Market Summary

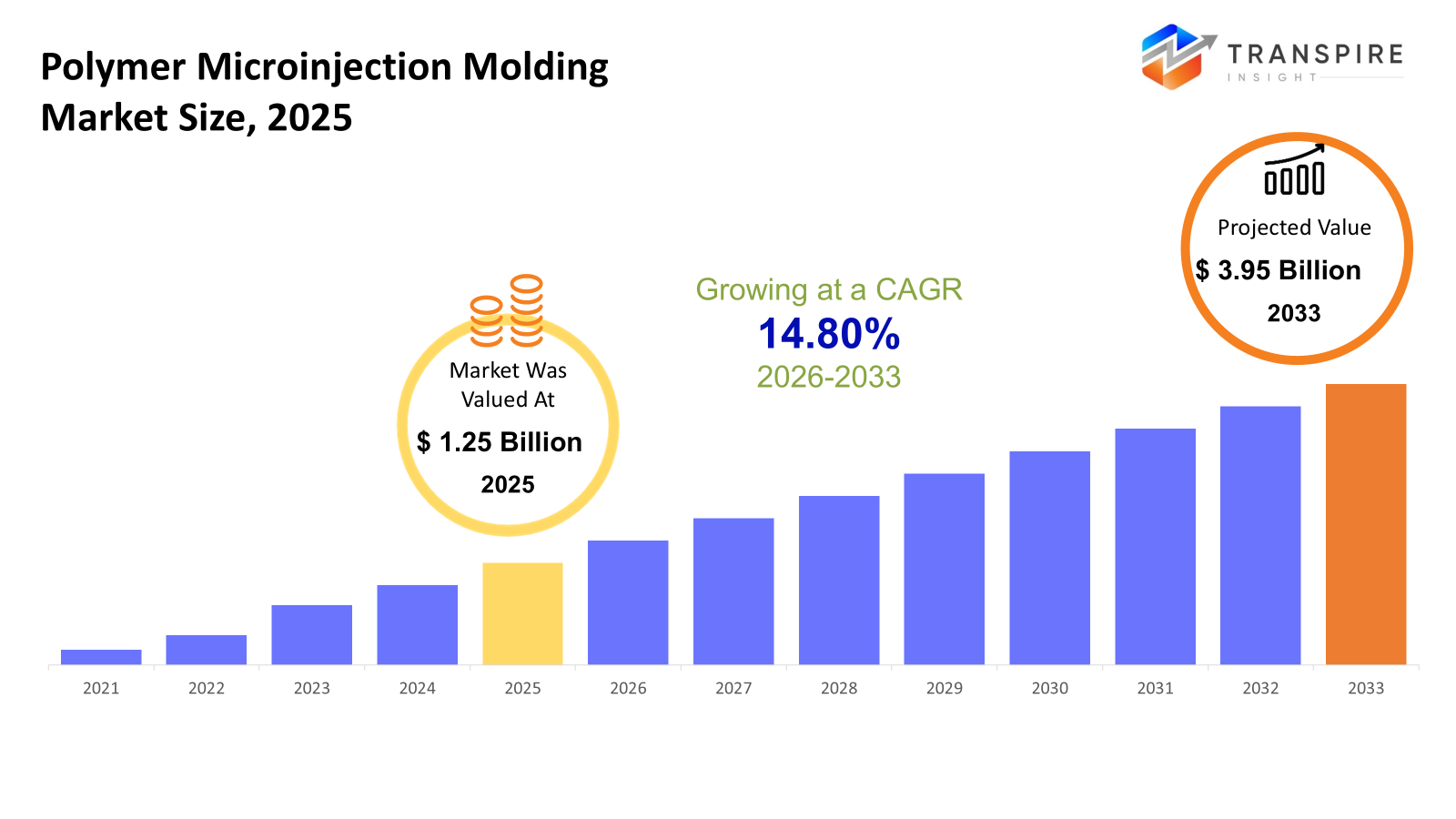

The global Polymer Microinjection Molding market size was valued at USD 1.25 billion in 2025 and is projected to reach USD 3.95 billion by 2033, growing at a CAGR of 14.80% from 2026 to 2033. The Polymer Micro-injection Molding market is growing with a steady CAGR due to the increase in the application of miniaturized, precision components in the medical, automotive, and telecommunication sectors. Breakthrough developments in the application and production of high-performance polymers are improving efficiency. The growing application of MIS in medical and compact electronic devices is also contributing positively to the market.

Market Size & Forecast

- 2025 Market Size: USD 1.25 Billion

- 2033 Projected Market Size: USD 3.95 Billion

- CAGR (2026-2033): 14.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is registering a rising growth in the field of polymer microinjection molding because of high demand from the healthcare industry as well as the automobile industry, and moreover, the manufacturing facilities in the region are of a very advanced nature.

- United States remains in the forefront in the market due to their early embracing of state-of-the-art micro-molding technology, intense R&D expenditures, and growing production of MIMD, micro-electronic, and telecommunication connectors with ultra-tight tolerance.

