Market Summary

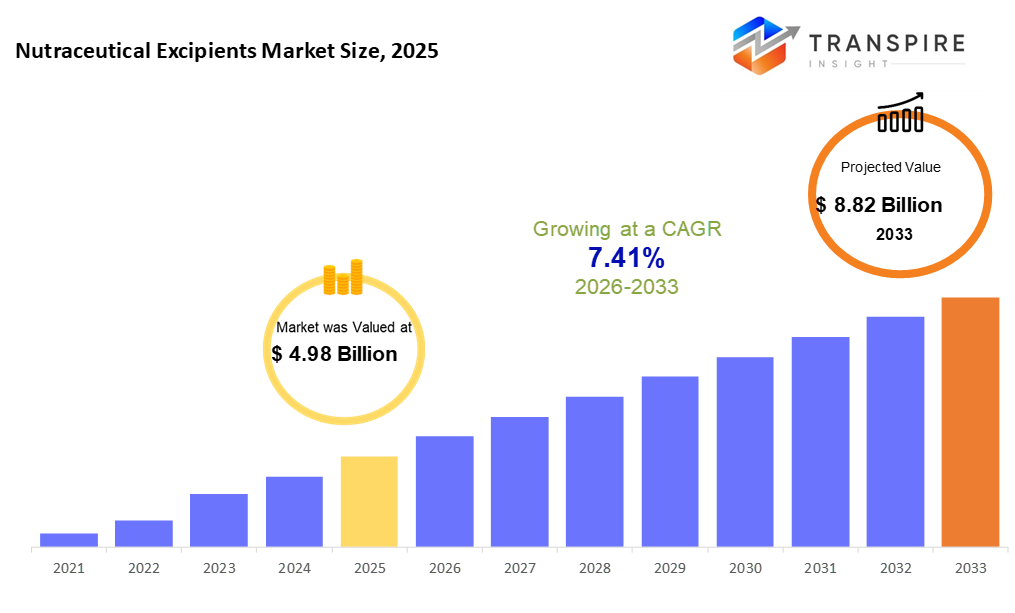

The global Nutraceutical Excipients market size was valued at USD 4.98 billion in 2025 and is projected to reach USD 8.82 billion by 2033, growing at a CAGR of 7.41% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 4.98 Billion

- 2033 Projected Market Size: USD 8.82 Billion

- CAGR (2026-2033): 7.41%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has a market share of approximately 40% in 2026. North America stays ahead because strict rules mix with people caring more about health, pushing up sales of top-quality excipients.

- Asia-Pacific growth is speeding up due to more people joining the middle class, higher use of health supplements, and a solid need for affordable plant-derived additives.

- United States Rising demand comes from top-tier ingredients that meet tight regulations, alongside strong consumer interest in supplements; these elements drive market gains. Products showing clear labels, solid research behind them, while fitting strict safety rules, boost sales steadily across states.

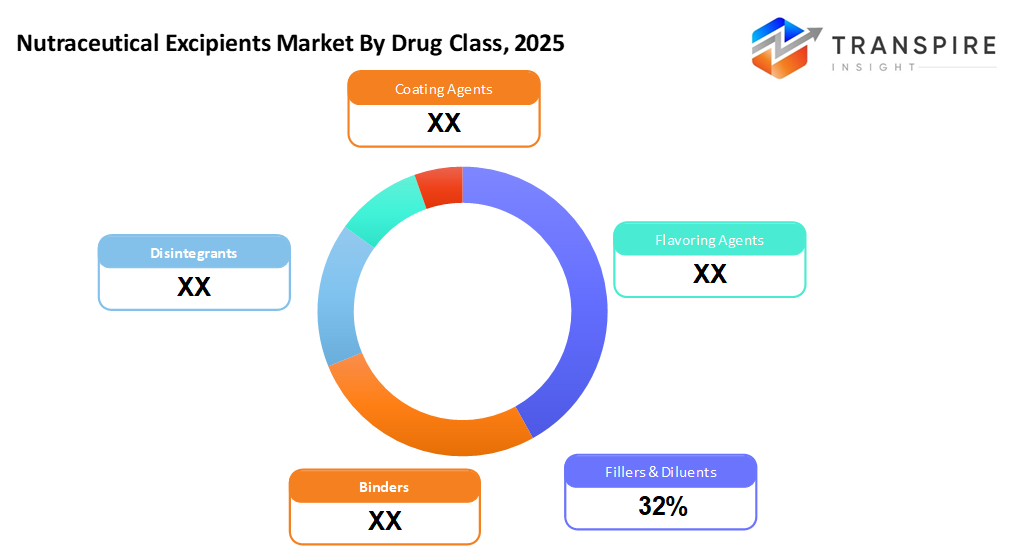

- Fillers and Diluents are growing with approximately 34% market share in 2026. Increasing preference for multifunctional fillers that improve compressibility and reduce formulation complexity

- Dry Form Tablets still rule, people pick them 'cause they are easy to carry around. Capsules hang close behind, thanks to their no-fuss use on the go.

