Market Summary

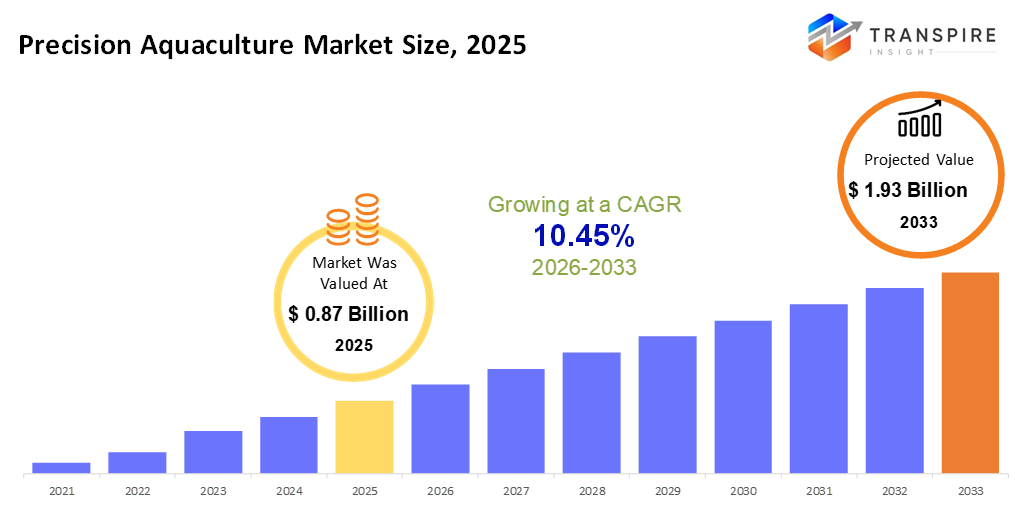

The global Precision Aquaculture market size was valued at USD 0.87 billion in 2025 and is projected to reach USD 1.93 billion by 2033, growing at a CAGR of 10.45% from 2026 to 2033. Fish farming's tech side keeps moving forward, thanks to tools that watch water, control systems automatically, and study patterns in numbers, helping farms run more smoothly while wasting less. Quality matters more now; people want seafood they can track back, know is clean, and trust how it was raised. Devices that sense changes, internet-linked gear, and smarter programs for daily tasks all quietly push growth, reshaping how ponds and pens operate behind the scenes.

Market Size & Forecast

- 2025 Market Size: USD 087 Billion

- 2033 Projected Market Size: USD 1.93 Billion

- CAGR (2026-2033): 10.45%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 30% in 2026. Fueled by cutting-edge RAS setups, North America sees steady market gains. Policies focused on long-term ecological balance play a role, too. Digital tools in fish farming are widely used here, adding further momentum.

- That country pushes it hard, thanks to heavy backing for clever tools. Seafood grown at home now grabs more attention there, too.

- Fish farming on a huge scale pushes the Asia Pacific ahead. Growth here outpaces elsewhere because more people want seafood. New tools spread quickly across the area. This part of the world leads simply by doing more, faster.

- Monitoring & Sensors share approximately 30% in 2026. Sensors now play a big role in keeping water clean and safe on farms. As a result, fewer lives are lost. Farms run better when they know what is happening underwater at any moment. Watching conditions closely helps catch problems early. Real-time data changes how decisions get made every day.

- Fish farming leads the way because more people around the world eat seafood these days. Better tech helps manage illness while improving how much food fish need to grow.

- Freshwater shortages push more farms toward closed-loop tanks. Because disease risks stay low there, operators find it easier to meet safety rules. Tighter laws on waste make these systems harder to avoid. Growth here outpaces others for those reasons.

- Farms growing fish for sale still lead the pack. Big operations are spending serious money on clever tech to get more output while spending less. Their push shapes how these systems evolve.

Out in fish farming, tools are getting smarter fast. Producers now lean more on digital gear that runs itself, just to keep things steady and efficient. Instead of guessing, they rely on live data pulled by gadgets tucked into tanks or ponds. Gadgets like probes, smart feeders, and linked monitors track what’s happening under the surface. This setup watches everything: how warm it gets, how much oxygen stays dissolved, and even how the creatures behave. Decisions shift based on facts, not habits. Feeding times adjust when fish need food, cutting waste. Fewer animals die because problems show up early. Even water conditions stay balanced across different types of farms, whether coastal pens or indoor tanks. Quality stays high since small changes get caught before they grow. Technology sticks close to nature here; it does not replace it, just helps manage its rhythm better.

Fish farming stays on track when tools help watch what happens below the surface. Because systems keep an eye on water conditions, movement habits, and meal times, problems show up sooner. When machines handle tasks based on live information, fewer mistakes occur even as operations grow. Farms supplying more seafood worldwide rely on these updates to stay steady amid changing demands.