- The Asia Pacific market is currently growing due to the large-scale production of electronics, the development of electric cars, and the domestic production of medical devices, especially in China, Japan, South Korea, and India, which are focusing on cost savings and precision manufacturing.

- The interest in polymer microinjection molding in emerging applications is identified to be high because of superior thermal stability, chemical resistance, and mechanical strength. This reliable production makes micro-scale components meet the demands of medical, automotive, and electronics applications.

- Medical and healthcare forms the largest application segment. This is mainly driven by the increasing demand for micro-scale precision, biocompatibility, and repeatable manufacture of minimally invasive devices, implants, and diagnostic tools at regulated quality standards.

So, the medial and healthcare segment dominates demand due to the increase in minimally invasive surgeries, implants, and diagnostic devices. Microinjection molding provides the accuracy required for producing components like catheters, micro-valves, lab-on-a-chip instruments, which need tight tolerances and consistent quality. Increasing healthcare expenses and the technology that went into developing innovative medical devices are speeding up the acquisition of polymer microinjection molding. Manufacturers in the market are using value-added high-performance polymers to offer biocompatible, durable, and affordable solutions to clients. This segment will surely continue to act as a key driver for substantial growth in this market as a result of global healthcare systems reinforcing their focus on compactness, reliability, and efficiency in medical technologies.

Polymer Microinjection Molding Market Segmentation

By Type

- Polyether Ether Ketone

The polyether ether ketone PEEK material’s high temperature stability, resistant properties to chemicals, and high strength of the material make it suitable for the production of high-performance medical, automotive, and electronics components.

- Polymethyl Methacrylate

Polymethyl methacrylate, or PMMA, is quite transparent and hence is the material of choice in applications where vision and weight, and surface finish, are important, such as in the healthcare industry and display screens.

- Polyethylene

Polyethylene PE is very versatile and economical and is commonly used in micro-component applications such as automotive components, bio-medical devices, and consumer electronics application areas where scalability is possible and production can be efficiently achieved at precision polymer components at low cost

- Polyoxymethylene

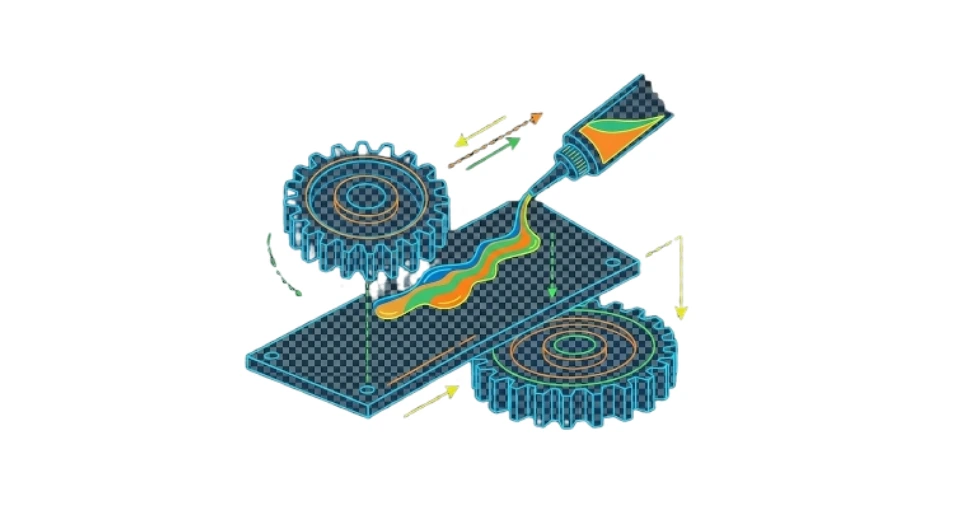

Polyoxymethylene, or POM, has high stiffness, low friction, and stability, making it a suitable material for the production of micro-gears, connectors, or any other precision mechanical product for micro-drive technology.

- Liquid Crystal Polymer (LCP)

It has high temperature stability and precision properties through Liquid Crystal Polymer LCP technology, making it suitable for use in telecommunication fiber optic and electronics connectors, even on a micro scale.

- Polylactic Acid

PLA’s biodegradable and eco-friendly nature is finding increasing uses in single-use medical products and environmentally friendly micro-components.

- Other

Other Specialized polymers are used in specialized applications where biocompatibility, resistance to chemicals, and ultra-high-performance characteristics are needed. These applications relate to the development of micro-components in the fields of medicine, electronic devices, and aerospace applications

To learn more about this report, Download Free Sample Report

By Application

- Medical and Healthcare

The growing demand for minimally invasive procedures, implantable devices, and lab-on-chip diagnostics fuels the demand for microinjection molding of polymers for highly accurate biocompatible components.

- Automotive

The focus on lightweight, energy-efficient designs for sensors, connectors, and micro-gears in the automotive sector propels the adoption of precise microinjection molding capable of meeting such demands for performance and durability.