- Folks want cleaner stuff from Natural & plants based these pushes makers to use more eco-friendly fillers. Because people care where things come from, brands now pick simpler, earth-sourced helpers instead.

- Protein and amino supplements are gaining traction as more people now focus on fitness, which boosts demand for these products. Excipients in protein formulas help stability, making them popular in active lifestyles. Growth is steady thanks to stronger consumer awareness around muscle support and recovery benefits.

- Retail’s growing fast online shops and wellness stores lead the way since people want quick ways to get supplements. While digital shopping rises, physical health spots keep pulling crowds thanks to trust and instant pickup. Even small brands find space here, bypassing big pharmacies by selling straight through websites or pop-up markets.

The nutraceutical excipients market involves non-active components used when making items like dietary supplements, functional foods, or specialized nutrition goods. Instead of just filling space, substances like bulking agents, binding materials, breakdown helpers, outer coatings, sugar substitutes, flavor boosters, and spoilage blockers help keep products stable, easy to produce, better absorbed by the body, tasty, and longer lasting. Since many nutraceuticals now aim to meet strict pharma-level rules, demand grows for reliable, regulation-friendly additives.

Demand for nutraceutical excipients grows fast because more people use dietary supplements and functional foods - this trend comes from a better health focus, prevention habits, older age groups, along with issues tied to modern lifestyles. People now want supplements for stronger immunity, digestion support, protein intake, or vitamins; that means more need for excipients in pills, capsules, powders, and even liquids. On top of this, buyers prefer clean labels and natural ingredients, pushing makers to use plant-derived or certified organic excipients instead.

Fillers and diluents make up the biggest group because they are widely used in pills and tablets. Dry powders stay popular since they last longer and are easier to manage. New developments aim at ingredients that do more than one job, like making tablets form better, mix simpler, or help nutrients get absorbed faster. Products that hide bad tastes, release slowly, or boost how well the body uses nutrients are getting noticed. This is especially true for kids’ supplements, probiotics, and protein-based formulas.

North America tops the nutraceutical excipients scene because people there take more supplements, rules are clear, plus production tech is ahead of the curve; meanwhile, Asia-Pacific’s growth zooms thanks to higher spending power and wider use of these products across China or India. This space is not dominated by just a few big names; instead, major companies push new ideas, build lines around plant-based helpers, and team up through alliances so they can keep up with shifting buyer habits alongside changing regulations.

Nutraceutical Excipients Market Segmentation

By Functionality

- Binders

Binders help hold tablet or capsule bits together, so each dose stays steady. They boost how well pieces stick, plus make pills tougher overall.

- Fillers & Diluents

Fillers plus diluents give more volume while improving consistency key when doses are small in supplements.

- Disintegrants

Make pills dissolve fast so the body can use the nutrients better, using these means, quicker uptake inside.

- Coating Agents

Coating agents shield key components, hide unpleasant flavors, while boosting shelf life and how things look.

- Flavoring Agents

Common in protein powders or chewable vitamins. They make stuff easier to swallow while keeping it tasty without being overwhelming.

To learn more about this report, Download Free Sample Report

By Form

- Dry Form

Rules the scene because it stays stable, lasts way longer on shelves, and also slips smoothly into pills or capsules.

- Liquid form

- Liquid options are rising due to more people wanting drinkable health mixes, flavored drops, or easy syrup formats.

By Source

- Natural

Growing fast due to clear labels, vegan ingredients, or honest branding that shoppers now want.

- Synthetic

Stays useful because it saves money, works reliably, and fits big production needs.

By End-Users

- Prebiotics & Postbiotics

Prebiotics or postbiotics need helpers to stay fresh plus reach the right spot intact.

- Postbiotics

Probiotics rely on shielding ingredients to keep microbes alive plus extend storage time.

- Protein & Amino Acids

This adds helpers to boost how well it flows, mixes, feels, and tastes.

- Vitamin Supplements

Vitamin supplements often use extra stuff just to stay steady or measure right, yet most of it is not even nutrients. Some bits hold the shape; others help with shelf life -but swallowing way more than vitamins.

- Mineral Supplements

Mineral supplements need specific additives that help them hold together better while lowering unwanted chemical reactions.

- Others

Other types cover plant-based plus niche supplements needing specific filler ingredients.

