result of economic diversification strategies and international collaborations for the long-term development of technological capabilities.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, Airbus has announced the successful launch of the Sentinel-6B satellite from the Vandenberg Space Force Base in California. The Sentinel-6B satellite, developed by Airbus, will operate in conjunction with the Sentinel-6 Michael Freilich satellite to provide high-precision sea surface height data, which is essential for global climate observation.

- In July 2025, SES has officially announced the completion of its acquisition of Intelsat, forming a more robust global multi-orbit satellite operator with an extended GEO and MEO constellation. The new constellation provides improved multi-band connectivity and customized solutions for governments and commercial customers, which will greatly enhance the competitive advantage of SES in the satellite industry.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 630.00 Billion |

|

Market size value in 2026 |

USD 670.00 Billion |

|

Revenue forecast in 2033 |

USD 1,200.00 Billion |

|

Growth rate |

CAGR of 8.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

SpaceX,The Boeing Company,Lockheed Martin Corporation, Airbus SE, Northrop Grumman Corporation, Blue Origin LLC, Rocket Lab USA Inc, Arianespace, Maxar Technologies, Thales Group, General Dynamics Corporation, Honeywell International Inc., China Aerospace, Science and Technology Corporation, SES S.A., Hindustan Aeronautics Limited |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Satellite Technology, Launch Vehicle Technology, Space Robotics and Automation, Space Propulsion Systems, Space Communication Systems, Space Navigation and Positioning Systems, Space-Based Observation and Imaging), By Platform (Satellites, Launch Vehicles, Space Probes, Space Station, Rovers and Landers, Ground Support Equipment), By Application (Communication, Earth Observation and Remote Sensing, Navigation and Positioning, Space Exploration, Scientific Research, Space Tourism, Defense and Security) and By End User (Government and Military, Commercial Enterprises, Research and Academic Institutions) |

Key Space Technology Company Insights

SpaceX is a transformative leader in the area of reusable launch vehicles and global broadband satellite constellations, with the potential to significantly lower the cost of access to space. The Starlink satellite constellation provides global high-bandwidth internet connectivity, while the Falcon and Starship launch vehicles enable multi-mission government and commercial satellite missions. Vertical integration of manufacturing, launch, and satellite production capabilities enhances operational effectiveness and positioning. The innovation path and launch rate of SpaceX shape industry cost structures and performance standards.

Key Space Technology Companies:

- SpaceX

- The Boeing Company

- Lockheed Martin Corporation

- Airbus SE

- Northrop Grumman Corporation

- Blue Origin LLC

- Rocket Lab USA Inc

- Arianespace

- Maxar Technologies

- Thales Group

- General Dynamics Corporation

- Honeywell International Inc.

- China Aerospace Science and Technology Corporation

- SES S.A.

- Hindustan Aeronautics Limited

Global Space Technology Market Report Segmentation

By Technology

- Satellite Technology

- Launch Vehicle Technology

- Space Robotics and Automation

- Space Propulsion Systems

- Space Communication Systems

- Space Navigation and Positioning Systems

- Space-Based Observation and Imaging

By Platform

- Satellites

- Launch Vehicles

- Space Probes

- Space Stations

- Rovers and Landers

- Ground Support Equipment

By Application

- Communication

- Earth Observation and Remote Sensing

- Navigation and Positioning

- Space Exploration

- Scientific Research

- Space Tourism

- Defense and Security

By End User

- Government and Military

- Commercial Enterprises

- Research and Academic Institutions

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636