- Fiber Optics

Telecom The rising demand for broadband, 5G infrastructure, and miniaturized connectors drives demand for LCP and high-performance polymers in order to ensure signal integrity and reliability in telecom components at a micro-scale.

- Micro Drive Systems and Control

- The growing use of microactuators, gears, and precise instruments in robotics and automation is fueling the demand for polymers suitable for precise, strong, and low-friction micro-components.

- Other Applications

Aerospace, consumer electronics, and lab instrumentation are driving the requirement for micro-molded polymers customized for highly precise, miniature components for various new applications.

Regional Insights

North America is a mature market where innovations in medical devices, high-performance automotive components, and developed telecom infrastructure drive the market. The usage of PEEK, PMMA, and LCP materials for microinjection molded precision components is led in the US, and Canada and Mexico also add to the market, mainly through medical, electronic, and automotive segments. The market growth observed in Europe is steady, with an emphasis on high-precision automotive and medical micro-components from Germany, the UK, and France, while Italy and Spain are scaling up their microelectronics and micro-drive systems production. The market from Rest of Europe is divided into niche applications and industries related to automation.

The Asia Pacific region is currently undergoing a growth spree due to the increase in car electrification in countries such as China, Japan, South Korea, and India. Australia, New Zealand, and the rest of the Asia Pacific region are also embracing Microinjection Molding in high-tech electronics, medical instruments, and industrial automation fields. South America, comprising Brazil and Argentina, sees a slowly growing adoption of medical equipment and precision components for the automotive industry. The Rest of the South America region uses microinjection of polymers for manufacturing components for the micro-industrial and consumer electronics sectors.

Middle East & Africa, comprising Middle East and South Africa, is in the process of adopting microinjection molding, particularly in the healthcare, electronic, and industrial automation sectors, while the Rest of the region imports and sees local production growth.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 2025, Accumold recently announced plans to attend MD&M East in New York City in May. This is because the high-precision micro injection moulding solutions provider is scheduled to attend with its solutions in the area of medical devices and components.

- In April 2025, Makuta Technics, a leading company in micro injection molding, continues to advance their production of zero-defect micro components using high-precision automated cells and specialized tooling to meet growing demands in the medical, electronics, and automotive industries.

(Source:https://www.mingliprecision.com/newsc144-top-5-plastic-micro-injection-molding-manufacturers-in-2025)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.25 Billion |

|

Market size value in 2026 |

USD 1.5 Billion |

|

Revenue forecast in 2033 |

USD 3.95 Billion |

|

Growth rate |

CAGR of 14.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Accumold LLC, Makuta Technics, Inc., Precimold Incorporation, Micromolding Solution Inc., Stack Plastics Inc., Stamm AG, Sovrin Plastics, ALC Precision,American Precision Products,Rapidwerks Inc., Norco Injection Molding, OMNI Mold Systems, Precipart, Likuta Technics Inc., Milacron India Pvt. Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Polyether Ether Ketone, Polymethyl Methacrylate, Polyethylene, Polyoxymethylene, Liquid Crystal Polymer (LCP), Polylactic Acid (PLA), Other), By Application (Medical & Healthcare, Automotive, Telecom Fiber Optics, Micro Drive Systems & Control, Others) |

Key Polymer Microinjection Molding Company Insights

Accumold LLC is an internationally leading manufacturer of high-precision microcomponents through microinjection molding. It varies from the manufacture of high-volume components for the consumer electronics segment to high-reliability components for the medical segment. By concentrating on the latest micro molding technology trends and developments, it is possible for Accumold to manufacture ultra-small components at high volume to suit high throughput requirements. With automation in the true sense and special micro-component molding equipment and technology, Accumold is capable of producing the latest polymer microcomponents designed and developed in minimally invasive medical products and precision connectors. By sustained focused R&D investment and strategic adoption of latest technological advancements, Accumold has established its strength in the global marketplace in meeting the latest demands of high-end OEM manufacturers looking for intricate microcomponents with high consistency on quality and regulatory requirements.

Key Polymer Microinjection Molding Companies:

- Accumold LLC

- Makuta Technics, Inc.

- Precimold Incorporation

- Micromolding Solution Inc.

- Stack Plastics Inc.

- Stamm AG

- Sovrin Plastics

- ALC Precision

- American Precision Products

- Rapidwerks Inc.

- Norco Injection Molding

- OMNI Mold Systems

- Precipart

- Likuta Technics Inc.

- Milacron India Pvt. Ltd.

Global Polymer Microinjection Molding market Report Segmentation

By Type

- Polyether Ether Ketone

- Polymethyl Methacrylate

- Polyethylene

- Polyoxymethylene

- Liquid Crystal Polymer (LCP)

- Polylactic Acid (PLA)

- Other

By Application

- Medical & Healthcare

- Automotive

- Telecom Fiber Optics

- Micro Drive Systems & Control

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636