Fish farms now follow tighter rules to protect nature. These systems cut down on water waste while managing runoff better, staying within legal limits set by producing areas. When people choose eco-friendly fish, it pushes farmers to adopt tech that tracks every step of growth and handling. Clear records come from digital tools built into daily operations. Rules keep changing, so upgrades happen often without fanfare.

New ideas keep flowing because tech firms, scientists, and fish farmers work together. Thanks to progress in smart software, data tools, and online systems, forecasts improve alongside daily farm decisions. With time, these solutions grow easier to reach and cheaper to use. That means careful fish farming could spread further, reaching richer nations and growing regions alike. Growth like this may help the entire sector move forward steadily.

Precision Aquaculture Market Segmentation

By Technology

- Monitoring & Sensors

Sensors keep watch on water quality, fish well-being, and surrounding conditions throughout production cycles. These tools deliver steady updates so farm activities can run smoothly. Information flows without pause, allowing adjustments before issues grow. Live feedback helps maintain stable settings across the system. Tracking happens nonstop, ensuring nothing critical slips through cracks.

- Automation & Robotics

Machines take over tasks like feeding fish or sorting them by size. This means less hands-on work every day. When it comes time to harvest, robots handle much of the load. Equipment runs checks and keeps systems clean without constant supervision. Efficiency grows as routines become more precise. Human effort shifts toward oversight instead of repetitive chores.

- Data Analytics & Software Platforms

Smart tools study field information to guess future outcomes. These systems help farms run better by spotting patterns over time. One thing leads to another when numbers guide choices instead of guesses. Machines learn from past results, so people can act sooner. Results shift when real details replace assumptions. Decisions gain clarity through steady measurement. Patterns emerge where once there was only uncertainty.

- IoT & Connectivity Solutions

Devices talk easily with one another through smart links. These connections reach far beyond local setups. Information moves smoothly across networks. Systems stay in sync without constant oversight. Remote tools keep watch consistently. Communication stays steady even at a distance.

To learn more about this report, Download Free Sample Report

By Aquaculture Type

- Finfish

Fish farming dominates output because people around the world eat a lot of types like salmon, tilapia, or carp. Yet it is these particular kinds that push finfish to the top spot in volume. What stands out is how common they are on plates across continents. Because demand stays high, their production keeps rising too.

- Crustaceans

Shellfish bring solid profits thanks to steady global market interest. Their worth drives consistent cross-border sales activity.

- Mollusks

They thrive when farms cut waste. Less food is needed. Costs drop without heavy spending. Running things simply keeps them growing steadily.

- Others

Some newer options involve sea plants plus colorful fish aimed at smaller groups of buyers.

By Farming Environment

- Recirculating Aquaculture Systems

A fish farm setup that recycles water through smart cleaning methods sits at the core of modern tank-based breeding. Filters pull out waste while clean water flows back into tanks where fish grow steadily under close watch.

- Ponds

Freshwater basins still see broad use simply because they demand little setup money, and handling them is straightforward.

- Net Pens

Floating cages sit out past the shore, holding fish where waters run deep. These structures work best near coasts or farther out at sea. Farming happens openly, using natural currents to help manage waste and supply oxygen.

- Hybrids

Blending different systems can boost how well things work together. Still, it also helps them handle tougher conditions out in nature.

By End-Users

- Commercial Aquaculture Farms

Profit matters most when running large fish farms. Output gets boosted through streamlined processes. Scaling up operations allows steady growth over time. Efficiency shapes daily decisions behind the scenes.

- Research & Educational Institutes

From labs to fields, these institutes spark new methods by testing crops and refining techniques. Growth begins where knowledge meets real-world trials.

- Government & Regulatory Agencies

Fishing rules get checked by officials who watch how farms operate. These groups make sure laws are followed plus ecosystems stay balanced. Oversight happens through visits, reports, then follow ups when needed. Staying within limits keeps operations legal while protecting water life.

- Niche Aquaculture Operators

Farming rare fish means focusing on unique types, using methods built just for them. These growers choose less common species, shaping their work around specific needs. Working this way allows careful control, matching each animal's environment to its habits. Success comes not from size but from precision and attention. Specializing sets these farms apart, avoiding mass-market pressures entirely.

Regional Insights

Across North America, high-tech fish farming thrives, especially in the United States and Canada, due to solid internet networks and a push toward greener methods. Instead of just following trends, these places use real-time tracking systems, automated controls, and number-crunching software to manage operations. Meanwhile, Mexico and lesser-known spots in the region begin testing Internet-linked sensors and forecasting models. Over in Europe, nations like Norway, Britain, Germany, and France play major roles, pushed forward by tight ecological rules and consumer need for food transparency. On that continent’s eastern and southern edges, smaller countries slowly adopt digital upgrades to stay aligned with standards and improve output.

