Market Summary

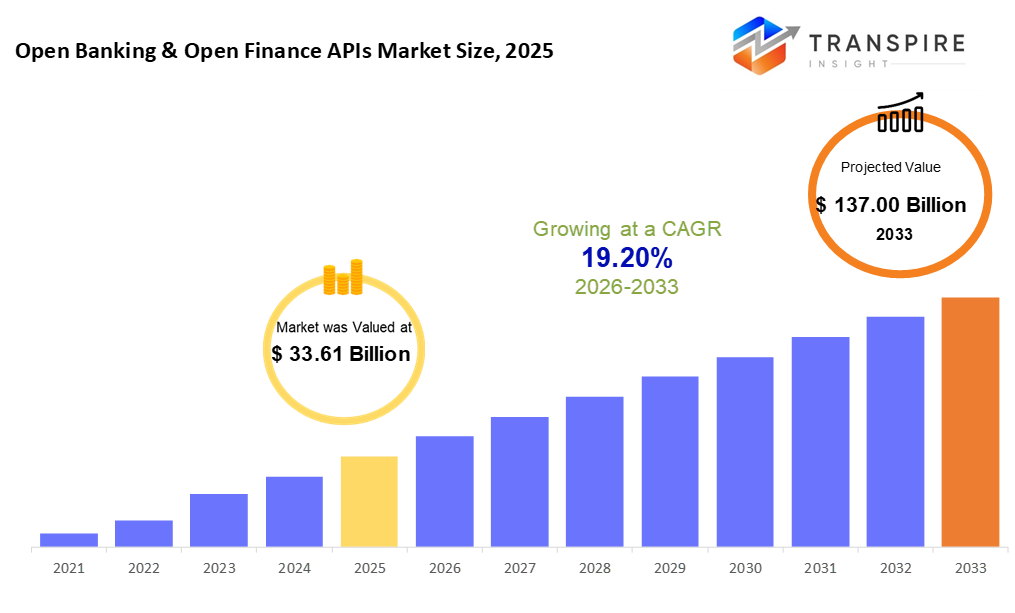

The global Open Banking & Open Finance APIs market size was valued at USD 33.61 billion in 2025 and is projected to reach USD 137.00 billion by 2033, growing at a CAGR of 19.20% from 2026 to 2033. The strong growth of the Open Banking & Open Finance APIs market is driven by increasing regulatory mandates for data sharing, rising adoption of API-based financial ecosystems, and growing demand for personalized digital financial services. Additionally, rapid fintech innovation, expansion of embedded finance, and greater collaboration between banks and third-party providers are accelerating market expansion at a high CAGR through 2033.

Market Size & Forecast

- 2025 Market Size: USD 33.61 Billion

- 2033 Projected Market Size: USD 137.00 Billion

- CAGR (2026-2033): 19.20%

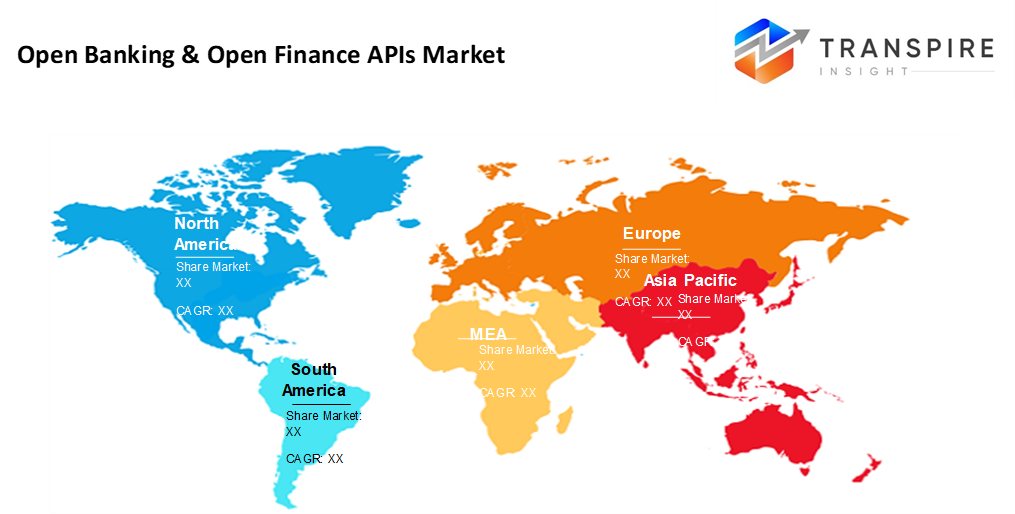

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 35% in 2026. Fueled by cutting-edge tech, North America sits ahead in fintech progress. Strong API usage pushes its financial systems forward. New ways of blending services into everyday apps are taking shape across the region.