Regional Insights

North America’s nutraceutical excipient scene is developed and tightly regulated, fueled mostly by a solid appetite for supplements across the United States and Canada. On top of that, buyers there want clean, natural ingredients meeting pharma-level purity. Factories in this area run on cutting-edge tech while sticking to tough safety rules, backed up by big-name ingredient makers setting up shop nearby. Europe trails just behind, powered by heavyweights like Germany, Britain, France, Italy, and Spain; here, staying within legal limits matters a lot, as does eco-awareness plus using plant-derived fillers. Producers overseas stress full supply chain visibility, organically grown raw materials, and novel performance traits, which keep sales strong for high-end additives.

Asia-Pacific’s nutraceutical excipient market is expanding more quickly than others, fueled by strong growth in countries like China, India, and Japan. Because people earn more now, they are paying closer attention to health this pushes up the use of supplements in forms like pills or powders. Instead of sticking to simple fillers, makers in the region are moving toward consistent, cleaner, plant-based options, especially for overseas sales. Having cheap production setups plus plenty of raw supplies helps the area become a top spot for making and buying these ingredients.

Latin America’s on the move, with Brazil, Mexico, and Argentina taking the lead, boosted by bigger cities and more folks paying attention to vitamins and health-focused foods. In the Middle East and Africa, places like the Gulf nations, South Africa, and parts of the north are still catching up, yet signs point upward thanks to a better understanding of health needs and supportive policies. Even though these areas depend heavily on foreign-made supplement ingredients now, slow gains in homegrown production could help markets grow steadily down the road.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 15, 2025 – Balchem launched StabiliPro excipients for probiotics. (Source: Nutraceutical World https://www.nutraceuticalsworld.com/breaking-news/balchem-launches-stabilipro-excipients-for-probiotics/

- November 20, 2023 – Roquette launched new excipients for moisture-sensitive nutraceutical ingredients (Source: Pharma Excipients https://www.nutritionaloutlook.com/view/roquette-launches-new-excipients-for-moisture-sensitive-nutraceutical-ingredients

- July 24, 2021 – Omya launched new excipients for nutraceutical tablets (Source: Pharma Excipients https://www.pharmaexcipients.com/binder/omya-nutraceutical-excipients/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.98 Billion |

|

Market size value in 2026 |

USD 5.35 Billion |

|

Revenue forecast in 2033 |

USD 8.82 Billion |

|

Growth rate |

CAGR of 7.41% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key company profiled |

Roquette, Ingredion Pharma Solutions, Sigachi Industries, Azelis, MTC Industries, Catalyst Nutraceuticals, Ankit Pulps & Boards Pvt Ltd, Vivion Inc, BASF SE, Cargill Inc., Kerry Group Plc, SPI Pharma, DFE Pharma, SMP Nutra, Alsiano, SMS Corporation, JRS Pharma, and others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Functionality (Binders, Fillers & Diluents, Disintegrants, Coating Agents, Flavoring Agents) By Form (Dry Form, Liquid Form) By Source (Natural, Synthetic) By End-Users (Prebiotics & Postbiotics, Probiotics, Protein & Amino Acids, Vitamin Supplements, Mineral Supplements, Others), |

Key Nutraceutical Excipients Company Insights

Roquette Frères stands out in the nutraceutical excipients field by focusing heavily on plant-made, label-friendly ingredients. Instead of relying on synthetics, it pulls materials like starch and cellulose from nature to create fillers, binders, disintegrants, and coatings for pills, capsules, or powdered forms. Because it knows how pharma-level quality works, customers trust its ingredient mixes more easily. With factories spread around the world, on top of steady R&D spending, it’s become a go-to source for makers of supplements plus specialized food products.

Key Nutraceutical Excipients Companies:

- Roquette

- Ingredion Pharma Solutions

- Sigachi Industries

- Azelis

- MTC Industries

- Catalyst Nutraceuticals

- Ankit Pulps & Boards Pvt Ltd

- Vivion Inc

- BASF SE

- Cargill Inc.

- Kerry Group Plc

- SPI Pharma

- DFE Pharma

- SMP Nutra

- Alsiano

- SMS Corporation

- JRS Pharma

- others

Global Nutraceutical Excipients Market Report Segmentation

By Functionality

- Binders

- Fillers & Diluents

- Disintegrants

- Coating Agents

- Flavoring Agents

By Form

- Dry Form

- Liquid Form

By Source

- Natural

- Synthetic

By End-Users

- Prebiotics & Postbiotics

- Probiotics

- Protein & Amino Acids

- Vitamin Supplements

- Mineral Supplements

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636