Across the Asia Pacific, farming fish with high-tech methods is expanding quickly. Led by China and India, large-scale operations now rely on smart tools that boost output without harming nature. In places such as Vietnam, Indonesia, and Thailand, internet-connected sensors and automated feeding appear more often thanks to the rising appetite for seafood and policies encouraging innovation. Countries like Japan, South Korea, Australia, and New Zealand are not leading in volume but pour resources into real-time tracking devices and data analysis platforms. Meanwhile, smaller island states across South Asia and the Pacific slowly begin testing new techniques once rare in their waters. Growth here ties closely to both local needs and global shifts in how we raise aquatic life.

Farming fish with high accuracy gains ground in Latin America, especially where Chile and Brazil lead, thanks to salmon and tilapia grown for global sale. Elsewhere in that area, places such as Mexico, Argentina, and Peru begin using digital tools like smart feeders and health trackers to keep up. Support comes from national programs aiming to upgrade how farms operate. Over in Africa and the Middle East, signs of change show up too Egypt, Nigeria, and South Africa bring in simple sensors and automation to grow more food reliably. In several other countries, early steps toward tech-based methods aim to boost homegrown output and rely less on outside supplies.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 6, 2026 – Startup SmartGreen Aquaculture opens India’s largest integrated Inland RAS trout farm in Hyderabad

- May 23, 2025 – Canadian project to test advanced precision aquaculture technology in salmon.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.87 Billion |

|

Market size value in 2026 |

USD 0.96 Billion |

|

Revenue forecast in 2033 |

USD 1.93 Billion |

|

Growth rate |

CAGR of 10.45% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

AKVA Group, ScaleAQ, Innovasea Systems, Aquabyte, Skretting, XpertSea, CageEye, Eruvaka Technologies, Pentair Aquatic Eco-Systems, Deep Trekker, Signify Holding, Imenco AS, Aquaculture Systems Technologies, CPI Equipment, Lifegard Aquatics, Umitron, AquaMaof Aquaculture Technologies, Bluegrove, and Observe Technologies. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Monitoring & Sensors, Automation & Robotics, Data Analytics & Software Platforms, IoT & Connectivity Solutions) By Aquaculture Type(Finfish, Crustaceans, Mollusks, Others) By Farming Environment (Recirculating Aquaculture System, Ponds, Net Pens, Hybrids), By End-Users (Commercial Aquaculture Farms, Research & Educational Institutes, Government & Regulatory Agencies, Niche Aquaculture Operators) |

Key Precision Aquaculture Company Insights

A fresh wave of tech-driven change started long before today's spotlight hit aquaculture. AKVA Group was already deep into it. Fish farms on land or at sea rely on their gear because reliability matters when lives swim inside your system. Equipment lines stretch from automated feeders to floating enclosures engineered against rough currents. Instead of guessing, farmers now track behavior using smart sensors tied to learning algorithms. These digital helpers adjust routines based on real-time data, reducing waste while watching growth patterns. Efficiency climbs when machines learn the rhythm of life underwater. Health checks happen faster thanks to imaging tools trained to spot subtle shifts in movement or appetite. Four decades ago, the first steps were simpler, yet they pointed forward. Growth did not come overnight; offices sprouted gradually across regions where water meets industry needs. Merging with focused specialists sharpened what they could offer without losing core strength. Innovation is not a goal; it shows up daily in calmer waters and stronger survival rates.

Key Precision Aquaculture Companies:

- AKVA Group

- ScaleAQ

- Innovasea Systems

- Aquabyte

- Skretting

- XpertSea

- CageEye

- Eruvaka Technologies

- Pentair Aquatic Eco-Systems

- Deep Trekker

- Signify Holding

- Imenco AS

- Aquaculture Systems Technologies

- CPI Equipment

- Lifegard Aquatics

- Umitron

- AquaMaof Aquaculture Technologies

- Bluegrove

- Observe Technologies

Global Precision Aquaculture Market Report Segmentation

By Technology

- Monitoring & Sensors

- Automation & Robotics

- Data Analytics & Software Platforms

- IoT & Connectivity Solutions

By Aquaculture Type

- Finfish

- Crustaceans

- Mollusks

- Others

By Farming Environment

- Recirculating Aquaculture System

- Ponds

- Net Pens

- Hybrids

By End-Users

- Commercial Aquaculture Farms

- Research & Educational Institutes

- Government & Regulatory Agencies

- Niche Aquaculture Operators

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636