- Fueled by quick moves into open finance, the United States shapes progress across the region - tech advances spark change while widespread API rollouts keep pace. Growth takes hold where innovation meets scale.

- Fueled by digital banking growth, the Asia Pacific moves ahead fast. Mobile-first users shape its path forward. Financial inclusion pushes progress here, too.

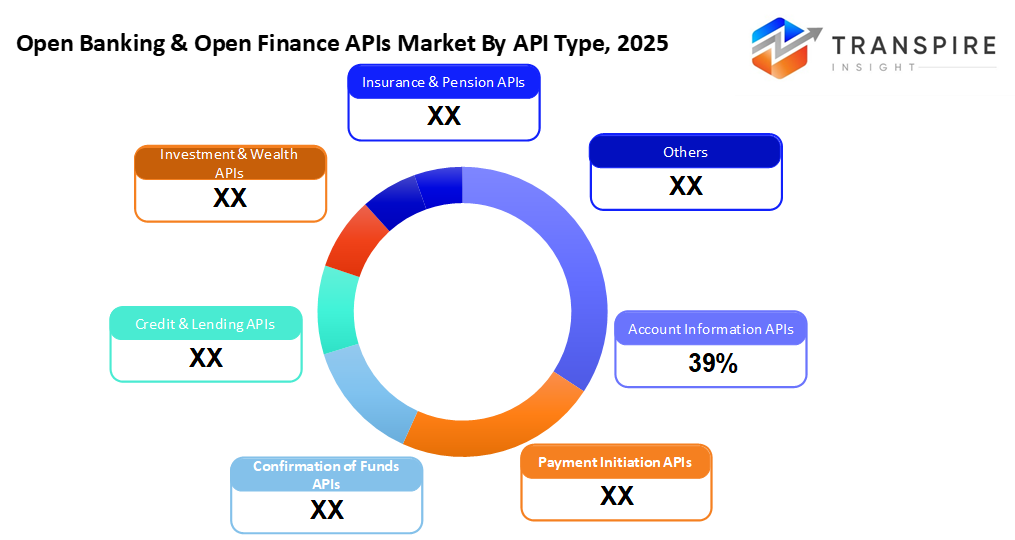

- Account Information Services share approximately 40% in 2026. Account access tools take front stage when people want their finances combined, clear, and built on real information. These interfaces grow fast because insight matters more each day.

- What stands out is cloud-based deployment taking the lead. Speed of scaling pushes it forward, while shared API formats help too. Savings on costs seal its advantage.

- Big companies push ahead, pouring money into open finance networks while upgrading their tech. Growth follows where investment flows, especially when old systems give way to new tools.

- Open banking laws that make sharing data through tech connections a must.

Starting fresh, more companies now build connections through shared finance tools. One key shift comes from how banks let outside apps access account details safely when users agree. Instead of staying closed off, money platforms increasingly exchange info using clear rules. Pressure from new laws pushes firms to adopt these open models faster than before. Working together across old boundaries becomes easier as standards emerge and take hold.

Nowadays, more people want quick access to their money details through tools that let them check balances instantly. Because of this shift, systems allowing instant payments grow popular among users who expect smooth transactions online. One reason these technologies spread so fast lies in how they pull together accounts from different places into one view. Speed matters too; payments move more quickly when connected platforms talk directly to each other. Think about shopping apps or ride services; they now build banking features right where they are needed. Banks notice this change, opening up parts of their software so others can plug in easily. Instead of holding everything back, many banks choose to share select functions publicly. Doing so helps keep customers coming back while offering new kinds of help beyond basic banking. Staying relevant means adapting, not just keeping pace, but reshaping what's possible inside modern finance.

Out in today’s fast-moving markets, tech progress shapes how things grow. Cloud setups now lead because they stretch when needed, adapt easily, and fit different budgets. Systems that handle APIs work better alongside stronger shields for data, like tighter locks, smarter access rules, and safer transmissions. When these link up with smart algorithms and deep number-crunching through open interfaces, results shift toward custom money advice, sharper lending judgments, and clearer views on possible dangers.

Out here, past regular banks, money systems stretch into open finance, think loans, investing, coverage plans, retirement funds. Not just banks anymore; tech firms, outside players, big corporations tap shared digital tools to build new ways to handle cash right inside everyday apps. Rules shift slowly, teams link up more closely, and cooperation grows stronger. Growth keeps coming for these connected platforms, fed by fresh ideas, smooth connections between systems, and a real push for services that work together easily.

Open Banking & Open Finance APIs Market Segmentation

By API Type

- Account Information APIs

With Account Information APIs, getting hold of customer account details happens safely. These tools let systems pull balance records along with past transactions. Data flows smoothly into apps that track spending patterns. Access stays protected while software gathers what it needs. Such connections support deeper financial insights without exposing sensitive inputs.

- Payment Initiation APIs

With Payment Initiation APIs, money moves straight from one bank account to another. These tools make transfers happen fast while keeping fees low. Instead of waiting days, funds arrive almost instantly. Some systems handle the process within seconds. Moving cash this way cuts out extra layers. Efficiency improves without needing traditional intermediaries. Transactions stay simple yet reliable behind the scenes.

- Confirmation of Funds APIs

A quick check on money status happens first, thanks to Confirmation of Funds APIs. Payments move only when funds are confirmed ready. This step lowers the chance of failed transfers. It also helps block suspicious activity before it starts.

- Credit & Lending APIs

Lenders tap into fresh streams of financial details through Credit & Lending APIs. These tools open doors to nontraditional data, speeding up decisions on who gets a loan. Information once hard to reach now flows smoothly behind the scenes. Approval timelines shrink when systems pull more than just standard credit reports. Outdated methods fade as real-time insights step in. Access shifts from slow checks to continuous updates. Decisions grow sharper with broader views of borrower history.

- Investment & Wealth APIs

Money tools via API let apps share account details, support buying or selling assets, and help run online investment platforms. Some systems link financial records across services while allowing trade execution plus automated advisory setups.

- Insurance & Pension APIs

Fresh access to insurance details, claim records, or retirement funds flows smoothly through digital links when systems choose openness. Data moves only where allowed, connecting accounts without extra steps.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- Cloud-Based

Cloud-based setups are common now because they grow easily, adapt quickly, launch APIs fast, plus need less spending on hardware.

- On-Premises

Housed within their own facilities, some organizations choose on-premises setups when tight oversight of information matters most. Control stays internal, especially where rules around data are non-negotiable.

- Hybrid Deployments

Folded into one setup, cloud flexibility lives alongside local control tight fit for strict finance settings. Where rules tighten, both pieces hold steady without clash. This blend keeps data close when needed yet taps new tools on demand.

By Organization Size

- Large Enterprises

Big companies rely on open APIs to update their technology while staying within legal rules, at the same time growing their online networks through shared platforms that allow smoother integration across services used daily by thousands.

- Small & Medium Enterprises

A fresh start can come from tiny tweaks. SMEs often find power in API tools. These connections speed up how systems talk. One update might spark a whole new method. Cheaper banking options appear when tech links well. Growth hides inside smooth digital handshakes. Innovation shows up quietly through smart linking.

By End-Users

- Banks & Financial Institutions

Facing rules head-on, banks plus financial outfits lead the pack when it comes to using APIs just to stay on track. These groups share info, meet standards, while stretching what they offer day by day.

- FinTech Companies

Some fintech firms rely on APIs to create tools for payments. Others shape loan systems through shared digital access points. Personal money management apps often grow from these connections, too. Embedded financial services take form when platforms open their core functions. Each solution links pieces that others built before.

- Third Party Providers

Firms from outside the bank step in to link several finance players together. These helpers pull services into one place, making access smoother through a single point. Instead of dealing separately, connections form via these middle partners who support the flow between institutions.

- Enterprises & Corporates

Big companies plug into APIs to handle payments right where they work. Money moves get smoother through built-in tools for tracking and control. Accessing financial records becomes part of daily operations without extra steps.

Regional Insights

Mature banks shape how open finance works across North America and Europe. Driven by rules and fast internet, these regions stand out in sharing financial data through APIs. The United States and Canada move ahead because startups build new tools using bank interfaces. Fueled by tech experiments, their progress feels natural, almost effortless. Meanwhile, Mexico picks up speed thanks to clearer laws and rising mobile payment habits. Rules kick-started change there, giving room for slow but sure growth. Over in Europe, places like the United Kingdom, Germany, France, and Nordic nations set the pace. Because of PSD2, opening banking systems became a must, not a choice. Shared standards help apps talk easily between countries. Borders matter less when code connects accounts seamlessly. Elsewhere, the southern and eastern parts adapt at their own rhythm. Not rushed, they follow European guidance while welcoming more fintech players. Progress creeps forward where regulation meets ambition. Quietly, steadily, pieces fall into place.

Across the Asia Pacific, growth surges ahead where both top-tier and emerging markets fuel widespread API use. Leading the charge, nations like China, India, Japan, Australia, and Singapore thrive on advanced digital banking, state-driven open finance efforts, alongside near-universal smartphone access. Farther south, countries including Indonesia, Vietnam, Thailand, and the Philippines push fast into open APIs fueled by expanding fintech funding and shifting regulations. These shifts power financial access, digital payment tools, and new lending models across everyday lives.

Across Latin America and parts of Africa and the Middle East, fresh momentum is building in fintech. Brazil stands out early, backed by strong rules around open finance and fast payments. Not far behind, countries like Mexico, Chile, and Colombia push forward using shared digital tools to reach more people. Farther east, the United States and Saudi Arabia shape their own path - testing new models under flexible oversight and focused tech plans. Meanwhile, places such as South Africa, Kenya, and Nigeria turn to open connections between apps, helping millions tap into banking from phones. Growth here may quietly reshape global trends over time.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 3, 2025 – Citizens sharpens its open banking edge with new API design.

(Source: https://tearsheet.co/10-q/citizens-sharpens-its-open-banking-edge-with-a-new-api-design/

- June 19, 2025 – Open Finance platform Fabrick completed the acquisition of Schufa Holding AG.

(Source: https://www.openbankingexpo.com/news/open-finance-platform-fabrick-completes-acquisition-of-finapi/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 33.61 Billion |

|

Market size value in 2026 |

USD 40.07 Billion |

|

Revenue forecast in 2033 |

USD 137.00 Billion |

|

Growth rate |

CAGR of 19.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Plaid, Tink, Truelayer, Mastercard, Yodlee, Bafin, Salt Edge, Flinks, Mx Powers, Token.io, Bankable, Oracle, IBM, Ozone API, F5 Solutions, and Capgemini. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By API Type (Account Information APIs, Payment Initiation APIs, Confirmation of Funds APIs, Credit & Lending APIs, Investment & Wealth APIs, Insurance & Pension APIs), By Deployment Mode(Cloud-Based, On-Premises, Hybrid Deployment), By Organization Size (Large Enterprises, Small & Medium Enterprises), By End-Users (Banks & Financial Institutions, FinTech Companies, Third-Party Providers, Enterprises & Corporates), |

Key Open Banking & Open Finance APIs Company Insights

Plaid, Inc. is one of the leading players in the Open Banking and Open Finance APIs market, widely recognized for its secure financial data connectivity platform. The company enables fintechs, banks, and enterprises to access consumer-permissioned account information, transactions, and identity data through robust APIs. Plaid’s solutions support use cases such as payments, lending, personal finance management, and fraud prevention. With a strong presence in North America and expanding global partnerships, Plaid plays a critical role in accelerating open finance adoption and ecosystem interoperability.

Key Open Banking & Open Finance APIs Companies:

- Plaid

- Tink

- Truelayer

- Mastercard

- Yodlee

- Bafin

- Salt Edge

- Flinks

- Mx Powers

- io

- Bankable

- Oracle

- IBM

- Ozone API

- F5 Solutions

Global Open Banking & Open Finance APIs Market Report Segmentation

By API Type

- Account Information APIs

- Payment Initiation APIs

- Confirmation of Funds APIs

- Credit & Lending APIs

- Investment & Wealth APIs

- Insurance & Pension APIs

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid Deployment

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By End-Users

- Banks & Financial Institutions

- FinTech Companies

- Third-Party Providers

- Enterprises & Corporates

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636